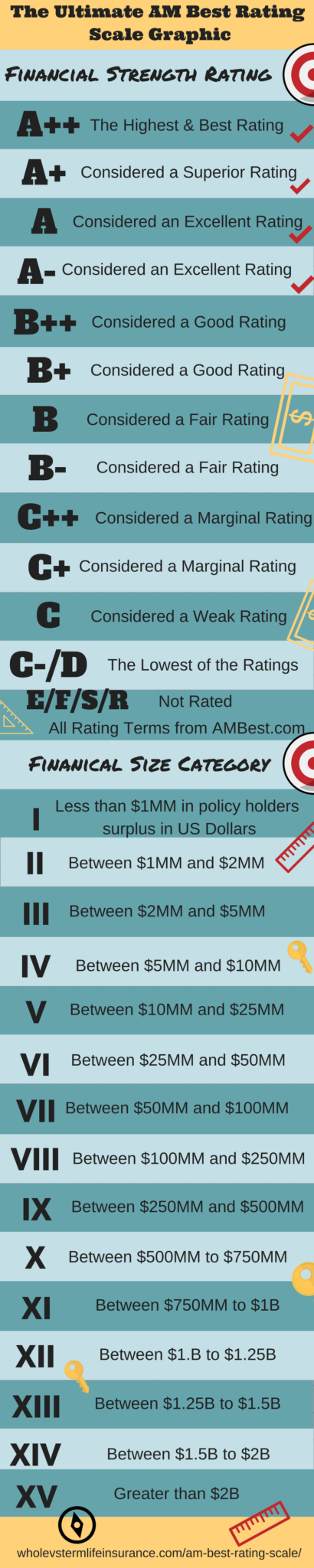

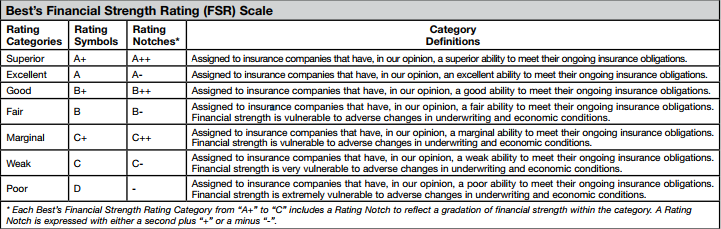

The AM Best Rating scale is a form of a Financial Ratings Scale that is specific to the AM Best Brand. Below please find detailed information concerning their ratings and classifications.

Since AM Best is the creator of the IFS rating classification and since they are the only credit rating agency to specialize in life insurance ratings, they seem to be the rater that most of the life insurers tend to focus on. Therefore a post that goes into detail of the rating scale is important. Our Ultimate AM Rating Scale Infographic is below.

Financial Strength Ratings focus on the insurer's ability to pay claims.

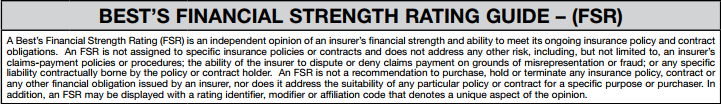

Almost all the information from this article is pulled directly from AM Best .com. The document most often referred to is the AM Best Financial Strength Rating Guide. The guide can be found on AM Best's site (//www.ambest.com/ratings/guide.pdf)

The AM Best Preamble:

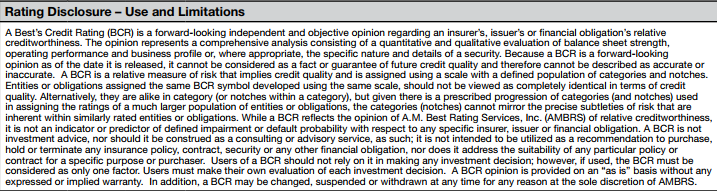

One of the biggest things to know, before learning about the rating scales is that AM Best is expressing an 'opinion' about the insured's ability to pay out claims. The FSR rating is "not a recommendation to purchase." As with any credit rating agency, its always possible that the rating agency could be incorrect about their assessment. This is one of the reasons that we always suggest that you check Financial Strength Ratings with at least two Credit Rating Agencies.

Please also understand that we are discussing most specifically a Financial Strength Ratings scale and Not a Credit Rating Scale. For AM Best their Credit Ratings are often known by Issuer Credit Ratings. Those are distinct and different. In other words they are different.

AM Best also rates insurers on their financial size. They do this by using what is known as a Policyholder Surplus. This is abbreviated PHS.

The AM Best Rating Scale:

When reading about the AM Best rating scale take great care not confuse the one plus vs the two plusses. Confusingly ++ is considered better than +. In other words an AM Best A++ is considered the very best Financial Strength Rating that they give out. And A+ is considered to be the second best. An A is just below that.

AM Best Poor Rating:

D & -

An AM Best "poor" rating is a terrible terrible score for any insurance company to receive. I can not imagine any reason to buy from any insurer that has a D or "-" rating from AM Best. Steer clear of these companies.

AM Best Weak Rating:

C & C-

A Weak ranking is a very very bad score to receive and although it is clearly better than their poor score, it should mean that you consider insurance from an carrier in this rating. I would advise clients to also stear clear of this rating level.

AM Best Marginal Rating:

C+ & C++

Although a marginal rating sounds OK, it is really not. The C+ and C++ may be ok for Geometry but its really bad news for your life insurer. There is little reason to consider these insurance companies.

AM Best Fair Rating:

B & B-

The Fair rating is the first AM Best rating that I could imagine in some scenario possibly suggesting that someone buy insurance from. However still, this rating is poor enough and with so many carriers I am not certain why this would be necessary. Our general opinion is to stay away from this category level if you can.

AM Best Good Rating:

B+ & B++

Although the word good sounds fine, its still not good enough. Often these are solid life insurers that have fallen. The B+ and B++ rated insurer is a far off possibility, but with so many A rated carriers, its not very likely.

AM Best Excellent Rating:

A- & A

The AM Best Excellent rating is the lowest rated level that we generally recommend for the purchase of life insurance. AM Best Excellent rated life insurers are insurers that have an "excellent ability to meet their insurance obligations."

AM Best Superior Rating:

A+ & A++

The Superior category is the most desirable category to be in. Life Insurance companies know this and almost all of them work very diligently to get to this rating level, whether its A++ or A+. Between both the Superior and Excellent Best ratings there are literally hundreds of life insurers to choose from.

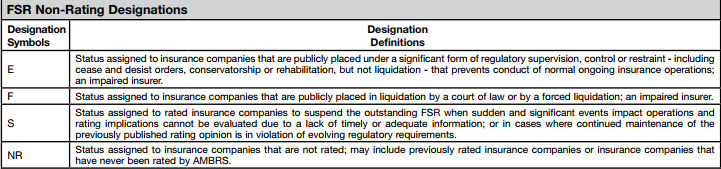

The AM Best Non Rating Scale:

Whole Vs Term does not recommend purchasing life insurance from any non rated company. However for the purposes of clarity and thoroughness with the AM Best Ratings Scale we do recommend understanding the non rated categories.

AM Best Non Rating Symbol E:

The AM Best E rating is reserved for insurers that are "under a significant form of regulatory supervision, control, or restraint." As to what exactly a non significant form of regularly supervision is we can not say. I would clearly not purchase any form of any insurance product with this AM Best rating.

AM Best Non Rating Symbol F:

This Financial Strength Rating is held for insurance companies that are in a "publicly placed in liquidation by a court of law or a by a forced liquidation." This rating is about as bad as it gets. These are insurance companies going under, but in a regulatory fashion. Do not buy any form of insurance from any insuer with the F Financial Strength Rating.

AM Best Non Rating Symbol S:

The AM Best S rating is a bit less clear on its exact meaning. It is held for firms who experience "sudden and significant events" that "impact operations and rating implications" that can not be "evaluated." This is another form of Financial Strength Rating to clearly not buy a product from.

AM Best Non Rating Symbol NR:

The Financial Strength Rating NR - merely means that it is "Not Rated." Although this is not necessarily bad news, it would seem odd to purchase any insurance product from any insurance company that has yet to be rated. Although potentially understandable for some sort of insurance conglomerate that is splitting up or splitting off, I would still generally recommend not buying any form of insurance from this type of company as well.

AM Best Ratings Disclosures:

Please read AM Best's full set of disclosures whenever reviewing the FSR ratings. AM Best Financial Strength Ratings are an opinion of the "issuer's obligations."

The World of Life Insurance is Complex, Don't Get Lost.

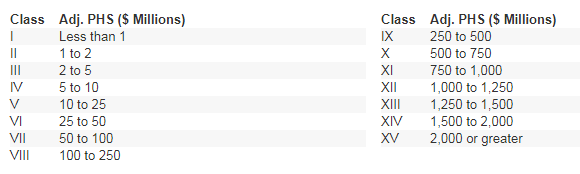

AM Best Roman Numerals / PHS:

Best also categorizes insurer's by their size category. Classes I to XV, with XV being the largest and I being the smallest. In my opinion its hard to see how this categorization helps average consumers much, but we present this information with the intention of sharing the full story.

According to AM Best, the Financial Size Category or FSC for short is "based on adjusted policyholders surplus (PHS) in US Dollars and may be impacted by foreign currency fluctuations."

Financial Size Category I

Less than $1 Million in US Dollars.

Financial Size Category II

Between $1 Million and $2 Million in US Dollars.

Financial Size Category III

Between $2 Million and $5 Million in US Dollars.

Financial Size Category IV

Between $5 Million and $10 Million in US Dollars.

Financial Size Category V

Between $10 Million and $25 Million in US Dollars.

Financial Size Category VI

Between $25 Million and $50 Million in US Dollars.

Financial Size Category VII

Between $50 Million and $100 Million in US Dollars.

Financial Size Category VIII

Between $100 Million and $250 Million in US Dollars.

Financial Size Category IX

Between $250 Million and $500 Million in US Dollars.

Financial Size Category X

Between $500 Million and $750 Million in US Dollars.

Financial Size Category XI

Between $750 Million and $1 Billion in US Dollars.

Financial Size Category XII

Between $1 Billion to $1.25 Billion in US Dollars.

Financial Size Category XIII

Between $1.25 Billion to $1.5 Billion in US Dollars.

Financial Size Category XIV

Between $1.5 Billion to $2 Billion in US Dollars.

Financial Size Category XV

Between $2 Billion and greater in US Dollars.

Questions about AM Best Rating Scale:

The world of life insurance is complex, find a guide

The Decision of which type of life insurance is hard. Both Whole and Term Life Insurance have their best uses. Learn how to assess for yourself if you are a better candidate for Whole or Term. If you find yourself wanting whole life, Run the Numbers for yourself.

Term Life: Simple, Affordable, and Easy to Understand. Inexpensive Term life insurance is available in bands of time. After that period of time, your insurance needs should be over and you will likely not need insurance with the extra money saved.

Whole Life: A Cash Value Life Insurance policy is one that has an "investment" side component that will build up a small accumulation after a decade or so. Whole life is complex and requires a lot of investigation.

How to Check a AM Best Rating:

How Do I Check a Financial Strength Rating with AM Best?

It is pretty simple. There are two sets of instructions depending if you already have an account with AM Best or not.

If you do have an account with AM Best:

- Go to ambest.com

- Type in the Name of the Insurance Company under AM Best Rating Services on the Left Hand Column. Hit "Go."

- It will either come up with the exact company you want or you will need to choose it.

- Look for the Financial Strength Rating usually about the middle of the page.

How Do I Check a Financial Strength Rating with AM Best if I do not have an Account?

- Go to ambest.com

- In the upper right hand corner click "sign up"

3. Fill out all of their requested information including Email, Password and read through the terms and conditions.

4. Follow through the new login instructions

5. Go back to the AM Best homepage.

6. Type in the name of the insurer and hit Go.

7. It will either come up with the exact name you want or you will need to choose it.

8. Look for the Financial Strength Rating in the middle of the page.

More Questions About AM Best Rating Scale:

What is an Financial Strength Rating from AM Best?

A Financial Strength Rating is an "independent opinion" by AM Best rating of an insurer to "ability to meet its ongoing insurance policy and contract obligations." Financial Strength Ratings are assigned to entire companies not specific contracts of policies.

What is the difference between IFS and FSR?

IFS and FSR are really abbreviations for the same thing. Insurer Financial Strength Rating.

Best prefers the FSR designation in most of their material whereby some of their competitors may list this differently. Focus of finding the key words: Financial Strength Rating or Ratings.

What are the other types of Ratings from AM Best?

In addition to their IFSRs, Best also issues Issuer Credit Ratings. Issuer credit ratings, as the name implies, are more specific to companies ability to maintain its "ongoing financial operations." These can be issued on both a long and short term basis.

As with the Financial Strength Rating, Issuer Credit Ratings from AM Best are not a suggestion to buy any given product or service from any firm.

Why Life Insurance Ratings Matter:

Insurer ratings matter because insurance companies business operations are not easy to understand. For the average consumer it is not possible to distinguish between a well run and poorly run financial situation. The Financial Strength Ratings scale allows consumer to understand in a simple and straight forward manner their "claims paying ability."

Who are the other Credit Rating Agencies that Cover Life Insurance Companies?

The other options to check Financial Strength Ratings are: Moodys,S&P, and Fitch. They all offer Financial Strength Rating scales.

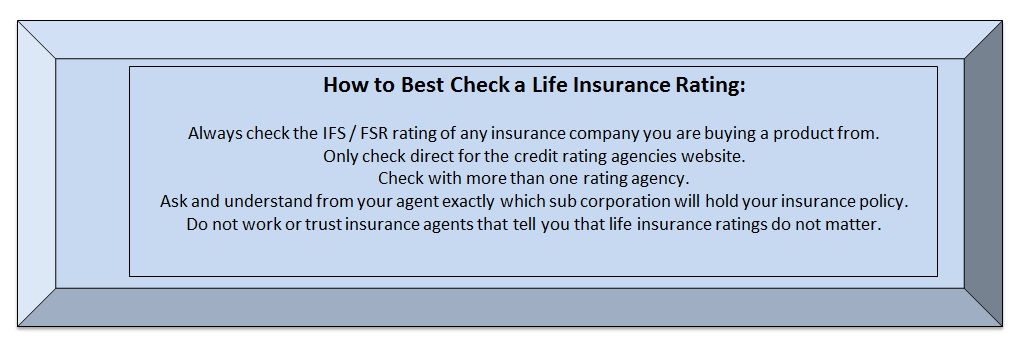

What are the Best Practices when Checking Financial Strength Ratings?

There are some general rules that I recommend:

- Always check ratings direct from the credit rating agencies.

- Only compare companies FSR results from the same rating agency.

- Check with two or more rating agencies whenever you are considering purchasing any form of insurance.

- When dealing with business that have a parent child relationship, please learn about and understand the inter-relatedness of the entire organization as well as where your policy will be placed.

The Best Practices When Checking a Financial Strength Rating for Life Insurance are...

Where do I find Insurance Company Ratings for 2017?

One can find IFSRs at the AM Best website, directly yourself.

As a general rule you should not trust ratings on insurance companies or insurance agents websites. Please always check the financial strength rating from the Credit Rating Agencies themselves.

What is the difference between AM Best's rating scale and S&P's rating scale? Also what the difference between AM Best's rating scale and the other rating agencies?

S&P and AM Best have different Financial Strength rating scales. All of the different rating agencies pretty much have different rating scales.

Do not attempt to compare Insurance company A's rating from Credit Rating X with Insurance company's B rating from Credit Rating Y. It will not work out. Only compare insurance companies from the same rating agency.

Who is AM Best?

AM Best is a private Credit Rating Agency. They were founded in 1899 in Oldwick, New Jersey. According to Investopedia, AM Best is the only rating agency "that specializes solely in the insurance industry."

Should you use Financial Strength Ratings Only for Life Insurers?

No, FSRs should be checked, in our opinion, each and every time you are researching any type of insurance, property, health, commercial, personal, or otherwise. The overall soundness of the insurer is of critical importance. Ignore financial strength ratings at your own peril.

Thanks for reading our AM Best Rating Scale article. Should you have a question that was not answered in this short piece please feel free to contact us direct.

How to Contact Us

Email: sales@marindependent.com

Phone: 415-294-5454

PO Box 585 Mill Valley CA 94942

Twitter @marindependent1

Speak with an experienced advisor!

Speak with an experienced advisor!