- How to Evaluate How Much Term Life Insurance you need

- How to Calculate how much term coverage you should consider.

- What not to do…

Buying life insurance can be difficult for some, but it does not need to be so. Buying level term life insurance for stay at home dads should be a piece of cake. But how do you calculate how much term life insurance a stay at home dad needs? We show you in just 4 Simple Steps how to calculate how much to buy.

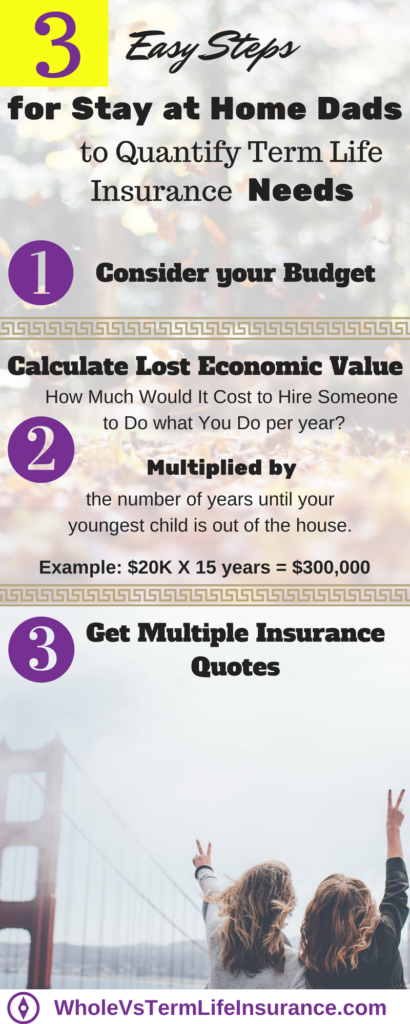

Step One – Calculating Stay at Home Dads Life Insurance Needs:

Budget Concerns

The best place to start off in calculating this number is often to first figure out what you can afford. Because it does not really matter if you require a certain amount and cannot afford it. When you buy a life insurance policy, its generally best to stick with something that you can afford this year, the next, and each year until the termination of the proposed policy length.

- Consider your yearly and monthly budgets.

- Calculate how much money you have available, generally yearly.

- If you have no budget, as in zero available. Consider what you can cut back to buy some term life.

The budget concept is important because it is worthless to buy life insurance if you can not easily afford to pay it each and every year. As a general rule of thumb, life insurance becomes more valuable as you age, therefore you want to make sure you can afford it as you become older.

Contact Us Today

Let Us Help you Figure this out

Contact Whole Vs Term Life Today

Step Two – Calculating Stay at Home Dads Life Insurance Needs

Lost Economic Value

In many of my blog posts I have discussed how ‘stay at home parents’, such as stay at home dads can begin to try and compute how much life insurance that they need. However, these computations are really just ideas of a place to start. Your specific situation will change it. Clients must consider their own personal situations and add in or remove out certain considerations. No online calculating method will be perfect.

Assuming the stay at home Spouse is home and caring for the kids full time, consider the following;

- Additional Cost to hire a full time, 50 or so hours per week, nanny or daycare.

- Cost to hire a cleaning service, perhaps one time per week.

- Cost to use a laundry cleaning service.

- New transportation costs. How will the kids get from point A to point B?

- Increased costs for meal preparation and take out dinners.

- A few years worth of Therapy sessions for the entire family.

- Potential tutoring service costs.

- New lawn and garden care services.

- Additional costs for sports and associations because the surviving spouse may not be able to volunteer like in the past.

- Increased costs to fly family out to visit and hence help the surviving spouse out.

- Increased cost to fly your kids and sometimes you out to grandparents and other family members.

Now calculate the number of years until your youngest child reach the age of maturity. Note – this age can be pretty specific.

Now multiply those years by the amount of the costs per year that would need to be replaced.

Are there ways in which your families costs will be lowered with the loss of a loved one? Yes technically but unless there is huge expense that the Stay at home parent typically incurs, I would largely just ignore that cost.

Get a Term Quote Today

Other Calculation Considerations:

There are also other family considerations when buying term life insurance, that many people would only consider pertaining to the working spouse. However, I would encourage you to ponder these questions:

- Would we want the life insurance to be used to pay off the mortgage?

- Would we want the surviving spouse to be able to quit their job and stay home?

These consideration will likely make your life insurance requirements much more expensive. It may not be possible for the stay at home spouse to even be able to procure enough life insurance for these purposes. However they are considerations worth asking.

Step Three – Calculating Stay at Home Dads Life Insurance Needs

Get Quotes

Getting a life insurance quote is easy. Finding the right and best life insurance price is not. Go out into the open market and speak with many agents to come up with multiple insurance potential prices:

- Get a Variety of term length options quoted out, such as 15,20, and 25 year policies.

- Get Dollar amounts both higher and lower than you forecast you need. For example if you believe you need $400,000 in term life coverage, then also get numbers for $300,000 and $500,000.

- As a general rule stay at home parents may not be permitted to buy MORE life insurance than the working spouse.

Contact Us Today

The World of Life Insurance is Complex, Don’t Get Lost.

How Best to Shop:

- Get Insurance quotes from not just your home/auto agent.

- Contact an online life insurance agency and ask a life insurance specialist.

- Insist on the type of life insurance that you want and need, not what an agent tries to sell you.

- Consider AM Best A- and above rated insurers. Potentially A and above.

- Ask about your specialized underwriting situation. Inquire about your personal situation as a stay at home dad or stay at home mom.

- Do not sign or agree to anything until you have time to sit down and review the options.

Step Four – Calculating Stay at Home Dads Life Insurance Needs

Compare and Contrast

Now that you have understood your budget, discovered how life insurance you need, and have quotes in your hand, it is time to compare what you can afford, with what you need, based on the actual term costs.

- Use a spreadsheet, such as Excel or Google Docs to list our all of the term life insurance options. Add at least the name of the company, db amount, term lenth, yearly premium, and Financial Strength Rating

| Insurance Options for Stay at Home Dad | ||||||

| Theoretical Insurance | ||||||

| Insurer | Death Benefit | Term Length | FS Rating | Premium | Notes | |

| Excelliot | 400,000 | 20 | A+ | $612 | From online.com | |

| Excelliot | 500,000 | 20 | A+ | $625 | From online.com | |

| Excelliot | 600,000 | 20 | A+ | $670 | From online.com | |

| AQ Dod | 450,000 | 25 | A | $650 | Spoke with Sue | |

| AQ Dod | 500,000 | 15 | A | $480 | Sue Recommended | |

| AQ Dod | 500,000 | 20 | A | $495 | Spoke with Sue | |

| AQ Dod | 500,000 | 25 | A | $560 | Spoke with Sue | |

| ABC Home | 500,000 | 20 | A | $875 | Same as home/auto | |

| Note: These are all made up numbers and made up insurers | ||||||

- Now compare these overall yearly costs with what you determined was what you could afford in step one.

Get a Term Quote Today

Now you can Compare:

- I would like to buy the $560 in term life insurance coverage

- But I can only afford $495 in insurance.

- At this point it may make sense to consider consulting a trusted friend, a financial adviser, and certainly your spouse.

Now its Time to Make Your Life Insurance Decision:

Now comes the decision that you must make. For some people its all too easy to obsess on the answer and never make one. I always caution clients against this. As a general rule any term life insurance policy is better than no term life insurance policy. Make a decision and get the application started today.

Thank You

Thanks for reading my post about how to calculate how much term insurance a stay at home dad needs. Remember life insurance is necessary and important for a large part of our society and generally speaking just about any term life insurance product is better than no life insurance.

Please read our privacy policy. Speak with a licensed agent when you have questions.

Speak with an experienced advisor!

Speak with an experienced advisor!