The Incontestability Clause:

The incontestability clause is a key and important term in the world of life insurance. Whole, Universal, and Term Life Insurance. The concept is rather unique as it relates to all other types of contracts and even other types of insurances. Understanding just this one clause could really help to protect you.

Incontestability Clause Definition:

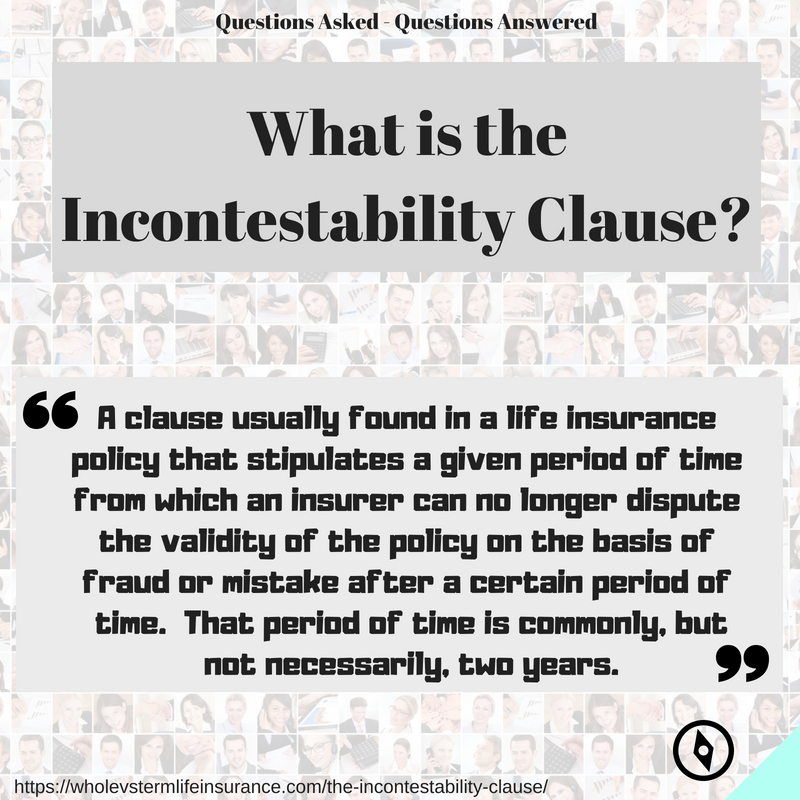

According to US Legal - the definition of the incontestability clause is: "a provision of an insurance-policy that prevents the insurer, from disputing the policy's validity on the basis of fraud or mistake after a specified period." That specified period is completely dependent on the Insurer and Policy Form. Often is may be about two years, although this is not universally true. The definition continues: "Most of the states in the U.S require life insurance policies to contain a clause making the policy incontestable after it has been in effect for a specified period, unless the insured does not pay premiums or violates policy conditions relating to military service. Some states require these clauses to be included in accident and sickness policies also."

According to IRMI - it is "A clause in a life or health insurance policy that stipulates a given length of time (usually 2 years) during which the insurer may contest claims. After expiration of this time, claims cannot be contested for any reason other than nonpayment of premium."

According to Investopedia: it is "a clause in most life insurance policies that prevents the provider from voiding coverage due to a misstatement by the insured after a specific amount of time has passed. A typical incontestability clause specifies that a contract will not be voidable after two or three years due to a misstatement." Also: "Some states also allow the insurance company to void a policy if deliberate fraud is proven."

The exact time frame should be referenced in your own insurance policy or insurance proposal and should be clearly stated. As you can see all three of these definitions fall along similar lines.

"A clause" commonly found in a life insurance policy "that stipulates" a given period of time from which an insurer can no longer dispute the validity of the policy "on the basis of fraud or mistake" after a certain period of time. That period of time is commonly, but not necessarily, two years.

These are four different versions of the life insurance incontestability clause definition. You will note the different degrees to which the term 'Fraud' is used. That is because there is not universality, amongst the various 50 states, concerning Fraud when applied to the incontestable clause. In other words fraud to some extent depends on the state in which the life insurance policy is issued in and specific case law.

About the Incontestability Clause:

Now that we have reviewed what this term means, lets discuss its impact. You will note that some of the definitions above use the term "misstatement" and not the word "fraud." The discussion of misstatements vs fraud is a key area that needs discussion.

Here we must discuss a definition of fraud. This one is from National Association of Insurance Commissioners: "Insurance fraud occurs when an insurance company, agent, adjuster or consumer commits a deliberate deception in order to obtain an illegitimate gain. It can occur during the process of buying, using, selling or underwriting insurance." More specific to our situation concerning completing a life insurance application is "knowingly omitting or providing false information on an application" is an "example of insurance fraud."

Misstatements vs Fraud

In other words if you willingly commit fraud, your life insurance policy may be completely or partially void depending on which state you are in. Misstatements generally refer to casual and unintentional errors made during the life insurance process. Fraud is more concerned with the intention to deceive the insurer. If you are attempting to get a life insurance policy by lying - this is certainly fraud.

A good example of fraud is if a client has another individual complete his paramed exam for him because he fears that he will not 'pass' the exam. Since this scheme is done with the intent to deceive the insurer and purchase life insurance that he may not qualify for it is a clear example of fraud.

A good example of a misstatement is when a client miss-remembers the year when they had their tonsils removed. There probably is no reason to miss-remember such a date and its unclear what the benefit from lying about it would be. Since the misstatement was unintentional and was not intended to deceive the insurer this life insurance policy likely would be protected by this Clause.

The incontestability clause does NOT give you license to commit fraud. Various states have differing regulations with regards to some of the finer points here, however - it is NEVER In your best interest to commit fraud on any insurance application.

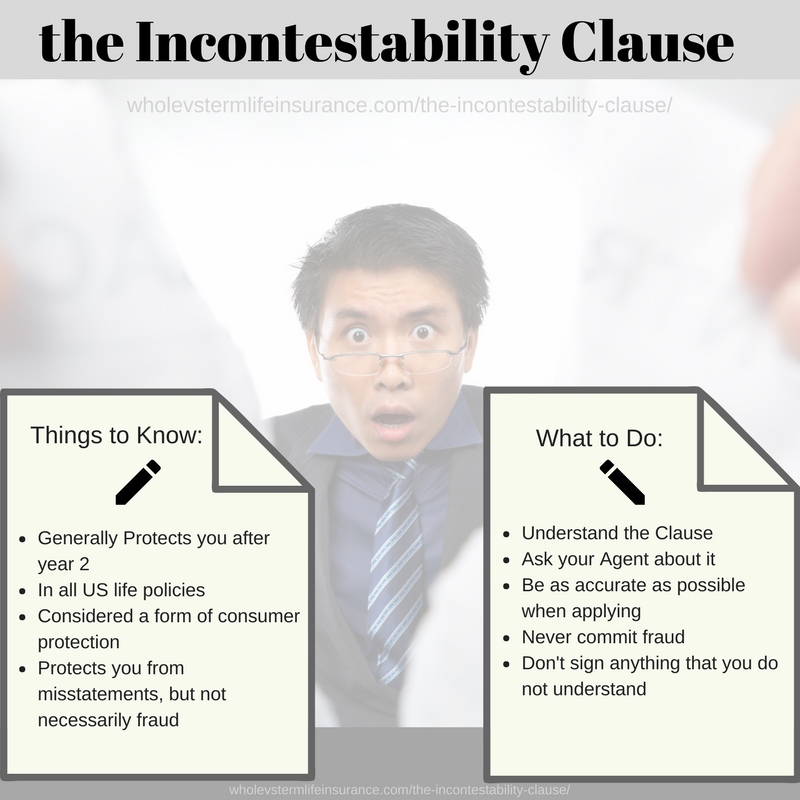

Incontestability clauses are really a great and useful provision of modern life insurance policies. Consumers should be happy they exist.

Misstatements = Generally Covered by Incontestability Clause

Fraud = State Specific under the Incontestability Clause

The Incontestability Clause can also go by the following other names/terms: the Incontestable Clause and the noncontestability clause or uncontestable clause.

How to Protect Yourself with

the Incontestability Clause:

The incontestable clause is really best classified as a consumer protection within most american life insurance products. The common provision protects you after year two or three from a casual error that was made on the original insurance application. The clause probably will not protect you if you commit outright fraud.

Some general recommendations: is to first understand the this clause and confirm with your insurance agent that it exists in your policy. That being said, I do believe it is now currently required in all insurance policies. Second- do attempt to be as accurate and correct as possible with your insurance application, making note of any errors that come through. Don't sign incorrect documents nor anything that you do not understand.

Thanks for Reading

Thanks for reading our piece. Should you have any specific questions regarding your life insurance policy, its best to speak with your insurance agent and / or insurance company. Kindly please consult your insurance policy language for more details.

For general questions, please feel free to contact us directly:

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!