There are many factors that go into determining life insurance pricing. One of the most important things is your life insurance health class. This health class is a combination all sorts of important health tests and characteristics boiled down to one of four primary health classes. Beyond those four classes are what are known as Table Ratings. If you do not qualify for one of the four general classifications, you may qualify for table ratings.

A loose definition is: A life insurance health class is a combination of medical tests and characteristics, personal and family health history, combined with your career and lifestyle choices to form a single level of life insurance qualification.

Insurance companies are increasingly allowing underwriters to use "stretch criteria" in determining exact classifications. Stretch criteria essentially allow insurers some slight variances to their more common underwriting guidelines.

Your life insurance health class is comprised of the following considerations:

Yes, your families past medical history plays a role in determining your future life insurance health class. Underwriters will want to fully understand your families past medical history and how they may affect you in your life. Often insurers are more concerned about an early death than the onset of any one specific disease. Life insurance underwriters are, generally speaking, a fan of more certain information.

So does having a past early death from a mother or father preclude you from qualifying for an inexpensive term life policy? No, not necessarily. It may, however, knock you out of the highest and cheapest class, it will not typically prevent you from a good health class.

Family Health History Considerations:

These are the most common past family medical conditions that the insurance company may want to know about. All of them will assist in determining your life insurance health class. There are of course others, such as Stroke, Heart Issues, Cancers, and ongoing diseases are the big ones to be consider.

Best Practice for Family Health

A best practice when you have a poor history of family overall health is to reach out to a life insurance specialist and immediately inform them of your situation. This will allow them to fully appreciate your situation and perhaps assist you in securing a fair life insurance premium.

Your health history is of obvious importance for life insurance underwriters. How you take care of yourself, what medicines you take, and what has been you past medical health issues. Your medical history is so important that it is broken up into a few sub categories here. Your Height and Weight being one and your Prescriptions and Medications being another.

Other than those two sub categories though, a potential life insurance company will want to know about about your past medical diagnosis and physicians name. After you complete a life insurance application they will order medical tests once you have signed forms allowing them to do this.

Many clients incorrectly assume that having a past medical history or having been to a specific doctor is a bad thing. This is often not the case. In many situations, life insurance underwriters often appreciate the fact that you have seen a health care practitioner about something. Often a treated medical condition is better than an untreated one, even if that means prescriptions. What they definitely like to see is a consistent relationship with the attending physician and prescribed protocol that is being followed.

In other words they would rather you regularly see a doc about something than skipping the visits and ignoring the protocol.

Your Health Considerations:

There is a full list of diseases and disorders your life insurance agent will review with you. The above is more for quick reference. Ask yourself this, what surgeries, elective or non elective have you had? Was the problem fixed by the surgery? Do you take any ongoing medicines? If so, how much and what kind.

Makes sure you fully discuss your situation with your agent. Try and not forget your past medical history as it rarely helps in the long run.

It often helps to have an ongoing relationship with your doctor. This is especially true if you have a chronic disease. Think of it from the insurers standpoint, if the physician comes back with few notes about a disease you have had for fifteen years, that might not look so good.

Two medical numbers that can be most helpful with ascertaining your overall health can be your cholesterol and your blood pressure. If you do not know these two numbers - call your physician and get them. For the cholesterol you will want the full panel of information, not just the total cholesterol.

Best Practice for Your Health

A Best practice when procuring life insurance is to ask your life insurance specialist about a given condition before the application stage.

Many insurers have different underwriting guidelines and sharing your condition with your agent, may allow him or her to find a carrier with a more open set of rules.

Often an independent agent may be your best bet.

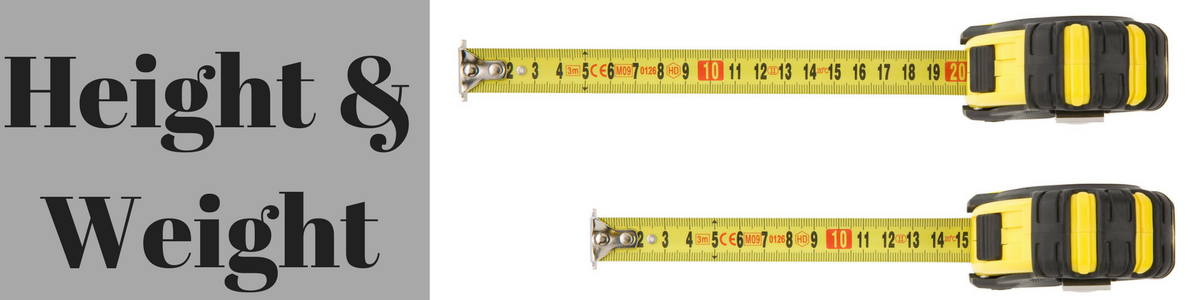

Height Weight Charts are an incredibly crude way for life insurance companies to measure body mass. Insurers use these charts to determine if a potential client is considered obese or overweight in any manor. The reason for this is that obesity, like smoking, is linked to all sorts of health issues. Issues from being overweight put clients at elevated risk of Diabetes, Heart Issues, Stroke, Blood Pressure, Cancers, Gout, and various breathing related illnesses.

Other than obesity, there are other reasons that life insurance companies do care about your height weight matrix. It may, in theory, demonstrate to them that you lead a healthier lifestyle. It may be in part because there really is no way for insurers to know with any certainty if you do actually go to the gym each week or not.

There are of course numerous other reasons that insurers may want to know about your height weight - which is often referred to as BMI. BMI stands for Body Mass Index and it is a method of calculating the body height weight relationship. This index is an calculation if you are considered overweight. The Body Mass Index has all sorts of issues with it -mostly because it is a crude tool. However it is the tool that almost all the insurance companies use.

A Typical Height Weight Chart for Life Insurance Purposes

|

On top of height and weight charts, life insurance companies will also measure you in other ways. They will often measure your stomach and chest with a tape measure. What exactly this information is used for is open to some debate.

Best Practice for Height and Weight

The most important best practice is to be honest with your life insurance agent about your current weight. Not your hoped for weight and not the weight when you were 17, but today's weight. Occasionally it can make sense for you to lose a few pounds before your paramedical examination. Knowing where you sit on a given insurers height weight chart could save you a lot of money in the long run.

Prescription medications are bit of dual situation. One the one side, they increase your overall cost of life insurance, but on the other side, if routinely taken - they can reduce an ongoing health situation and lessen problems you are having. This can therefore serve to save you money on your insurance.

Confused?

You are not alone in your confusion as many insurance agents get confused about this as well. The exact type, dosage, and reason for the medicine is most important. A potential insurer will also want to know how long you have been taking the medicine and may check to see if the prescriptions are regularly and routinely being filled. The refilling of the prescriptions is really their way of confirming that you are actually taking the medicines prescribed.

On a redundant note here, life insurance companies would prefer that prescribed medicine is taken just as the doctor ordered. They do not like it when clients haphazardly stop using medicines and abandon a treatment plan.

There is no surprise that a potential future insurer will want to know what medicines that you are currently taking and have taken. This is to allow a given insurer to completely get a full medical opinion. Underwriters are looking to confirm that you are on the treatment plan prescribed by your physician. They are also checking to make sure that the plan is not being abused in any way.

People that skip dosages, end them before the doctor recommends them, or go off plan in other ways are unlikely to qualify for the best life insurance class that they could have otherwise. Therefore it is imperative that you follow the protocol.

Are there medicines that insurance company prefer more than others? Yes there are. Some medicines are helpful and have very benign negative affects, while others can be aggressive with serious side affects. However it is really situation specific.

Insurance companies will want to know more than just the prescribed medications. They will want to know about any other physician requested procedures, implants, or any other type of medical intervention.

Best Practice for Prescriptions

In general your best course of action is to be up front with your insurance agent about what you are taking and who prescribed it.

Have a list of the medicines that you take and their dosage. Make sure you are taking the correct amount as prescribed by your doctors.

Nutraceuticals are loosely defined as a "A dietary supplement (that) represents a product that contains nutrients derived from food." This definition is new and open to much debate. According to the International Journal of Preventative Medicine, common nutraceuticals include: Cod Liver Oil, Ginseng, Echinacea, Green Tea Extract, Glucosamine, Omega-3, Lutein, and Folic Acid. Nutraceuticals may be prescribed by a doctor, however often clients take them without a prescription based on their health beliefs. Since these products do not require a "prescription" to purchase typically - just the concept of being prescribed them is open to debate as well.

For our purpose let us just consider nutraceuticals as any pill that is taken that has potential health benefits with or without a prescription, other than pharmaceuticals and recreational drugs.

Nutraceuticals pose three separate problems for life insurance companies:

What is the Product Exactly? Since many of these products are not authorized by the FDA, the life insurer may not know much about them. In the past, some products sold as beneficial have ended up hurting people.

The Drug Interaction: Although nutraceuticals are not prescribed they can have an impact on other prescriptions that you are taking. From the standpoint of the insurer, this could produce a bit of a problem. From a consumer standpoint, this is why you will want to speak with your doctor.

Why is the Client taking it? Is the client using this product to solve an undiagnosed condition? For example St John's wort is rumored to be used to treat all sorts of conditions, including depression. Therefore since often it is taken without a prescription, does that mean that the client is suffering from depression?

Will the potential insurer know if you are taking one of these products? Well first off you will have to legally sign an application in which you may state that you either do or do not take another other products. Second, they may find out in the process of subsequent conversations or via a blood test or even a past doctors note.

So yes, you should tell your insurance agent all the products that you are regularly taking.

Best Practice for Nutraceuticals

A best practice for users of neutroceuticals is to understand what you are talking with an experienced insurance agent about it.

Keep a list of all the products that you take the quantities and amounts.

Yes your employment matters for both life insurance acceptance and overall pricing. Some careers such as stunt men rarely surprise people, others such as pilots occasionally do surprise.

There is usually very little that people can do about their employment as far as buying life insurance. The only obvious course of action would be to switch careers and from an insurance agents standpoint that is really not something best suggested. Often the best course of action is speak with someone that specializes in writing insurance your employment position. For example if you are in the military you likely should speak with an insurance agent that works on or near your base and writes many active military personnel. Certain insurance companies may be more open to writing your policy if they know all the details of what exactly you do.

Jobs That May Make Life

Insurance Rates More Expensive:

Dangerous adventures can certainly disqualify you from buying life insurance, but it does not need to.

First off, if you participate in these sorts of things the first thing you need to know is that Failure to work with a life insurance agent that knows what he is doing could really work against you. In general you do not want to get denied a life insurance policy as that will have all sorts of potential unintended consequences.

Typically participating in some of these adventurous pursuits should, in theory, only raise your rates. BUT NOT ALL LIFE INSURERS are like this, some will just flat out deny you coverage. Therefore its important to not submit an application until you have a handle on it.

For obvious reasons participants of dangerous activities are at an increase risk of death, therefore their life insurance rates, should accordingly, cost more.

When considering these activities a good insurance specialist will want to know about the following categorizations of the activity: Frequency, Personal or Professional, Certifications, and General Specifics.

Frequency, as in, how often do you Scuba Dive?

Personal or Professional, as in, do you do this for a living?

Certifications, as in, are you PADI certified or some other dive certifications?

General Specifics, such as how deep do you dive? Do you dive at night or in caves?

Each sport will have different versions of this, but they generally fall along these lines.

Dangerous Activities that may Cost you Extra with Life Insurance Companies

Keep in mind that each insurer will maintain their own list. Generally Backpacking/Trekking, Snorkeling, Cycling/Mountain Biking, Skiing/Boarding, and Surfing are more dependent on a given insurer but are often less of an issue.

WholeVsTermLifeInsurance.com

Best Practice for Employment

A best practice for adventures is to call an independent insurance specialist and lay out your situation. Be prepared to go into details about your fun lifestyle. Do not necessarily expect that a given life insurance agent will know off the top of their head the best insurer. Likely they will need to do some research in order to best serve you and your situation.

There you have it the most important considerations for life insurance health class. Up next we will review the four general life insurance classifications, which are Preferred Plus, Preferred, Standard Plus, and Standard. These are broken out into separate for Both Smokers and non smokers. In other words their is often a preferred plus smoker and a preferred plus non smoker.

Preferred plus is the highest and best life insurance classification available. Access to this class should be seen as a symbol that you are really in top notch condtion. Preferred Plus can also be called Super Preferred by some insurance carriers.

Preferred Plus is not a common class for most consumers to qualify for, you need to be in superb health, take very few if any medicines, be spot on with the height weight chart and have a very clean MVR. Generally as we all age, it becomes less likely to qualify for this level of life insurance.

If offered a life insurance policy at the Preferred Plus rate clients should be ecstatic about it and probably should not let the offer for a term life policy at this rate pass you up. Your health situation can change easily and what you can qualify for now, might change in just a few short months.

The preferred classification for most Americans is the best that they may be able to do. Often this is because they have had some of minor health issue, have an moderate ongoing concern, or are slightly overweight. They may even just be more muscular and are struggling to find a carrier open to the higher Preferred Plus category.

This life insurance classification is a great classification to attain and you should be very happy if you are able to qualify for this as it gives you access to very low life insurance rates. Remember the preferred class is the second best rate.

Standard Plus goes by other names in the insurance world such as Non Smoker Plus. It depends on the insurer. Standard plus is a solid category that allows for some family medical issues and/or early family deaths, It allows for potentially chronic conditions, some dangerous hobbies, being overweight or highly muscular build. Standard plus takes into consideration medicines. As with all of these life insurance classifications, the insurers prefer to see your health condition under control and that you are being treated by a physician and that you are following their protocol.

Standard Plus rates are more expensive than Preferred Plus and Preferred, but less expensive than standard. Standard plus is one step better than standard and gets you a fair discount from that pricing option. Many people whom have chronic conditions or some other situations should be fairly happy qualifying for this level of life insurance pricing.

The Standard life insurance class is the last of the regular classifications, after which clients may be offered life insurance in what are known as table ratings. If you have experienced life insurance table ratings you will be happy to qualify for the standard life insurance rate. Standard rates are more expensive than Preferred Plus, Preferred, and Standard Plus, but less expensive than all of the table ratings.

Many people qualify for the standard rate because they have multiple underwriting criteria working against them. Such as being overweight and having a chronic health condition. Or someone that might participate in a somewhat risky hobby and have a past somewhat major health condition.

For some, the Standard Life Insurance offer can be a let down, for others, it might be a relief.

Life Insurance Health Class & Life Insurance Classification:

Information is power.

Now you have power.

Please use that power for your own good. Use this information to help you save on life insurance.

Contact us with any questions that you may have sales@marindependent.com or 415-294-5454.

Thank you reading about our article about life insurance health class.

Speak with an experienced advisor!

Speak with an experienced advisor!