We will discuss the following Questions:

Is Whole Life Insurance a Scam?

The internet is full of claims by clients that they were scammed out of their money buying whole life insurance. This is sad. This should not be the case. That any consumers believe that they were scammed out of their money when they purchased permanent life insurance is horrible. This is a problem that needs to be addressed. It is also a question worth asking - Is Whole Life Insurance a Scam?

In this article we will explore the reasons that many people feel scammed by buying whole life insurance. We shall focus on whole life for this article, however many of the same arguments could be made about universal life insurance as well. To a lesser extent the vastly more complex form of life insurance called Variable life insurance could possibly also be associated with this same problem. But we will avoid the discussion of Variable Life Insurance because we are not licensed to sell this product.

First lets start off with a simple explanation with what whole life insurance is exactly.

How does Whole Life Insurance Work?

Whole life insurance is a form of permanent life insurance. The policy lasts your entire life, from the moment you sign the completed policy and make that first payment until you die. The only real caveat is that you need to make the payments on time, each and every year, forever. A typical whole life policy requires that the yearly premiums be level - that is the exact same each and every year.

The odds of a younger client dying are low in the initial years, but become much greater as the client ages. Therefore the level premium during the first couple of years creates what is essentially an over payment of funds. Those over payment of funds build up as a cash value within the permanent life policy. That cash value can in theory pay dividends on a participating whole life policy. These are the basics of how whole life insurance works.

Whole Life Insurance = A Policy that Last your Entire Life

There are of course, variances of whole life insurance policies, such as ten pay whole life policies and even single premium whole life policies. These limited pay policies require more money be paid each year, but for less years. This is how a whole life insurance policy works.

The Main Issues with Whole Life Insurance:

The build up of cash value within permanent life insurance policies serve to be a form of savings. These savings have numerous benefits and protections. However there are also lots of issues with them.

First off, permanent life insurance is expensive, very expensive. It is often 8-15 times more expensive than a twenty year term policy. The product is so expensive that often clients struggle to be able to afford the necessary death benefit.

Second, whole is complicated. If you have been researching permanent insurance chances are at some point you became extremely confused.

Third, whole life insurance requires the premium be paid... for your entire life, more or less. Do you need a large yearly premium due during retirement?

Forth, permanent insurance is really hard to compare from one insurer to the next. Its pretty much not possible to do.

Fifth, whole life insurance dividends are lower than stock markets historical rates of return.

Sixth, the policies are front loaded with expenses and fees.

Seventh, and this is somewhat similar and combed with point six, whole life does not accumulate much cash value for the first five to ten years of the policies life.

Those are just the more major issues with them, there are certainly more. The competing form of insurance, term life, has issues as well. The most major issue is the fact that it only lasts a limited period of time. Perhaps its because term is so much cheaper - but it seems easier to overlook some of few major issues with term insurance.

The Competing Choice - Term Life Insurance:

Simply put term life insurance is pure insurance. Term life has no investment account, no ability to gain in value. Term life lasts only a limited period of time. In many ways term insurance is what most people think of as insurance. You have it, while you pay for it. You have it while you need it. When your kids are living with you and depending on you, you should have it. Once you leave the house - you may no longer need life insurance.

Term Life Insurance = A Policy that Lasts for a Period of Time.

Term is offered in bands of time. The most popular lengths are 10,15,20.25, and 30 years. Some term policies have the ability either built into it or added via a rider to convert them, during the policy life, to a whole life policy.

What is a Scam?

According to Merriam-Webster a scam is a "a fraudulent or deceptive act or operation." The odd thing about this defnition is the next part to the definition, it continues with "an insurance scam." As in "She was the victim of an insurance scam." Or "a sophisticated credit card scam." Please see note below.

Dictionary.com defines the noun version slightly differently: "a confidence game or other fraudulent scheme, especially for making a quick profit; swindle." The verb version they define as thus: "to cheat or defraud with a scam."

Basically a scam involves a fraudulent scheme done deceptively with the intent to profit.

I would like to be very clear and point out that the above definition of "an insurance scam" is not referring to our central question and theme of this post: "Is Whole Life Insurance a Scam." That definition is more than likely referring to a scheme whereby someone's money is collected for insurance but is never used for it. These schemes are completely illegal.

Whole Life Insurance Scam - An Agent Issue

Now we move on to why consumers sometimes feel that they have been scammed when they purchased their whole life insurance policy. There is no one problem, but dozens. Simply put - when life insurance is sold for any purpose other than pure insurance reasons it leaves open the possibility of being miss-sold. (Actually technicially it can be miss sold when it is sold as a pure insurance policy as well.)

Is life insurance sold as a scam? We will address that in the ladder part of this article. Here we will address the potential miss selling of whole life by insurance agents.

Whole LIfe Miss-Selling Reason 1 - "Whole Life As a Retirement Vehicle"

Countless insurance agents claim that life insurance can be used as a retirement account. They are not entirely incorrect. However the numbers show that it pales in comparison to Roth IRAs, Roth 401Ks, 401Ks, IRAs, and to a lesser extent Non Deductible IRAs. Why?

You can loosely break retirement accounts into two different classifications: Tax Free and Tax Differed, lets look at both of them independently.

Definition of Traditional IRA

"A traditional individual retirement account (IRA) allows individuals to direct pretax income towards investments that can grow tax-deferred; no capital gains or dividend income is taxed until it is withdrawn." IRA Definition from Investopedia.

Whole Life Insurance Vs Tax Free Retirement Accounts:

Roth IRAs and Roth 401Ks work by taking money previously income taxed and putting them into qualified accounts that allow them to grow and be withdraw tax free at retirement time. In other words if the money is used at retirement you pay zero investment, income, or dividend taxes on them. (NOTE you may have to pay inheritance taxes.) How exactly can life insurance beat that? They may, partially, be able to match it (some of the time) but they can not beat it. How can you beat tax free?

Definition of Roth IRA

"A Roth IRA is a special retirement account that you fund with post-tax income (you can’t deduct your contributions on your income taxes). Once you have done this, all future withdrawals that follow Roth IRA regulations are tax free." Roth IRA Definition from RothIRA.

The way a whole life insurance policy works is that you faithfully pay your premium for decades and at about year 15 real dividends start getting paid to the policy holder. Hopefully the policy holder is choosing to buy more life insurance with the dividends or use them to make their yearly premium payments. Around retirement time, assuming the policy is in good enough shape to handle it, the client may opt to either take out low cost loans from the policy or remove money from the whole policy. Does that sound simple? Well its not, it has lots of moving parts. What I have yet to mention so far is that you will still need to make those yearly premium payments once you retire to keep the policy in force. With a Roth IRA, you can stop investing anytime you like. However I would not advise doing this until retirement time.

The truth is that nothing beats Roth IRAs and Roth 401Ks. Period.

Whole Life Insurance Vs Tax Differed Retirement Accounts:

The way 401Ks work is that money is pulled from your pay check before income tax is calculated and placed into a different a type of qualified investment account. You pay no income tax on the money earned, rather you have to pay income tax when you remove the money at retirement time.

This stands in direct contrast to permanent life insurance policies which use post income tax money. So the two are not truly comparable. However, since 401Ks are supported at the workplace many of them have a company matching level. Let us just agree that even the worst life insurance agent would not recommend not at least putting the up to the maximum match level is a 401K match program.

Definition of A 401K

" is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax, depending on the options offered in the plan." 401K definition from the IRS.

With the typical 401K match at some companies, your instant return is 100%. You put in 2%, say $1,000, into your company 401K account and voila another $1,000 in match money instantly appears. How on earth does a whole life insurance policy beat this?

However the debate with post match 401K money vs whole life is less easy to compare. One grows income tax free and starts generating real income somewhere around year 15 or so. The other can earn interest on 100% of the clients money right away and also leverages a secret weapon. But this entire account will be income taxed when it is accessed.

What exactly is the secret weapon? Well the government allows you to earn interest on their money. Does a the cash value life insurer allow you to earn interest on their money?

How does the IRS let you invest and earn interest on their money? In a 401K the money you set aside, the money is tax differed. This differed tax is not taxed when you put it in. It is not taxed until 20,30, 40 years later when you pull the money out. In other words, if you place $10,000 in a 401K, you may owe the feds and state $3,000 of that in taxes. However since it is in a qualified 401Ks account you do not need to pay that in the year you earn it. You get to use that $3,000 and invest it, earning an income on it. Its a real nice trick that pay HUGE dividends twenty and thirty years down the road.

That $3,000 will likley be worth $12,965 at a 5% interest rate in thirty years. At a 7% interest rate it could be worth $22,836. Want to run the calculation yourself, try this calculator from the SEC. The exponential factoring of using the governments money for your retirement makes whole life insurance seem like a poor choice.

My experience says that few insurance agents attempt to sell permanent life insurance policies as a replacement for qualified retirement accounts. Getting back to our original question -Is whole life insurance a scam? - I can see why consumers would feel this way if an insurer or agent claimed that a cash value policy is indeed a better use of your money than a Roth IRA. I still don't see how this qualifies as a scam, but it may border on it.

Whole LIfe Miss-Selling Reason 2 - "Whole Life as an Investment"

We have previously discussed how an insurance agent may pitch whole life as a tool for retirement accounts. Hopefully you have seen that in comparison to Roth IRAs and 401Ks, this is hogwash. However the money used for savings after filling up those accounts - well it gets much more nuanced and complicated.

For post Qualified Accounts, whole life possibly could be an 'OK' investment. But so are other investments. What makes permanent life better than many of the others. Its not possible to fully discuss this specific subject in this article, so we will just shoot for a few salient points.

One of the best places to store money is in a short term savings account. Up to a point. Everyone should have 3-6 months worth of savings in an internet savings account earning interest. These banks should be FDIC insured. Although you will not earn a high rate of return and although there is they are taxed as general income - the fees and interest that you will save from not having to take out loans when things happen will more than suffice for the lost rate of return from some other investment option.

Beyond that its hard to say why another more mid term savings account would not also be a great idea. Something that earned a higher rate of return but may take a couple of weeks worth of time to redeem. Money market accounts, CDs, Safe Bond Funds - investment such as this.

Next up your house, assuming you own one. I debate this subject with people all the time, paying down your home with one extra mortgage payment per year is a solid known investment return. The rate of return is the rate of interest you pay. If you are paying 4% than making one extra mortgage payment per year will return you 4% per year for the life of the loan. Depending on how you look at this, this may be considered tax free.

From here, I will freely admit that Whole Life may start looking like an attractive investment choice. But wait there are more considerations.

HSAs- if you have access to one these could be a smart option.

Rental Properties - due to their tax structure, purchasing rental properties can be quite advantageous.

Definition of an HSA

" A health savings account (HSA) is a tax-deductible savings account that’s used in conjunction with an HSA-qualified high-deductible health insurance plan (HDHP.) HSA definition from Healthinsurance.org.

Municipal Bonds - Various municipal bonds are federal and even state tax free. Isnt that what some insurance agents say WL is, tax free income?

Long Term Stock, Mutual Fund , and ETF investments - probably will outperform whole life insurance, but their tax status may not be quite as solid. However if money is held and redeemed in an intelligent way.

Whole LIfe Miss-Selling Reason 3 - "Safe Place to Put your Money"

Whole life insurance is a relatively safe place to put your money, this is actually mostly true. I dare anyone to find a more stable financial company than New York Life or Northwestern Mutual. These two A++ rated firms have been around for hundreds of years and their balance sheets are amongst the cleanest on the planet. So placing your money with an A++ or A+ insurance company is actually indeed a safe place. However there is still a problem. The first dollar put into a savings account at a Large Safe Financial Institution is certainly safer than the first dollar put towards an A+ rated life insurance company. How so?

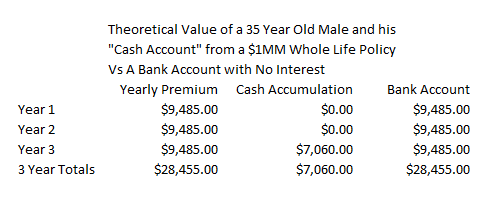

An Example of the balance of a Whole Life Insurance policy at Year 3.

Life insurance products, although safe, are horrible investments for the first five to seven years. Why is this? Because for the first couple of years, almost no money in placed in the cash account. All of the first two years of costs, typically are used to pay marketing and sales expenses. These sales expenses are also called commissions. Guys like me, get a commission when we sell whole life insurance policies. From years three to years ten a small, but growing percentage of your yearly premium will be put into your cash account. Depending on the policy and how it is set up you likely will be underwater on the product until often years ten to fifteen.

Therefore, Permanent Life Insurance products are not really a safe place to put your money until your cash account is at least the size of the money you put into it, less the pure insurance costs.

Whole LIfe Miss-Selling Reason 4 - "Way to Save for College"

Whole life insurance is a horrible method to save for college. There it has been said, do not save for your kids college with a Whole Life policy. Instead opt for a 529 or a Coverdale ESA account. These are far superior to cash value policies such as permanent life.

I have run these numbers countless times, and honestly I have no idea what insurance agents mean when they say that you can save for college with a whole life insurance policy. It can only make sense if you already have a well funded policy before your child is born.

If not, I struggle to see the value.

Definition of A 529

"A 529 plan provides tax advantages when saving and paying for higher education. There are two major types, prepaid tuition plans and savings plans." 529 Definition from Investopedia.

But to buy a policy from the day a child is born with the idea of saving for college with it - I just don't see it - period. There is just not enough time for a whole life policy to turn the corner and grow enough before this is the case. Even if you were to over-fund the policy in the early years, it is still hard to see how you can beat a tax free investment such as a 529 account.

A quick note on this, do not be confused with using the death benefit from whole or universal or term policies to pay for college expenses after the tragic loss of a loved one. This is great use of a life insurance. What we are discussing here is attempting to use the cash value of a life insurance product to pay for the planned education of a child.

Whole LIfe Miss-Selling Reason 5 - "You need life insurance forever"

I find this argument higher on the scam factor. There are two primary reasons.

First there are indeed other ways of having life insurance forever other than whole life insurance. You can buy a Guaranteed Universal Life Insurance policy / Lifetime term for far less money. You could have a group term life insurance policy, perhaps through work, which could possibly be for your entire life. Some group policies allow you to port it to you when you leave.

Second, do you really need life insurance forever? Do you really want that tricycle you got when you turned 3 forever? You may have thought you wanted it / needed it forever when you got it at that young age. But you did not actually want it forever? There are a few select people that will want life insurance forever, but this is small minority of the population. The reality is that most financial planners believe that you have life insurance when you need it, not when you do not. A whole life insurance policy assumes to some extent that you need life insurance forever.

In conclusion I find this argument to be mostly bogus. Most people do not need life insurance forever. Some people may want life insurance forever, but few actually need it forever.

Whole Life Insurance Scam - An Understanding Issue

It would not be fair for me to approach this topic: 'Is Whole Life Insurance a Scam?' without considering other reasons that people are asking this question. It is not all the insurance agents and insurance companies fault. There are other reasons that consumers are asking these question.

Consumer Miss understanding the Need for Life Insurance:

As much as I love to bash sales practices I must admit I am dazzled by how many consumers believe that life insurance is truly needed forever. I am open to the debate, but having discussed this for ten years, I rarely find clients that actually need the coverage forever. Sure, who would not prefer to have an in force life insurance policy at their death, you can see the appeal. But... when you look at the numbers again and again who really wants a whole life insurance bill forever?

A good financial plan beats a long term life insurance policy at least 80% of the time. It is possible that that good financial plan may involve a life insurance policy, but rarely forever for the masses. It is just not a sound use of money.

Consumer Belief in a magic bullet:

Creating and Maintaining a financial plan takes work, solid work, hard work. It is not easy. Many consumers seem to be overwhelmed by it all. Almost ready to give up. And I believe this is where the problem starts. Some consumers seem to want to find the one person or one product that can come in and solve their savings problem with a simple solution.

The truth is that a simple solution to a lifetime of not planning does not exist. Even if it did exist a permanent policy is unlikely to be the solution.

Consumers Being Too Trustworthy:

Just because you know someone, does not mean that they have your best interest at heart. It is one thing to stop at a bakery to order a muffin for two dollars from your neighbor who owns the bakery. It is completely different to order a $10,000 per year life insurance policy from your neighbor. I have seen this time and time again - consumers being too trustworthy, especially from people that they know.

Remember your goal for your finances should be to carve out a plan. Now follow that plan. Don't allow someone that can sell you a financial product to create that plan for you.

Lack of Transparent Data:

Insurers are regulated greatly about what they can and what they can do. There is also much regulation about the life insurance illustrations that are shown to clients. What seems to happen with some unhappy whole life clients is that they fail to understand one important fact of life insurance policies. The fact is this: Life Insurance Dividends are generally only paid by participating insurers on money in the cash account. In other words, dividends are not paid out on all of the money put into the account. This simple confusion leads to cancellations down the road. In my opinion, I truly believe that clients should be shown guaranteed charts and the first ten years worth of expected cash balance should be highlighted for clients. If they feel comfortable with the lack of return in the first decade, then perhaps they will truly understand the product.

Another important consideration regarding lack of transparent data is the Financial Strength Rating. Financial strength rating are opinions about an insurers ability meet its claims paying obligations. The higher the financial strength rating the better. But financial strength ratings are difficult for consumers to access. AM Best, one of the four main FSR raters, requires consumers to create a free account and login to see their ratings scale. Most insurers are proud to display their AM Best FSR rating. But these ratings are not simple to understand.

First off each of the credit rating agencies maintain their own scale.

Second FSRs are not the same as Credit Ratings.

Third the FSR rating scales are not set up in an easy to understand method. Countless times I have explained to consumers that an A+ Financial Strength Rating is not actually the highest rating. That honor is reserved for A++. But the difference between A++ and A+ is almost insignificant. Where the real difference lies is lower than A-. A B++ grade may look nice, but in fact its quite a bad FSR rating. Numerous insures seem proud to display a B++ financial strength rating. Its clear to me that these insurance companies believe that consumers don't understand the rating system and how bad their B++ rating actually is. There are not too many circumstance when I would suggest that a consumer buy any life insurance or annuity from any company rated lower than A-.

Whole life Insurance Policies are virtually Impossible to Compare:

This is one of the core issues with permanent life insurance, ease of comparison. Over the years it may be the number one reason that I just struggle to suggest this product. In no way is whole life opaque. In fact its the opposite of that. I personally, would never buy a stock that I did not understand basic information about, how can people buy an investment such as WL with so little information?

Even if you knew a little bit of information about one participating carrier how exactly does a consumer compare it to another participating insurer? The answer to the question is that they don't. Generally they pick an insurance agent, which usually ends up meaning that they are right there picking the carrier. Some independent agents have the ability to work with lots of carriers, but many of the best insurers such as New York Life, Northwestern Mutual, and Mass Mutual, only work with captive insurance agents. So even the independent agents can't really compare many of these policies for you because they really don't have access to them.

There does exist a tiny sliver of independent whole life insurance specialists that will sell their "services" at finding the best carrier for you based on your need. In essence they charge you for their time. But this is very rare.

The things that I would want to know in order to compare might be the following: Company Age, Domestic Address, NAIC Number, Financial Strength Rating from the four rating agencies for the past twenty years, dividend history for at least ten years, and of course the premium. I may want to know what their international exposure is, how their corporate hierarchy works, and are they involved in any non life insurance financial products. I would also want to know their consumer complaint history (often filed with the state insurance regulator, their consumer reports ranking, and other consumer ratings. On top of all this I would want to see the riders that are available, get a good understanding of their investment matrix, their underwriting criteria, and lastly the actual policies themselves.

Insurance Agents Miss-Selling the Product:

This real concern has pretty much already been reviewed in this post. Some insurance companies and agents probably bare some of the blame. Claims that whole life insurance is a suitable replacement for your Roth IRA and 401K are amongst the worst claims that some agents out there may make. The idea that you can save enough money for your eight year old's college education seems mathematically incorrect in my opinion. That seniors aged 73 are offered up Guaranteed Universal Life Insurance policies seems sort of ridiculous as well. This sub headline issue, I added to both the major sub categories here because it is both an agent/industry problem and an understanding issue.

A regulatory Concern:

It has always seemed odd to me that in order to sell a stock to someone you need to be registered as an adviser and pass several tests. Then you must be hired by a financial firm and obey extremely strict rules to sell stocks and mutual funds, etc. Most people in this field have multiple degrees and licenses. However to sell a life insurance policy as an investment you merely need to pass a state insurance exam? This does not make sense to me. Insurance agents need not pass any investment courses. I do not intentionally mean to put down my industry, but it is not hard to become an insurance agent, certainly when compared with a stock broker.

Why state regulatory bodies allow these types of products to be pitched as such, I cannot say.

Whole Life: Scam or Antiquated?

So is whole life insurance a scam? No - whole life insurance is not a scam. It is however, sadly, often, sold in scammy ways. Life insurance agents that sell permanent life insurance as the greatest financial tool that has ever been created are likely either dreaming, confused, or worse. But it is hard to see how the product qualifies as a scam.

Whole life is an antiquated product. Whole life was originally created several hundred years ago. In comparison many of the other more modern financial tools that we have discussed are less than 100 and even 50 years old. These products such as the 401K are much more modern.

Whole Life Insurance = Created About 1762

Municipal Bonds = Created 1812

Mutual Fund = Created about 1924

ESA = Created 1966

401K = Created 1978

ETF = Created 1993

529 Plan = Created 1996

Roth IRA = Created 1997

Roth 401K= Created 2006

The point of listing all of this is to demonstrate how old of a product whole life insurance is in comparison to other 'investment' options. Not that old is bad, but its not really modern. Even in the 1950s, it was probably a pretty solid place to put your money. However today there are so many more modern tools that the average american has. Certainly newer is not necessarily better, often older is better.

As the years have gone by, some of the individual uses of whole life insurance have been picked off by newer more modern tools. Perhaps whole life insurance was a great way to save for college up until the creation of the 529 in 1996. As I have previously said - How do you Beat Income Tax Free? Yes there are limitations for this, such as the money must be used for college, but isn't that what a college fund is for?

Perhaps given the high costs of investing in individual stocks made Whole Life Insurance a solid investment decision up until the 1920s when mutual funds came along. With lower and lower costing mutual and index funds though, this is largely no longer the case. That old advantage of whole life now seems gone.

Maybe its the safety of insurers that remains one of the few remaining areas where mutual insurers hold firm ground in comparison to individual investments. After all some life insurers did go out of business during the depression, but certainly not like the quantity of banks and certainly not the stock market losses did. "While there have been several notable failures of insurance companies during the depression, the only relatively large life company in difficulty is the $150,000,000 Illinois Life of Chicago..." During the great financial recession of 2008, AIG was one notable insurer who "sought the safety" of government hands. But again insurers seemed to have fared better than investment firms.

Answers to our Questions

Is Whole Life Insurance an Investment?

Its hard to rule whole life insurance as being an investment or not. Since it is so convoluted and mixed with a true insurance component, it is probably is best described as a pseudo investment. Can you make money in whole life insurance? Yes after being with in the same policy and faithfully making premium payments for decades. One reason that I fail to consider it as a true investment is the almost impossible task of calculating its returns. Here is a quick math problem: If you spend $5,000 per year on a permanent life policy and receive a 4% yearly dividend and you use those dividends to purchase more insurance, what will be the total death benefit of your policy after 20 years? The answer is - no consumer can know this. Only the insurance company and possibly the agent can estimate this for you.

Is Whole Life Insurance a Good Investment?

In comparison to historical market returns, on average whole life insurance is not a great investment. Whole life insurance contains many confusing, heavy, and sometimes hidden fees. The dividends are typically a lower rate of return then the market. A typical whole life contract may take ten plus years just to break even. In bad times, when the market crashes for ten plus years, its possible though that the returns of a cash value policy could then be viewed as a better return. However looking at it as a forty plus year holding period (it is after all a policy for your entire life), it is hard to value it as a better investment than a combination of qualified investment accounts. But this still does not make whole life a scam.

Which is better Whole or Term Life Insurance?

The debate between whole and term insurance probably will never end. Term insurance is more than likely the best form of insurance for most people. Permanent life is probably a better option for a small minority of consumers. Such as people that are super wealthy, need it for a specific business purpose, families that can not qualify for term, or families needing it for a special needs trust.

Is Whole Life Bad?

Whole life is not bad, it is just dated and antiquated. One hundred years ago, it was probably a great place to place your money. However as we have demonstrated it is not a modern product any more. At a certain point of wealth accumulation it probably makes good sense for a select few to consider this incredible product. But for people that are struggling to save up the maximum in their qualified (401K, Roth IRA) accounts - it is likely not a good choice.

What is Broken with Whole Life Insurance?

There are lots of things that are more or less broken with whole life insurance. Here are a few of the most important.

Is Whole Life Insurance a Rip Off?

Whole life is not a rip off, its just not a great use of your money. There are several category of people that can find great value from these policies, but it is not a great use of your money for the vast majority of people. What possibly could be a better use of your money than Roth IRAs, 529 accounts, and possibly HSAs?

The one exception is if a WL policy is purchased and cancelled in the first ten years. In these situations I can imagine why a consumer would consider it a rip off.

Is Whole Life Insurance a Scam?

Whole life insurance is not a scam. It is however sometimes the method that it is sold in makes it a scam. "If you don't buy permanent life you won't be able to be insured forever." "Whole life is a great way to save for retirement." "You can save for your children's college education with whole life." I would beware of any of these statements.

Questions - Please Ask.

If you have questions, please feel free to ask. Either send me a private contact via email or ask in the comments section.

Speak with an experienced advisor!

Speak with an experienced advisor!