Paid Up Additions...

Paid Up Additions for Whole Life Insurance:

Paid Up Additions are additional life insurance purchased through life insurance policy dividends. Dividends are generally paid out by Mutual Life Insurance Companies. (Although some stock companies can also pay out dividends.) These paid up additions are available via a rider sold alongside a cash value life insurance policy - such as Whole Life Insurance.

If you are going to purchase a whole life insurance, a paid up additions rider is often a good consideration.

Paid Up Additions = Participating Life Insurers

Paid Up Additions for Whole Life Insurance:

Paid up additions are only available on cash value life insurance policies such as Whole Life Insurance. They are generally not available via Term Life Insurance.

Paid-up additions are also only paid on participating life insurance companies. Usually these are Mutual Insurance companies, but they make also be non mutual companies.

Participating insurance companies typically issue dividends on the cash value of the life insurance policy. Those dividends may be used in a number of ways. Some of the ways include,:paying the policy premium, receive cash payments, and/or potentially buying paid up additions.

What is a Paid Up Life Insurance Policy?

Lets cut down on the confusion here and explain that there are Paid Up Life Insurance Policies and Paid Up Additions and the two are not the same. Although they are similar.

A paid up life insurance policy is a life insurance policy that may have no more payments due. This can come about due to a variety of reasons. One of which is a limited pay whole life policy in which all payments have been received. Another reason may be a policy owner who has enough cash value in their policy and wish to make no further payments. For those, the option of changing their policy to allow it to be a in a paid off status may be an option. This may involve them purchasing a reduced paid up life insurance policy.

These are not the focus of this article.

Paid Up Life Insurance is not the same as Paid Up Additions

The Paid Up Additions Rider:

Paid up Additions are basically small additional insurance policies. These additional insurance amounts are typically purchased via a whole life dividend. Hence, since especially in the early years, the dividends of the policy are typically very small, the additional insurance amounts are often very small in the beginning.

Paid up additions are usually allowed to be purchased via a rider, or endorsement to the whole life insurance policy that allows this. Each participating insurer however has their own practice and rules to do doing so. Therefore check with your insurance company. Ask to see the exact policy language when doing your research.

Paid Up Life Insurance purchased with Dividends.

The life insurance paid up additions rider can be abbreviated as PUAR. PUARs are one type of a rider, typically insurers will offer numerous other options. Popular riders include Accelerated Death Benefit, Disability Income, & Waiver of Premium. You will also notice that sometimes this rider is referred to as a Paid-Up additions as opposed to Paid Up additions.

Paid Up Additions should not be confused with a similar, yet different dividend option called the "Additional Term Insurance Option." The additional term insurance option sometimes allows dividends to be used to purchase additional term insurance on the policy holders life. The additional term insurance option is occasionally referred to as the fifth dividend option. Exact policy language and terms should be checked with your insurance company.

Types of Paid Up Additions:

Loosely defined there are two different types of Paid Up Riders: Level and Flexible.

A level paid up additions rider allows a "set" amount to be used each and every year to purchase additional whole life insurance.

A Flexible paid up additions rider allows you to increase or decrease it as you see fit.

I caution readers into reading too much into this categorizations as each year insurers are coming up with new definitions with riders.

I would also caution you when you speak with an insurance agent that simply defines the answer as either Level or Flexible. I can imagine unscrupulous sales people answering the question as such. An example might be: "The policy is a Flexible Paid up Additions Rider." And only after speaking further with them do you learn that its "flexible in that it allows you to purchase the "set" amount of insurance unless you fail to make the yearly premium payment." In other words, seek specific policy language.

Paid Up Additions - Best Practices:

If you are purchasing a whole life insurance policy I do believe that the paid up additions rider is a great consideration. Professionally I would prefer a Flexible or Variable type rider be used. If the only type of rider allowed is a Level or Set, it will be a difficult decision.

Why? Advising clients to purchase level paid up riders is often ill advised because so many people struggle to afford whole life insurance policies long term. This blog has made the case against permanent life insurance policies for the masses for a long time, due to the long term costs, confusing nature of the product, and many other reasons. By committing your dividends to future increased insurance you are potentially going against the grain of needing less insurance as you age. On top of this, you are denying yourself one of the best attributes of participating insurance = dividends to pay down your premium.

I would encourage you to ask your future insurance company if you are allowed to add the level paid up additions rider at a later time. I would also encourage you to ask them what the process is? Is it a guaranteed addition or does it need to be underwritten itself.

HOw to Best Use Paid Up Additions

(assuming you already have or are committed to whole life insurance)

Is Whole Life Insurance Right For You?

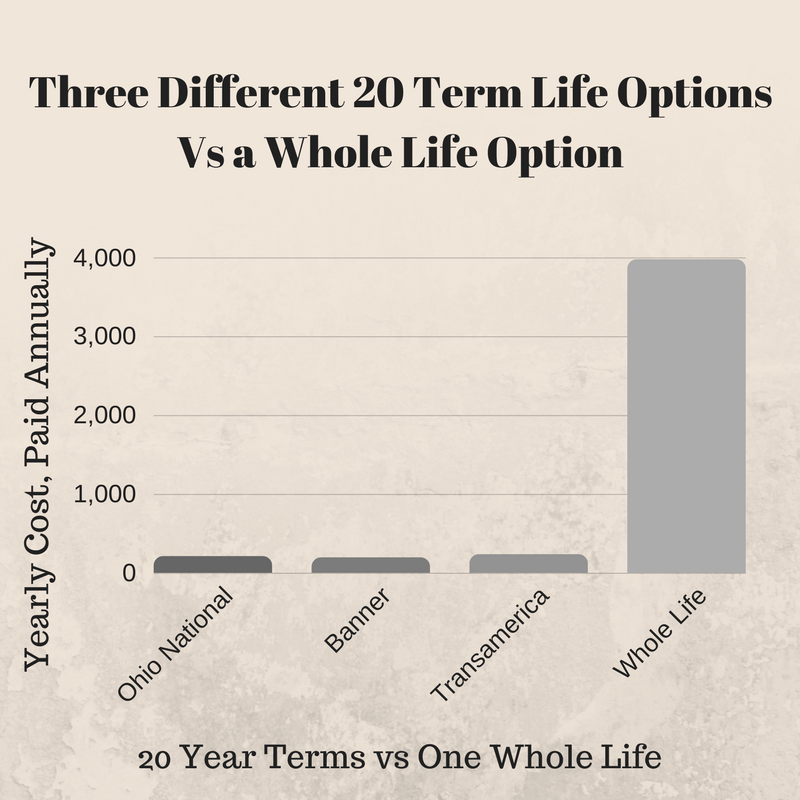

It has often been said that Whole life insurance is sold not bought. This is most certainly true. Term life insurance tends to sell itself when evenly compared with whole life policies. When clients learn that a typical policy can cost them eight, ten, or twelve times per year what a competing 20 year term policy can offer them- they often lean towards the simple and affordable term policy.

That does not necessarily mean that whole life insurance policies are right for no one. If you have your mind set on whole life insurance - I only ask that you consider all of your options. Is your insurance agent offering you a permanent policy for your benefit or theirs?

The Power of Paid Up Additions:

The power of paid up additions is really in the exponential factor of its use. Albert Einstein is rumored to have said that compounding interest "is the most powerful force in the universe." The compounding affect on participating whole life polices regularly using the paid up addition - potentially could be gigantic. However in between saving, and insuring - life happens. Life often gets in the way and ends up costing far more than we had imagined, hence limiting our ability to meet our savings goals. This is why the flexible version of this tool is more than likely best.

Are Life Insurance Paid Up Additions the Magic

that Can Make you Rich?

If you search long enough on the internet you are likely to come upon certain insurance agents pitching Paid Up Riders as the greatest tool since sliced bread. All things being equal - Paid Up Additions are a good tool indeed for participating whole life insurance policies. However the idea that paid up additions are going to somehow make you fabulously wealthy is pretty questionable.

Great claims require Great Evidence.

The greatest financial tool that most Americans have are qualified accounts such as 401Ks, Roth IRAs, and non qualified accounts, but specially tax treated 529 plans. In general those are the best places to put money for retirement and savings. Not life insurance policies. The numbers typically do not add up.

There are numerous situations in which you should well consider whole life insurance for various financial planning uses. These include the setting up of a Special Needs Trust, as a Business Policy, For Extremely Wealthy Americans, and for those Not Able to qualify for level term policies, certain final expense policies are in fact a type of whole life insurance.

However for so many Americans its hard to see the value of purchasing a whole life insurance policy, even with the paid up additions rider. For most, a simple, level, term life insurance policy paired with a qualified 401K, Roth IRA, and a non qualified tax advantaged 529 accounts may be best.

You will never know unless you run the numbers though.

Questions about Paid Up Additions:

Should you have specific questions please feel free to ask below in the comment box or email us or call us. Thank you for reading.

sales@marindependent.com

Question: Are Paid Up Additions the same as Paid Up Life Insurance?

Answer: No, they are similar but not the exact same. Paid up Life Insurance - is a life policy that has been fully paid off. A Paid Up Addition is a rider that allows you to purchase more insurance via a flexible or level program.

Question: Are Paid-Up Riders available from only Mutual Insurance Companies.

Answer: No, however they are most common with the Mutuals. However the world of insurance is changing and you never know what non mutual insurers will come up with.

Question: Where do you Get Paid Up Riders?

Answer: Generally speaking you Get Paid Up Riders from a participating Whole Life Insurance Company at the time of conception. It may be possible (check with your insurer) to add it at a later time.

Speak with an experienced advisor!

Speak with an experienced advisor!