Single premium life insurance is aptly named. The insurance policy requires only one payment, which is the initial payment. The initial payment is also the only payment. These single premium policies do not usually come in term life insurance plans. Therefore single premium policies rest on whole or universal policy forms.

About Single Premium Whole Life:

Single Premium Whole Life Insurance is the most popular form of single premium policies. The other being Single Premium Universal Life. What you get with a single premium whole life policy is guaranteed to pay out policy on a simple insurance form. One Payment, One Plan, One and Done.

There are two main types of single premium life insurance policies: Single Premium Whole Life and Single Premium Variable Life. Single premium life insurance can loosely be defined as a life insurance policy that has only one large up front premium payment but benefits that generally last your entire life.

Single Premium Life Insurance and How it Works:

Single premium life insurance is a form of life insurance that is paid for all at once with one payment. Held in what are called Universal or Whole life insurance policies, single premium life insurance plans eliminate the need to worry about meeting annual premium payments. However because of them only having one payment - that payment is very large.

About Single Premium Life Insurance

Decades ago single premium whole life policies were fairly popular. This was due to the potential tax advantages of using participating life insurance plans as an investment. However congress closed this loophole long ago and now they are not nearly as popular. This loophole reclassified single premium life insurance potentially as Modified Endowment Contracts.

However that does not mean that there is no reason to consider single premium life policies.

Single Premium Whole Life Vs Regular Whole Life:

Most life insurance policies are paid annually. That annual payment can happen once per year, or be broken up into quarterly or monthly payments. Regardless, once you sign up for a life insurance policy these policies require yearly payments for the full life.

Single Premium Whole Life policies require just one total payment.

As an example, a forty year old man that wished to buy a participating whole life policy may expect to live to age 90. Therefore he would probably need to expect to pay 50 annual premium payments.

1 Total Payment vs 50 Annual Payments

As one can imagine the single payment will be much higher than the 50 individual payments.

Which Insurers Offer Single Pay:

This a complicated question, one which should have a simple answer, but sadly, does not. Which insurers offer Single Pay policies really depends on a variety of factors - such as which State you are located in, and What year it is. Quiet frankly there are not a lot of sales of these types of products, so the list seems to be changing.

Another consideration is which chassis the policy is built on: Whole or Universal. If you are looking for a full set up options - email us what you are looking for and we will come up with options for you.

Sample Rates Single Premium Whole Life Insurance:

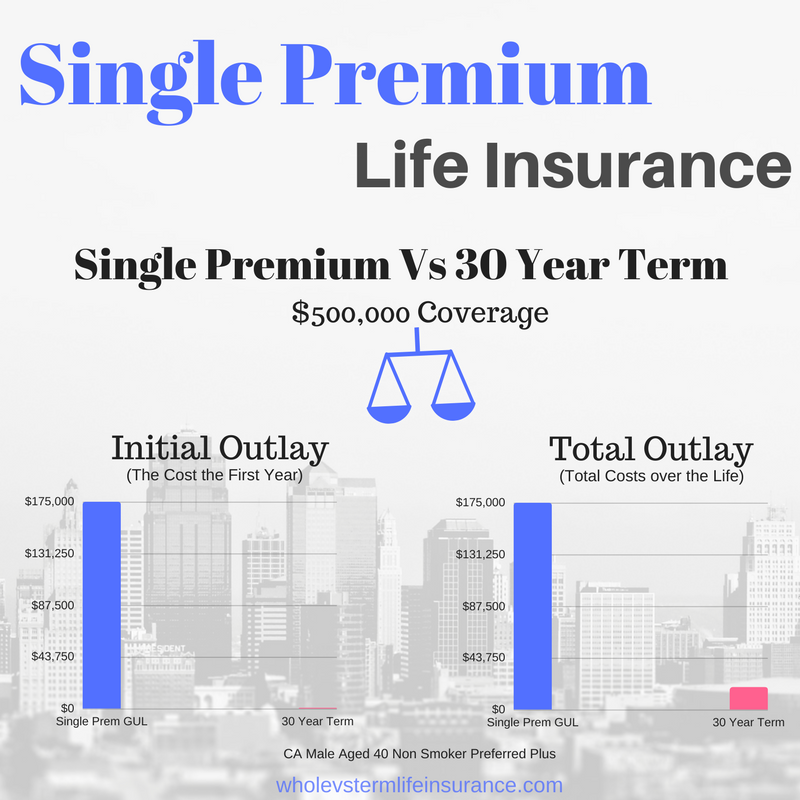

Here is a sample rate and case to consider: a 40 year old male, non smoker, in perfect health with no other underwriting conditions.

Should he purchase a single premium Single Premium life policy for insurance, likely for his entire life? Should he purchase a 30 year term life insurance policy for a guaranteed coverage amount until age 70?

$634 per year or $174,835 Once?

If he buys the 30 year term his yearly outlay will be $634 or $19,020 over the life of the policy. Over 30 years he will save $155,815. Without considering any interest (or potential dividends) it would seem that he comes out ahead with the term policy. However looks can be deceiving. At age 70 he may lose his term life insurance as his rates will skyrocket.

Simple charts can both illustrate honest truths yet hide necessary details. Neither of these two insurance policies are very similar. For those reasons please contact us and we can walk you through your own options. That being said another, potentially more realistic option is listed below.

The 10 Pay Life Insurance, Another Option:

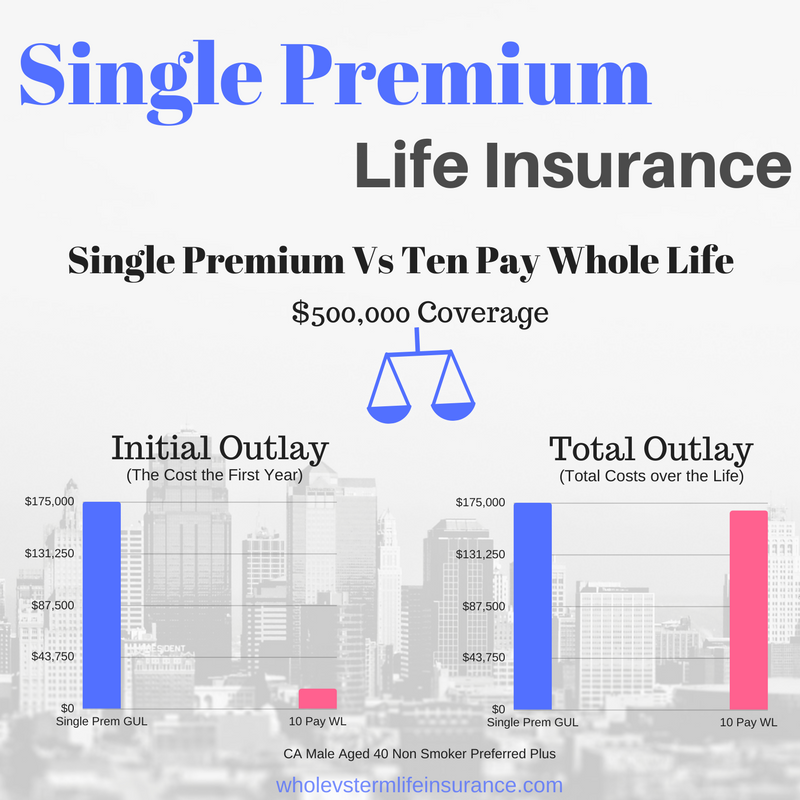

Slightly more popular than single premium policies are ten pay life insurance policies. Ten Pays are just what their name would imply. A ten pay life insurance policy has ten payments due, typically annually for just ten years. Then, all expected payments are done. The ten pay policy seems to be more palatable than single premium policies.

If you have your head set on a single premium policy you may wish to consider the ten pay option. My professional opinion of the ten pay option is that it may allow consumers to pay down (and off) the participating whole life policy during the course of their working years. In other words a forty year old man might be able to have it paid off by his 50th birthday. This is appealing for numerous reasons.

Ten pay whole life policies also generally are more conforming in their avoidance of Modified Endowment Contracts.

* A++ Single Premium Life Insurer vs A+ Ten Pay Life Insurer.

There is a tendency in the purchasing of whole life insurance policies for consumers to either buy too much whole life insurance or too little. I find that this is not as common with term life insurance, which is so much cheaper. On the one had you have consumers that are put off by the hugely expensive costs to purchase, say a $1MM dollar whole life policy and hence only buy a $500K policy. These folks might be considered under-insured. On the other hand you may have those that choose to purchase a giant $2MM whole life insurance policy only to discover that they can no longer afford it fifteen years down the road.

A sample premium that would be much more similar to the would be a Ten Pay Whole Life policy. The same client could consider the same $500,000 policy and more than likely have more choices open to them. A quote from a participating insurer would show a quote possibility of $16,835 per year. That is each year for ten years. After which time the client more than likely would be finished with their financial outlays.

$16,835 per year -10 times or $174,935 Once?

The solution to the folks that are over buying whole life insurance policies may be the ten pay whole life option. The solution could also be the Single Pay Whole Life plan.

Issues with Single Premium Life Insurance:

No life insurance policy is perfect. Single Premium life insurance policies carry their own risks.

- 1The high cost for single premium life insurance plans.

- 2The scarcity of options and lack of widespread use of single premium whole life policies.

- 3Lack of competition for this type of life insurance.

- 4The point of no return purchase. Once you pay for it, you can not change your mind.

- 5Potential MEC compliance issues with single premium policies.

- 6Potential Increased restrictions on the ability to increase/decrease coverage amount.

Of note here is statement 4 concerning not being able to change your mind. Some will say that after you commit to a 30 year term policy you would not be able to change your mind either. However, you have only used 1 years worth of money in that situation. You would be able to cast aside the thirty year term and reshop for another one, albeit with a slightly higher rate now that you are one year older.

The Single Premium WHole Life MEC Issue:

A MEC is a modified endowment contract. By definition a typical Single Premium Whole life policy is considered a MEC. Most insurance policies that are properly set up and utilize the seven pay rule are not considered MECs. According to the IRS, there are three rules for life insurance policies to qualify as a MEC: (1.) Be set up after 06/20/1988, (2.)be a life insurance policy, and (3.) not meet the (TAMRA) 7 pay test.

Modified Endowment Contracts have special rules, laws, and guidelines in terms of taxation and are not treated the same as most permanent cash value life insurance policies.

If you are buying a life insurance policy for anything other than the death benefit then a Single Premium Whole Life policy is probably not a good idea. In general MECs are to be avoided if possible.

Single Premium vs Ten pay - A Breakdown:

Questions about Single Premium Whole Life & Single Premium Life Insurance:

Question: What are Single Premium Life Insurance Policies?

Answer: Single Premium life insurance is a form of cash value life insurance that is paid in one full payment.

Thanks for reading our post about Single Premium Life Insurance / Single Premium Whole life. Please feel free to ask questions either below in the comments box or email or call us.

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!