The Savings You Need - the Coverage you Deserve.

$1,000,000 Life Insurance:

One Million Dollars in term life insurance used to be more rare. However times have changed, for many Americans - $1 Million in term life is considered almost the norm. At ten times earnings, anyone making about $100,000 per year could warrant a $1,000,000 term policy.

Fifty years ago - whole life insurance was considered the standard. Today, with the increased simplicity of term insurance and with the decreased cost of it- Term Life has become the new standard.

Term insurance allows consumers to buy more insurance for periods of time such as 30 years.

$1,000,000 Life Insurance Policy Options:

1000000 life insurance policies come with all sorts of options depending on the type of life insurance and insurer selected. Typically with most term life policies there are a variety of riders that one can select.

These riders (sometimes called endorsements) allow consumers to slightly modify the original policy to meet their lifestyle.

Below are some of the Options / Riders that may be available with a given 1000000 life insurance policy:

$1,000,000 Life Insurance Great Candidates:

The 1000000 life insurance policy is far more common than it used to be. It is common enough that it is starting become the new normal. Many consumers that are now having children of their own - may indeed need a One Million dollar term policy.

"Do I Really Need a $1,000,000 life insurance policy?"

The working mother and wife in Kansas who earns $115,000 per year as a mid level manager. Her husband also works, and earns slightly less money. The husband has a 25 year - $500,000 term policy of his own. She selects a $1,000,000 20 year level policy. The total life insurance policies in the house add up to $1.5 Million dollars.

A widowed father living in New Mexico with two children. He makes $60,000 per year but is the sole provider for his family. He wants a bit more protection to care for his children in case something happens to him. He is currently shopping for a 1000000 million 10 year policy to get his youngest daughter through college.

The retired father in Ohio, who maintains a $1,000,000 term life insurance policy that was originally provided by his corporate employment that he now pays through till its term end. Although he may not necessarily need it as he once did - he finds comfort in having it for his wife.

The Single mom in Arizona, who raises her four kids by herself. She earns about $50,000 per year working two jobs. She is terrified of what would happen to her kids if she did not come home one day and purchased a level 30 year policy four years ago.

The working Dad and Husband, living in upstate New York, who is the sole income earner in his family. His wife, does not work and does not yet have her own term policy (although she needs one.) He earns $75,000 per year and wants slightly more insurance than may be typical because his wife "never wants to work again."

The corporate executive Wife and Mother residing in Denver, whose husband works but his salary is nominal. The executive has terrific savings of over $500,000 and uses the $1,000,000 - 30 year term life insurance as a backup to provide for her three children and husband.

The New Parents, both Husband and Wife who each work and make comparable incomes, $85,000 and $90,000 per year. They live in Sacramento, and are each shopping for 25 or 30 year policies. Although $2,000,000 in term insurance seemed like a lot when they started searching, once they calculated the cost to send their child to college they both decided it prudent. They each opted for a $1,000,000 25 year term policy.

All of these people are considering $1,000,000 life insurance policies for a variety of reasons. Each of these families situations are unique. What you will find as the commonality is that they wish to protect their loved ones in the case of a fateful accident.

Some of the Best Reasons for People Considering One Million Dollar Life Insurance Policies Include:

$1,000,000 Life Insurance Special Considerations:

When buying life insurance in the One Million Dollar Face amount, there are numerous things that are different. In general insurance carriers are going to want to do more medical tests. Each carrier has their own list of required underwriting, but many will generally require a paramed be completed. A paramed is an exam done, often at your home, for the purposes of considering you for a life insurance policy. Paramed exams are quite common in the life insurance world and generally you should expect one at this coverage valuation. Ask your insurance agent about underwriting criteria for your proposed insurance policy.

Another consideration when shopping and procuring a $1,000,000 term policy is that some carriers will want the working spouse to carry more insurance than a non working spouse. Although this can be somewhat different with various insurers, for some families both the working and non working spouse may each wish to, separately, purchase their own 1000000 term life policies at the same time.

$1,000,000 Life Insurance Sample Rates:

Looking for Sample Life Insurance Rates for a 1000000 life insurance policy? Look no further. We have got them here for all sorts. Want a more specific quote - check out our term life rater to the left.

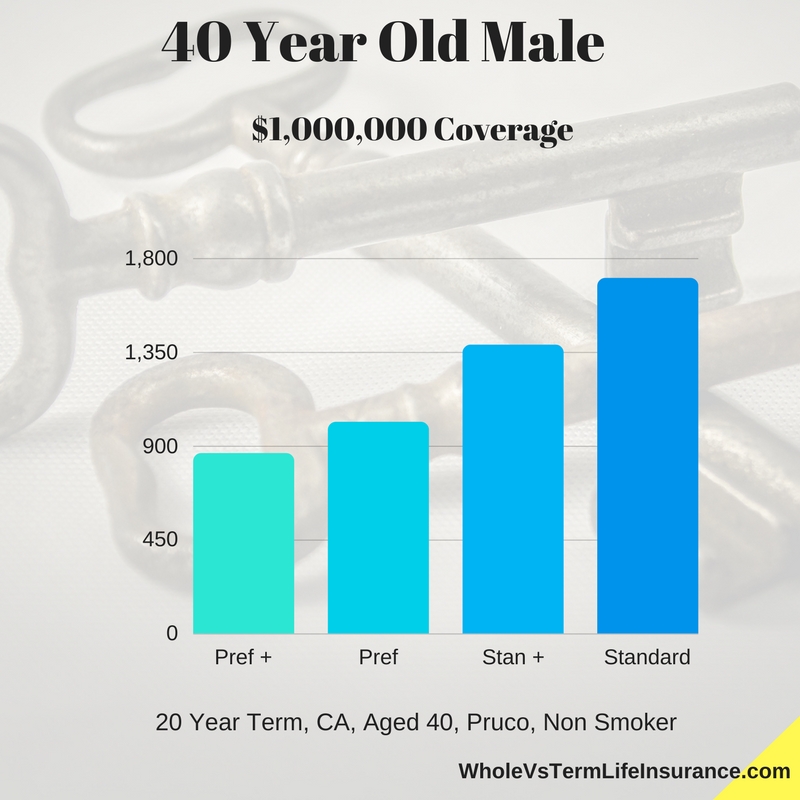

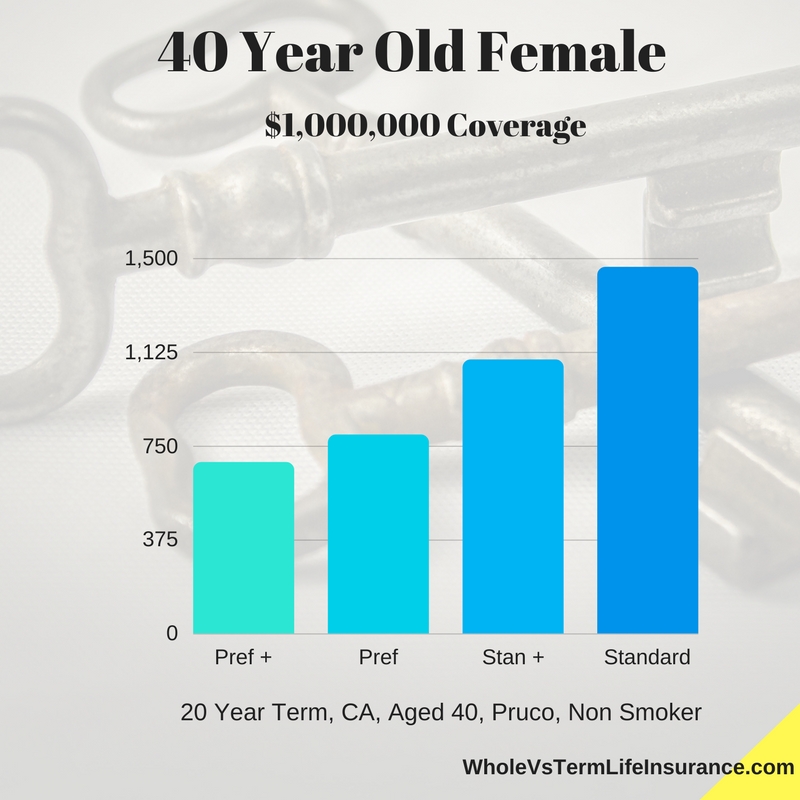

Here are 1000000 life insurance sample rates for 20 year terms for both men and women from Pruco Life Insurance:

Listed above we have broken out the rates into the four major life insurance health classifications: Preferred Plus, Preferred, Standard Plus, and Standard - all for Non Smokers. Pruco is a potentially wonderful option if you have some underwriting conditions.

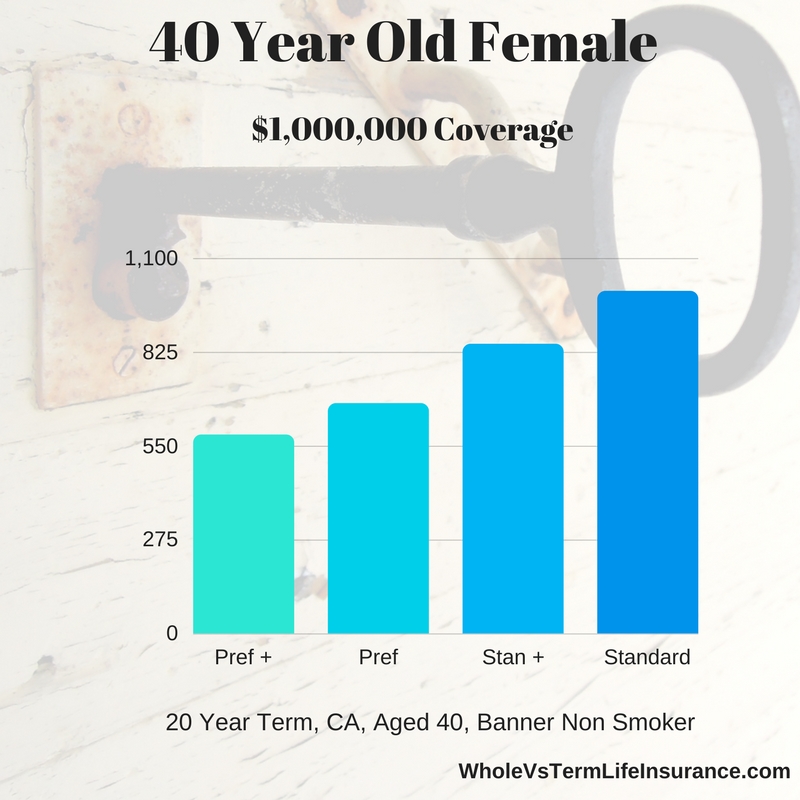

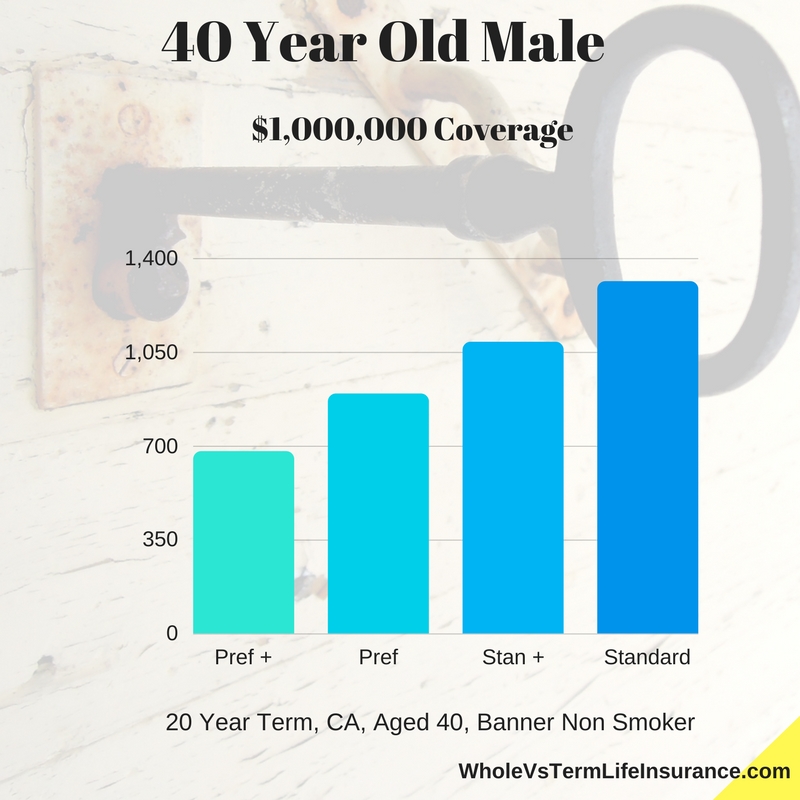

Here are 1000000 life insurance sample rates for 20 year terms for both men and women from Banner Life Insurance:

These $1 Million Dollar quotes from Banner are also broken down into the four major underwriting classifications: Standard, Standard Plus, Preferred, and Preferred Plus - All non smokers. Banner is one of the market leaders in low cost life insurance and they offer great products.

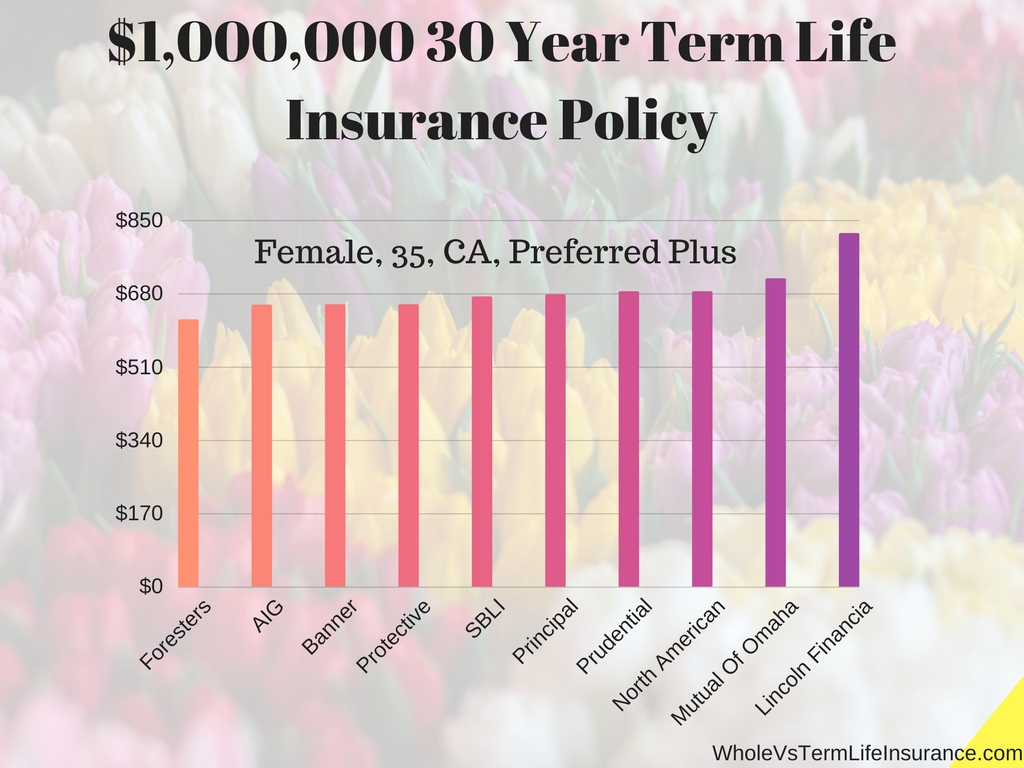

1000000 life insurance sample rates for a woman, aged 35, 30 Year Term from numerous life insurance carriers.

As you can easily see many of the carriers are all pretty closely aligned with their pricing.

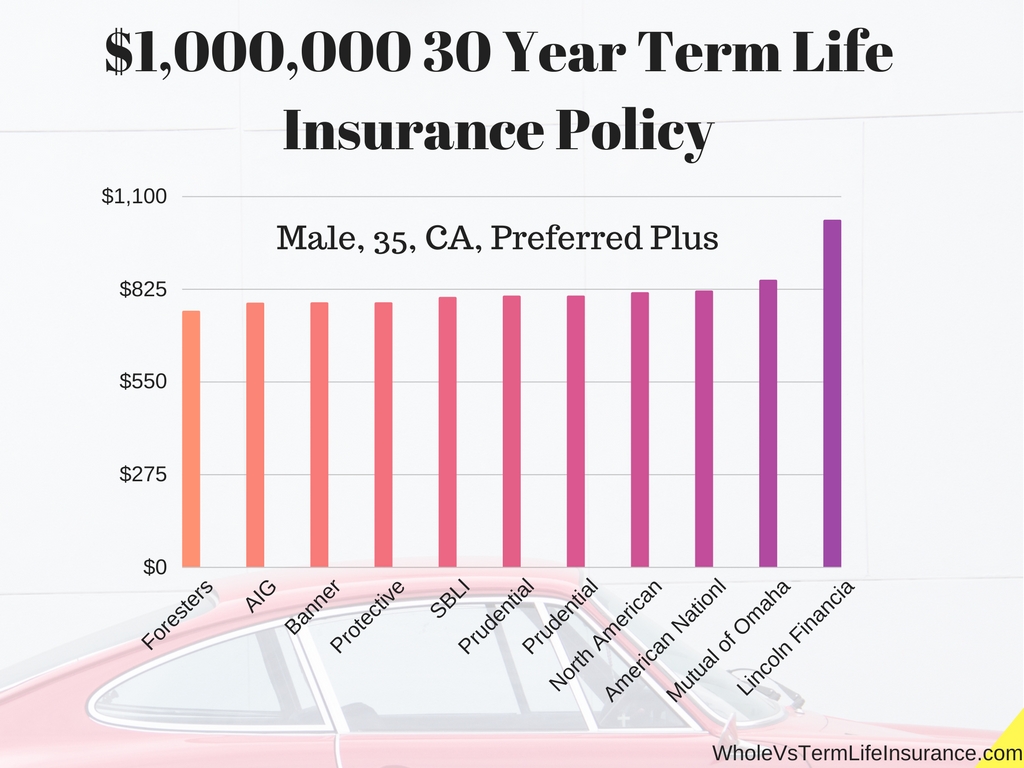

1000000 life insurance sample rates for a man, aged 35, 30 Year Term from numerous life insurance carriers.

This too shows many of the carriers at this rate to be pretty closely aligned with each other.

$1,000,000 Whole Life Insurance

Vs $1,000,000 Term Life Insurance:

Should you consider a 1000000 whole life insurance policy? Perhaps. Life insurance is pretty complicated and buyers should beware. Whole life insurance is a relatively safe product. However whole life insurance is pretty costly in comparison to term life insurance. A typical whole life insurance policy for a 35 year old non smoker male, residing in California in perfect health may cost about $9,485 per year from an A+ rated carrier.

So the question then becomes

$760 per year on a 30 year term or $8,400 forever?

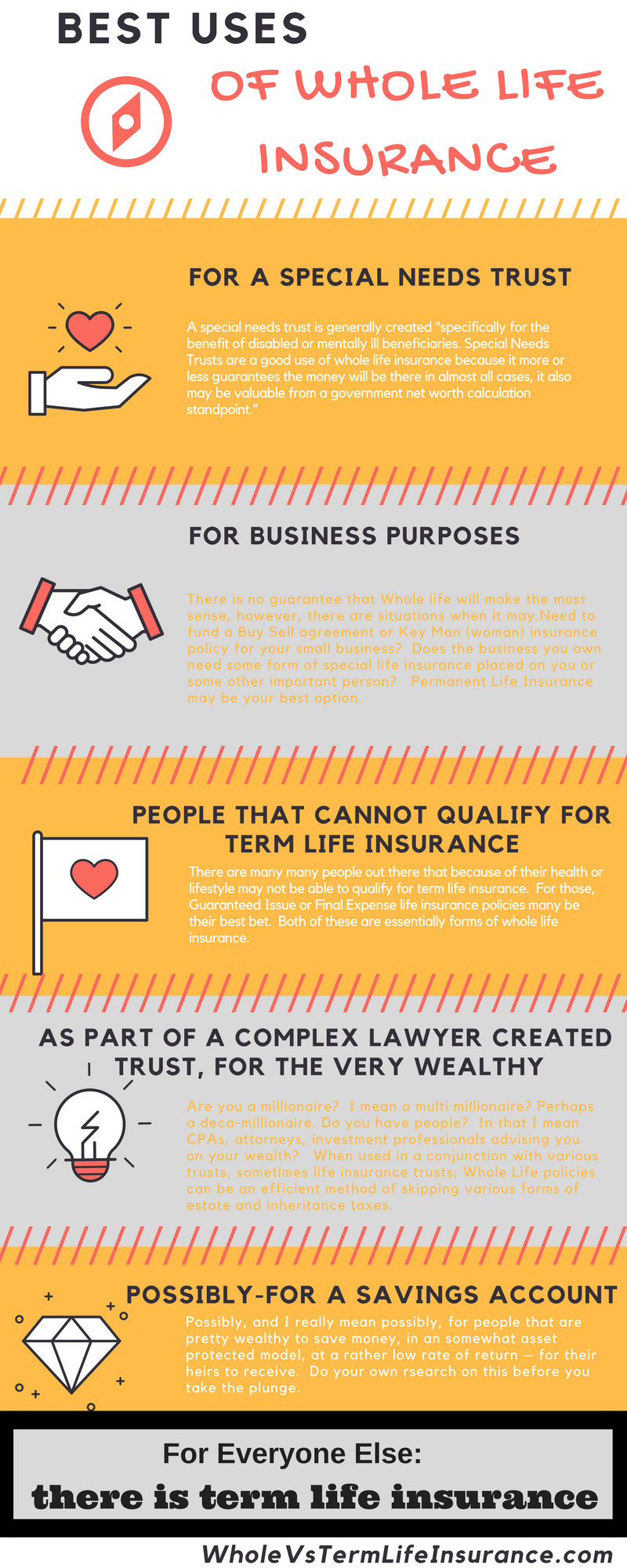

Perhaps whole life insurance policies are not for the average american. However there are some good reasons for others to consider the coverage type.

This will by no means solve the debate on a 1000000 whole life insurance policy vs a 1000000 term life insurance policy. However it may provide a bit of context surrounding 1 million dollar life insurance policies.

Should you have questions or concerns about our One Million Dollar life insurance post - please feel free to contact us at 415-294-5454 or email at sales@marindependent.com. Also feel free to add your comment to the "Leave a Reply" bar below and we will get back to you just as soon as we can.

Speak with an experienced advisor!

Speak with an experienced advisor!