Life Insurance is complex business, but don't let it scare you - Ask these simple questions of your insurance agent - otherwise it may cost you a boatload of money.

Do you want to waste money?

Don't Get Tied Up in the Wrong Insurance - Ask these Questions or - Over Pay.

The First Question for your Life Insurance Agent

Are you a Captive Insurance Agent or an Independent?

The world of Insurance is complex. One of the complexities is in understanding the differences between Captive Agents, Independent Agents, and Brokers. For life insurance the term broker is often not the best term. However a broker is usually an insurance person that is not appointed by the given insurance company. Whereas an Insurance Agent is.

What you really want to know with life insurance is are you a Captive Insurance Agent or an Independent Insurance Agent. Ask the agent: "How many insurance companies do you work with." Or "How many insurance carriers can you work with?" A captive insurance agent can only work with one group of insurance companies. The group of insurance companies may be comprised of a few insurance carriers but which are all part of the same family. A modern independent insurance agent may be able to work with up to sixty or so different insurance carriers.

The Second Question for your Life Insurance Agent

Do you Sell Only Life Insurance?

Many people dabble in insurance sales. Some insurance agents treat it as a side job, selling mortgages along also. Some have a full time corporate job and sell insurance on nights and weekends.

Some insurance agencies will focus on health and life and other insurance agencies will sell property and casualty for homes and small businesses as well.

In the United States there are lots of types of Insurance and Insurance Licenses. Insurance licenses are approved and dispensed by individual states, such as the State of Texas: Texas Department of Insurance.

In the state of Texas there are approximately 30 types of Insurance licenses. What exactly else in your Insurance Agent dabbling in?

The Third Question for your Life Insurance Agent

Are you a Life Insurance Specialist?

A life insurance specialist may mean that the agent focuses on life insurance underwriting and sales. Although potentially loosely defined this could mean that the insurance agent is possible more intelligent and knowledgeable about the underwriting process.

Self styled life insurance specialists often don't bother selling too many other forms of insurance instead choosing to hone their skills. By honing their skills they may be better placed to help you out with your situation.

Does having a life insurance specialist matter for your situation?

It may.

Consider two different scenarios. John, a family man, is very healthy and needs a small amount of term life insurance. Vs Mary, a 'go-getter' corporate type, who smokes and sky dives at least once a month. Which of these prospects might make a good candidate for the specialist? The boring Dad or the Smoking Sky Diver?

The Fourth Question for your Life Insurance Agent

What is the Process to buy Life Insurance?

I am often surprised how few people ask me this question. Buying life insurance is nothing like a car. There is no guarantee that you will drive off with that new car. It is also massively different than other forms of insurance procurement.

Unlike auto insurance, which takes some underwriting, a policy can be up and running in a day or so. With the exception of a temporary life insurance option, that is not really the case with fully underwritten life insurance.

The process for buying life insurance depends, partly on the type of life insurance purchased. A quicker issue no medical term policy can be issued quickly vs a higher premium paramed required term life insurance policy.

Thus, the processes are different. Make sure you ask this important question to understand the difference.

The Fifth Question for your Life Insurance Agent

How Long Does it Take to Get Life Insurance?

The life insurance underwriting process depending on which route of life insurance you are taking. But typically a fully underwritten term life policy with a medical exam can take 4-6 weeks, perhaps longer to get to an offer. But this is dependent on all of the requirements coming together. A missed form by a single doctor can quickly slow down the process.

But...if you want a form of life insurance put into place faster, potentially immediacy, you may be in luck. This is one of the reasons that you need to ask this very important question. Question number 5 and number 6 tie into together well.

The Sixth Question for your Life Insurance Agent

Do you offer Temporary Life Insurance while we wait for underwriting?

Temporary life insurance can be a great option for people that immediately want some security. It may not be offered and may not be available in all situations. However if you are interested in it, you should certainly bring it up in your conversation with your insurance agent.

A Temporary Insurance agreement, according to Riscario of Canada, "is a binding contract between the insurer and the applicant which the agent issues." Generally, if the insured dies, "during the underwriting process, the insurer pays the death benefit unless the insurer can prove that they would not have issued the policy for which you applied." There is usually limits to this program depending on the insurance carrier.

The reason that this is important question for your insurance agent is because some agents may, sadly, not know that it may be available to you or make just forget to offer it. Again, asking the right questions can really make all the difference.

The Seventh Question for your Life Insurance Agent

Do you Offer Electronic Signature Technology?

Electronic signature allows clients to sign documents from their computer and sometimes even their smart phone. This single technology has a variety of benefits. First off, it easily speeds up the life insurance process by eliminating mailing, signing, copying, and emailing out documents. Second it increases the security of the applications as it electronically stores them out of sight of prying eyes. Third, it has a cost and environmental benefit cutting down on printing out 76 page life insurance applications and various forms, some of which were never needed in the first place.

E Signature technology also allows clients to sign documents when they are traveling. When you are dealing with a process that can take weeks - this often happens.

I do everything mobile on multiple devices, and pride myself on being paperless. I save time and don't need to go to the office. It's also much easier for my clients because they don’t need to find me.

As Robert Bolar of OwnUtah.com stated, electronic signature technology is beneficial for the selling agent. But it is also very helpful for the consumer as well. Is E signature right for everyone? No, but its great for most people.

The Eighth Question for your Life Insurance Agent

What are your thoughts on Whole vs Term Life Insurance?

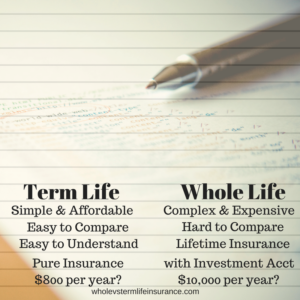

Frequent readers of this site will know about our belief on the value of both Whole vs Term Life Insurance. Whole life, which is complex, complicated, and more expensive is the form of insurance that many insurance agents will recommend. Insureds should do their due diligence before deciding to not purchase the far less expensive and more modern product of Term Life Insurance.

However, knowing how an agent feels about the differences between the two may assist you in understanding why they may be recommending one vs the other. Term Vs Whole Life is a perennially question.

SPECIAL NOTE: If you are considering Whole life insurance there is another much larger set of questions that you will want to speak with your agent about. Please DO NOT JUST RELY ON THIS LIST.

The Basics of Life Insurance

Term Life:

Simple, Affordable, Easy to Understand and Quick to Purchase Pure Insurance.

Whole Life Insurance

Complex, Expensive, Hard to compare Life Insurance with an Investment Component.

The Ninth Question for your Life Insurance Agent

How does my Health Affect my Life Insurance Rates?

Your health situation will greatly change the rates of life insurance that you are ultimately offered. You should know this going in. But how much it changes your rates depends on your situation.

Many captive insurance agents or inexperienced brokers may be unaware of the differences in rates that clients can see from just a simple health situation. The more you ask your about your situation the more you may learn about the insurance agent themselves.

Don't be turned off though if an insurance agent wants to get back to you though. Many good insurance agents will run potential theoretical cases by other agents, underwriters, etc to get a feel for your situation. Finding someone that is willing to take the time to research your case could save you thousands of dollars.

The Tenth Question for your Life Insurance Agent

How does my Lifestyle Affect my Life Insurance Rates?

Not only your health, but your lifestle will raise or lower your life insurance rates. Activities such as Scuba Diving, Base Jumping, Motorcross Riding, Hanggliding, Rock Climbing, Etc may affect your premiums. There are numerous others.

Asking your insurance agent about your hobbies is very important and is often one item that clients fail to foresee. Many so called dangerous hobbies or activities may be able to be placed at a reasonable rate if their occurrence frequency is low and of the general moderate form. Sometimes finding an agent with a experience writing a specific dangerous avocation may be your best bet.

As with all insurance applications - remember Do Not Lie.

The Eleventh Question for your Life Insurance Agent

What are your Specific thoughts on underwriting for my situation/condition?

This more general question may allow you to get an understanding of the thinking of your potential new insurance agent. If your agent does not have much of an opinion, they may not be experienced.

An experienced insurance agent likely will have numerous opinions about your situation and potentially lots of follow up questions.

FOR EXAMPLE: Client "I have high blood pressure" Experienced Life Insurance Agent "What are your blood pressure readings? When Was this last taken? Do you take medicines to control your blood pressure?"

You may get the feeling with an inexperienced insurance agent that they are just not sure what to do.

The Twelfth Question for your Life Insurance Agent

What is a good Estimate of the amount of life insurance that someone in my situation may need?

In other words, how much life insurance do you think I need? Professionally I am always a little cautious telling me how much they need. In my opinion the best practice is to run some simple and more complex explanations about how they can decide the number themselves.

However that should not prevent you from asking your insurance agent this very question. There is nothing that says you need to buy the amount that they recommend, but asking is a smart thing to do.

In the world of life insurance sales, its easy to just throw around numbers. But insurance agents are not really the ones that will have to deal with the aftermath of being either over or under-insured...

You will.

The Thirteenth Question for your Life Insurance Agent

Approximately how long would you think I need Life Insurance For?

Term Life Insurance comes in bands of years.

10, 15, 20, 25, 30, Lifetime.

Choose one or a couple of them.

As with question twelve. It can be difficult when potential clients ask this question, but I do have some recommendations. Aim for the time period that you need to be covered for. Some people like to focus on getting their kids out of the house. In other words, the time period that it takes to get their kids mature and out of the house. That may be one reason why level twenty year term policies are so popular with new parents.

You should not just accept the number that the potential insurance agent suggests, but listen to their opinions to assist you in making up your own mind.

The Fourteenth Question for your Life Insurance Agent

If I have an employer provided life Insurance, do I still need my own life insurance policy?

Work life insurance can be a great benefit for employees. However depending on it as your sole life insurance policy can have major issues.

For Example: What happens if you lose your job?

Another Example: What happens if this benefit is not offered at your company next year?

Even if you do not lose your job the standard one times yearly salary amount that many forms of corporate life insurance offer may probably not be enough for most families. Assuming that many of the standard mathematical computations apply to your life insurance situation, a family may get one times life insurance at work and still be in need of nine times from an independent term life policy.

The Fifteenth Question for your Life Insurance Agent

What are your recommendations on Living Benefits?

A life insurance living benefit can mean slightly different things to different insurance companies. A company such as New York Life may have different options than a company such as State Farm.

This question could easily be changed to "Which living benefits are available with this insurance policy?"

Living benefits can potentially mean premiums that do not need to be paid if you lose your job or a partial payout of your policy in the case of a very significant negative health factor. Ask your agent and become intelligent about the proposed life insurance policy that you are buying.

The Sixteenth Question for your Life Insurance Agent

Will there be a Medical Exam?

Many life insurance policies require that you meet a paramed. A paramed visit is merely a nurse that comes either to your home or office and runs medical tests on you. Seeing a paramed may be the best way to assure you of saving money.

Some tests will be simple such as weighing and measuring you while others, depending on the size and type of policy may be far more complex such as a EKG. EKG stands for electrocardiogram.

There are lots of simple tests they will typically do though. Weigh and Measure, blood test, health questions, listen to your heart, take your blood pressure. If you are honest and truthful though, there is really nothing to worry about.

The Seventeenth Question for your Life Insurance Agent

What Happens if I can't pay my premium?

Generally speaking failure to pay your premium does not turn out well. Your life insurance policy in the case of a term life policy may have a small grace period. Failure to pay in that grace period usually means the end of your life insurance policy. With Whole and other Cash Value type life insurance plans, it may be possible for the premium to be payed by taking out a policy loan from within the cash portion of the account. Term life will not have this feature.

This is a good question, though when shopping for life insurance to allow you to fully understand a proposed policy as written. If you believe, reasonably, that at a future time that you may not be able to afford your life insurance premium, you may be purchasing too much.

The Eighteenth Question for your Life Insurance Agent

What is the Cost of the Proposed Policy for One Underwriting Class Lower than you Quoted me at?

This is almost what I would call a secret question. This is extremely important consideration because until all the medical tests come back, even the best insurance agent is merely estimating what health class you will be put into. Therefore its often best to hedge your bet and consider the what if scenario. In other words what if my cholesterol is much higher than I thought it was? The best plan of action here is to do as much pre underwriting on each case as is possible. And consider the lower (more expensive) health class as well. Sometimes company A s - super preferred health class might easily beat all the others but Company A s - preferred health class might not be nearly as competitive.

Many inexperienced agents skip over this consideration when it may end up costing the client a boatload more money when they miss out on the health class that we had all hoped for. Don't let this mistake happen.

Another consideration with regards to this is not let yourself get "Sold a Unrealistic Health class." In other words, Super Preferred is great and all, but its hard to qualify for. Many of the underwriting criteria for many insurance companies classes are indeed known. Check before you apply.

The Nineteenth, and Final Question for your Life Insurance Agent

What is the Financial Strength Rating of this Insurer?

A financial strength rating is a financial assessment of the quality of the insurers ability to pay claims. It is a grade ranking given your future insurer by a Credit Rating Agency. The exact details of how rating agencies rate insurance carriers is both complicated and not completely understood. However the results should assist you in choosing your future insurance carrier.

Many insurance agents seem to be oblivious about Financial Strength Ratings, but just because they are - does not mean you should be too. Educate yourself about FSRs and their potential impact on a given insurer.

There are about four main rating agencies that rate insurance carriers. These include the big three Credit Rating Agencies (S&P, Moodys, Fitches) and AM Best (an Insurance Specialty rater). Each rating agency has their own set of criteria and their own ratings scale.

Confused?

Don't be, just choose one rating agency to begin with and their Financial Strength Rating.

Conclusion of 19 Questions for your Life Insurance Agent:

This concludes 19 Questions for your Life Insurance Agent. As an add on to this article though we have placed some other common frequently requested information related to 19 Questions.

Should you have any questions, please feel free to contact us anytime.

Life Insurance Questions on an Application:

What types of questions are asked on Life Insurance Applications?

Insurance companies need lots of information to decide if they are going to be willing to write insurance on you and if they are, which rate they are going to offer you. Therefore will ask you lots of questions.

No two companies are the same, but these are the general types of questions that they will have for you.

- Your Age, Date of Birth, and Sex

- Home Address, Phone Number, and Full Name

- Location, including the Country of Birth

- Your Citizenship

- Your Drivers License Number and Driving Record. This will include information on accidents and tickets.

- Your past Medical and Pharmaceutical History.

- The past and current medical condition of certain family members such as Parents and Siblings

- Dangerous Avocations/Hobbies.

- Travel History, especially to certain foreign countries deemed less safe.

Term Life Insurance Questions:

Questions about Term Life Insurance? Lucky for you - Term Life is relatively simple and straightforward. Unlike its cousin Whole Life, Term Life is pure insurance that carries no cash value. Term is intended for a specified period of time.

Term life possibly should be the default choice for people starting out in their life insurance journey. Mostly due to its low cost, relatively low fees, and easy to understand structure. Sadly many life insurance agents will only bring it up as a back up to a much more expensive whole life insurance sales pitch.

Whole Life Insurance Questions:

Questions about Whole Life? I don't blame you. Whole Life and its cousin Universal Life Insurance are insurance policies that carry a side cash account. The so called "cash account" though is not simple to understand. Each additional dollar put into a whole life policy does not necessarily go into the cash account. And there in lies the rub. Generally speaking whole life carries large overhead marketing and expense fees as well as certain transaction fees that are often not fully understood by buyers.

This article is not a complete review of either whole or term life. However whole life is generally the best bet for people that find themselves in one of six or perhaps seven situations. Most of these situations involve wealthy people who are wanting a more complex and comprehensive form of life insurance.

Life Insurance Questions and Answers:

Here are some common Questions and Answers about Life Insurance that consumers often have:

- How long does it take to get life insurance? A simple underwritten term life insurance policy can often take anywhere between 4-6 weeks. There are other solutions if you want to procure life insurance faster.

- What is a paramed visit? A paramed visit is an at home/office visit by a nurse that conducts some basi medical tests on you. This assists the insurance company in rating you.

- Why do insurance companies need my medical records? To ascertain your full health and to formulate an offer of life insurance.

- What do they look for in my medical records? The Insurance companies cull through your medical records to assess overall health in order to price out an offer of life insurance.

- What happens if I do not pay my yearly life insurance bill? If we are talking about term life insurance, than usually your life insurance policy will lapse and the coverage will end. Often there is a small grace period.

- Why does the insurance company need by Drivers License Number? The Insurance company needs your drivers license number to confirm whom you are and to run an Motor vehicle record check on you.

- If I do not do Electronic Signature, how do I sign. Documents will either be mailed to you.

- What happens if I no longer want the life insurance when an offer comes through? Nothing, you owe nothing until you sign the offer of life insurance.

- What happens if the offer of life insurance that comes through is rated as a higher, more expensive health class? Typically we find out why and confirm that the higher class was justified. We then talk and discuss your options. You do not have to accept the offer as is.

- Does the life insurance company check my driving record? Yes typically they will check your driving record.

- Why do they check my driving record? The life company will check your record to see if you have unsafe driving habits.

- What happens if I an not a citizen of the United States? This one is complicated, ask your agent for more information.

- Can I change my life insurance beneficiary at a later time? Yes typically you can change your life insurance beneficiary at a later time?

- Why is my insurance agent pushing whole life insurance? There are various reasons for this so its impossible to say in every situation.

- Why is term life insurance so cheap? For numerous reasons, but generally its because Americans are living longer.

Speak with an experienced advisor!

Speak with an experienced advisor!