Should you 'invest in whole life insurance'

If you are unfamiliar with the debate raging within the financial world - we can help. Some people believe that whole life insurance is the best way to grow your money, others believe that Level Term Life Insurance paired with additional savings is ideal. In this article we run through the Pros and Cons and give you some analysis of a theoretical case.

Buy Term and Invest the Difference:

This website was created around the idea that millions of american consumers are attempting to figure out if they should buy a whole or universal life insurance policy or instead opt for a simple term policy. The logic for choosing the term policy is simple. Term life insurance, being so much less expensive allows consumers to invest their remaining money.

The Definition of Buy Term and

Invest the Difference:

As far as we can tell there is no real definition to the term 'buy term and invest the rest'. At least not officially. However we can craft a definition by breaking the term apart into pieces.

The Definition of Buy Term and Invest the Difference is comprised of:

First off, the phrase "Buy Term" refers to Level Term Life Insurance. So buy term life insurance.

Second, Invest means to "To commit, money or capital, in order to gain a financial return."

Third and last, the "difference" refers to the money that is saved between the higher cost of the whole life insurance policy vs the term policy. As an example if a certain whole life policy is $1,000 and a comparable term policy is $100, than it would be the difference which is $900.

When we put all of this together it means "Buy a Term Life Insurance Policy and Commit money, in order to gain a financial return from the excess not spent on buying a comparable Whole Life Insurance Policy." This seems to be a pretty good definition of Buy Term and Invest the Difference or BTITD.

"Procure term life" +

"Commit money for financial gain" +

"with money saved from not buying whole life."

In essence: Buy Term and Invest the Rest refers to buying term life insurance instead of whole life insurance and investing the difference in the stock and bond market. Often these investments are placed in qualified tax free and tax differed accounts such as 401Ks, Roth IRAs, IRAs, HSA, etc.

What is Buy Term and Invest the Difference?

Buy term and invest the difference is also known as Buy term and invest the rest. This can be abbreviated at BTITD. Or BTITR for Buy Term and Invest the Rest. You will see the abbreviations BTITD and BTITR used often here and they are essentially interchangeable.

How to Buy Term and Invest the Rest:

This seems such a simple and innocuous question that it is almost crazy. But in reality its probably crazy like a fox.

To be able to claim that Investing the 'Rest' is better than whole life insurance policies - you should be able to point to what types of investments routinely beat whole life insurance dividends and their plans.

The process of BTITR then comes down to which types and kinds of account we are investing in.

Buy Term & Invest the Difference Pros & Cons:

There are numerous pros and cons to buying term life insurance and investing the remaining funds.

pros & Cons - Buy Term and Invest the Rest

Benefits (Positives)

Drawbacks (Negatives)

An Example of this may be a client that is deciding between a whole life policy that is $5,690 per year for a death benefit of $500,000 and a competing term life insurance policy. For the whole life policy - They need to make annual payments of $5,690 for the rest of their life in order to keep the $500,000 death benefit.

Whole Life = Higher Cost, Longer Benefit Time Period.

That same client could also choose a $500,000 20 term life insurance policy for $340 per year. They would make 20 annual payments of $340 per year and at the end of those twenty years that guaranteed term life rate would end. Assuming the client does not choose to extend their term life policy, the coverage would lapse after the 20th year. Then the client would not have coverage.

Term Life = Lower Cost, Shorter Benefit Time Period.

* the term forever is somewhat general in nature and used to simplify the explanation.

WholeVsTermLifeInsurance.com

Is Buy Term & Invest the Difference a Myth?

Certainly there are many myths in the world of life insurance. However, buy term and invest the difference may not be the best method for everyone, but it is certainly not a 'myth'. Nor is it a scam either. Buying term life insurance allows people to use their money for other financial purposes. Buying term life insurance allows families to insure themselves for the duration of time that the insurance is needed.

If there is a myth involved here it may be the myth that older people, without dependents necessarily need life insurance. But Buy Term and Invest the Difference is not a myth.

Why Buy Term & Invest the Difference

Doesn't Work (Actually it Does)

Why buy term and invest the difference doesn't work? There are indeed many situations in which it does not work. However there are numerous reasons that buying a competing whole life insurance policy does not work either.

Lets start off with a baseline discussion on this one: 45%

45% of the people that buy whole life insurance policies abandon their life insurance policies within the first ten years. Going off of just this one number, then this means that eleven years on - only 55% of people could begin to consider whole life insurance working for them. That does not seem like a very high bar to meet. The numbers will only go down from there, although there is no good data on this. But imagine what the number is by year 20? What percentage of people that purchased a robust whole life policy are happy with their decision 20 years in? 50%, 45%, 20%? I cannot say, I can only guess.

For the sake of completeness, however, lets review some of the main reasons that Buying Term and Investing the Rest - may not work for some consumers.

The answer to Why Doesn't But Term and Invest the Difference Work is... it actually does work. It certainly does not work for everyone, but than again nor does the competing theory - Buy Whole Life Insurance and hope you can continue to afford it for 40 years or more.

For BTITR to be successful it only needs be successful more than 55% of the time...

Scenario One:

No Life Insurance or Life Insurance?

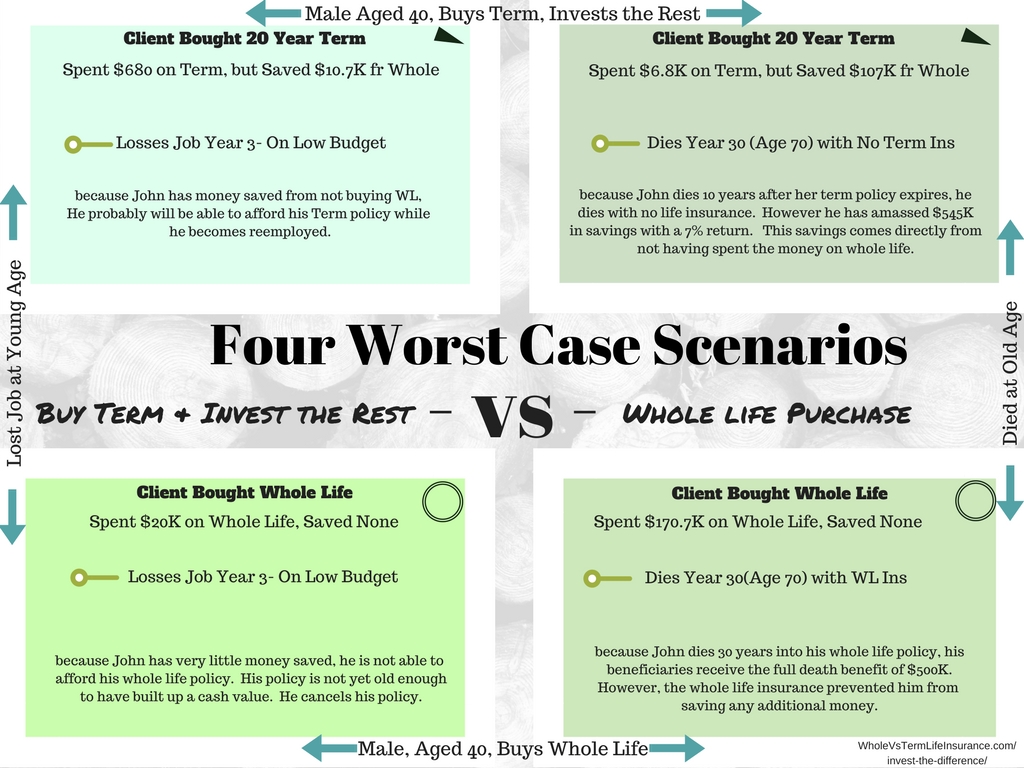

To further expand the discussion lets take on what I would call the two worst case scenarios for either of these two options for a hypothetical 40 year old male. Let us call him John.

Option One: Client Chooses a Whole Life Insurance

With this scenario a working father chooses a whole life insurance policy in the amount of $500,000. He cannot afford it for long (which is common) therefore he cancels it on year three after he loses his job. The whole life policy costs John about $5,690 per year, so she is out of pocket $11,380. His account has built up no cash value so he ends up without any life insurance.

Option TWO: Client Chooses BTITR:

The same working father instead chooses a 20 year level term policy for the same $500,000 in coverage. Just as above, he loses his job and is short of money. Since the policy is only $340 per year, he has $5,350 in savings from the first year of Not buying the above whole life policy. After making his second $340 payment he now has $10,700 in savings. (No interest accounted for - just to keep this simple.) Now that he has lost his job, he is forced to make a tough decision - Should he plunk down $340 for his term life policy or use they money for something else? John at least has the freedom to afford the term policy here if he chooses to keep it. (Remember he has not spent $10,700 on the other whole life policy.)

Which Option Would you have Chosen?

Scenario Two:

$500,000 Death Benefit Or $545,767 in Savings?

Now, just to review what could possibly happen on the other end, lets review the worst case scenarios for our theoretical client John, when he is much older. Now John is 70 and dies. Using the above two same scenarios and having chosen a whole life insurance policy vs a 20 year policy, which by age 70 would have expired.

Option One: Client Chooses a Whole Life Insurance policy...

The client sadly, dies at age 70 with a whole life insurance policy in force. He has faithfully made each and every premium payment in full on time. When he dies he receives his full $500,000 in death benefit.

However since he premium payment was high the client did not save any remaining money.

Option TWO: Client Chooses BTITR:

The same client sadly dies at age 70, but with a twenty year term life insurance policy that has expired about ten years ago. Technically speaking, he chose to let it expire after the guaranteed rates skyrocketed and he chose not to extend it. None the less, he no longer has any life insurance at age seventy.

John saved 20 years worth of not paying whole life insurance policies which amounts to about $107K total, before any interest. When you add in compounding interest of about 7% that would be about $234,678. That is what his money is worth at year 20.

At year 30, he has that money, with an additional 10 year of interest plus the 10 years worth of not paying the full whole life insurance premium of $5,690. Adding this all up brings you about $545,767 in savings.

So when John dies he can leave his family $545,767.

Which Option Would you have Chosen?

Analysis and Notes on these Scenarios:

These scenarios are pretty simplistic and there are a number of factors that we have avoided, mostly to make this understandable. We have avoided the types of accounts that the savings could be invested in, such as qualified (401K, Roth IRA, etc) and non qualified (savings accounts, general investment account) accounts. We have avoided taxes and tax rates. We have avoided whole life insurance dividends. We have avoided fees from whole life insurance policies as well as fees from investment accounts.

Some agents might argue that by avoiding these topics we make the Term Life Insurance option seem like a better option. However, this is not intended and is extremely debatable. The entire point of this article is to provide a simpler explanation of why buy term and invest the rest has such appeal. Both Qualified Accounts and Permanent life insurance policies have special tax benefits, so you could argue that the tax benefits more or less cross each other out. The argument for which is better -often gets lost in this world, when really the most salient points are that (1) so many whole life policies get cancelled and that (2) these policies typically do not meet market returns.

We have assumed in these two scenarios that our client John is one of the select few people that buys whole life insurance and keeps its for their whole life AND never takes out a policy loan. The moment the client cannot afford to keep the policy and then he or she dies, this whole debate becomes moot. Remember the earlier statistic = about 45% of whole life consumers end their policy in the first ten years?

It is absolutely possible for whole life policy holders to come out ahead. In our situation, John the client probably comes out financially ahead if the policy were to pay out between years 20 and 27. At least in this scenario when he faithfully makes the yearly premium payments. But only in that narrow band of years with a seven percent return. From years 0-20 he clearly comes out ahead with the term policy. From years 27 to 29 its a close call. From years 30 on - he comes out ahead again with BTITR option. He comes out farther and farther ahead with the BTITR option the longer and longer that he lives.

The client could also come out ahead if the market failed to meet typical returns and came through with only a 2% return. However even this basic data point has considerations. If the market is failing to perform well this will no doubt affect how the life insurance dividends pay out as well.

If you run any of these scenarios whereby the client must take a policy loan out, or fails to make a payment on the policy - just forget about it.

The question in the end may be is BTITR successful more than 55% of the time?

You will notice in our example that we used the return rate of 7%. Certainly the return rate of the Buy Term and Invest the Difference is crucial in computing out our scenarios. Where did 7% come from? Honestly lots of sources. The rate you end up getting can be far lower or perhaps somewhat higher. This will no doubt affect the overall outcome.

Questions about Buy Term &

Invest the Difference:

Question: Does buying whole life insurance ever make good financial sense.

Answer: Yes, it certainly can make good financial sense for a small minority of the population.

Question: My captive home and auto insurance agent tells me that I need a whole life insurance policy, should I buy it?

Answer: Probably not. More than likely you should do your homework and shop around. Always ask to see term life quotes alongside.

Question: Does buy term and invest the rest always out gain whole life policies?

Answer: No, buy term and invest the rest does not always beat whole permanent policies. The best opportunity a whole life insurance policy has to out gain a BTITR program is in a really prolonged period of financial stress. However the chances of something like this happening for an extremely prolonged period, say 40 year is very small.

Question: You do not really go into how to invest the rest?

Answer: We are not investment managers at WholeVsTerm - however for brevity's sake we chose not to delve into that subject on this post. However if you are able to use that money in your 401Ks and Roth IRAs, it is almost impossible to imagine a whole life policy beating them.

Question: Why do people want life insurance forever?

Answer: Other than a few rare, but specific situations, I cannot say.

Question: Isn't it a waste of money to put money into a term life insurance policy and never pull out a benefit?

Answer: No, quite the opposite really. Using a temporary inexpensive financial vehicle when you are young and have dependents, and then recycling it when you no longer need it is really quite ideal. The reality is that for most people the odds of you dying when you have young children is quite low, and the need for having insurance when you are older is also quite low.

Speak with an experienced advisor!

Speak with an experienced advisor!