When Everything looks the same how do you know which is BEST?

When Everything looks the same how do you know which is BEST?- ALL INSURANCE companies are not the same.

- Life Insurance Ratings Could Determine your financial success or FAILURE.

- What to AVOID with Financial Strength Ratings.

- Where Not to look for insurer RATINGS.

- Why you should NOT DARE buy insurance without reading this.

The Life Insurance Ratings Story:

What if I were to tell you that one of these gas valves was going to explode in the next 4 years-would you still buy the building?

You may.

But you would first have the building reviewed by a credentialed inspector. You would then choose to fix the leaky gas line or not buy the building. So why would you buy insurance without first using free resources dedicated to reviewing their complex financial foundation?

“Confusingly, There is More than One Way to Rate an Insurance Company…”

What is a Credit Rating?

According to Investopedia, a credit rating is “an assessment of creditworthiness of a borrower in general terms or with respect to a particular debt or financial obligation.” As it relates to insurance company’s a Credit Rating is essentially a financial analysis of the companies ability to pay its current and future bills. In the case of Insurance companies, we are talking about Claims paying ability.

Credit Rating Agencies comb through documents such as financial reports, investments, and just about any other public documents that they can assess how much money is going in and how much money is going out. In the case of Insurance companies they will also be looking at specific insurance metrics of policies in force. Knowing nothing else about a given insurer a credit rating is intended to give one an instant financial idea of the soundness of the company.

According to the United States Securities and Exchange Commission (SEC) Credit Ratings are NOT “a financial guarantee that a financial obligation will be repaid.”

Typically Credit Rating Agencies have a special type of rating that you use exclusively for Insurance Companies. These types of ratings go by the name Insurer Financial Strength Rating (IFS) or Financial Strength Rating (FSR). These type ratings are more specialized and specific to the needs of consumers of insurance. The judge a companies ability to meet its claims requirements.

What is a Financial Strength Rating?

A financial strength rating, or FSR, is an opinion of a of an insurer’s ability to meet and pay insurance claims and contract obligations. A financial strength rating is different than a credit rating. Financial Strength Ratings are issued by the Credit Rating Agencies. Financial Strength Ratings basically rank the financial soundness of an insurer.

What is a Life Insurance Company?

A life insurance company is an organization that provides contracts between the “insurer” and the policy holder. The contract agrees to pay out, a specified amount of money, in the event of the death of the insured person to a listed “beneficiary.”

All life insurance has Four parties to a contract:

- Insurance Company. Also called the Insurer.

- Owner of the Policy. Commonly this is also the Insured.

- Insured Person.

- Beneficiary. The person, persons, or entity to receive agreed funds.

Typically Life Insurance companies are set up as separate entities from home, auto, or other insurance businesses. Life Insurance was first started in a modern form in England in the early 1700s. Life insurance products first appeared in the United States in the 1760s.

How are Life Insurance Ratings Calculated?

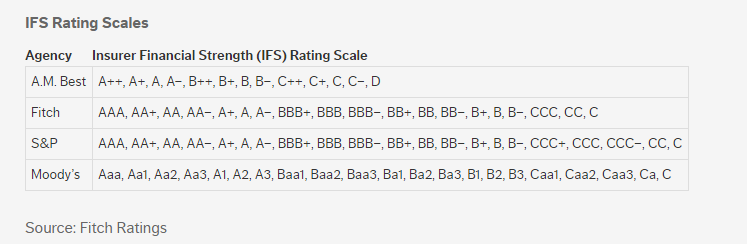

Each Rating Agency uses their own methods to compute credit worthiness. They also display their ratings in different methods. This makes the system very difficult to compare one credit rating from one company to another.

They use both Qualitative and Quantitative information. The rating is based on known financial obligations and outstanding policies together with future assumptions. Assumptions of future claims and other obligations. If the assumptions of the credit rating agencies turn out to be incorrect, the rating may not be accurate.

ICR vs FSR/IFS Ratings:

Believe it or not there is more than one way to rate an insurance company. If you were buying a company bond you might be concerned about the companies ability to pay back the bond. However if you are buying a life insurance policy you will, most likely, be more concerned with the insurers ability to pay a life insurance claim. Although these two outstanding “obligations” are similar they are technically quite different.

ICR stands for Issuer Credit Rating. An issuer credit rating has more to do with the insuring companies ability to meet its financial obligations. Although an Issuer Credit Rating is important, the FSR/IFS rating is probably more important for consumers of life insurance.

What are IFS Ratings?:

IFS stands for Insurer Financial Strength. IFS ratings are used exclusively for insurance and reinsurance companies. IFS is sometimes also confusingly referred to as FSR for Financial Strength Rating. There are four main agencies that provide IFS ratings: AM Best, Fitch, Moodys, and Standard and Poors. There are some differences between IFS ratings and general credit ratings.

According to Fitch, AM Best was the first rating agency to offer IFS ratings. AM Best is a specialty rating agency, whereby the other three are much broader and provide rankings across numerous industries. When researching your future insurers rating, be careful to review their IFS rating. The long term Credit Rating can be useful as well. These can be different.

More Information about IFS and the differences between General Credit Ratings can be found on a Fitch Whitepaper from July 2016.

AM Best Insurance Ratings:

AM Best Insurance Ratings:

Headquarter Location: Oldwick, NJ

About AM Best: AM Best was founded in 1899 by Alfred M Best. AM Best it a specialist rater and focuses only on rating Insurance Companies, their entities and Reinsurance companies. Their mission is to “report on the financial stability of insurers and the insurance industry.” The CEO and President of the corporation as of 2017 is Arthur Snyder III. In one form or another AM Best provides coverage for over 16,000 insurance companies worldwide. AM Best prefers to use the term FSR with regards to its Insurer Strength Rating.

AM Best provides not only provides Insurer Financial Strength Ratings for Insurers, but also Issue Credit Ratings as well. AM Best IFS Ratings go from a High if A++ to a low of D.

Fitch Insurance Ratings:

Fitch Insurance Ratings:

Headquarter Location: Dual headquarters in both New York and London.

About Fitch Rating: Fitch Rating is owned by the Fitch Group which is majority owned by the Hearst Group. The Fitch Group is comprised of three other divisions: Fitch Solutions, BMI Research, and Fitch Learning. As of 2017 Paul Taylor is the CEO and President of the Fitch Group. Ian Linnell is the President of Fitch Ratings. Fitch Rating was designated as a Nationally recognized statistical rating organization in 1975 by the Securities Exchange Commission of the United States. Fitch employs around 2000 people. It was founded in 1914 and was named after its founder John Fitch. Fitch Ratings go from a low of D to a high of AAA. Fitch Ratings prefers the term FSR when referring to Insurers Financial Strength ratings.

Fitch Rating White Paper Download “Not All Rating Insurer Financial Strength Ratings are Created Equal”: //www.fitchratings.com/site/insurance/ifsratings

Moodys Insurance Ratings:

Moodys Insurance Ratings:

Headquarter Location: New York, NY

About Moodys Ratings: The Moodys Corporation is the holding company for Moodys Investor Services. Moodys Corporation which employs about 10,600 people also owns Moodys Analytics. As of 2017 the current CEO is Raymond McDaniel. Founded in 1909 by John Moody, Moodys is considered one of the big three rating agencies. Moodys Investor Services maintains ratings on over 20,000 “public finance issuers.”

Standard & Poors Ratings:

Standard & Poors Ratings:

Headquarter Location: New York, NY

About Standard & Poors: Started in 1860 by Henry Varnum Poor, Standard and Poors is considered also to be one of the Big Three Rating Agencies in the United States. Standard & Poors Financial Services LLC is a division of S&P Global Inc. There are numerous divisions of S&P Global Incorporated. S&P employs more than 10,000 people.

The Others:

The Comdex Score:

The Comdex Ranking is a tool for advisers and insurance agents and it not marketed or allowed free of use for the general public. For that very reason – I find it hard to recommend.

The comdex ranking is itself not a “financial strength rating” – but a compilation of ” percentile ranking of life insurance companies derived from the financial strength ratings issued by A.M. Best, Fitch, Moody’s, and Standard & Poor’s.” So it essentially adds in all of the ranking from all the big three and AM Best to come up with a so called Master Score. This has both good considerations and bad. The good is that is may be a good way to look at just one score. The issue with using the Comdex Ranking is two fold. First is it not a public available rating. Second, since it incorporates all the rating agencies information, it is susceptible to a mistake by all of them simultaneously.

There are other Credit Rating agencies out there. Doubtless some of them cover insurance companies. However those four: S&P, Moodys, Fitch, and AM Best represent the most commonly sited and read about Life Insurance Rating Agencies.

Corporate Considerations:

The Insurance Entity:

The Insurance Entity:

Insurance companies are created along various foundations. These include, but are not limited to: Corporations, Mutuals, Reciprocals, Syndicates, etc. It may prove helpful to understand this formation For Example Mutuals are Insurance Companies that are owned by their policy shareholders. While Corporations are owned by stock holders.

The Insurance Subsidiary:

The Insurance Subsidiary:

Many Insurance companies are composed of a Master Entity with smaller sub entities. The Entities sometimes fall along regional lines, coverage lines, or other lines. This is done for many reasons. For consumers, it is important to look up not just the Master Entity but also the Subsidiary. Follow the chain either from the bottom to the top or from the top to the bottom where you policy will be held.

How to Compare Financial Strength Ratings from one Credit Rating Agency vs another Credit Agency:

Don’t.

For consumers of life insurance just do not do it. Look only at the Rating of the same agency to compare two different life insurance companies.

One should be careful comparing one rating from one rater for one insurance company, with another rating from another rater for another insurance company. An example of this would be comparing A+ Rated Insurance Company X vs AA Rated Insurance Company Y. It is almost always best to compare two different insurance companies financal strength ratings from the exact same credit rater. Better yet, compare them both from one rating agency first and then rate them each with a second rating agency.

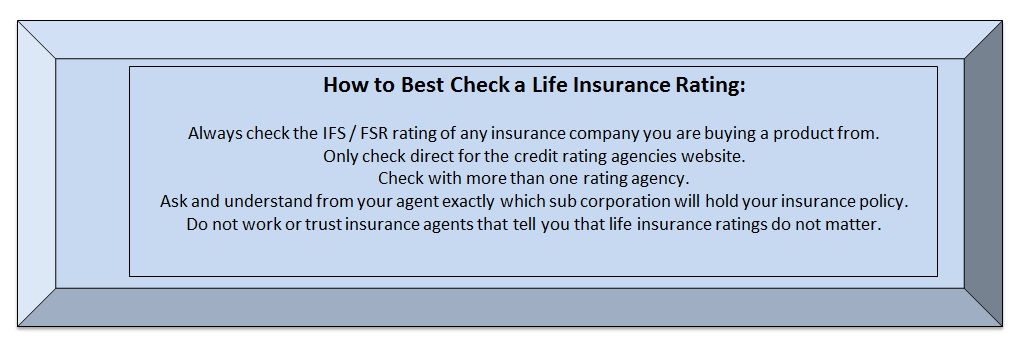

Why You Should Not Trust the Financial Strength Rating on Websites or Paperwork:

Why You Should Not Trust the Financial Strength Rating on Websites or Paperwork:

No one is trying to say that agencies intentionally give out false information about insurance companies. However, paperwork, webpages, they get old. A document that says a company is A++ may not have been updated for four years. Within the past four years, a companies rating could have plunged to A. Likewise a company that may have been ranked A- may have drifted upwards to an A. Without question the ideal location to find a companies financial strength rating is direct from the rating agency themselves.

How much does the Financial Strength Rating Matter When you Buy Insurance?

Well, it matters. It matters a lot.

All other things being equal, one should compare insurance premiums between A++ companies vs other A++ companies. A- insurers against other A- insurers. When you are placing insurance for a harder to write risk, such as an asthmatic, it might make general sense to get insurance from a lower rated company. However, when you have a regular, easy to write insurance situation, one should try and aim for a highly rated insurer at the best price.

One consideration is the duration of the insurance. When you buy home or auto insurance, you are buying insurance usually for periods of one year. With life insurance, typically you are buying insurance for 10, 20, 30 years. With whole life insurance, you are buying life insurance for your entire natural life. This should be a consideration when picking out a life insurer.

Another consideration is to understand the past history of the credit rating. Has it always been in the A range? Has it been going down steadily for ten years now? If there is a past trend, that might be important. If there were a certain period where there was a blip, finding out why, may matter.

“The Financial Stentgh Rating Matters for All Forms of Insurance.”

Does the Financial Strength Rating Matter for Whole Life Insurance more than Term Life Insurance?

The credit rating matters greatly for both Term AND Whole life insurance. For shorter periods of life insurance, such as ten year terms, it is hard to argue that the credit rating is as important as for a Cash Value life insurance plan that plan that you plan on having for the rest of your life. That being said, a large percentage of Americans that buy whole life insurance policies do not end up keeping them more than ten years. Given the lack of certainty of the time frame which many insurance policies will be held, I believe that the Credit Rating is generally as important for the average to longer term lengths as it is for Whole Life plans. A more important question may be: How does a consumer of insurance use Credit Ratings to Make Decisions?

How Do I buy Life Insurance using a Financial Strength Rating?

- Research

- Compare

- Contrast

- Ask Questions.

That is how you should use Financial Strength Ratings when buying term or whole life insurance. Life Insurance Ratings do matter.

Research Life Insurance Ratings:

Start off by pulling the credit ratings direct from the rating agency of your choice. You will likely have to create an account with one of them. Usually this can be done for free.

Compare Life Insurance Ratings:

Now you can start to compare ratings. First off always compare apples with apples. Start with multiple insurance quotes for the same length, coverage, and compare their Financial Strength Ratings from the same credit agency. Do not try at the start to use multiple agencies. Check their current rating and past historical ratings. Has it moved up recently or down?

Contrast Life Insurance Ratings:

Second, don’t just accept the advice that you should always just buy the highest rated insurance policy. That often might not make the most sense. If an insurance company can offer you a savings but be a slightly lower rated than a rival, than you should consider that. Would you accept a $71 yearly savings to buy a ten year term life policy that is an A- rather than an A? Some people would say no, others might take the chance. The choice is up to you the consumer.

“You May Be Working With the Wrong Agent if You are Too Afraid to Discuss Insurer Ratings.”

Ask Questions About Life Insurance Ratings:

Third – Ask Questions about why some insurance companies are being offered and others might not be. If your life insurance agent is suggesting a lower rated insurer over another ask them why? Sometimes life insurance companies are selected for their underwriting criteria. For example one insurer may be willing to accept someone that is slightly heavier than another insurance company. Some insurance agents may only be able to offer you life insurance policies from one or two insurers. Some agents my be unaware of FSRs.

Repeat:

Once you have narrowed down your selection to just two or three insurers, I would advise you to move to a different rating agency. Go from say Fitchs to AM Best. Use the second rating agency to just compare the options on equal footing. If the second rating agency now turns up a difference of opinion that the previous rating agency did not, you may now have your answer.//youtu.be/Dbh1FnU_6dY

Which is the Best Credit Rating Agency to Use?

It is beyond the ability of Whole vs Term Life to asses which Credit Rating Agency is best for rating insurance companies. We just do not know enough about their methods to draw a conclusion at this time. That is partly why we recommend checking more than one FSR. What we can suggest to you is that both Fitch and AM Best seems to be the most consumer friendly, in our opinion. That does not mean that there methods are any better or more accurate than other choices.

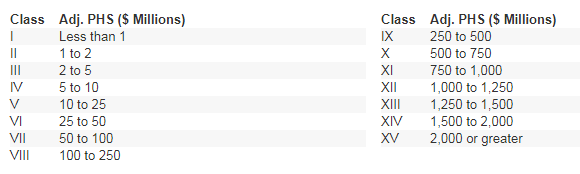

Are there Other Ratings Issued by the Credit Rating Agencies?

Yes, some of the credit rating agencies also rank insurers on their Financial Strength Category. An ‘FSC’ is “based on based on adjusted policyholders’ surplus (PHS) in U.S. dollars” and this may be changed “foreign currency” holdings and changes. With AM Best these ratings are listed in Roman Numerals. Some times you see them called the Roman Numeral ratings. These ratings range from the smallest size of I all the way to biggest insurers at XV. Some consumers and buyers feel more comfortable buying term or whole life insurance from larger carriers.

Judging an insurer by its size is not a simple thing to do. At this time we make no recommendation solely based on the size of a given insurer. Although knowing the size of the company could be useful.

What are the Chances of an Insurer Going Bankrupt?

Technically regulated insurance companies don’t really go bankrupt. Simply put (and it is more complicated than this) the insurance carrier becomes “impaired.” This often means that the state insurance regulator will come in and begin to assist in the running of the company. The goal is usually to continue to provide policy holders with their ongoing insurance. It is pretty rare for highly rated insurance company to become impaired. An AM Best study concluded that in the past year 2015 1.2% of insurers became impaired. However this is across all of the ratings. That was 9 impairments with only one of them being a life and health insurer. All of those impairments will certainly not lead to the next phase known as liquidation.

Past Performance though is no guarantee of the future.

Why Life Insurance Ratings are Important:

The purpose of life insurance is offload the risk of a premature death to an insurance companies balance sheet. But how is a consumer to know if that balance sheet can handle your untimely death? Rating Agencies solve this problem by using a simple lettering system to explain to consumers their ability to take on this risk. Don’t let all of their hard work go to waste by ignoring the information that only a few understand. Check the Financial Strength Rating Every Time your Shop for Life Insurance. Check at least two different agencies information. Check their past histories.

What are the Best Term Life Insurance Companies?

The best term life insurance company is the insurance company that best fits your needs. When purchasing a 20 year term life insurance policy it may be the highest rated company that offers you the best finalized price after going through your medical history. For a Whole Life policy it may be the best priced A+ rated carrier that allows the best build up of cash value.

Should I Ignore Life Insurance Ratings?

No, you should never ignore a life rating for any insurance company, life or otherwise. Life insurance companies are not all the same and the only way that consumers can get a handle on these financial differences is through Financial Ratings.

Help I am Confused!

If all of this information seems too confusing, please call us at 415-294-5454 or email us at sales@marindependent.com for more information or just to ask a question.

Speak with an experienced advisor!

Speak with an experienced advisor!