Whole Life Insurance has been around a long time. However what was once a well oiled machine seems extremely dated by today's financial standards. It has been said, by many, that Whole Life Insurance is Sold and Term Life Insurance is bought. There is a reason for this...

But in order to buy term life insurance, you may need to sidestep some of these claims:

Whole Life Insurance Agent Claims:

- Whole Life Insurance is a great investment.

- Whole Life is an asset protected method of saving.

- If you Don't buy whole life than you won't have life insurance forever.

- Whole Life Insurance is a great way to save for college.

- Whole Life Insurance is a great way to save for retirement.

Whole life insurance is a fascinating product. And as a life insurance agent I would love it if these things made more financial sense. However time and time again I have run the numbers. Again and Again. And contrary to what many of the infinite banking purveyors would have you believe, I rarely if ever see it make more sense to buy whole life insurance over a standard qualified savings concept combined with term insurance. The numbers just do not add up.

Claim: Whole Life Insurance is a Great Investment

Whole Life Insurance is a Great Investment. Is it really? According to Wall Street Journal, in 2008 "many insurers were paying 4% to 6% annual dividends, with guaranteed minimums of 2% to 4%." But that rate is only paid on the "cash value" part of your investment. Its nothing like putting money in a bank or even an investment account. Most insurers give you little if any credit for cash value for the first two, even three years of paying them.

Does that sound like a great investment idea to you? The average rate of return with whole life policies of course is just the half of it. Investing in whole life is really an investment in a two sided contract where both you, the insured, and the insurance company each have duties. One of your duties is to pay your yearly premium, on time, each and every year. Failure to do so, will have serious repercussions.

One would assume that as you make your payments your "Cash Balance" would go up. However, that is not how it works. In general for the first couple of years, much of your initial payments go to paying for marketing and sales expenses. In fact you might not have any cash balance for up to three years, perhaps longer. Even when the "cash balance" does start it is usually a paltry couple of dollars per year in the beginning. Only after 8,9,10 years or so will you notice the cash account accumulating any reasonable amount of money. Only at about year 10 will the dividends start to be a reasonable amount of money.

Depending on the Insuring company and the contract that you purchase you may not see the cash balance outpacing a Term and Bank Invested 'Rest' account for somewhere between 12-14 years. There are many reasons for this. One of these reasons is that dividends on whole life insurance policies are only paid out the accumulated amount that you have in your cash account, not the total amount of premiums paid out. Another reason is the above mentioned marketing and sales related expenses.

The confusion that exists about dividends being paid out only on the cash value portion of your whole life policy with potential negative subtractions taken out for money on loan is one of the primary reasons, in my opinion, that so many people cancel their whole life insurance policies in the first ten years.

Whole life insurance functions nothing like a traditional savings account nor even like an investment account.

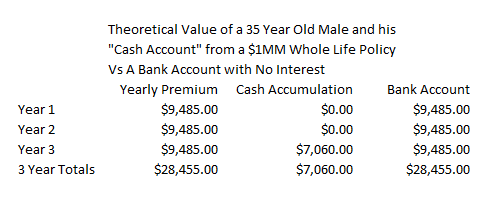

A Typical Whole Life Policy "Cash Account" vs a Straight Bank Account first three years:

After three years, you can either have $28,455 in a bank or $7.060 in a Cash Account on your Whole Life Insurance policy. There are of course numerous issues with this overly simple comparison. It does not include the cost for a $1MM term life policy. And it is only considering the first three years. However, we are also ignoring the interest from the bank account and the additional safety of socking away your own money in your own account.

By the way - a $1MM - 20 year, plan super preferred, could be had for as low as $424 per year.

So Is Whole Life Insurance a Great Investment?

Whole life insurance is not a good investment due to its complex structure, fees, and low rates of return.

Claim: Whole Life Insurance is an Asset Protected Model of Savings

The Truth is that there is a kernel of accuracy with this claim. But, just a kernel. First off there are two sets of bankruptcy / creditor protection laws that you should be aware of: Federal and State. States act according to federal law and set up their caps on specific exclusions. States are generally (or often) the limiting figure for Annuities, Life Insurance, Homestead, (and other types) of exclusions.

Therefore there is no ONE law that determines what you can protect in bankruptcy.

Second, we are not attorneys. Likely neither is your insurance agent though, so there is a limit to how much we or any insurance agent can advise you on this. So - see an attorney if you want to buy life insurance with the thought that you may be able to declare bankruptcy and keep your life insurance cash value.

Third, getting back to the claim that life insurance money saved is an asset protected model. Being that the individual states set laws in regards to caps of bankruptcy exclusions, you should at least consult a list such as 50 State Creditor Exemption Rules, here is one from a Law Firm Duggan and Bertsch. Or at least potentially your insurance agent selling you this claim should show you this.

If you merely look at the first two states you will see how all over the map the different states consider life insurance cash accounts. Alabama (AL) allows for "100% for insurance on self or spouse payable to self, spouse, or children." It makes no mention of cash value.

Alaska (AK) states "Up to Wage Exemption if beneficiary is insured's spouse or dependent." Alaska's whole life insurance exemption does not sounds that generous to me. Nor does it seem to mention cash value.

Arkansas (AR) states pretty clearly "Same as life insurance cash value." Arkansas exclusion seems to more clearly fit the claim made by national whole life insurance agents. However, there is even an issue with the wording on this one. If the cash value is lower than the death benefit, which it is often is, does that mean that you are only protected up to the Cash Value and not the entire death benefit amount?

I do not know. As I have stated, I am not an attorney. But I am not claiming to you that whole life insurance is a creditor protected savings account. There seems to me enough ambiguity to me that I would never consider buying a policy for this reason without meeting with an attorney first and foremost.

The next major issue is the difference between Criminal and Civil forfeitures. Criminal cases involve an illegal activity, typically someone that knowingly commits a crime or allows a crime to happen. Well meaning whole life insurance agents, may not be considering this when they tell you that "Yes Mam, your whole life insurance policy will be asset protected in court." Does this insurance agent really believe that modern RICO laws will somehow prevent the federal government from seeking assets from a convicted drug dealer? Really?

Money that has come from "questionable sources" can be considered tainted and essentially frozen by the federal government. The Law Firm Gallet, Dreyer, and Berkey, LP's opinion of this in regards to funds received from Bernie Madoff scandal, titled: If You've Received Madoff Funds, Can You Protect Them? is very telling. Their potential suggestion is that "reasonable and equally effective strategy would be to purchase a foreign annuity or life insurance policy. " Notice the word foreign, as not located in the United States. However, "As noted above, such policies are normally exempt, but are vulnerable to a fraudulent conveyance claim. However, if the policy is issued by a foreign company, and assets are wired offshore to that company, those assets would be outside the jurisdiction of the U.S. court system, and beyond the reach of the trustee."

First off they are not discussing the people that perpetrated the crime, but people's whose money came from a crime, essentially innocent people who unfortunately received 'tainted' money.

Second, they are suggesting that in order to even consider trying to protect this money that it needs to be wired to a foreign country and then be put into a whole life insurance product.

Another major issue is the situation when you owe the federal or maybe even the state government money. Perhaps for missed income tax payments or even property taxes. As a general rule of thumb, the one group of people that you do not want to miss payments with is the government. A well written article, titled "When the IRS Wants Your Life Insurance Policy" should be required reading for all insurance agents, in my opinion.

In just one section, titled: Federal Tax Lien, the article states: "Section 6321 of the Internal Revenue Code imposes a tax lien “upon all property and rights to property, whether real or personal,” belonging to a taxpayer, if he or she neglects or refuses to pay any taxes, including cash surrender values of insurance policies. "

"The lien arises when an assessment is made (IRC Section 6322) and even attaches to after-acquired property. Section 6334 exempts several classes of property from the government’s tax levy and provides that property not listed is exempt may be levied. The cash values of life insurance are not specified as exempt property, and are maybe subject to a levy."

But this article contains Five More potential reasons that the IRS could come calling for Your So Called Asset Protected Insurance Policy, such as: Government Collection Methods, When a Lien Attaches to a Property, Right to Disability Payments, Right to Annuities, Spousal Liability, Right to Income Taxes From Death Proceeds When the Government Has a Lien, and Right to Income Taxes From Death Proceeds When the Government Has No Lien.

"Don't Believe the Hype About Whole Life, But Term and Invest the Rest"

Lastly, even if the asset protection model was appropriate for you, would the lower returns of money placed in a cash value insurance policy warrant giving up higher returns in say a market investment account?

If you are merely looking for methods to hide monies from the federal government surely paying down or even paying off your house may make more sense, depending, of course on which state that you live in. Some states allow for 100% of the value of your home for potential asset protection. Other states have very little at all.

For that matter, if your goal is just to hide money for asset protection methods - why not just spend the money? Money spent will also not be able to be seized by authorities. And buying whole life insurance for this method is pretty similar to just spending the money anyways if you think about it.

Is Whole Life Insurance an Asset Protected Method of Savings?

Whole life insurance may have asset protection surrounding it, however, it greatly depends on what state you live in. Lastly, since whole life insurance takes so long to earn a decent rate of return it is not a best in class savings product.

Claim: Whole Life Insurance is the Only Way to Buy Life Insurance Forever

If you don't have a whole life policy you won't be able to have life insurance forever? There are two main objections to this outrageous whole life insurance claim. First off, this is just not true. One could have life insurance through a group life plan for their entire life. Its possible that their group life will allow them to take it with them when the leave. Or there is also a form of life insurance called Lifetime term which accomplishes this very act. So if one were to want life insurance for their whole life a Lifetime Insurance policy would be by far better and cheaper.

A lifetime term is really a Guaranteed No Lapse Universal Policy. A type of policy that potentially costs half as much as a completing whole life insurance policy.

The guaranteed universal no lapse policy carries no cash value. So some have taken to calling it a term policy with a lifetime of coverage. Universal life insurance is extremely complicated - so even with this form of insurance - I would advise you be very careful.

But do you...need life insurance forever?

The second counter argument to this ridiculous claim, is assuming that one needs life insurance for their whole life. Since the point of purchasing life insurance is to help loved ones left behind with their financial needs, Why would someone need life insurance when their kids are grown up out of the house and their own financial house is in order? Do you need life insurance during retirement? Do you think its cheap to have it during non working years?

Roughly assuming that whole life insurance is about 8 to 12 times the cost of a comparable 20 year term policy, the left over money NOT SPENT on a whole life policy allows the insured to save a huge amount of money in 401Ks, Roths, HSAs, Saving Accounts, and by paying down their mortgage early.

I have often wondered how the typical life insurance agent comes to recommending a whole life insurance policy to the typical american? Would not the insurance agent have to know your income, your expenses, your balance sheet, your properties, liabilities, all of your other insurances, short term and long term savings, and investments, plus all of your retirement information such as qualified accounts such as 401Ks and Roth IRAs in addition to pension information? Wouldn't they have to know all of this information before being able to consul someone of their need to have life insurance forever?

However, many life insurance agents just make the blanket statement that everyone needs life insurance forever. I question that concept.

Is Whole Life Insurance the Only Way to Buy Life Insurance for the Rest of your Life?

Whole life insurance is not the only way to purchase or maintain life insurance for your entire life.

Claim: Whole Life Insurance is a Great Way to Save for College

Whole Life Insurance is a great way to save for college? Money Saved in a Whole Life Account is not counted against you with FAFSA rules? These are really two separate arguments rolled into one. This one is a whopper and it deserves its own article. First off, without question the best way to save money for most Americans is either a 529 plan or the ESA plan. The ESA plan (Education Savings Account) is also called a Coverdale plan. According to Schwab, ESAs have income limits for the contributors.

Education Savings Accounts and 529 plans are both great places to save for college. Whole vs Term makes no recommendation between the two. However given the income limits for ESAs, we will focus just on the benefits of 529 plans.

How can I be so sure that money saved in a 529 plan is better than Whole Life. The numbers. Money saved in a 529 plan grow tax free as long as they are used for approved college expenses. Money saved in a whole life plan, must first get over the 12-14 year period that we discussed before it gets to par with a bank account, however then you need to understand how you would access the money?

ESA

Income Limits

$2K per year contribution limit based on income.

Tax Free growth used for Qualified Education.

Money does not need to be paid back.

No interest and fees set by agreement.

529

No Income Limits

Much Much higher limits, depending State.

Tax Free growth used for Qualified Education.

Money does not need to be paid back.

No interest and fees set by agreement.

Whole Life

No Income Limits

Contributions limited to life insurance contract.

Money can be taken out via a loan or other.

May have to be paid back at a later time.

Interest Charged and fees set by contract.

This is the precise question that I suggest you force your whole life insurance agent to answer. How do I access my savings for my children's college? Ask them to chart it out. Explain the fees, the loan costs, etc.

Next, it is mostly true that money that is squirreled away in your Life Insurance Contract will not count against you with the FASB rules. At least how they are currently written. However, if that is your goal, then you really should explore all of your options. So what other methods of saving do not count against you?

The simplest and least complex, is of course the very place you may be reading this = your house. By paying down your mortgage you are in essence shielding the money in a FASB shielded way from public universities. (It may also be a form of asset protection depending on your state and the value of your home.) Private universities may be slightly different. By shoving extra money into you mortgage payment you are guarantying yourself a return of at least what your mortgage rates is. If one were to need to pull the money out, its possible you could do a mortgage where by you take money out of your home. Yes, there will be fees and you will need to pay interest. But how exactly is that different than saving the money a whole life policy?

The last major point that I would suggest you consider is how much your extra savings will swing your FASB application. In other words does it really matter if I have $100K in a Savings Account vs $80K in a Whole Life account?

As with all of these wild whole life insurance claims, I'd suggest that you fill out a FASB form yourself and calculate the difference. If this sounds like too much work for you, I would just give up on the whole life option.

Is Whole Life Insurance a Great Way to Save for College?

Whole life insurance is not a good college savings plan when compared to federal tax advantaged plans such as ESAs and 529s.

Claim: Whole Life Insurance is a Great Way to Save for Retirement

Whole Life is a great way to save for retirement? One has to wonder if the sales agents pushing these products mean a great way to save for retirement like a Roth IRA or a 401K? 401Ks are considered qualified investment accounts which are allow money to be deposited into your account tax deferred and Roth IRAs are also considered qualified investment accounts that are are are allowed to grow tax free if the money is used for retirement. There are lots of qualifications and rules surrounding both of them.

There are other retirement savings accounts such as 403Bs, Roth 401Ks, etc. But both the Roth IRA and the 401K will suffice to be the major impediment to this so called claim by whole life insurance agents.

How can you beat an account that is allowed to grow tax free for retirement? Does a Whole Life Inurance Policy allow your money to grow tax free for retirement? Nope.

How can you beat an account that is allowed to grow tax deferred? Are whole life insurance accounts allowed to grown with tax deferred earned income from work? Nope.

Technically speaking a Whole Life policy allows your money to potentially grow tax free for your beneficiaries, but NOT for your retirement. In order for it to grow tax free for retirement you would need to "access it." There is precisely where the issue is.

How whole life savings work?

Some of the smarter life insurance agents that I have spoken with will say that indeed whole life insurance does not compare with 401Ks and Roth IRAs. Kudos to those agents, because I believe that that is true. However acknowledging this puts the argument of why whole life is good for retirement into a bit of a pickle. If 401Ks and Roth IRAs are indeed the best retirement vehicles then clients would need to fully fund both of these before even considering whole life for "retirement" savings. For tax year 2017, the maximum allowable amount that a contributor may put into their 401K is $18,000. When two are working you are talking about $36,000 before any employer matches. Lets just round this up with an assumed dual employer match of $2K each to $40,000. Then you consider either a Roth IRA contribution or a backdoor IRA or a non deducible deposits of $5,500 each for a total IRA amount of $11,000. When you add up these two numbers that is a staggering $51,000 per year!

In other words setting money aside for retirement in a whole life insurance policy would require some to be saving over $50,000 per year - BEFORE they consider putting money into the whole life plan - WOW.

The discussion from there goes on to where are next best places to save for retirement? Your home, a mutual fund account?

But where else can one save money for retirement? My opinion is it is really depends on your situation. Paying down your home, perhaps a rental property, municipal bond funds, or by setting the money aside in a low cost, low taxed ETF. Speak with a fee for service advisor.

Tax Free and Tax Differed Investment Ideas, potentially for Retirement:

- 401Ks

- Roth IRA

- Backdoor Roth IRA

- Non Deductible IRA

- HSA - Healthcare Savings Accounts

- Muncipal Bonds and Municipal Bond Funds

- Low Cost ETFs

- Rental Property

- Paying down your home mortgage

- Bank Savings Account

A dizzying array of options it most certainly is. But how can insurance agent who is not already somehow managing your money know if you really should invest for retirement in a cash value life insurance plan?

Is Whole Life Insurance a Great Way to Save for Retirement?

No Whole Life Insurance is not a great way to save for retirement. Whole life insurance should really only be considered as a retirement product once all qualified retirement maximums have been fulfilled and once many other personal financial goals have been attained. In short, you really have to be very well organized and wealthy for it to be a retirement consideration.

Are those the most outrageous claims by Whole Life Insurance Agents? Possibly not, perhaps they are the most common claims. They are certainly claims that we believe to be mostly not correct.

How to Protect Yourself Against Outrageous Life Insurance Claims:

- Educate yourself

- Ask the insurance agent how they are compensated.

- Ask lots of questions.

- Run all the numbers yourself.

- Ask for guaranteed charts.

- Get Quotes from Multiple carriers and agents.

- Beware of anyone peddling life insurance for any reason other than pure insurance.

The Basics of Life Insurance

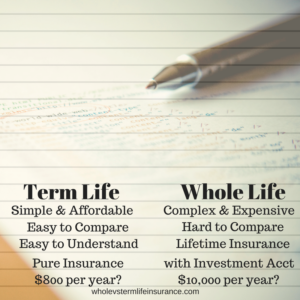

Term Life:

Simple, Affordable, Easy to Understand and Quick to Purchase Pure Insurance.

Whole Life Insurance

Complex, Expensive, Hard to compare Life Insurance with an Investment Component.

What to do with all of this information? If you are seriously considering purchasing a whole life insurance policy, I would thoroughly do your own homework. Run your home numbers with your own set of assumptions. Don't believe the hype about whole life. When in doubt find out if your qualify for level term life insurance. I would go so far as to suggest that you should even check up on what I have said, I could be wrong. If I am wrong, please prove it to me!

Why is Whole Life Insurance pushed by life insurance agents?

Whole life insurance is pushed by life insurance agents for lots of reasons. One of those reason is the sales culture, another reason may be the high commissions that agents receive from a whole life policy vs a term life policy.

However not being an agent that pushes whole life insurance policies, perhaps I am not the best person to answer this question.

Why do I need life insurance for my entire life?

This is question that I have been asking myself for decades. The assumption that someone even needs life insurance forever - however is part of the assumptive sales model. Ask someone a question containing an assumption in it. "How will you be insured during retirement if you don't buy whole life insurance?" This leads some to make the decision that they do need life insurance during retirement.

"How can you eat a sponge for lunch, if you don't have any?" This method may sound ridiculous when put into a context where we all feel competent to discuss something that we all know about, 'eating lunch.' We all know what you can and can't eat for lunch, but not everyone knows if they indeed need life insurance during retirement.

I have heard that really rich people invest in whole life insurance policies, doesn't that make it right for someone like me?

From an "investment" or "savings" standpoint, whole life insurance only makes sense if you are truly wealthy. Wealthy enough to fully fund all 401K and Roth 401K options. Fund IRA, Roth IRA, Backdoor Roth IRA options. Pay down (or off) your house. Saved for your kids college through ESAs and 529s. Built up a short term and long term savings accounts.

The one thing that is often missing in presentation of the idea that rich people have whole life policies is that they may be rich, but few of them "got" rich from buying a whole life policy.

Whole life policies do have some tax advantage for the owners and are really tax advantaged for the beneficiaries. To some extent a whole life policy is a great tax and savings tool for your next generation. However, its not a great retirement tool for the owner of the policy, nor is very suitable for college savings.

Is Whole Life Insurance the Rich Mans Roth IRA?

No, Whole life insurance is not a Roth IRA and any claims that it is are just plain wrong. Roth IRAs are a qualified tax free retirement account. These accounts have numerous legal and financial benefits that were created by the US Government. Roth IRAs are typically held at custodial accounts and can be invested in a broad range of investments.

As opposed to Whole Life Insurance, Roth IRAs may be typically be withdrawn tax free at the time of the legal retirement age.

How to Contact Us

Email: sales@marindependent.com

Phone: 415-294-5454

PO Box 585 Mill Valley CA 94942

Twitter @marindependent1

What is the Best Whole Life Insurance Policy?

If you indeed one of the lucky people for which whole life insurance is a good use of your money than the Best Whole Life Insurance policy is the one that provides the best value, with the highest rated company, with special dividend consideration.

One additional note to learning about whole life insurance policies is to consider reaching out and speaking with someone that specializes in comparing whole life policies. These things are extremely complex and have lots of moving parts.

I have heard that Single Premium Whole Life Insurance Can be the Way to Go?

That is an interesting question. In a generic scenario single premium whole life policies may be a good decision if you are already going to buy one. There are other limited pay whole life policies as well. The real benefit with these policies is you remove all of the issues of failing to be able to afford the ongoing permanent contract. Therefore it removes some of the issues, but not all.

What is the Best Term Life Insurance Policy?

The best term life policy is the policy which is rated highest, that has the appropriate length and benefit amount, at the most affordable cost.

Special consideration should be made in regards to getting you qualified at the best underwriting level. Not including table ratings there are generally four typical life insurance classifications for each smokers and non smokers.

How Does Whole Life Insurance Work?

Life insurance is a way of insuring your financial future in the event of an untimely death in your family. Life insurance should be purchased for both spouses, working or not. The insurance can be used to replace lost income, pay down various debts, or even potentially provide a little bit of comfort during a troubling time.

Outrageous Claims of Whole Life Insurance Agents:

Thanks for reading the Whole Vs Term article about ridiculous sales statements made about whole life insurance, titled Outrageous Claims of Whole Life Insurance Agents. For the record, these statements tend to be made a minority of insurance agents. I hope you have enjoyed this long form article and learned enough to make a well informed life insurance decision.

About this Article:

This article about miss-selling and misleading statements has been a long time coming. To be fair some of the ideas and concepts about many uses of life insurance start with a basic fact. However that basic fact can be misused and twisted to turn it into something that it was never intended to be.

I believe to this day that Whole Life Insurance is a very valuable tool for some Americans. (This is often high net-worth families.) But the people that are buying these products need to understand what it can and can not do well. There is a very small sub set of consumers that would do well to consider buying an affordable whole life insurance policy.

Green Certified Business

We are Certified as a California Green Business.

Accomplishing our green certification takes an initial amount of time and a yearly ongoing commitment. We have removed over 95% of our waste of this business by moving to electronic signature capture and electronic data files. We are proud to utilize green cleaning products and full recycling. We have been certified by the State of California.

Speak with an experienced advisor!

Speak with an experienced advisor!