The person who receives financial protection from a

life insurance plan is called a Beneficiary.

Welcome to our simple beneficiary guide. Please feel free to reference our material in your quest in finding just the right life insurance plan.

Beneficiaries - A Simple Guide

Beneficiary - the person who receives financial protection from a life insurance plan is called this. The other parties to a life insurance contract are the policy owner and the insured. Often the policy owner and the insured ARE THE SAME PERSON. Together with the insurer, the beneficiary, the policy owner, and the insured constitute all the major parties to an insurance contract.

Of all the parties the beneficiary is usually the only one that is easily changeable. Many consumers agonize during the life insurance process about who to name as their beneficiary of their new life insurance policy. Assuming that you are not choosing a irrevocable designation of the beneficiary, changing the beneficiary at a later time is usually very simple.

The most important lesson in setting up life insurance beneficiaries is to choose the simplest format, unless you have some sort of legal reason to do otherwise. In those situations often you would receive consul from an attorney.

Parties to a Life Insurance Contract:

Beneficiary - the person who receives financial protection from a life insurance plan.

The person who receives financial protection from a life insurance plan is called a Beneficiary

A general definition of beneficiary from Merriam-Webster is: "the person named (as in an insurance policy) to receive proceeds or benefits." The beneficiary is usually selected at the time of the policy inception by the owner of the contract. There are several key considerations when choosing beneficiaries: 'Whom is the Beneficiary', 'Can the Beneficiaries be Changed', and 'Does Changing the Beneficiary Require the Beneficiaries Authorization'.

The Other considerations are the exact order of payout and very specific rules that take place if one of the beneficiaries is no longer alive.

Types of Beneficiaries for Life Insurance:

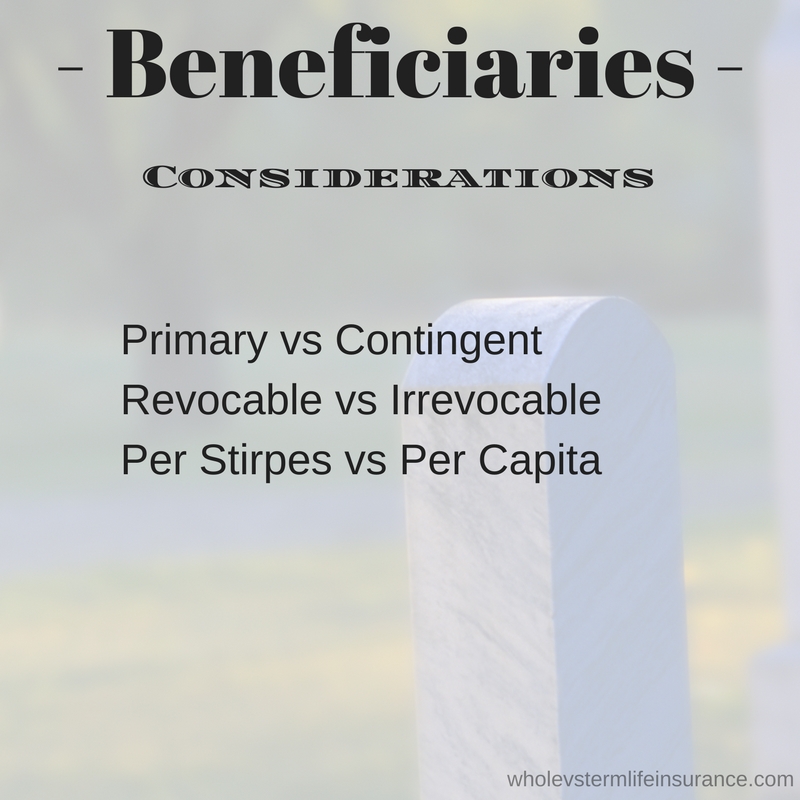

There are three separate ways of categorizing life insurance beneficiaries. They are broken out into categorizations of Order (1) and categorizations of Changeability (2) and categorizations of Strict Legal Types (3).

1. Beneficiary Order

2. Beneficiary Changeability

3. Beneficiary Legal Type

Lets start off with the simpler concept here, Beneficiary Order.

Order - Primary and Contingent:

As the name would imply - Order of Beneficiaries designates the strict line of receipt of benefits. This could also be called Beneficiary Level.

Primary Beneficiary:

The primary beneficiary is the primary person that will receive the death benefit upon death of the insured. The primary beneficiary can be one or multiple people. There are a few ways to split up the benefits. The primary beneficiaries will be the first people to receive a payout. If the primary beneficiaries die before the insured dies, and the contract is not changed, then the contingent or secondary beneficiaries will receive the payout.

Contingent Beneficiary:

The secondary beneficiary will receive the death benefit if the primary beneficiaries are not alive. They have zero rights to receive the benefit if the primary beneficiary are still around. Contingent beneficiaries are extremely important because time happens and things change.

Changeability-Revocable vs Irrevocable Beneficiaries:

When you set up your life insurance policy you have the ability to set up the policy whereas it is either easier or more difficult to change the beneficiaries.

Revocable BENEFICIARY:

A revocable beneficiary designation allows the owner of the policy to change any selected beneficiary at will. It requires no consent from the current beneficiary. This is by far the more common and simpler method.

IrREVOCABLE BENEFICIARY:

An irrevocable beneficiary designation only allows the owner of the policy to change the selected beneficiary with the current beneficiary's consent. This is a much rarer and exceedingly more complicated selection choice.

Strict Legal Types - Naming Multiple Beneficiaries:

Yes policy owners can name multiple beneficiaries at the same level. Typically by percentage allowance. Doing this gets complicated. However it is obviously the correct thing to do when naming multiple children. A problem arises if a named beneficiary of a multiple beneficiary model is selected when one of them is no longer alive. What happens to one of the children's portion of the payout? Is it adsorbed by the rest of the surviving children or does it get passed down to the deceased child's children (the grandchildren?)

Per Stirpes Vs Per Capita inheritance with Life Insurance:

When you elect multiple beneficiaries you will need to make a few more decisions. One of those decisions is the exact legal inheritance estate distribution form. These terms are not unique to life insurance as they are also used through estate courts and probate.

Per Stirpes: The definition from National Law Forms: "Per Stirpes means that the Grantor intends that the Beneficiary's share of the inheritance will go to his or her heir. "

Per Capita: The definition from National Law Forms: "Per Capita indicates that the Grantor intends that NO ONE except the named beneficiary receive that share of the estate."

A more practical explanation is that Per Capita divides the payout with the surviving members only, while Per Stirpes divides the payout by the branches of the family. With Per Stirpes if one member of the family has died, but had children (or grandchildren from the deceased) then those grandchildren would be eligible for the payout.

The person who receives financial protection from a

life insurance plan is called a Beneficiary.

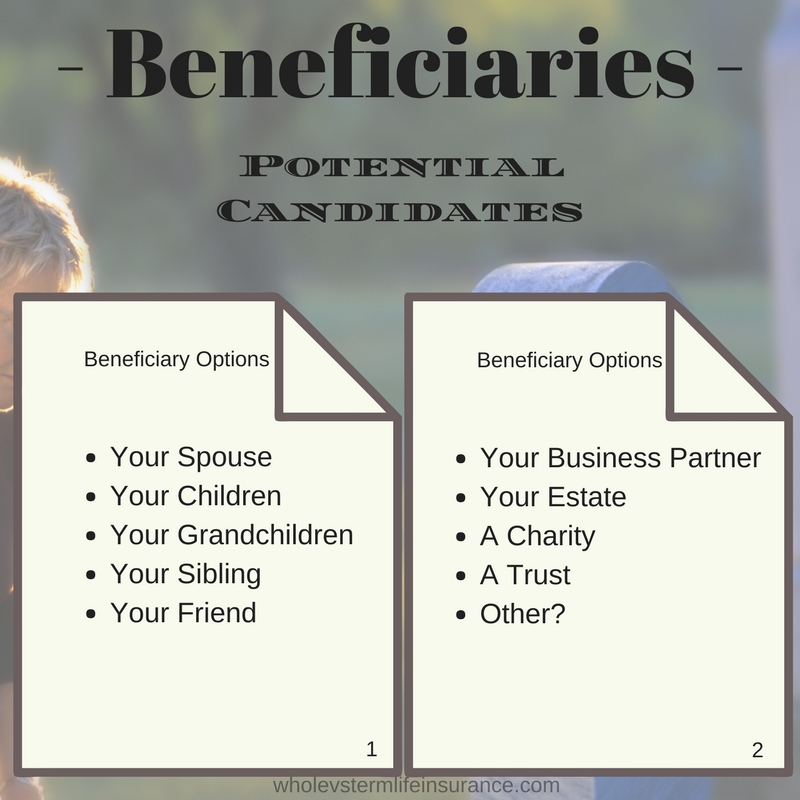

Your Beneficiary Options:

People that you may consider choosing to be the beneficiary of your life insurance policy.

Your Spouse: Your spouse is probably the most common selection of whom to choose for your life insurance beneficiary, at least from the policy start. In the beginning when you have little money and children in the household, this option often makes the most sense. However as you age, create wealth, this option begins to loose its appeal. Often clients change from this beneficiary to a different one later on for tax related issues.

Your Children: Selecting your children as your beneficiary is often an initial choice as a contingent beneficiary for families that do not have a revocable trust set up. Often children are upped to a primary beneficiary as the two parents age. Of special note here is that, generally, if your underage children are the beneficiary of record during a loss of life, typically a court appointed trustee will be required to manage the funds for them. For this reason alone, it is not usually suggested that children be selected as primary beneficiaries.

Your Grandchildren: Similar with the case as selecting children, grandchildren, even great grandchildren can be selected as primary and contingent beneficiaries. Similar court minority status, as described above, can occur if cash payout happens when these grandchildren have not reached the age of legal maturity.

Your Brother or Sister: Siblings can also be selected as a beneficiary and are often a great choice for unmarried individuals with no children. Choosing your Sister and/or Brother as beneficiaries can be a good choice for some.

Your Friend: Yes you can select a friend as a beneficiary. Although not common, for people that are not married and have no children it can be a perfectly logical choice. Choosing a friend as a beneficiary is more common than many people think.

A Business Partner: Although not suggested for personal life insurance policies, this is complexly useful and a practical thing to do for business life insurance policies. Why would you name a business partner on your business life insurance policy? Simple, in order to complete a previously agreed upon transaction in the event of one partner's death. The life policy becomes the funding mechanism for this agreement. In essence this allows one partner to buy the entire company via the life policy with the surviving spouse ultimately receiving the buyout funds. So it really protects all parties.

Another time when a business life insurance policy may name a business partner as a beneficiary is in something called a Key Man Life Insurance policy. These types of policies are more or less beyond the scope of this article. A short description is that Key Man policies are placing insurance on an individual when an employee essentially becomes the product or simply indispensable.

A Charity: Selecting a charity is rarely the initial beneficiary option for most Americans. However as time goes by and wealth increases, often clients will make the necessary change to name a known charitable cause. Care should be taken to research charities and become familiar with there financial and social situation. Good questions to ask potential charities include what percentage of money donated actually goes towards the cause.

An Estate: Technically an estate can be chosen with most insurers, however this may greatly complicate the process known as probate. There may be large tax implications in making this selection. I am not a tax adviser but I would not suggest making this selection for most.

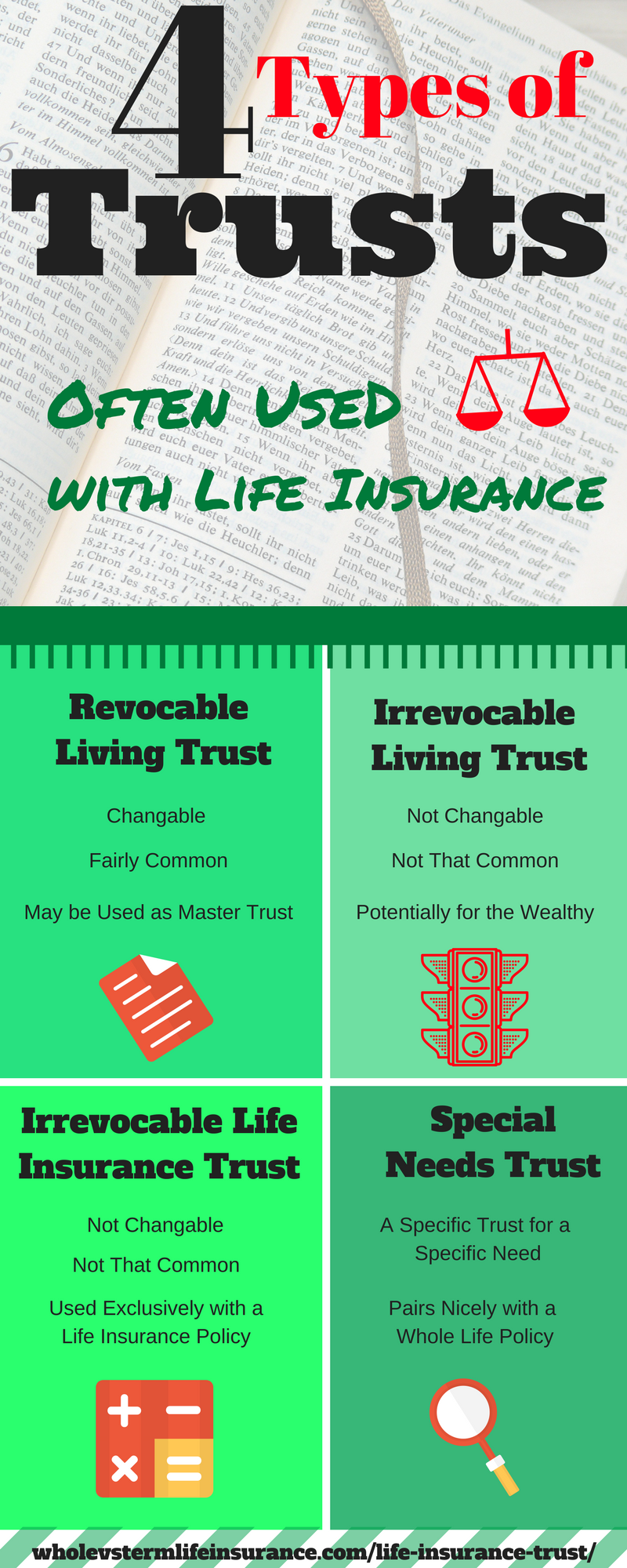

A Trust: An irrevocable or revocable trust can be selected as your life insurance beneficiary. This should only be done after you have discussed this with your attorney. When selecting a trust most insurers will want to know lots of information about the given trust such as the exact name and creation date. They may also wish to see the one or two page creation document that contains the seal.

No One: Can you name no one as a life insurance beneficiary? Whether you can actually do this or not, really doesn't matter. You should not name no one as your life insurance beneficiary.

This being said, it does happen that no surviving beneficiaries are alive at the time of payout. What happens in this situation is based on Insurance and Inheritance law. Typically the funds will be paid out to the insured's estate in which case the probate court will determine the money's ultimate future. One thing is more clear -not having a predefined life insurance beneficiary lets others control your money's future. Do you really want this?

It is of course, not possible for this list to be a complete list. Certainly there are other potential candidates for life insurance policies.

* Of special note here - in some states certain laws may prevent married couples from changing their primary beneficiary away from their current spouse in general or without their written consent. There are also other laws, typically state dependent, that regulate and rule beneficiary designation.

There are numerous states that to various extents may require you to get a signature from your spouse if you are NOT going to make them your beneficiary from the inception. These are many of the so called community property states such as Wisconsin, Washington, Texas, New Mexico, Nevada, Louisiana, Idaho, California, Arizona. This may not be a complete list.

Is Your Choice of Beneficiary Final?

Is your choice of life insurance beneficiary final once you die? The simple answer is No, your choice of life insurance beneficiary is not necessarily final. The more practical answer is that it is more than likely final unless you run afoul of some state specific law or a court rules that a beneficiary selection was miss handled - or you choose to change a revocable beneficiary. As with any probate or estate situation, where exactly the money goes can be challenged in a court of law. The exact explanations here are better dealt with from a law firm, but here are some scenarios where this could be the case.

According to Chenault and Hoge, "Approximately half of all states have laws that automatically revoke the beneficiary designation to a former spouse after the divorce is final. If the insured person dies and a former spouse is named as beneficiary on the policy, the proceeds may go to either the contingent beneficiary or or to the deceased’s estate if there is no contingent named. An exception may be made when the policy is part of the divorce agreement."

Another scenario might involve a change of the named beneficiary in community property states, as noted above. According to Minyard and Morris - Family Law: "In one of the most important family law cases in 2014, the California Supreme Court ruled that an insurance policy purchased by husband during marriage, naming his wife as the policy’s only owner and beneficiary, was community property upon the couple’s divorce."

If a minor child is named as a beneficiary and at the time of death, the insurance company will not just mail your kid a check. The court will decide how and where the funds will be dispersed and will often select someone to oversee them. However it depends on the situation.

If your beneficiary is a foreign national- special care should be taken. Contact your insurance agent if you wish to make this happen. But it is technically possible for the money to get held up because of this.

The last category of life insurance beneficiaries not actually being handed over to the named beneficiaries are a rather dark corner of insurance rules and regulations. It is also somewhat common sense. There are so called Slayer Statutes that typically disallows a murdered from receiving the payment when they kill the insured. Therefore in one of these situations if the beneficiary is found to be the killer they would not get the life insurance money.

The good news to all of this is that insurers have become very adroit at handling clients when they change their named beneficiaries. They will usually provide information about the laws in your specific state when you ask to change the name. It is possible that they may refuse to make the beneficiary name change if you fail to provide all of the necessary paperwork, such as a signed letter from your spouse.

Common Combinations with Life Insurance Beneficiaries:

Now that you have gone through who can be named and the various types of and levels of beneficiaries, lets review some common selections that numerous clients make:

A Small Middle American Family with no Trust and a Small Amount of Assets:

The husband takes out a small policy on top of the policy that he has through work (a group policy). He names his wife as the primary beneficiary and his two small children as contingent beneficiaries, each with a 50% Per Stirpes share.

A Larger Middle American Family with no Trust and a Small Amount of Assets:

The wife takes out a $250,000 term life insurance policy and selects her husband as the primary beneficiary and her three small children and her resident niece (as she is the guardian) as contingent beneficiaries. Each of the contingent beneficiaries are named Per Capita.

A Wealthy Couple with No Children and No Children Planned:

Both spouses have no need for independent personal life insurance since they have policies through work and have very little debt and no children planned. On their work group life policies -they both name their favorite charities as primary beneficiaries and their revocable living trust (100%) as contingent beneficiary.

A Wealthy Couple with Two Children:

The father takes out a whole life insurance policy that he expects to grow in value over time. He names his wife as the primary beneficiary and their revocable living trust as contingent or secondary beneficiary. He plans to change the primary beneficiary from his wife to the trust at a later time. At that point he will add his two children as contingent beneficiaries as a fail safe.

A Single Divorced Mom:

During the divorce proceedings it is suggested that the two parties establish a trust for the benefit of the children. The divorced mother lists the revocable trust as the primary beneficiary and her sister as contingent.

Two Accountants whom are Business Partners:

Two similar business life insurance policies are created in conjunction with an end of partnership legal agreement. An attorney is retained and all parties, including the insurance agent follow the lawyers guidance. Each partner's life insurance policy names the other partner as the primary beneficiary. It is agreed via the legal document that the money once received from the life insurance payout will be used to buy out the other partner's 50% ownership. This will allow the now dead partner's widow to essentially receive her money from the sale of the partnership through the insurer.

Basic Concepts on Trusts as Beneficiaries:

The subject of using various trusts as beneficiaries in life insurance policies is complex. First off, please see a lawyer to learn more. Second this topic is changeable and different in various countries and even within various US states. Therefore its difficult to give any client an exact road map of how to handle this. In general adding a trust as a beneficiary on your life insurance policy may change your tax situation or it may not. It may assist you with your estate planning efforts. Much of it depends on the actual trust and your situation.

If any insurance agent makes tax recommendations in regards to adding or removing trusts as the beneficiary I would be very wary of listening to them unless they are a certified tax expert. These rules and laws change frequently.

Not to confuse the matter, but trusts can also be the partly listed on the Policy Owner. By allowing a trust to be listed as the policy owner you may be able to avoid estate and income tax, again depending on how it is set up and where you reside. Our article, Life Insurance Trusts goes into much greater detail on these matters as there are four more common types of Trusts used with life insurance contracts.

That all being said, if you already own some form of a revocable trust and you are acquiring a life insurance policy you will want to ask your estate attorney about adding the trust as either the primary or secondary beneficiary. Most estate planning attornies are opinionated on this matter.

If you are buying a cash value life insurance policy and have been advised to do this within the confines of an Irrevocable Life Insurance Trust, follow your attorney's advice to the letter.

What to Watch Out For:

The world of life insurance beneficiaries are usually pretty simple, except when people try to do exotic and irrevocable things. Just the term irrevocable should concern you. A typical revocable beneficiary is often changed three, four, or even five times during the life of a common term life policy. When is the last time that you made a financial decision and never once slightly changed your original plan?

The creation and use of irrevocable trusts with cash value policies is pretty complicated. These things have lots of moving parts. Make sure you fully understand what you are getting yourself into when making any decisions that you cannot change.

In many ways this is exactly why revocable trusts are so popular. As their name would imply, they are typically changeable to some extent.

One last note in regards to Wills - Generally speaking your life insurance beneficiary trumps what your will says. If your will or a non affiliated trust says that all of your money goes to your Son John and your life insurance beneficiary is listed as your Aunt Sally - the proceeds more than likely will go to your Aunt Sally.

Conclusion and Questions for Beneficiary - the person who receives financial protection from a life insurance plan is called this:

Remember, the person who receives financial protection from a life insurance plan is called the Beneficiary. Beneficiaries come in a few forms and types. As long are you do not choose an irrevocable life insurance beneficiary, you can almost always change it later. If you are interested in understand more about various payout methods from life insurance policies, consider our article titled: Life Insurance Settlement Options. Thank you for reading our article.

Did this post answer your question? We would greatly appreciate knowing.

Kindly add a comment or email us. Thank You for your Time.

Beneficiary - the person who receives financial protection from a life insurance plan.

Speak with an experienced advisor!

Speak with an experienced advisor!