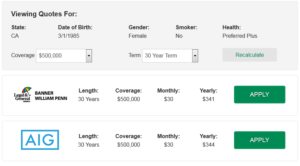

Getting an online Term Life Quote? Be careful assuming that the lowest rates that you see, are the correct rates for you. The differences between the correct quote and a haphazard one are tremendous. Below are sample life insurance rates for a 32 year old female.

The 32 Year Old Female:

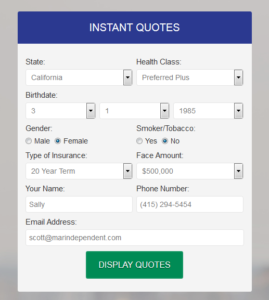

If you are a 32 year old female, you will probably pay a nice low rate for term life insurance. There are two main reasons for this, first you are a woman, and women tend to live longer. Second you are young and younger people also tend to pay less for life insurance. Therefore a health non smoking 32 year old will pay a nice low rate. For all of the rates that we are reviewing today they will be for $500,000 in death benefits. This is the amount of money, sadly, paid out upon the insured’s death. Also all of these rates are for a California Insured. Each state has slightly different rates, so you will want to run your own quote to do this. Our own quoting engine is located just to the left.

Preferred Plus 30 Year Term Life:

Preferred Plus 30 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall good health and takes no medications, and has no family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, likely will be able to qualify for a Preferred Plus policy. This 30 year term life policy could cost as low as $341 per year from an A+ carrier.

Preferred 30 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall good health and does take medication, or has a minor family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, likely will be able to qualify for a Preferred Plus policy. This 30 year term life policy could cost as low as $405 per year from an A+ carrier.

Standard Plus 30 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall OK health and takes some medications, or may have a family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, may will be able to qualify for a Standard Plus policy. This 30 year term life policy could cost as low as $554 per year from an A+ carrier.

Standard Non Tobacco 30 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, possibly does participate in dangerous activities, or who is OK health, or takes some medications, and does have a family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, may will be able to qualify for a Standard Non Tobacco. This 30 year term life policy could cost as low as $635 per year from an A+ carrier.

The 32 Year Old Female Smoker:

Smoking makes the placement harder for a number of reasons. Be prepared to discuss your smoking history and how much you smoke and of course, what you smoke. Smoking itself can produce other health related issues with it. A 32 year old Smoker who smokes about 20 cigarettes per day. And who resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall good health and takes no medications, and has no family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, may be able to qualify for a Preferred Plus policy. This thirty year policy could cost as low as $1,095 per year. A smoker that was also a bit heavier, was taking some medications, had some health history or family history of cancer, stroke, diabetes, etc could range up from that $1,095 price to about $1,900 on the higher side.

Moving On:

You will note the difference between the lowest rated non smoker vs the highest rated smoker. Since a Thirty two year old female can possibly get a thirty year police for such a low number, it seems incorrect to review any shorter period of time. However, just for readers curiosities we shall.

Preferred Plus 20 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall good health and does take medication, or has a minor family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, likely will be able to qualify for a Preferred Plus policy. This 30 year term life policy could cost as low as $243 per year from an A+ carrier.

Preferred 20 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, does not participate in dangerous activities, who is in overall good health and does take medication, or has a minor family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, likely will be able to qualify for a Preferred Plus policy. This 30 year term life policy could cost as low as $317 per year from an A+ carrier.

Standard Plus 20 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, possibly does participate in dangerous activities, or who is OK health, or takes some medications, and does have a family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, may will be able to qualify for a Standard Non Tobacco. This 30 year term life policy could cost as low as $395 per year from an A+ carrier.

Standard 20 Year Term Life:

A thirty two year old female, who does not smoke, resides in California if of the average height and weight, does not have a criminal history, possibly does participate in dangerous activities, or who is OK health, or takes some medications, and does have a family history of Heart Attacks, Strokes, Diabetes, Liver Disease, cancer before the approximate ages of 70, may will be able to qualify for a Standard Non Tobacco. This 30 year term life policy could cost as low as $469 per year from an A+ carrier.

What Term Life Insurance for a 32 Year Old Female to Buy?

A young healthy female in need of term life insurance, as you can see, should be able to secure a twenty or thirty year policy for quite a low amount. If your insurance class is preferred or preferred plus you probably should consider going with a 30 year term policy given the low cost. Even if you are a standard non smoker, you may still want to go ahead and purchase that length. Definitely speak with your insurance agent about your range of options. There are other possible options as well, such as a 25 year term.

Notes on Sample Life Insurance Rates for a 32 Year Old Female:

All of these quote are California Specific. All quotes are for Term Life Insurance only. All quotes are based on a theoretical person and may for other reasons not discussed not fit for you. A quote is a quote and not an offer of actual life insurance. Always check the credit rating of any insurance company. Prices subject to change. Thank you for reading Sample Life Insurance Rates for a 32 Year Old Female.

Speak with an experienced advisor!

Speak with an experienced advisor!