Many seemingly perfectly healthy people try buying life insurance only to be surprised that they have a cholesterol problem. This is the full story about cholesterol and how to save money when buying term life - either untreated or treated with Statins..

Why High Cholesterol is an Issue for Life Insurers:

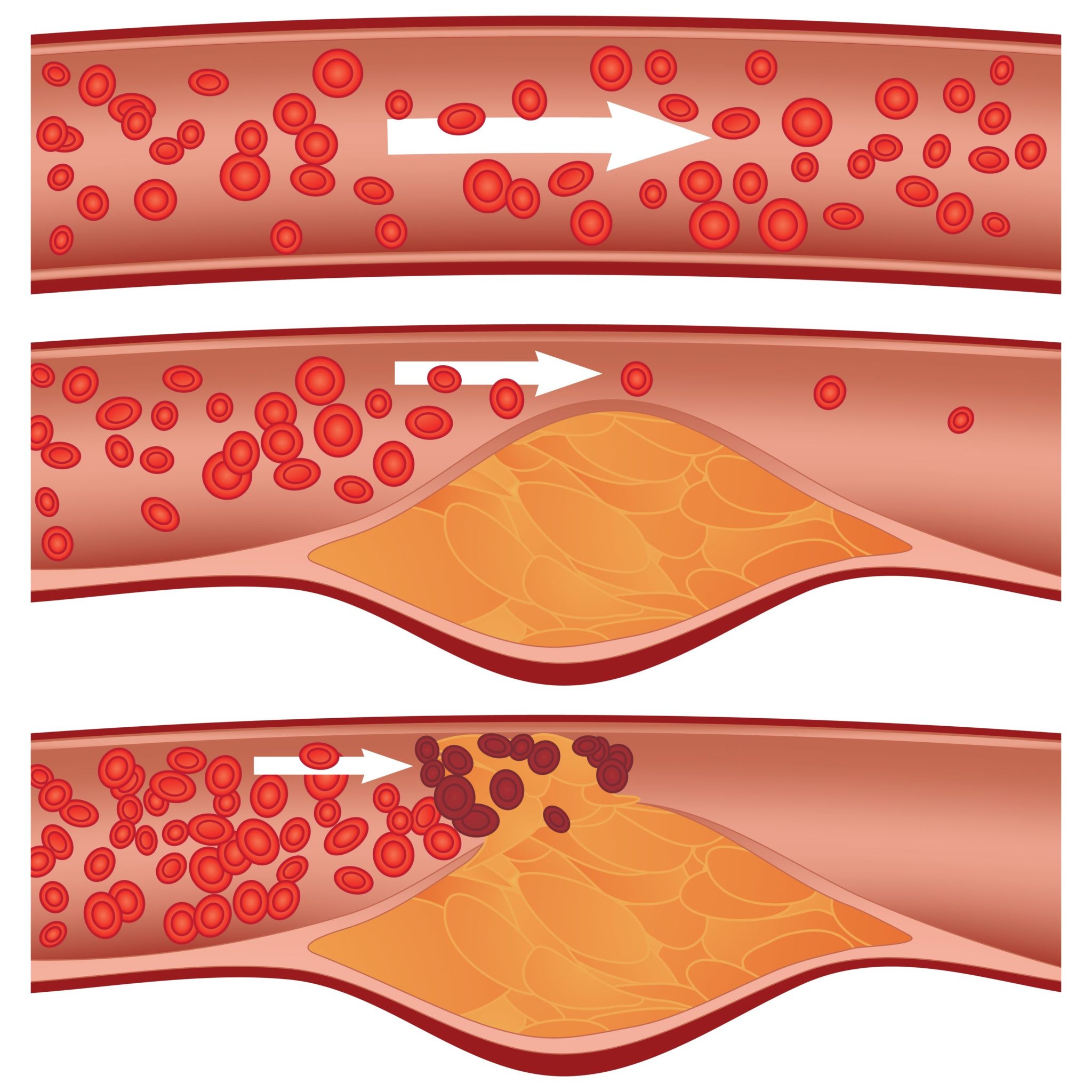

High Cholesterol is an issue for life insurance companies because it can lead to all sorts of long term health issues and potentially, an early death. Cholesterol levels are closely correlated with an increased incidence of Heart Attacks, Strokes, Diabetes, and more. Therefore getting it under control is very important to insurers.

Some medical studies indicate that proper control of cholesterol levels (among other things) "could result in further improvements in life expectancy." High levels of cholesterol is also known by the medical term of hypercholesterolemia.

About

Cholesterol:

According to the American Heart Association cholesterol is "a waxy substance" that is necessary for your body, but too much of it "can be a problem." This is why doctors frequently measure your levels of this substance. Cholesterol comes from two sources:

For the most part almost all of the cholesterol that you body needs is made by your liver. The rest of the cholesterol your body has comes from your food intake. Intake of foods that you eat such as meats (chicken, beef, pork) as well as butter, eggs,etc. Some forms of food can also cause your liver to produce more cholesterol. Some of these include coconut oil, palm oil, and palm kernel oil. Therefore it is more complicated than how much cholesterol is in the foods that you are eating. It is also your body's reaction to the foods that you take in.

There is still some debate within the medical community about cholesterol and why certain people have higher levels of this waxy substance. Some people seem more likely to have high cholesterol numbers based on their genetics or other lifestyle factors.

One thing that is not debated is that high cholesterol levels can be bad for you and your health.

The Different Types

of Cholesterol:

There are fundamentally two types of the waxy substance:

When you go to a physician and get your physical and blood work done, they will measure your cholesterol in a number of ways.

- 1A Total Cholesterol Count, of all cholesterol numbers.

- 2Triglycerides which are a type of blood fat.

- 3HDL number.

- 4LDL number.

- 5Total Cholesterol to HDL Ratio.

- 6VLDL Number. VLDL stands for Very Low Density Lipoprotein. This number is not always measured by some tests.

The Total Cholesterol Number or Count is the simple version of your blood situation. It is a starter, but from a medical perspective it alone, is not all that useful. The HDL Ratio combined with the HDL, LDL, and Triglyceride counts are what are most important. VLDL estimations are also sometimes used.

About High Cholesterol

Health Issues:

Having a High Total Count or Poor HDL ratio may mean that you are at an increased risk for numerous health issues. These health issues could include the following:

High levels of this waxy substance, sometimes known as hypercholesterolemia, are much more complicated and nuanced than a simple list can explain. Further complications and other health issues can and do exist. Please speak with your licensed physician for more information concerning your overall health.

Methods Used to

Control Cholesterol:

The internet is full of suggestions on how to lower your total count. Physicians often recommend a number of lifestyle, including dietary changes to a patient's life. These recommendations usually include cutting down on high cholesterol foods such as red meat, butter and increasing intake of vegetables and fruits. Combined with an increase in exercise these two steps can assist many people.

However these steps do not always alleviate the health concern. Some clients are prescribed medicines to assist in the control of the issue. According to WebMD there are several classes of Medications used to control cholesterol:

Statins and

Life Insurance:

Statins are easily the most common prescription for this health situation. They work by lowering LDL and Triglycerides, and by raising HDL. Basically they lower the bad type and raise the good type. There are numerous types of statins manufactured by different pharmaceutical companies.

Here is a partial listing of Statins:

Many consumers, incorrectly assume that because they are on a statin that life insurance companies will not like that. This is distinctly not true. As a general rule of thumb insurers would rather see a condition treated than not treated. Taking medications, in a way, is similar to saying "Hey I'm taking care of myself!"

High Cholesterol Life

Insurance How to:

If you have high cholesterol and you want life insurance there are a number of things that you can do. First off, acknowledge that you have a health issue. Some patients think its just a number and avoid dealing with it. Second, get your latest numbers checked by your physician. It is often best to receive the full panel workup. Do not settle for just the total cholesterol number. Third - speak with your physician about treating your condition. Next follow his or her protocol to a tee. If they prescribe a change in diet, do it. If they prescribe medicine - take it. When they request that you return for a follow up session - go.

Now that you have your health concern under some control, its time to consider your life insurance. That is your families life insurance needs. The first thing you will need is an updated set of results, hopefully that demonstrate that you cholesterol is under control. Next, find an insurance agent that has experience working with special health considerations, such as high cholesterol. Insurance agents that do this, rarely if ever work for one insurance company. Typically independent insurance agents will be your best bet. However, not just any independent insurance agent, but an independent agent that has experience with this.

Once you have a potential agent call them up. Have your results handy, and the names and dosages of your medicines as well. You will also want to be prepared with any other underwriting considerations. Speak with the agent and explain your situation.

High Cholesterol Life Insurance -

Don't Do This:

There are lots of mistakes that consumers can make when applying for life insurance with any medical condition. However the number one worst mistake is the following. DO NOT, under any circumstances apply for a life insurance policy just because your 'current' insurance agent does not know what they will accept. If your 'current' insurance agent is not able to request more information about their underwriting standards in regards to your cholesterol levels - MOVE ON. Do not risk getting a life insurance decline, you do not want this.

Another slightly lesser mistake that people make is to accept a more expensive life insurance health classification. In other words - an insurance company accepts them but charges them more.

The secret to the sauce with health issues to learn to lead with the health issue.

What happens if you already accepted a higher premium life insurance policy for your condition?

Assuming you are speaking of a term policy then this is not a big deal to fix. Get your health condition under control and reshop.

It may be advisable to have you reapply (with a different company) and attempt to get a new replacement term life insurance policy. You will probably have to rejigger the term length. However you could end up saving hundreds of dollars per year.

High Cholesterol Life Insurance -

What Exactly is High?:

This may be the most important question on this page. How high is high? Each insurance company will have different charts of what is too high.

Many carriers will consider an HDL ratio of 4.5 or 5 at the preferred plus level.

Some carriers will consider at preferred an HDL ratio of 5.5 and 6.

Some carriers will consider at standard plus an HDL ratio of 6.5 and 7.

At standard non smoker and standard smoker, there is not much uniformity for the required HDL ratios by the various life insurers.

Total cholesterol of over 300 can be an issue for many carriers.

Some life insurers accept treated cholesterol issues, while others only allow it at certain levels.

*there are other mitigating factors to consider with proper life insurance placement.

One super important thing to understand here is that each insurance company has their own limits to your cholesterol numbers that they will accept. This is why you need to speak with an agent with your numbers in hand. This will allow your agent to look at a number of various carrier options.

High Cholesterol Life Insurance -

Where to Shop:

Shopping for life insurance when you have a medical condition is all about the following three things: 1. Gathering all of your medical information. 2. Using an Insurance Agent that has experience writing policies with this condition. 3. Using an independent insurance agent. One that has access to lots of insurance companies. Failure to follow these three rules may mean that you end up either paying too much for the life insurance or risk getting a life insurance decline.

What to do when Shopping for Term Insurance with Cholesterol Issues:

- 1Gather All of Your Medical Information.

- 2Locate an Insurance Specialist.

- 3Consider an Independent Insurance Agency.

Follow these Best Practices, or:

- 1Pay More for your Insurance

- 2Possibly get Declined for Life Insurance

High Cholesterol Life Insurance -

What to Expect:

First off, for most fully underwritten term life insurance policies, they will check both your medical records and they will test your cholesterol numbers. In other words this is a condition that is pretty difficult to hide from the insurer.

If you apply for life insurance without knowing that you have a cholesterol issue you can expect to generally pay more for life insurance. You may also be declined on your application.

If you know you have a cholesterol issue and your agent tells you that it does not matter you may expect the exact same results: Lower Health Class Rating / Higher Rates and a Possible Declination.

If you contact a life insurance specialist - you should potentially expect a different outcome. You will discuss your exact total cholesterol numbers, your HDL ratio, the rest of your treatment plan, and any medications that you are on. From there your specialist will consult a number of different life insurance underwriting guides. They will then compare these results with generalized quotes to prepare a more accurate pricing estimation for you.

Higher Rates

Possible Declination

Vs.

Lower Rates

Possible Acceptance

There is no guarantee that following these ideas will "guarantee" a better outcome. However there is certainly a "higher chance" of a better outcome.

Sample High Cholesterol

Life Insurance Pricing:

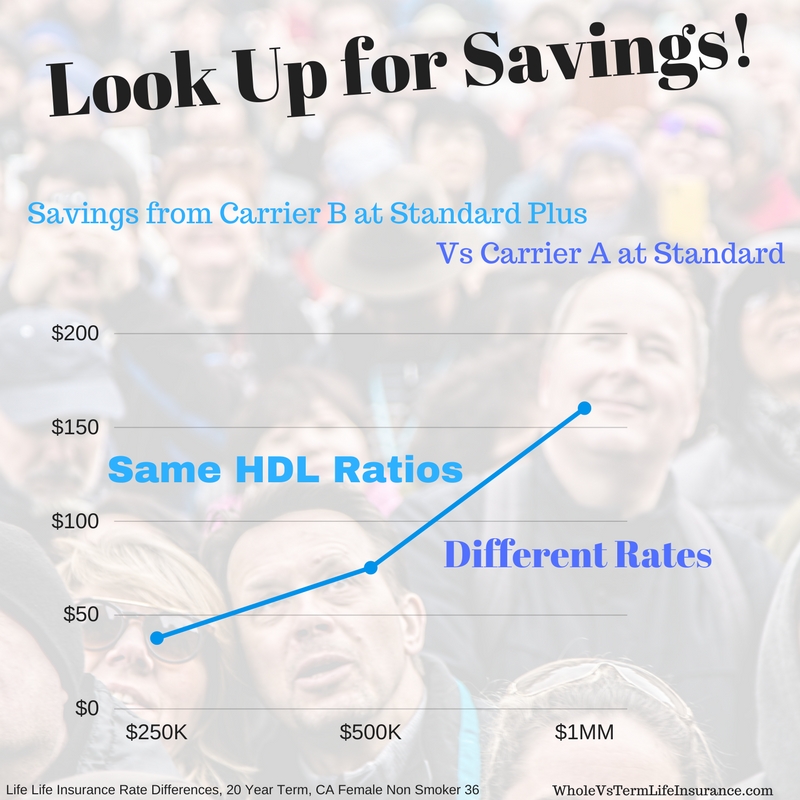

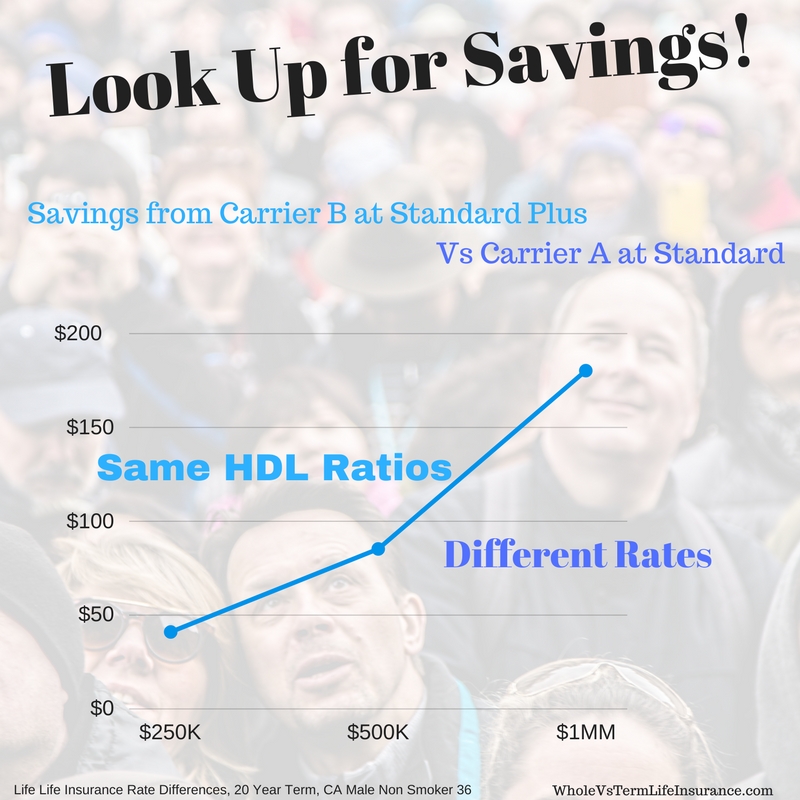

Same HDL Scores = Different Rates

Female, CA, Non Smoker, Aged 36

With Carrier A client Qualifies as Standard at Carrier B Qualifies at Standard Plus

Insurer A | @ Standard Rate | Insurer B | @ Standard Plus Rate | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

$250K | $500K | $1MM | $250K | $500K | $1MM | ||||||||

10 Year |

|

|

|

|

|

| |||||||

15 Year |

|

|

|

|

|

| |||||||

20 Year |

|

|

|

|

|

| |||||||

25 Year |

|

|

|

|

|

| |||||||

30 Year |

|

|

|

|

|

|

Would you rather pay $723 for a $500,000 30 year term policy

Same HDL Scores = Different Rates

Male, CA, Non Smoker, Aged 36

With Carrier A client Qualifies as Standard at Carrier B Qualifies at Standard Plus

Insurer A | Standard Rate | Insurer B | Standard Plus Rate | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

$250K | $500K | $1MM | $250K | $500K | $1MM | ||||||||||||||

10 Year |

|

|

|

|

|

| |||||||||||||

15 Year |

|

|

|

|

|

| |||||||||||||

20 Year |

|

|

|

|

|

| |||||||||||||

25 Year |

|

|

|

|

|

| |||||||||||||

30 Year |

|

|

|

|

|

|

How about you

Would you rather pay $1,723 for a $1,000,000 30 Year Policy

Questions about High

Cholesterol Life Insurance:

Question: Why are life insurance rates higher when you have high cholesterol?

Answer: Life Insurance Rates are more expensive with many health issues because of the increased risk of an earlier death.

Question: How much more can I expect to pay for life insurance when I am on Statins?

Answer: This is another good question, but one that we can not answer without more detailed information about the exact situation.

Question: Is it true that a difference between HDL ratios as little as half a point can cost you more money with an insurance carrier vs another insurance carrier?

Answer: Yes, each insurance company has their own limits and looking around with your ratios and cholesterol numbers can save you money.

Question: What happens if I only find out that I have high cholesterol while applying for life insurance?

Answer: If you find out that you have high cholesterol while in the process of applying for it, likely the insurance carrier will either charge you more for insurance or refuse to offer it to you.

Question: What exactly is hypercholesterolemia?

Answer: According to wikipedia, hypercholesterolemia" is the presence of high levels of cholesterol in the blood."

Thank you for reading our post:

Should you have any questions:

1. Call us at 415-294-5454

2. Email us at sales@marindependent.com

3. Post a Comment Below

Please speak with a licensed physician in your jurisdiction if and when you have any form of health issues, including high cholesterol. Should you have questions about your cholesterol levels and what your results mean, please speak with your doctor. WholeVsTerm provides "general" health information for the purposes of finding and procuring life insurance, not for healthcare purposes. Please see our privacy policy.

Speak with an experienced advisor!

Speak with an experienced advisor!