Sample Rates for a 43 year old woman.

What Type of Insurance to buy.

What type of Insurance you can't afford to buy.

Which Rating Class to Avoid.

Sample Life Insurance Rates for a forty three year old woman. Sourcing and procuring life insurance is a complex process, but it does not need to be complicated.

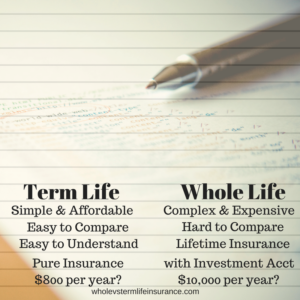

If you are 43 years old and considering buying life insurance, many agents will propose a form of cash value life insurance known as Whole Life Insurance. Whole life is complicated and your potential insurance agent may have trouble fully explaining it to you. Needless to say, for most Americans, Whole Life might not be a smart choice.

Consider your options before being pushed into Whole life. The purpose of Whole Vs Term is to assist consumers in making intelligent decisions concerning life insurance. A better alternative to whole live insurance is probably Term Life Insurance.

The Basics of Life Insurance

Term Life:

Simple, Affordable, Easy to Understand and Quick to Purchase Pure Insurance.

Whole Life Insurance

Complex, Expensive, Hard to compare Life Insurance with an Investment Component.

Why Term Life for a 43 Year Old Woman?

Term life insurance is pure insurance. It contain no cash value. It contains no mysterious charges or fees. Term life is the form of life insurance that most often is suggested by the National Radio personalities such as Suze Orman and Clark Howard. A level term life insurance policy is simple, inexpensive, and affordable.

Term Life Lengths:

Level Term Life Insurance is sold in bands of time. This period of time will guarantee your coverage and cost for that time. You should choose a length of time that suits your lifestyle and your families needs.

Deciding what length of time to cover you and your family could be very important to your families future.

10 Year Term

15 Year Term

20 Year Term

25 Year Term

30 Year Term

Sample 43 Year Old Female Non Smoker Rates:

Generally speaking their are four life insurance rating classes. Depending on a variety of rating factors you will be categorized into one of these four classes. The better your rating class, the lower your life insurance rate. Therefore its important to speak with someone that can help you assess your life insurance rating class.

The Four Rating Classes

Super Preferred Non Smoker

Preferred Non Smoker

Standard Plus Non Smoker

Standard Non Smoker

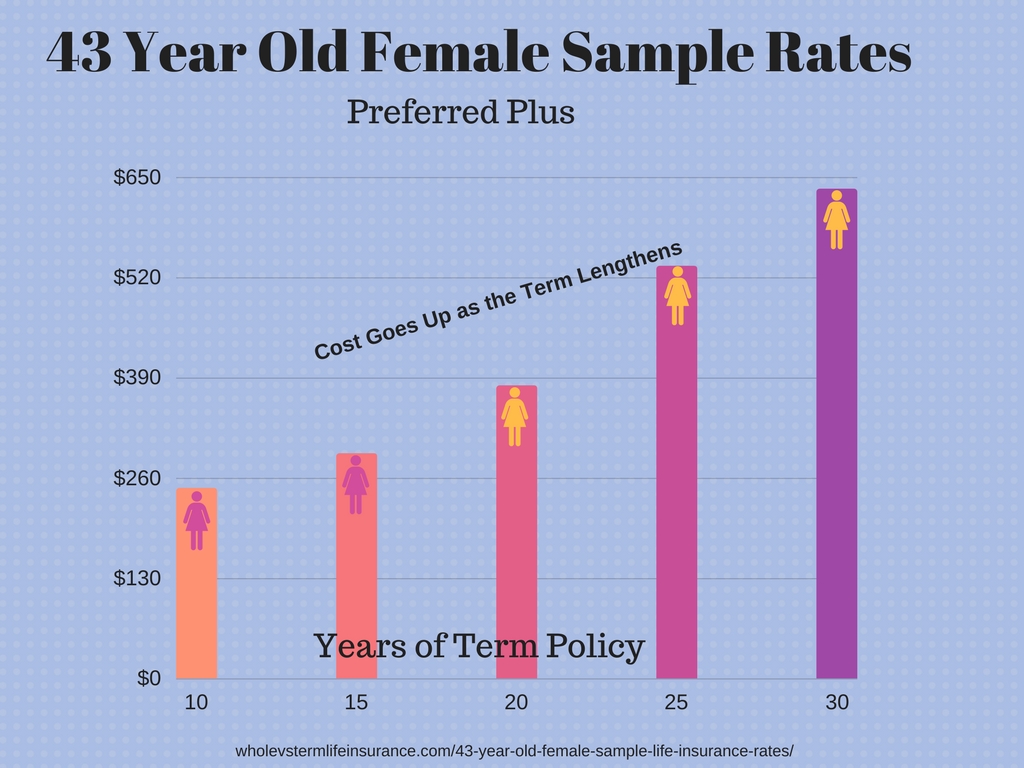

Sample 43 Year Old Female Life Insurance Rates – Preferred Plus:

| Female California Rates, $500K in Coverage | |

| Preferred Plus Non Smoker | Rate |

| 10 Year Term | $ 247.00 |

| 15 Year Term | $ 292.00 |

| 20 Year Term | $ 380.00 |

| 25 Year Term | $ 535.00 |

| 30 Year Term | $ 635.00 |

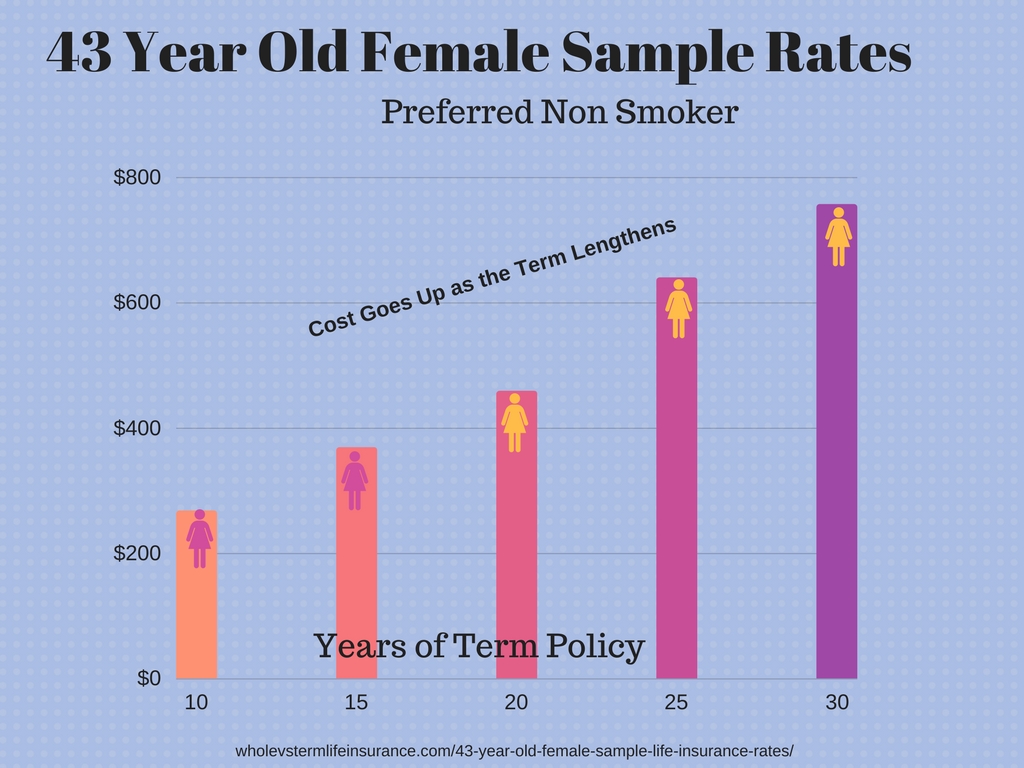

Sample 43 Year Old Female Life Insurance Rates – Preferred:

| Female California Rates, $500K in Coverage | |

| Preferred Non Smoker | Rate |

| 10 Year Term | $ 268.00 |

| 15 Year Term | $ 369.00 |

| 20 Year Term | $ 459.00 |

| 25 Year Term | $ 640.00 |

| 30 Year Term | $ 757.00 |

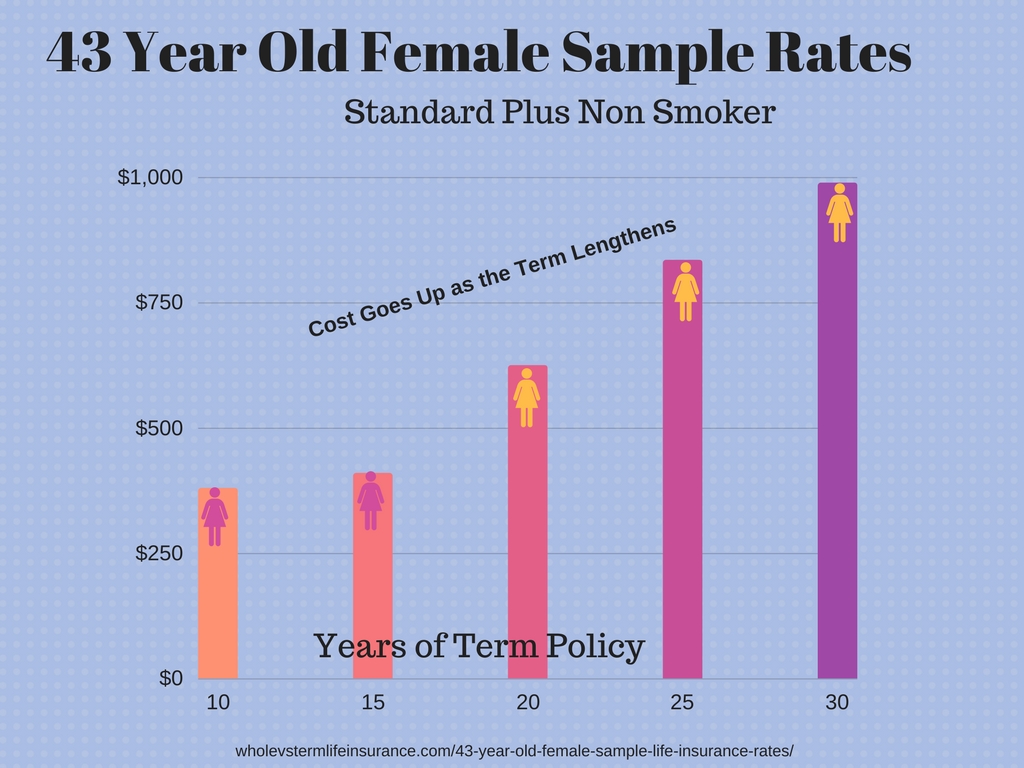

| Female California Rates, $500K in Coverage | |

| Standard Plus Non Smoker | Rate |

| 10 Year Term | $ 380.00 |

| 15 Year Term | $ 410.00 |

| 20 Year Term | $ 625.00 |

| 25 Year Term | $ 835.00 |

| 30 Year Term | $ 989.00 |

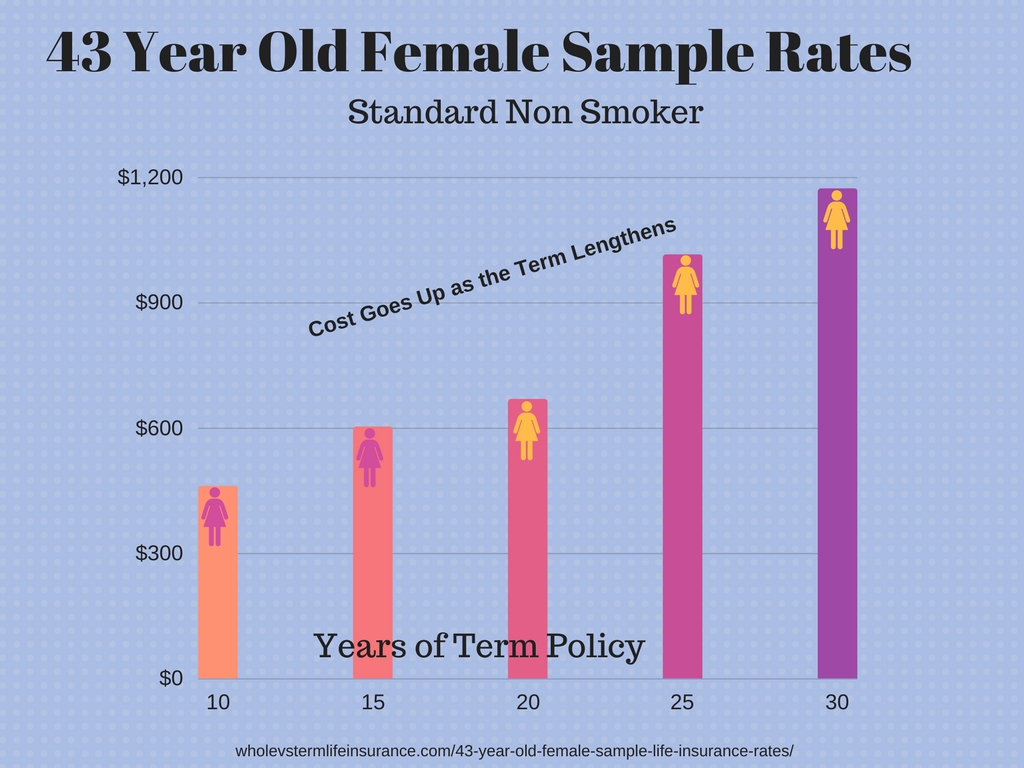

| Female California Rates, $500K in Coverage | |

| Standard Non Smoker | Rate |

| 10 Year Term | $ 461.00 |

| 15 Year Term | $ 603.00 |

| 20 Year Term | $ 669.00 |

| 25 Year Term | $ 1,015.00 |

| 30 Year Term | $ 1,173.00 |

Now What?

Don't just stop here after reviewing the pricing options. Apply now and put your stress behind you while you get the process started.

The life insurance process when fully underwritten can take 4 to 6 weeks. You may even be able to get temporary insurance while the underwriting is happening.

What is the Life Insurance process for a 43 Year Old Woman?

I Won't Sell You an Overpriced Insurance Product that You Neither Need Nor Want

Step 1: Research Quotes Online

Step 2: Review your Medical, Driving, Work Histories with an Agent.

Step 3: Complete Full Quote Online, by Phone, or Email.

Step 4: Complete a Life Insurance Application.

Step 5: Complete a Paramed Visit at your Home or Office.

Step 6: Sign Application

Step 7: Wait for an Offer of Insurance

Step 8: Pay for and Sign Term Life Insurance Offer.

What Rating Class to Avoid:

First off, the number one thing you should try and avoid whenever procuring any type of life insurance is getting declined from life insurance. As in a, "No Thank You but we will not be offering you a life insurance policy."

The second thing that you want to avoid if you can is what is known as Table Ratings. You may need to be table rated if your insurance case truly justifies it. However sometimes if you work with the correct insurance agent you may be able to avoid this.

Why do you want to avoid table rating? Because it will cost you more money.

About Whole Vs Term Life in the Press:

Articles Written in the National Press

Why Stay at Home Parents Should Buy Life Insurance

"When it comes to life insurance, it’s really important that stay-at-home spouses are not left out....Many people incorrectly assume that these non-employed or lower-earning spouses don’t need life insurance."

By Scott W Johnson

Auto Insurance Often for the Rich Often Covers and Costs More

"As you can imagine, policies for wealthy individuals, with higher limits and other perks, cost more.."

By Scott W Johnson

Stuck in your Companies Group Life Plan - Consider Your Options

"Covered by a group Term Life policy through your employer? Congratulations - not many people are. Take what you can get, but be careful depending on that form of life insurance as your only life insurance policy."

Speak with an experienced advisor!

Speak with an experienced advisor!