A Life Insurance Trust

Contrary to what the internet may tell you - there is no one "life insurance trust." Trusts are creations of attorneys and each of them are their own separate entity. However - trusts that are used often with life insurance products can loosely be broken down into a couple of categories.

In this short article, I will attempt to review the most common types of trusts that we, as insurance agents deal with. I am not an attorney and I advise you to speak with one whenever you are considering creating, closing, or amending any kind of trust. Some of the information in this article has been simplified to assist in creating a general knowledge on the subject.

A Revocable Living Trust

I have heard this called the Standard Revocable Living Trust numerous times, but there is nothing standard about them. Revocable living trusts also go by the term Inter Vivos Trust. Revocable living trusts are often created to avoid the legal process known as probate. Revocable Living Trusts usually will have assets placed in them, such as your house. This type of trust often will become irrevocable upon the death of the owners. A recoverable living trust should usually be added to your home insurance policy via an Additional Insured Endorsement or as a Named Insured.

Revocable Living Trusts occasionally may be listed on the life insurance policy as:

1. Policy Owner

and / or

2. Beneficiary

There are numerous benefits to doing either of these, however there are also drawbacks. The key to understanding revocable trusts is knowing that they are changeable, to a certain extent. Revocable living trusts may be the most common form of trusts created with Estate Attorneys.

Sometimes Revocable Living Trusts serve as the master trust with other somewhat independent trusts within them. Many revocable living trusts become irrevocable once the last trustee dies.

An Irrevocable Living Trust

Irrevocable living trusts are similar yet vastly different than their cousin Revocable Living Trusts. An irrevocable living trust, once created and established, really can not be changed. It is quite possible that an irrevocable living trust could also be used with a life insurance policy in a similar way as its cousin the revocable living trust.

In my experience irrevocable trusts are not that common. These trusts are considered ironclad. Irrevocable living trusts may create a layer or creditor protection once they are created.

Irrevocable Living Trusts may be more common in situations where clients are extremely wealthy.

Revocable Vs Irrevocable Definitions:

Revocable: Capable of being revoked or cancelled.

Irrevocable: Not able to be changed, reversed, or recovered. Final.

An Irrevocable Life Insurance Trust

An irrevocable life insurance trust is sometimes referred to as just a life insurance trust, although this term is a bit misguided because numerous types of trusts can be used with life insurance policies. There really is no one life insurance trust. An irrevocable life insurance trust may be used to assist in preserving life insurance benefits from possibly taxation and or probate. Taxation benefits may assist at the state or federal level, or both.

Irrevocable Life Insurance Trusts occasionally may be listed on the life insurance policy as:

1. Policy Owner

and /or

2. Beneficiary

As stated previously irrevocable means that the trust creation is often unchangeable once it is completed. These life insurance trusts often can in theory save people money on federal and possibly state inheritance taxes. According to the IRS, the new federal estate tax "exclusion amount: is $10,000,000, before taking into account the necessary inflation adjustment." Therefore these forms of life insurance trusts would seem to most benefit very wealthy or affluent individuals and or families. In 1997 the federal exclusion sat at $600,000 and in 2002 it slowly reached the limit of $1,000,000. By 2010/2011 Congress settled on $5,000,000. It is possible that things could reverse course and the need for life irrevocable insurance trusts could grow again.

Life Insurance Trusts (Irrevocable Life Insurance Trusts) are complex creations. They require a competent attorney to put them together and provide you complete instructions on how to integrate your irrevocable life insurance trust with your life insurance policy.

These life insurance trusts are often paired with a cash value life insurance policy. Such as a Whole Life or Universal Life Insurance policy. Although they are not exclusive to these types of life insurance.

Irrevocable life insurance trusts are incredibly complex to set up and manage and I would never suggest that someone do so without a good lawyer to assist in its creation. As we have discovered irrevocable means forever.

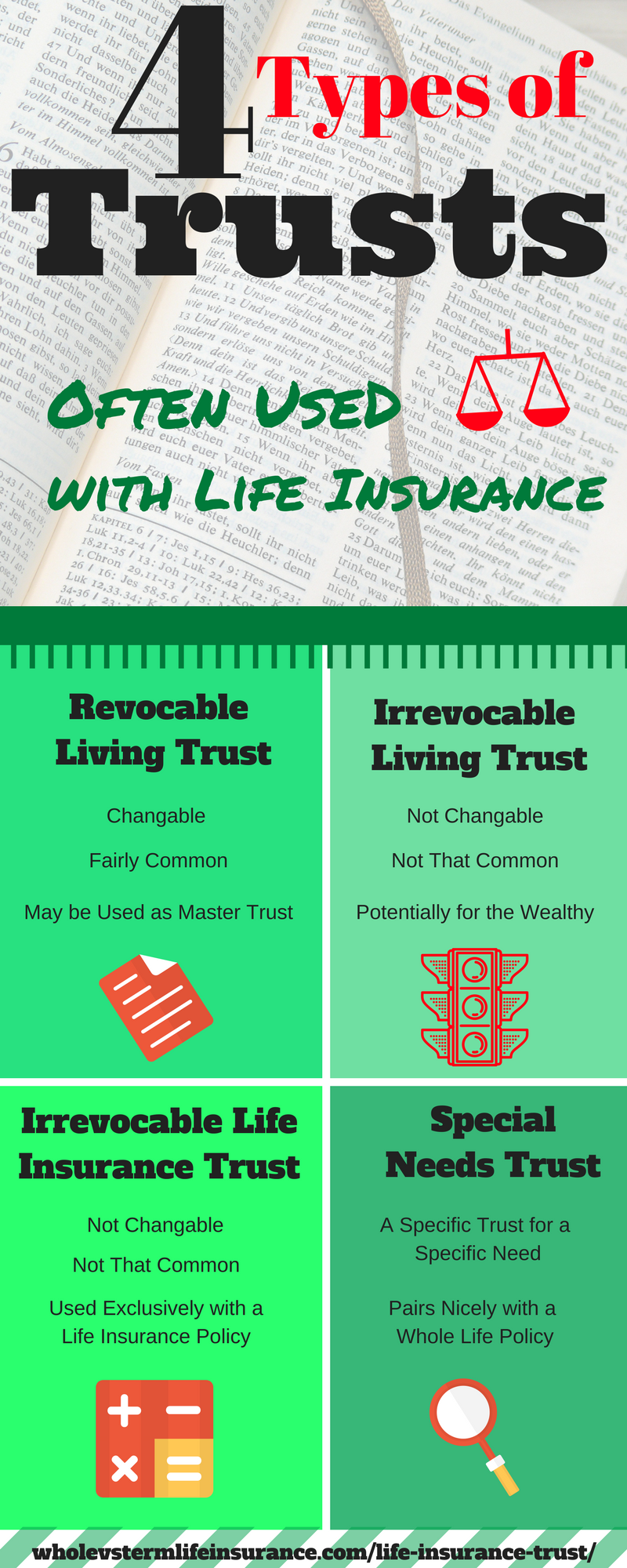

The Four Common Trusts Used with Life Insurance:

Revocable Living Trust | Irrevocable Living Trust | Irrevocable Life Insurance Trust | Special Needs Trust |

|---|---|---|---|

Changeable | Unchangeable | Unchangeable | Depends |

May be Policy Owner &/or Beneficiary | May be Policy Owner &/or Beneficiary | May be Policy Owner &/or Beneficiary | May be Policy Owner &/or Beneficiary |

Used in Conjunction with All Life Products | Depends | Used in Conjunction with All Life Products | Used in Conjunction with Whole Life |

Very Common | Uncommon | Less Common | Very Specialized |

May be Used as Master Trust | More Common with Extremely Wealthy | Used Specifically With a Life Insurance Product | Set up for Special Needs Purposes |

*the information explained above is meant to be general in nature and not accurate in all situations.

** Revocable Life Insurance Trusts often Become Irrevocable after the death of the Trustees.

A Special Needs Trust

A special needs trust is created for the specific needs of the mentally ill or disabled. Often they too, are created in conjunction with a Cash Value Life Insurance plan. However they are not just created to save money on taxes. Special needs trusts, in my opinion, may also be called a life insurance trust, because they are created with the express purpose of using a cash value life insurance plan to fund them.

Special needs trusts are usually paired with cash value whole life policies, because they can fund the trust to some extent, no matter what happens. In contrast with a term life policy that only pays out in the event of a death during the term of the policy, a whole life insurance policy can provide protection for the entire life of the caretakers. I believe that Whole Life Insurance Policies sold in conjunction with special needs life insurance trusts constitute one of the best uses of whole life insurance.

What is Probate?

According to Findlaw, Probate is a legal process "that deals with the assets and debts left behind after someone dies. By default, probate is supervised by a court, called the probate court."

The probate process can be slow and expensive. The probate process may require the function of an attorney and individual states may have probate fees or costs.

Many attorneys seek to minimize the probate process through the use of some forms of trusts.

What to Watch out for with Life Insurance Trusts:

Trusts created with proper purpose and an attorney may very well assist you in your financial planning efforts. However, anyone other than a lawyer and/or a credible wealth manager that suggest that you should set up some form of a trust should probably be treated as having an ulterior motive. I have read and seen insurance agents that tout the values of buying cash value life insurance policies paired with certain types of trusts in order to assist you in creating and preserving wealth.

I advise all of my clients to be extremely careful with this strategy, as government rules and regulations change. Markets go up and down, new products come and go. Thirty years ago the federal inheritance tax exclusion was only $600,000 and universal life insurance policies were sold as the last life insurance policy that you would ever need. The exclusion is now over sixteen times this and many of those universal life insurance policies basically crashed and burned.

Looking back on it with clarity now I wonder why most people would do much of anything irrevocably.

Interested in more information about the various types of trusts created by lawyers, a good place to start is Kellen Bryant's 37 Types of Trusts Used to Protect Assets from Creditors, the Government, and other Predators. "Just like ice cream… there are many types of trusts out there!"

Should you have any questions concerning life insurance trusts - please speak with a licensed and insured attorney. If you have questions concerning insurance please contact us. I am not an attorney and this information is provided for general consumer use, not as legal advice of any kind or type. As I have stated previously. this article is intended as a simplified version of the life insurance trust situation. I do not consider it a 'deep dive.' There is a lot more to know about life insurance trusts. Please see our full privacy policy.

Speak with an experienced advisor!

Speak with an experienced advisor!