The thirty year term life insurance policy is a real deal when compared with whole life insurance policies. However when compared with 20 and 25 year policies it can look more expensive. In our short article we will show the all of the advantages and disadvantages and show you loads of examples and pricing.

The thirty year term life insurance policy is a life insurance contract whose premiums and death benefit last thirty years. After those years the policy is typically cancelled, although many policies do allow extended coverage although at a far great yearly premium.

The Thirty Year Term Policy

The thirty year term life insurance policy is generally considered to be the longest term life insurance policy that you can buy. Although there is a product often known as a "lifetime term" this product is technically more of a universal policy. For our purposes let us just assume that the 30 year term is the longest of the life insurance term options. The other options commonly available are the ten, fifteen, twenty, and twenty five year policies. In recent years a few companies have come out with options that are actually longer than 30 years, such a 35 and 40 year policy. But these are not common and are very hard to find. For our purposes let us assume that the 30 year is the longest commonly available option.

Although the American lifespan has seen a slight overall decrease in the past several years, in general US citizens are living far longer than they did 20 and 40 years ago. Therefore the need for longer forms of term life insurance has truly increased in our society. The thirty year policy deserves a real consideration

Who Writes 30 Year Term Policies?

Unfortunately not all life insurers have a thirty year option. However many do. The twenty year term life insurance policy is probably the most common term policy purchased. When you go to shop a 30 year, likely you will see some reduced competition for this product. Due to less competition the pricing sometimes is not as heated and competitive as other term products. Therefore the cost may be higher than it otherwise might be.

Here are some companies, as of this publication, that are willing to offer term life insurance policies for thirty years:

Allstate

AIG

American National

Banner Life

Columbus Life Insurance Company

Farmers

Global Atlantic Life Insurance

Liberty Mutual

Lincoln

Metlife

Mutual of Omaha

Nationwide

North American Company

Pacific Life Insurance Company

Phoenix

Protective

Principal

Prudential

SBLI

Transamerica

State Farm

TIAA CREF

USAA

Doubtless there are other companies that offer this product. Please note that not all insurance companies offer life insurance in every state. We do not represent many of these companies. This list changes and some of this information will change.

Why 30 Year Terms are Such a Great Product:

Being the longest of the common term policy lengths - the thirty year term policy is the closest thing to a permanent policy that most individuals can get shy of a whole life or universal life policy. The 30 year term policy is terrific for all sorts of uses and people.

30 Years can be a great source of protection for a wide variety of Americans. Still far cheaper than a permanent policy such as a whole or universal life, yet long enough to stay with you and your family for a long time - thirty year term policies can be a great solution. The question that many people ask themselves is: Do I need the extra protection of five more years? Why five more years? Because the next lowest term life length is 25 years.

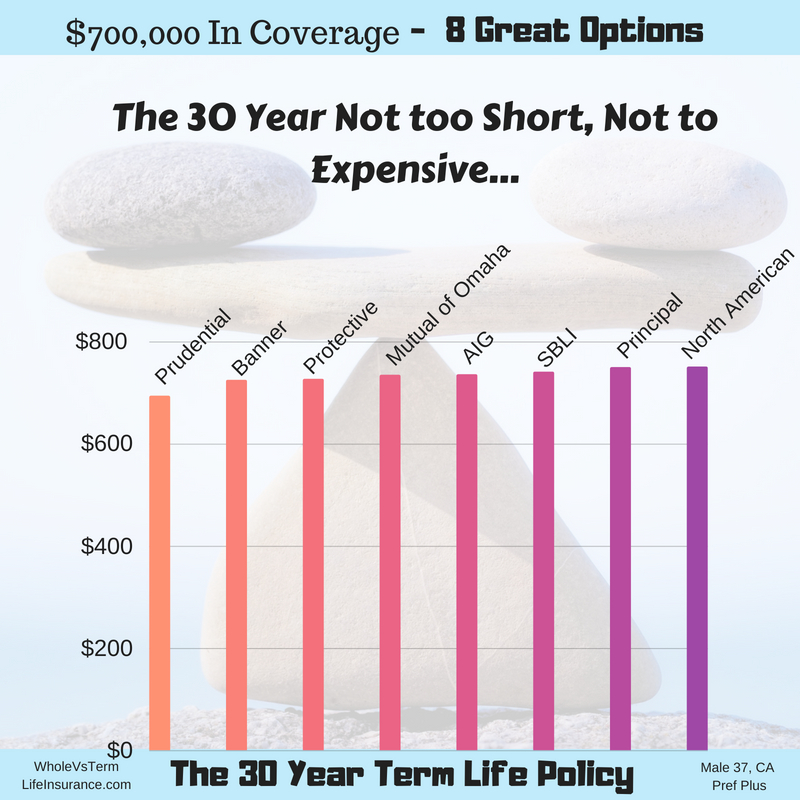

In the chart above you can see 30 year term insurance pricing for $700,000 in coverage for a 37 year old California female in Preferred Plus Health Class. The price estimates are all within a narrow range and are from: Prudential, Banner, AIG, Protective, Mutual of Omaha, SBLI, Principal, and North American. They really are eight great choices for this type of long term - term coverage. Keep in mind that other carriers doe offer these great products.

The Cost Difference with the 20 Year Term:

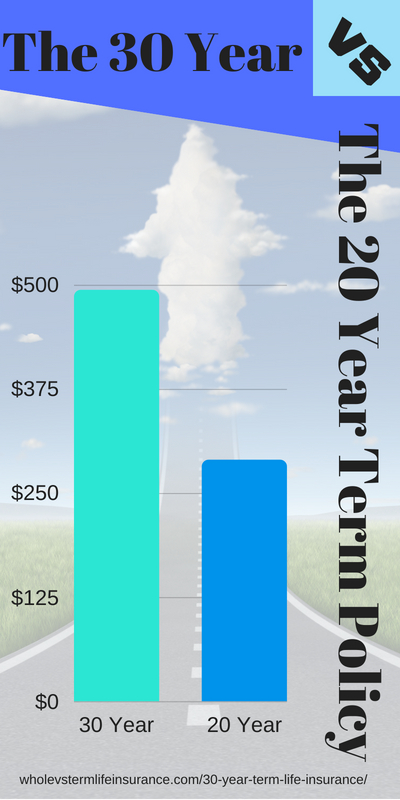

The 30 Year Vs the 20 Year

The cost difference between the thirty year term policy and the more standard twenty year policy is more extreme than the twenty five year policy for obvious reasons. Although generally this comparison is probably not as useful as the comparison with the twenty five, we have included it in order to be as complete as possible.

The cost differential from a 20 year term vs a 30 year for a 40 year old female is only $204 more per year. $290 vs $494. Assuming Preferred Plus Health Class and $500,000 in coverage. At a standard nonsmoker rate it goes from $543 to $918 and the cost differential between a 20 year and 30 year is about $375 per year.

For our preferred plus example the total cost to go from a twenty year to a thirty year is about only about $204 more per year for those first 20 years and the full $494 for ten remaining years.

Our Chart to the right illustrates these cost differences.

20 Years of additional $204 = $4,080 and 10 Years of $494 = $4,940

For a Total of $9,020 more.

This example highlights the cost extreme differences between the two products, but it somewhat ignore a 50% longer coverage length: 20 vs 30 years in term coverage.

$290 for 20 Years is $5,800 for a Twenty Year Term.

vs

$494 for 30 Years is $14,820 for a Thirty Year Term.

The Cost Difference with the 25 Year Term:

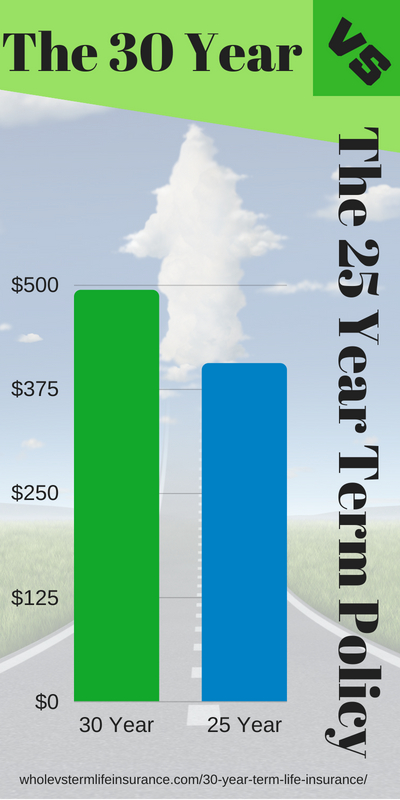

The 30 Year Vs the 25 Year

The cost differential from a 25 year term vs a 30 year for a 40 year old female is only $88 more per year. $406 vs $494. Assuming Preferred Plus at $500,000 in coverage.

At a standard nonsmoker rate it goes from $770 to $918 and the cost differential between a 25 year and 30 year is about $148 per year.

In the case of the preferred plus rating than for only about $88 more per year for those first 25 years and the full $494 for five years, you can add on 5 more years worth of coverage and protection.

The chart to the right provides a snap shot of the premium difference between a 30 year term life policy and this 25 year term.

25 Years of additional $88 = $2,200 and 5 Years of $494 = $2,470

For a Total of $4,670 more.

For a total of $4,670 more in total clients can receive an extra five years worth of protection. But is it worth it? For that we might want to look at the total cost of the a Preferred Plus 25 year term vs a Preferred Plus 30 Year term.

$406 for 25 Years is $10,150 for a Twenty Five Year Term.

vs

$494 for 30 Years is $14,820 for a Thirty Year Term.

Although our example considers all aspects of the cost difference between a 25 and a 30 year policy - it is possible that the cost difference will not be this great if and when clients opt to cancel the policy earlier than its ultimate end. An example of this might be the client that purchases a thirty year policy, but after twenty five years opts to cancel it. Their net difference than would only be the 25 years of paying $88 more ($2,200.)

The Cost Difference with a Whole Life Policy:

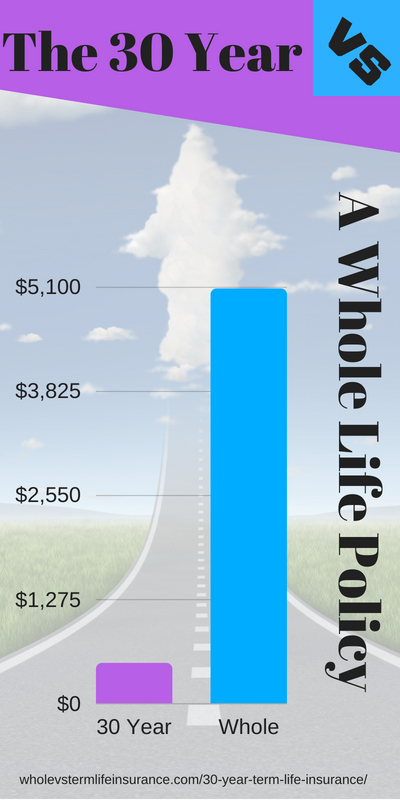

The 30 Year Vs whole life

A 25 year term policy is the shorter policy option for 30 years and a Whole life is probably the next best option for clients that want something longer than a 30 year. Although this is an arguable point, as a lifetime term may be a better option, Whole life is more widely sold and available. For that reason we choose to compare a thirty year with this type of policy.

Starting with the exact same base yearly price and total cost of $494 and $14,820 for our example a comparable Whole Life Insurance policy cost can vary widely depending on what type and kind that you choose.

For our example though we have chosen an A+ rated mutual carrier.

The chart to the right provides a simple snap shot of the cost difference between a 30 year term and this hypothetical whole life policy.

$494 for 30 Years is $14,820 for a Thirty Year Term.

Vs

$5,080 per year for your entire life or $254,000 for 50 Years.

So

a Whole Life Policy could Cost You at Least $239,180 more.

As our example shows the cost to buy up to a whole life insurance policy is quite high. Much higher than most would believe. However in fact this is typically the case for clients considering both forms of insurance: Term and Whole. Although mutual whole life insurance offers numerous benefits, the costs are typically so extreme when compared with any type of term product as to make it seem almost unaffordable. Should you really consider spending about $254K on life insurance? Does this really make much sense?

The real point of including this number is this article is not to discuss the positives and or negatives of whole vs term life insurance. This subject we cover often. Rather the reason is to demonstrate the relative low lifetime cost of a 30 Year Term Life Insurance product compared to one of the next major options. Term Life Insurance is Not Expensive.

Advantages & Disadvantages of 30 Year Terms:

There are numerous examples of advantages with longer term life insurance policies. The obvious disadvantage being the higher cost of insurance and longer time period that you will need to deal with the insurer. Some of the major advantages of these policies include the longer protection coverage period, the ability to change the policy for a longer period of time. One might wish to cancel it or convert it to another form of life insurance. Although 30 years are more expensive than 20 and 25 years, the are still less expensive than an equivalent whole or universal life policy.

Pros and Cons of Thirty Year Term Policies

ADVANTAGES:

DISADVANTAGES:

WholeVsTermLifeInsurance.com

Since less insurance companies offer 30 year policies than the 20 year policy, this is a clear and unique disadvantage of it. Because less insurers offer it there is more than likely less competition in this market and it 'may' be priced slightly higher because of it.

That all being said the clear major disadvantage compared with shorter length policies is the higher cost and this should not be forgotten.

30 Year Term Life Insurance Cost:

What does a 30 Year Term Life Insurance Cost? There are a multitude of factors that go into deriving the costs of all life insurance products including 30 year term policies. In other words the costs are different for everyone. A 30 year term policy costs more as you age. It costs more as you health declines. It costs more as you begin taking more prescriptions. For more information on what your thirty year policy might cost you - contact us to arrange a brief discussion.

Below we provide a snap shot of sample pricing to assist in answering the question What does a 30 Year Term Life Insurance Cost?

Above you can see thirty year term life insurance quotes for $700,000 in coverage for a 37 year old California male in Preferred Plus Health Class. The price estimates are all within a narrow range and are from Prudential, Banner, Protective, Mutual of Omaha, AIG, SBLI, Principal, and North American.

Sample Pricing for 30 Year Term Policies - Preferred Plus:

Our 30 Year Term Life Insurance Rate Charts begins with the preferred plus pricing. The 30 Year Term Life Insurance Cost for preferred plus is exclusively for those in the best physical condition with no other underwriting issues such as hobbies, travel, or career. Preferred plus thirty year term policies are hard to qualify for.

Female | Age 20 | Age 25 | Age 30 | Age 35 | Age 40 | Age 45 |

$250,000 | $180 | $184 | $201 | $235 | $300 | $452 |

$500,000 | $280 | $294 | $324 | $385 | $530 | $800 |

$750,000 | $393 | $409 | $454 | $535 | $760 | $1,170 |

$1,000,000. | $460 | $480 | $564 | $685 | $900 | $1,515 |

Above you can see sample preferred plus (non smoker) pricing for ages 20, 25, 30, 35, 40, and 45 in the $250,000, $500,000, $750,000, and $1,000,000 range. All prices are estimates only.

Sample Pricing for 30 Year Term Policies - Preferred:

The next 30 Year Term Life Insurance Rate Chart is preferred. The 30 Year Term Life Insurance Cost for preferred is for those in good physical condition with few underwriting issues such as hobbies, travel, or career. Preferred thirty year term policies are not easy to qualify for. Preferred pricing does allow for some leniency.

Female | Age 20 | Age 25 | Age 30 | Age 35 | Age 40 | Age 45 |

$250,000 | $208 | $218 | $235 | $266 | $360 | $515 |

$500,000 | $330 | $359 | $394 | $445 | $634 | $943 |

$750,000 | $465 | $507 | $559 | $625 | $910 | $1,375 |

$1,000,000. | $560 | $590 | $704 | $805 | $1,110 | $1,751 |

Above you can see sample preferred non smoker pricing for ages 20, 25, 30, 35, 40, and 45 in the $250,000, $500,000, $750,000, and $1,000,000 range. All prices are estimates.

Sample Pricing for 30 Year Term Policies - Standard Plus:

Standard plus pricing is the next health insurance underwriting class. The 30 Year Term Life Insurance Cost for standard plus is for those candidates in good physical condition with a few more underwriting issues such as hobbies, travel, or career. Standard plus thirty year term policies are not as difficult to qualify for as preferred and preferred plus..

Female | Age 20 | Age 25 | Age 30 | Age 35 | Age 40 | Age 45 |

$250,000 | $263 | $273 | $300 | $326 | $460 | $655 |

$500,000 | $440 | $479 | $524 | $570 | $835 | $1,225 |

$750,000 | $630 | $687 | $756 | $813 | $1,210 | $1,795 |

$1,000,000. | $770 | $810 | $920 | $1,055 | $1,555 | $2.255 |

Above you can see sample non smoker standard plus pricing for ages 20, 25, 30, 35, 40, and 45 in the $250,000, $500,000, $750,000, and $1,000,000 range. All prices are estimates only.

Sample Pricing for 30 Year Term Policies - Standard Non Smoker:

Finally the Standard Non Smoker 30 Year Term Life Insurance Rate Chart is presented. Standard non smoker rates are the rates offered to the many Americans. The 30 Year Term Life Insurance Cost for standard are one of the more common rates for many consumers to qualify for. Standard non smoking allows for a number of underwriting issues. Although for some standard non smoking may seem like high pricing, it can be offered to some with significant issues and in reality be a real deal compared to other more restrictive rated classifications.

Female | Age 20 | Age 25 | Age 30 | Age 35 | Age 40 | Age 45 |

$250,000 | $295 | $305 | $342 | $392 | $540 | $794 |

$500,000 | $520 | $540 | $610 | $700 | $992 | $1.481 |

$750,000 | $745 | $775 | $884 | $1,008 | $1,458 | $2,190 |

$1,000,000. | $840 | $870 | $1,121 | $1,255 | $1,845 | $2,755 |

Above you can see examples of standard non smoking estimates for ages 20, 25, 30, 35, 40, and 45 in the $250,000, $500,000, $750,000, and $1,000,000 range. All prices are estimates only.

30 Year Term Life Insurance Best Practices:

Now that you have all of this information, what do you do? Having lots of knowledge and sample rates is terrific. But it is often not actionable. Therefore we put together a simple to use 30 year term life insurance action plan. How to Buy it, What to ask for, and the special considerations.

Great Candidates for 30 Year Term Policies:

Here we provide some great examples of consumers that could best be served by a thirty year policy.

"Do I Really Need a 30 Year Term life insurance policy?"

The Working Single Mom:

A working young single mother who has two children to support and care for in Houston, Texas. Her children are ages two and four and although a twenty year term might be enough she feels more comfortable with a slightly longer period.

The Sole Working Head of Household:

The working father of a family with a wife and three children who is the sole financial supporter. The husband and wife envision having more children. A thirty year term life insurance policy was their second choice originally. Only after seeing whole life insurance pricing did they decide that it made the most sense. They each opted for a thirty year policy from Mutual of Omaha (MOO).

Double Income No Kids:

Both a Husband and Wife living in Los Angeles, California. They are young and newly married but want to have children at some later time when they finish their residency. Although they probably will receive some form of group life insurance from their future employers, since they are doctors. However - its possible they could go off on their own to form independent private practices and group policies may not necessarily be available.

Second Marriage - Homemaker:

The younger spouse ( the wife) of a two parent family. This is the husbands second marriage and he is twelve years older than her. The step mom quickly fell in love with his four children whom she now considers her own. She wants to add one more to the mix and thinks that a thirty year policy from Pruco is the way to go.

Single with No Kids, but Things Can Always Change:

A young aggressive businessman who does not plan on having any children. However, after speaking with his best friend from college he is convinced that more and more that he could be wrong. Although only 27 years old, he feels that a thirty year term policy from Banner life insurance that is convertible may be the way to go.

The Reformed Agent:

A reformed insurance agent that used to think that Indexed Universal Life Insurance was the best thing since sliced bread. After quitting selling insurance policies and becoming an insurance actuary, she now believes that long term - term life insurance policies make the most sense.

Divorced and Working Together:

A divorced young couple that has one child. Once the divorce was finalized they began to work together much better. They both believe that caring for their child is the most important thing in their life. Neither are terrific with budgets and they both believe that thirty year policies make the most sense. They each choose policies from different companies: TIAA and State Farm.

WholeVsTermLifeInsurance.com

Conclusion of 30 Year Term Life Insurance:

The thirty year term policy is an awesome financial tool. Its use is invaluable for countless Americans. It may be undersold in the marketplace based on our experience. Although its total cost can range from 50% to 80% more it can well be worth the extra money as it truly and efficiently lengthens out the coverage time.

Thirty year term life policies are not offered by all insurers. They are probably offered by far less insurers than whole life policies. However given their relative low cost and long coverage length these policies should be a primary consideration when compared with permanent policies. For clients that are loath to opt for a thirty year policy vs a whole life policy a special thirty year convertible policy could be a great solution.

Speak with an experienced advisor!

Speak with an experienced advisor!