The Great Debate: Whole Vs Term

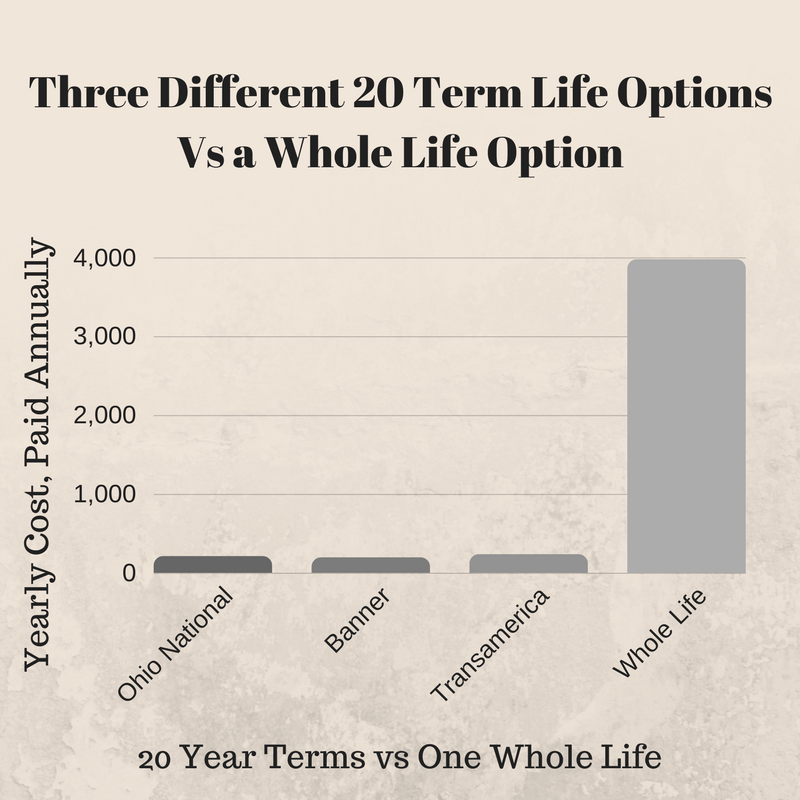

Over the past twenty years the insurance landscape has changed dramatically. Gone are the days where consumers could just rely on the opinion of their home and auto insurance agent to recommend a life insurance policy. Insurance companies have changed, they have specialized, and so have insurance agencies. Many american consumers can save hundreds, if not thousands of dollars per year by shopping around and procuring the best forms of insurance, including life insurance.

Great Candidates for Whole Life Insurance:

Whole life insurance still has its place. The powerful combination of a true Cash Value Life Insurance Policy that receives yearly Mutual dividends with a virtual guaranteed death benefit can be the perfect financial tool for many. However, for others the complexity, the cost, and the opaque investment nature of them deem them to be unusable.

One thing with Whole Life Insurance policies is absolutely certain, they rarely make good financial sense if it prevents you from maxing out qualified investment vehicles. These include 401Ks, 403Bs,IRAs, Roth IRAs, General Pension Contributions, and others. Only afterwards can they make sense.

Great Candidates for Term Life Insurance:

For the vast majority of Americans, term is really often your best life insurance option. Assuming you need life insurance. Unless you have one of those special situations when a whole life policy could make good sense - Term is Usually a Good Solid Choice.

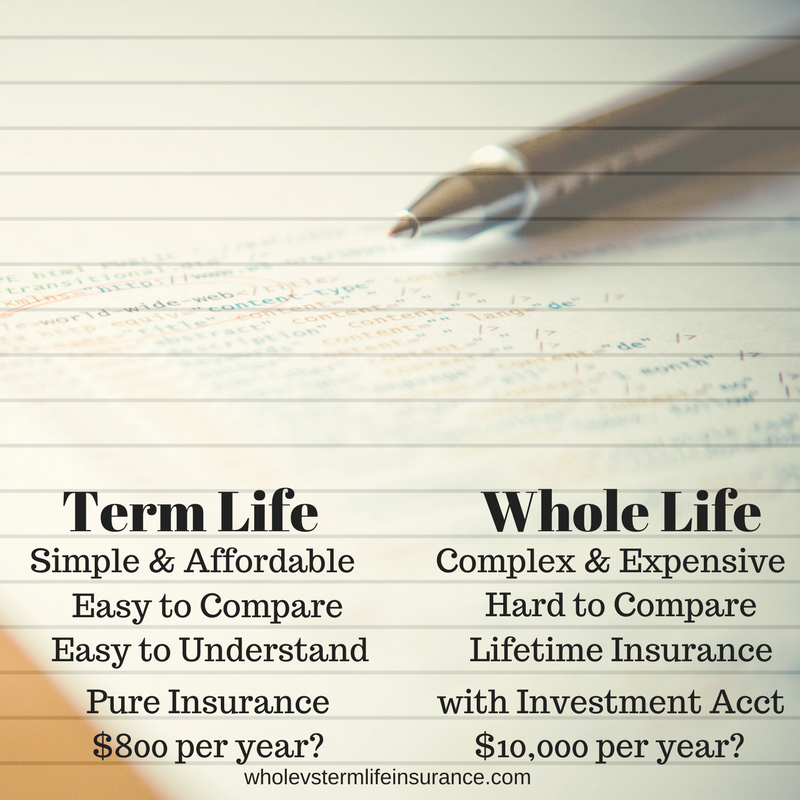

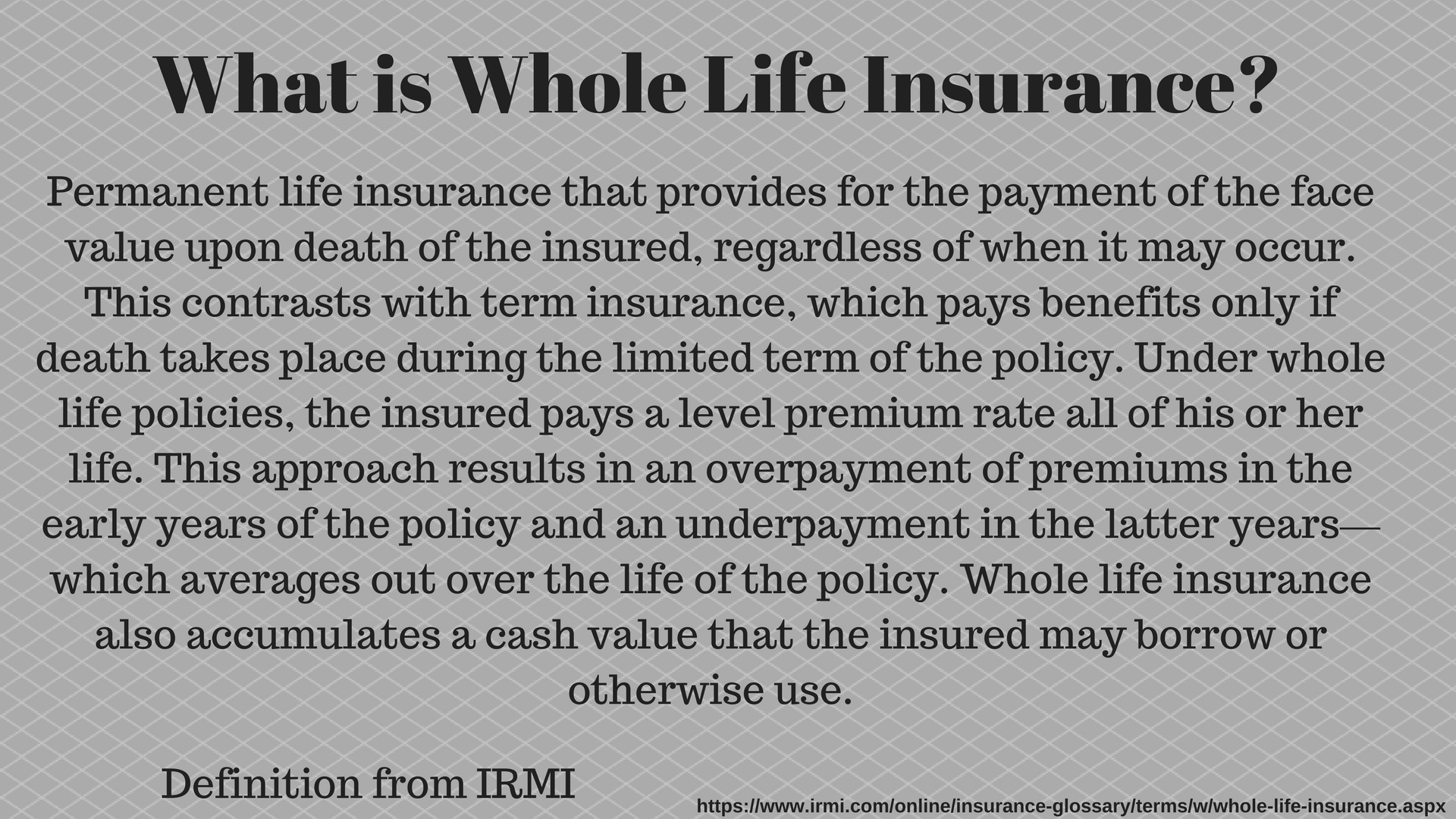

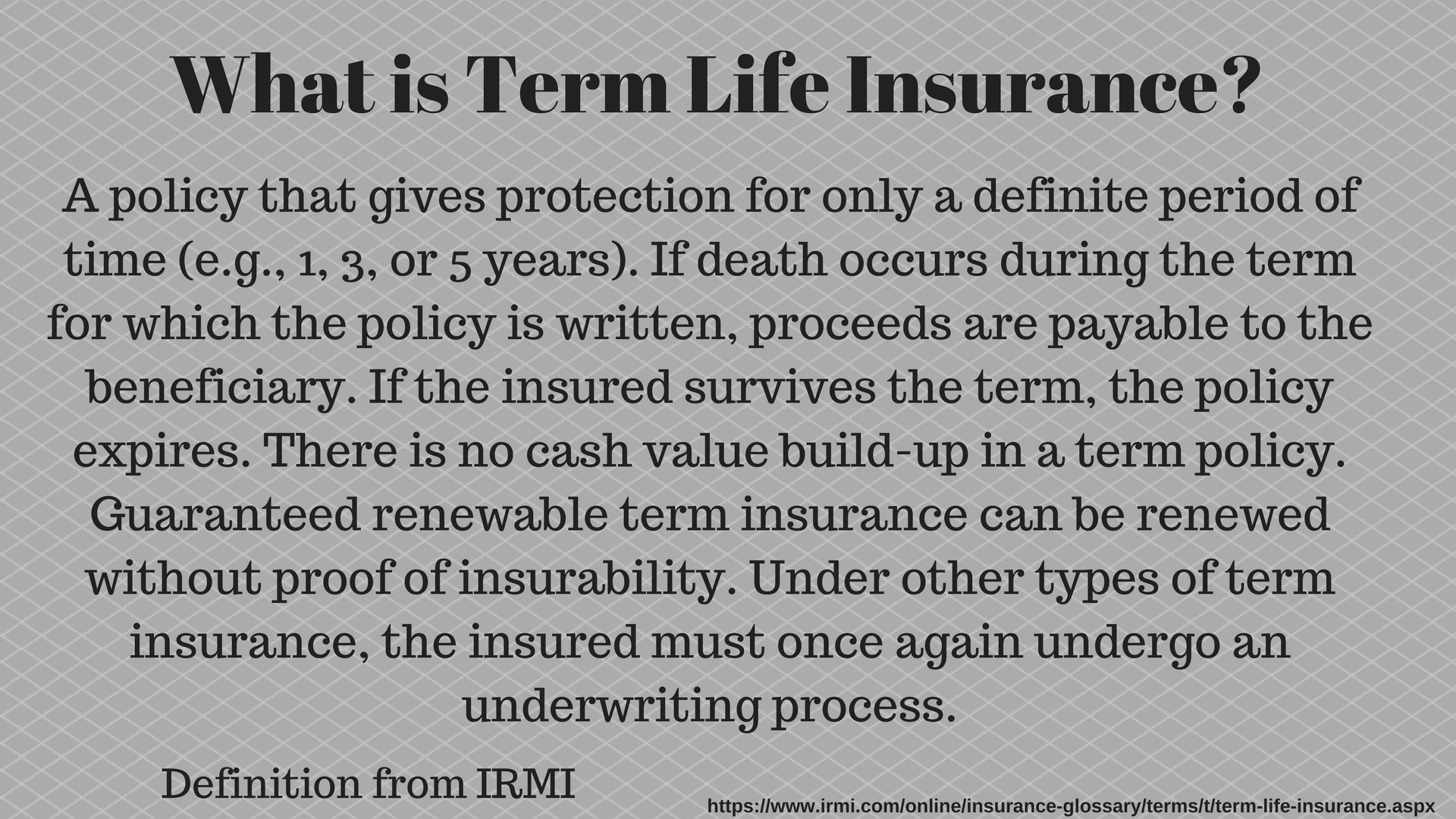

Definitions of Whole and Term Life Insurance:

The two visual definitions of whole term life insurance are both from IRMI. Basically term life insurance is temporary insurance where the cost is far lower. Whole life insurance is insurance for your entire life but the cost is far higher.

Speak with an experienced advisor!

Speak with an experienced advisor!