Life Insurance is not really too important – WRONG

Avoid getting wrecked buying life insurance by learning these three key secrets.

The world of life insurance is needlessly complicated. But in a few quick minutes you can master the world of life insurance buying – read on and learn.

The First Secret of Life Insurance

Term Life Rules the Day.

Life Insurance is made doubly complicated by the fact that Insurance agents allow clients to become confused by attempting to sell you insurance products that are mixed with an investment component.

Typically clients either become so confused by the various options that they either Opt to Buy one of the overpriced life insurance policies or fail to do anything. Both of these scenarios are a complete failure from the insurance industries standpoint. Why would the life insurance industry want to turn away new potential clients?

They Don’t.

But the train left the station on this years ago and there is not really a way to stop it.

Why is Term Life Insurance so much better than all of the other options?

Generally speaking unless you are one of the few people that are exceedingly wealthy, need a special needs trust, or are setting up a lawyer created trust to avoid inheritance taxes – there are not many good reasons to purchase any form of life insurance other than Term Life. Unless of course you cannot qualify for level term life insurance.

The Basics of Life Insurance

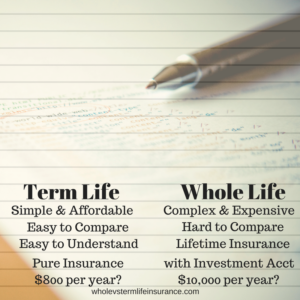

Term Life:

Simple, Affordable, Easy to Understand and Quick to Purchase Pure Insurance.

Whole Life Insurance

Complex, Expensive, Hard to compare Life Insurance with an Investment Component.

Whole Life, a form of a cash value life insurance is a good solid product, but the savings component tied to it, earns very little money compared with other best in class savings products. The claims that whole life insurance can act as a retirement or college savings account, although partially true, are mostly over exaggerated.

Term life which can succinctly be defined as “Pure Life Insurance” – contains no cash value. It is simple, straightforward, and rather easy to purchase. Often it can cost less than one tenth (1/10) of the cost of a competing whole life insurance policy.

Buyer beware! If you are truly interested in purchase whole or universal life insurance you best run the full set of numbers yourself without a pushy life insurance agent breathing down your neck.

The Second Secret of Life Insurance

The Financial Strength Rating of your Insurer is more important than you think.

The IFSR or Insurer Financial Strength Rating is a rating, down by a Credit Rating Agency that rates an insurers ability to pay back life insurance claims. Similar, yet different, to an Issuer Credit Ratings, an IFSR is based more on claims paying ability rather than ability to pay back loans.

These ratings though, are rarely discussed by agents.

Why is that?

Contact Us Today

The World of Life Insurance is Complex, Don’t Get Lost.

Why would useful consumer information not be openly discussed with customers? Honestly – I don’t really know. But in my entire life I have almost never heard a life insurance agent bring up the topic. Occasionally when shopping and comparing life insurance companies – I have heard insurance agents make passing references about “credit ratings” (although that is not the correct term.) But I have never heard a discussion of the subject.

Even the term “credit rating” is not fully accurate. Although issued by Credit Rating Agencies, a credit rating is not the best thing to look for. Credit ratings, technically are not based on claims paying ability.

Why would you care if your insurer can pay back a long term loan to a bank? Well, perhaps there is some deep financial reason that you care. But the main thing you care about is there ability to pay your family if you should, god forbid – perish. The proper term is a Financial Strength Rating. Sometimes confusingly also referred to as a Insurer Financial Strength Rating.

Part of the confusion and lack of clarity on the subject, may be because of the Credit Rating Agencies themselves who seem to be relatively guarded about the methods they utilize to calculate Financial Strength Ratings. A deep search on google returns very little actual real information on the subject.

The Third Secret of Life Insurance

Pretty Much Any Life Insurance Product is Better than No Life Insurance.

Although I rarely find whole or universal life to be a good deal for clients, usually even an overpriced cash value life insurance plan is better than none. At least while they shop for term life. Corporate Group Life – Yes that it is certainly better than no life insurance. Return of Price Term Life – yep – that is better than none also. The point is, that fretting about which type of life insurance can take a toll on your situation.

Being that most american families need some form of life insurance, you would think that this would be the general marketing message of life insurers. Sadly I find it is not.

Many clients become obsessed with calculating the ideal coverage amounts and term lengths. And although I find this geekie-ness to be cool, It is often better to just pick a simplified term life product for now. What difference will it make if you are under insured by 25% – really? Sure its better to have an optimized plan – but generally speaking you can always buy more life insurance.

Just get something in place for now.

The world of life insurance is complex, find a guide

The Decision of which type of life insurance is hard. Both Whole and Term Life Insurance have their best uses. Learn how to assess for yourself if you are a better candidate for Whole or Term. If you find yourself wanting whole life, Run the Numbers for yourself.

Term Life: Simple, Affordable, and Easy to Understand. Inexpensive Term life insurance is available in bands of time. After that period of time, your insurance needs should be over and you will likely not need insurance with the extra money saved.

Whole Life: A Cash Value Life Insurance policy is one that has an “investment” side component that will build up a small accumulation after a decade or so. Whole life is complex and requires a lot of investigation. Whole Life Insurance is typically the first life insurance pitched to you by many insurance agents.

Speak with an experienced advisor!

Speak with an experienced advisor!