Genetic testing is a new health technology that has the potential to upend the Life Insurance Industry. Using either physician prescribed genetic tests or consumer requested tests may assist potential insurance companies to rate potential insureds far more efficiently. However the privacy, legal, and moral concerns are far more complex than the typical medical underwriting process, known as life insurance underwriting. Current insurance laws seem tremendously inadequate as of April 2019.

What you need to know about the Life Insurance process and Genetic Tests.

According to Best Review: "A federal law passed in 2008 prevents health insurers from seeking the results of genetic testing. However, life, disability, critical illness and long term insurers are not bound by the Genetic information Nondiscrimination Act (GINA)."(*) Therefore according to this statement it appears that genetic results can be used in the life insurance process."

This article is extremely important for it is written by an exceptionally well regarded Credit Rating Agency: AM Best. Its' opinions on the matter though, are by no means the final say. The Media loves headlines about Genetic Testing and its use with Life Insurance applications. In many regards it is both Orwellian and Creepy. However when you fully understand the actual life insurance process, some of it is just a natural extension of that process, while other potential uses of genetic results are probably of questionable legality.

This article about Genetic Testing and Life Insurance is a quickly evolving field and is not finished. It is an ongoing work that may take years. Please check back when more information becomes available.

Genetic Testing and Life Insurance Underwriting, an Evolving Field:

Genetics is the science of our our heredity and our genes. Life Insurance underwriting is the process whereby insurers determine and price risk. An open question remains - What information are life insurers allowed to legally, ethically, and morally use? Will it's use make economic sense? What are the safeguards? Who determines all of this in a landscape of almost one hundred governmental governing associations within the United States?

The Current State of Genetic Testing with Life Insurance:

The current state of using genetic testing for the purposes of life insurance seems unclear and quite murky. Although numerous articles and reports claim that insurers (Long Term Care and/or Life Insurance) can use genetic information: "In general, long-term-care insurers can indeed use genetic test results when they decide whether to offer you coverage." Source NPR. Many of these articles seem to miss some important considerations. These include if a test was (1) ordered by a physician and (2) which state the insured lives in. In addition (3) just because an insurer CAN use something, it might not mean they will.

In general - the situation is changing. If you have had genetic tests done in the past, its possible that they could be involved in the medical underwriting. But just because a genetic test was completed - does not mean that an underwriter can and will look at them.

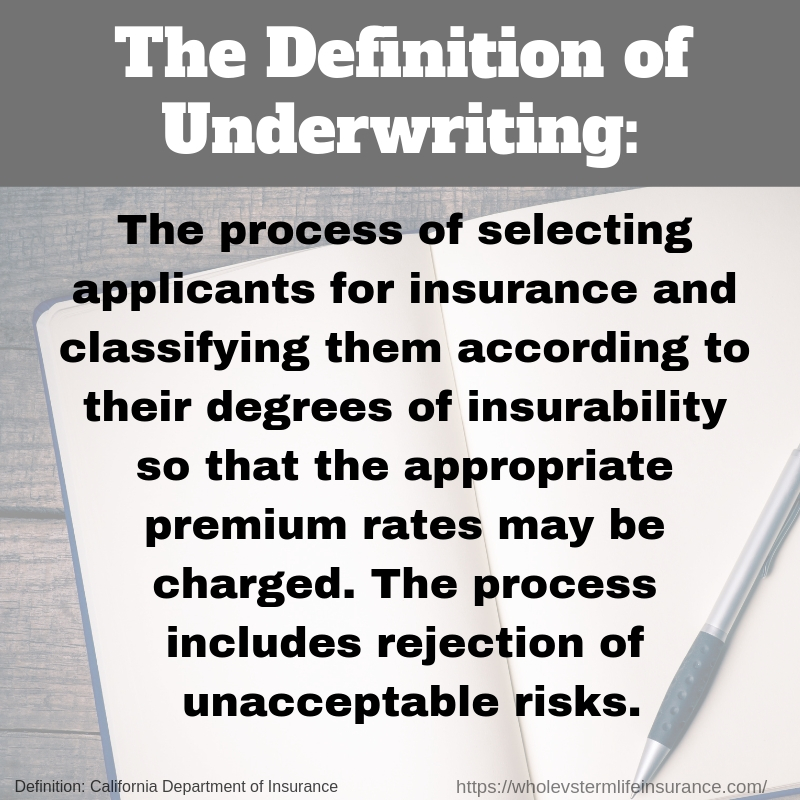

What is Life Insurance Underwriting:

Life insurance underwriting is the process of assessing risk and ensuring that a given premium is appropriate to a proposed life insurance policy. Most common: term, universal, and whole life insurance policies have a period of time after the initial application is received whereby the consumer is tested and various reports are reviewed by the insurer. This period of time is known as the underwriting period.

It should be noted that some insurers are now offering an abbreviated Accelerated Underwriting Policy period whereby contracts can be issued in weeks, days, and even hours. But even these policies go through their own version of underwriting.

Therefore Genetic Testing is of particular interest for those applying for life insurance. Can genetic tests be used to decline, rerate, or otherwise determine pricing or acceptance for a life insurance product?

What is Genetics?

According to Encyclopedia Britannica, Genetics is "the study of heredity in general and of genes in particular." The article further explains that "Genetics arose out of the identification of genes, the fundamental units responsible for heredity." It "may be defined as the study of genes at all levels, including the ways in which they act in the cell and the ways in which they are transmitted from parents to offspring." The study and understanding of genetics today is significantly different than what our ancestors thought of. "Modern genetics focuses on the chemical substance that genes are made of, called deoxyribonucleic acid, or DNA" Modern genetics is based off the work of Gregory Mendel.

Mendel was a Friar and Scientist who initiated what we consider to be the beginnings of modern genetic work in the 1850s and 1860s. He studies pea plans and simply put, discovered what he called “recessive” and “dominant” traits.

Modern Genetics picked up from their with the discovery of linked genes in the early 1900s. In 1953 an American Scientist James Watson and British Scientists Maurice Wilkins and Francis Crick created what is known as the Double Helix model. "This model showed that DNA was capable of self-replication by separating its complementary strands and using them as templates for the synthesis of new DNA molecules. Each of the intertwined strands of DNA was proposed to be a chain of chemical groups called nucleotides, of which there were known to be four types."

The NIH (National Institute of Health) says that: "Segments of DNA called "genes" are the ingredients. Each gene adds a specific protein to the recipe." Therefore genes are our building blocks or blueprints. "Most of our cells contain 46 chromosomes....Two of these 46 chromosomes determine the sex of a person." But genes determine so much more than just the sex of a child. Genes determine eye color, height, and so many other factors of our lives. It is also argued that genes can indicate some future illness.

Breast Cancer is a terrific example of where certain genes may increase your risk of developing the disease. Both the BRCA1 and BRCA2 genes are thought to be a potential cause of hereditary breast cancer when certain mutations are present. Although "most cases of breast cancer are not caused by inherited genetic factors" - " It is important to note that people inherit an increased likelihood of developing cancer, not the disease itself." Therefore "Not all people who inherit mutations in these genes will ultimately develop cancer." Source: NIH.

What is Genetic Testing?

Genetic testing could easily be defined as testing your genes. A better definition is from the Mayo clinic It "involves examining your DNA, the chemical database that carries instructions for your body's functions. Genetic testing can reveal changes (mutations) in your genes that may cause illness or disease."

Hence this is why this could be such a big deal in the world of life insurance. Genetic testing may reveal "genes that may cause illness or disease" as we discussed about Breast Cancer and the BRCA1 and 2 genes.

According to that same Mayo article genetic testing is often done for one of about seven different reason/methods:

- Diagnostic testing: " If you have symptoms of a disease that may be caused by genetic changes, sometimes called mutated genes, genetic testing can reveal if you have the suspected disorder. "

- Presymptomatic and predictive testing: A set of tests "a genetic condition" often if "If you have a family history."

- Carrier testing: "An expanded carrier screening test can detect genes associated with a wide variety of genetic diseases and mutations and can identify if you and your partner are carriers for the same conditions"

- Pharmacogenetics: "this type of genetic testing may help determine what medication and dosage will be most effective and beneficial for you."

- Prenatal testing: A test that"can detect some types of abnormalities in your baby's genes."

- Newborn screening: "all states require that newborns be tested for certain genetic and metabolic abnormalities that cause specific conditions."

- Preimplantation testing: "this test may be used when you attempt to conceive a child through in vitro fertilization. "

There are now all sorts of places for consumers and physicians to order genetic tests. Consumers can order them (themselves) online or potentially get them in conjunction with their doctor.

What is Genetic Discrimination?

Genetic discrimination "occurs when people are treated differently by their employer or insurance company because they have a gene mutation that causes or increases the risk of an inherited disorder." Source.

In the regular world the word discrimination is almost always considered a negative connotation. In the world of insurance - discrimination is used all the time. Not with your race, creed, or color, but with all sorts of other factors.

Insurance companies are legally allowed in certain situations to discriminate against someone that has lots of auto accidents, as an example. If you have had 5 accidents in the past two years, many auto insurers will not offer you a new policy. In life insurance insurers are allowed to discriminate between men and women. In general it has been shown the women, on average, live longer than men, and hence are allowed to pay less for life insurance. Discrimination in insurance is legal in certain circumstances in the United States. In Europe "gender cannot be a risk factor in determining an insurance premium", as of March 2011. Source.

According to Ronen Avraham, Kyle Logue, and Daniel Schwarcz: "Insurance companies are in the business of discrimination. Insurers attempt to segregate insureds into separate risk pools based on their differences in risk profiles, first, so that they can charge different premiums to the different groups based on their risk and, second, to incentivize risk reduction by insureds. This is why we let insurers discriminate. There are, however, limits to the types of discrimination we will allow insurers to engage in."

They continue to the central point of this very article: "But what exactly are those limits and how are they justified?"

The Regulatory Environment with Life Insurance, regarding Genomics:

Genetic discrimination may (or may not) be legal.The regulatory environment of this situation needs to be addressed. In general the federal government together with states regulates insurance, typically with the individual states taking the lead. Heath insurance is one type of insurance that we have recently seem an increased attention to what we might call federalization of its regulation, with the US government taking on more of the regulation. And at the same time, health insurance protections. Auto, Property, Commercial, and Life Insurance much less so. This has, in general, been left up to the individual states and territories.

There are numerous current limitations from varying levels of laws and government organizations that prevent various types of insurers from using genetic material, but there does not seem to be one unifying law. According to Mark Rothstein and Carlton Hornung: "the Health Insurance Portability and Accountability Act of 1996 (HIPAA) prohibits employer-sponsored group health plans from excluding from coverage, charging higher rates, or offering different benefits to members of a group based on their genotype."*** However notice the word "health insurance" and not the word life insurance. This also, sadly seems to be the case the GINA statute.

According to Tim Lendino: "Making matters more complicated for insurers, almost half of the states have enacted laws regulating how insurers either request genetic tests or ask for genetic information during the underwriting process"

What is GINA?

GINA** or "The Genetic Information Nondiscrimination Act of 2008 (P.L. 110-233, 122 Stat. 881)1... is a new Federal law that prohibits discrimination in health coverage and employment based on genetic information." The law was "signed ...on May 21, 2008."

GINA coordinates with various state laws: "GINA provides a baseline level of protection against genetic discrimination for all Americans. Many states already have laws that protect against genetic discrimination in health insurance and employment situations. However, the degree of protection they provide varies widely, and while most provisions are less protective than GINA, some are more protective."

GINA falls under the Department of Health and Human Services and seems to be specific to "Researchers and Health Care Professionals." Does this exclude life insurers? It seems unclear, in my opinion.

This information comes from a document titled: '"GINA" The Genetic Information Nondiscrimination Act of 2008 Information for Researchers and Health Care Professionals' published by HHS.

How Can Genetic Tests Be Used in Life Insurance Underwriting?

Here we discuss a few of the potential ways in which life insurance underwriting might use genetic testing. Added to this are some opinions.

Review EXISTING Genetic Testing During Underwriter Review?

During most life insurance processes, a physician's report is requested by the life insurer while requesting all medical information. The consumer signs documents allowing the insurer to do this. During the course of the medical underwriting review, the proposed life insurer may see the results of a previous physician's requested genetic test. Is this a legitimate use of using genetic testing for life insurance underwriting? As long as the underwriters are only using the portion of the genetic tests that pertain to the specific order and as long as the underwriters stick with science that has been backed, it seems pretty clear that this is probably perfectly legal and acceptable. It is really not that much different than any other tests the doctor as ordered.

According to Fast Company: "Jennifer Marie's" application for life insurance from an 'anonymous' life insurer was " denied" because of [her] positive BRCA 1 gene." Therefore according to this article, this has indeed happened before.

But what happens if the underwriters review a portion of the genetic test that was not requested for medical purposes or if they rely on 'unclear' science to deny a future policy? [As in they either looked at other genes or found genes that they thought may mean something but there is no medical evidence to this.] This very well seems that it might be pushing the ethics and potentially the law. That of course is an opinion.

Review a non Physician Ordered Genetic test?

Can a life insurance company require you to provide genetic tests that you yourself requested? Such as those from 23 and Me. Potentially, maybe. The legal ground here seems very unclear, in my opinion.

The good news is that according to Jason P. Veirs, in an article published on Huff Post, "most providers don’t specifically ask about genetic testing (yet) [article from 2018] nor can they require you to get genetic testing done." He continues: " However, if you have taken a genetic test and the insurance company asks for it, you technically need to disclose that information."

And there is the rub. If you previously had one of these self tests and the life insurers asks for it, failing to provide the information or lying about its existence could lead to all sorts of issues and future complications. Would misrepresenting the facts about the existence of a 23 and Me genetic test be cause for a denial of your life insurance application? Even worse, a cancellation of that policy, even after the two year incontestability period? This situation seems to be lacking in case law. Therefore in summation it is just such a new technology shift that life insurance regulators are lagging.

Request Genetic Testing for a Underwriting Review?

Can an life insurer request that you complete a genetic test for you to get life insurance? A test that was not ordered by your doctor? A test that you yourself did not necessarily want? Currently I am not aware of this happening. Is it legal, ethical, and / or moral? I cannot say.

The Future of Genetic Testing and Underwriting for Life Insurance:

The First chapter (clearly not the final) of this story, is still being written. The enactment of the GINA statute seems to be a solid starting place - however given that it does not appear to regulate life insurers - it may do little good. Future rules and regulations issued by possibly the federal government and definitely the states may assist in these regards. Bloomberg Law states it best: "What we’ve seen in all spaces is that law always lags behind the technology...The laws don’t protect the privacy of genetic information in all cases."

Therefore it might make sense to wait to order that genetic test yourself. But always always always be honest and upfront with life insurance applications. If a life insurance underwriter asks for you a genetic test and you do not want to share it, you may want to walk away and look for a new future insurer.

What to do If you Want to Take Action about Genetic Testing Results and Life Insurance:

Inevitably, someone will ask me this question. How do we/ I get life insurers to NOT be allowed to review genetic testing results for those applying for life insurance? The simple answer is that... it's probably not that simple. There are very few national insurance laws as the individuals states (and territories) regulate their own insurance rules. One might start off by contacting their congressmen.

A second, less well known step might be to contact your state insurance regulator. The National Association of Insurance Commissioners has a nifty map that provides many of these names. You might also, at the same time familiarize yourself with any specific state laws that 'may' pertain in your situation and in your state. [This article did not really address those.]

A final idea might to be to socialize this compelling issue. As an example you may consider sharing this article online or via email with the headline: "Did you you know that that a '23 and me' genetic test could cost you your future life insurance policy?"

Footnotes for Genetic Testing and Life Insurance:

*AM Best - Best Review Volume 120, Issue 1, January 2019: The Time is Now.

**GINA - The Genetic Information Nondiscrimination Act of 2008 (P.L. 110-233, 122 Stat. 881)

*** - Genetics and Life Insurance, by Mark Rothstein and Carlton Hornung.

This article contains opinions about life insurance and life insurance underwriting. The legality of this topic is still being determined. Certainly things will change and our opinions clearly could be incorrect.

Speak with an experienced advisor!

Speak with an experienced advisor!