Participating Whole Life Insurance is a Dividend paying mutual insurance contract.

Participating whole life insurance is a form of life insurance who provides dividends to its policy owners. The internet is full of confusing and often incorrect information concerning participating insurance policies. In this short article we will explain exactly what participating life insurance is, who provides it, common and historical rates of return, and answer some simple questions. We shall avoid the debate about if participating life insurance is a good use of your money as we have covered (and will continue to cover) this topic on numerous occasions.

Participating Whole Life Insurance:

A participating life insurance policy pays dividends to policy holders. Typically these are Mutual insurers and typically these are paid from Cash Value Life Insurance Policies, such as Whole and Universal Life Insurance. Cash Value Policies that do NOT pay dividends are usually called Non Participating Life Insurance Policies. Therefore not all whole life insurance policies are participating whole life insurance policies.

Participating Policies can also (rarely) be known as "with profits policy." You may also see participating policies shortened to par policies. This term 'par' policies seems to be a short hand version of 'participating' policy.

What is Whole Life Insurance?

Whole life insurance is a form of permanent life insurance that lasts for your entire natural life. Whole life policy premiums are typically level, meaning the same amount each year, for the life of the policy. This results in an over-payment of premium during the initial years and an under-payment during the latter years. Therefore whole life insurance policies often generate a cash value in a cash account which may be used for numerous purposes.

Whole life insurance stands in direct contrast to Term Life Insurance.

Some definitions of participating whole life insurance will indicate that in order for a policy to be considered "participating" they must be a mutual insurer. However, this is technically incorrect. There is nothing to stop a non mutual insurer, such as a stock insurer from providing a dividend paying policy. A practical understanding of participating insurers though is that they are almost always exclusively mutual insurers. So it is easy to understand where the incorrect assumption comes from.

Participating vs Non Participating Whole Life Insurance Definitions:

Definitions of Participating Insurance:

According to Investopedia a Participating Policy is: "A participating policy is an insurance contract that pays dividends to the policy holder. Dividends are generated from the profits of the insurance company that sold the policy and are typically paid out on an annual basis over the life of the contract. Most policies also include a final or terminal payment that is paid out when the contract "matures"

NAIC.org more loosely defines it as thus: " A participating policy allows the insured to share in the insurers Investment, expense and mortality experience by providing dividends, which can be received in cash, used to reduce premium payments or to purchase paid-up additional insurance. The dividend options make these policies more flexible than nonparticipating policies, but the policies are also typically more expensive."

Our definition of a Participating Whole Life Insurance policy is a permanent life insurance contract that allows policy owners to share in insurer profits via potential yearly dividends. Participating whole life is almost always exclusively offered from mutual life insurers. Dividends can be received via numerous methods.

The Definition of Non Participating Insurance:

An easy definition of non participating whole life insurance could simply be any whole life insurance policy that does not pay policy dividends. The Free Dictionary defines it as a "life insurance policy in which the policyholder does not have the right to receive a portion of the investments that the insurance company makes with policyholders premiums." In essence any policy not paying dividends is likely a non participating whole contract.

Participating Life Insurance Carriers:

Who offers Participating Life Insurance policies? Generally most of the Mutual Insurers that offer Whole Life Policies will offer them. A partial list of Mutual Insures are below:

Ameritas

American National

Foresters

Guardian

Lafayette Life

Mass Mutual Insurance

Met Life

Minnesota Life

Mutual Trust

New York Life

Northwestern Mutual

Ohio National

Penn Mutual

Primerica

Savings Bank Life of MA (SBLI)

State Farm

Security Mutual

TIAA

Transamerica

Thrivent

Western and Southern

Are there more? Sure there are, however these are the largest and more than likely most well known. Not all of the insurers shown sell life insurance policies in all US States.

Non Participating Whole Life Insurance Carriers:

So who sells Non Participating life insurance policies? This is a more incomplete list, but a few carriers are listed below:

AllState

Assurity

Axa

Cincinnati Life

Farmers Insurance

Foresters Financial

John Hancock Life Insurance

Nationwide

Sagicore Life

USAA

A more simple way to determine if your proposed policy is to ask if they are a participating insurer. Most participating insurers tend to be proud of this distinction. Non Participating insurers do not tend to advertise it. There are benefits to buying a non participating policy in some select situations.

How Does Participating Life Insurance Work?

Par insurance policies work by allowing the insured to gain in some of the profits that are made by the insurer. The insured, will at some point in the first couple of years begin receiving dividends based off of the "cash value" in their policy. The "cash value" account is not the same as the total amount of money paid into the policy. During the first couple of years, almost no funds will be placed in the cash account typically. The initial lag time that it takes cash accounts within whole life insurance policies to become equal to the money paid in is one of the biggest issues with truly making a good return with whole life insurance.

Why do Participating whole life insurance policies build cash value so Slowly?

This is typically the most common question that people have with whole life insurance projections within guaranteed and assumed value charts. Participating permanent policies build cash value very slowly generally because most of the original first couple of premium payments are used to pay marketing and sales expenses. These marketing and sales expenses include commissions.

A somewhat typical permanent policy will not begin to acquire any money in the cash account for the first two or sometimes three years. From years four to seven often just a few dollars are deposited. Of course these statements are very generalized and it does depend on the actual contract.

A whole life insurance policy is not at all similar to a bank account. Bank accounts accrue money immediately upon deposit. WL does not. Always ask to see the guaranteed chart before agreeing to purchase any insurance contract.

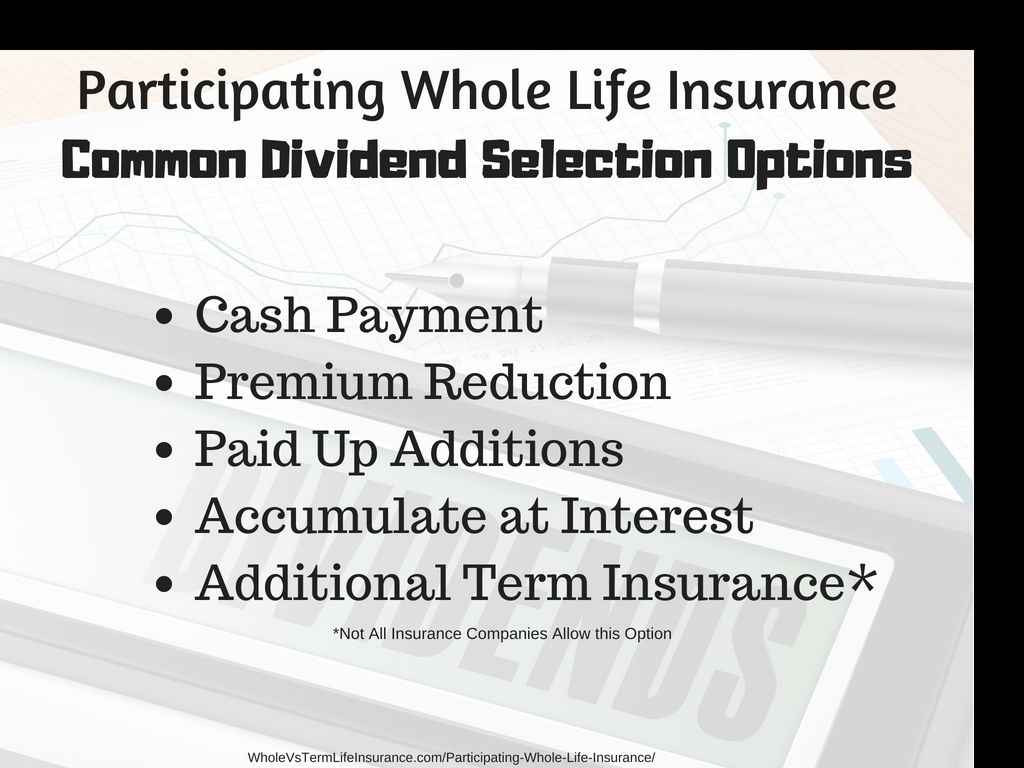

Dividends received may be used in one of four or five ways, depending on the policy form and language of the contract. The obvious first way is to receive the policy dividend as a cash payment which you may place in a standard checking account. A second way is to use the dividends to pay down your yearly (or monthly) premium payment. A third method of using your dividend is to keep the money in your policy and accrue more interest with it. A fourth method may be to use the money to purchase yet more whole life insurance, the so called paid up additions. Another option may allow you to purchase small amounts of term life insurance in yearly increments.

During many sales presentations of whole life insurance, agents demonstrate the incredible growth of said policy typically via the paid up additions method. However, this is not always the best course of action. With this suggested method, you will be constantly purchasing new life insurance with your dividends as you age.

If a Life Insurer is Not a Participating Life Insurer - What are they?

This question may sound simple but it is not. Whole life insurance policies that are not participating policies are called Non Participating Policies. However there is really no reason that these insurers need market these policies as such. In other words you may not not find the term "non participating" anywhere on the policy. It is participating policy insurers that will print and market this term more often.

Only money held in the cash account will accrue potential interest from dividends. In other words, the dividend calculation does not involve the total money paid into the whole life contract but from the money held in the cash account only.

- This is a very common misconception -

Non participating whole life policies have the benefit of typically being potentially lower in yearly cost. However they will not pay out a yearly dividend. This brings us to the question: Why Would Anyone Buy a Whole Life Insurance Policy that does not Pay Out a Dividend? The answer to this one, is hard to say. Other than the low price, I am not sure what the true benefits of non participating life insurance to be. My opinion is that many people buying non participating policies buy them because they are unaware of the par option.

Typical Participating Life Insurance Dividends:

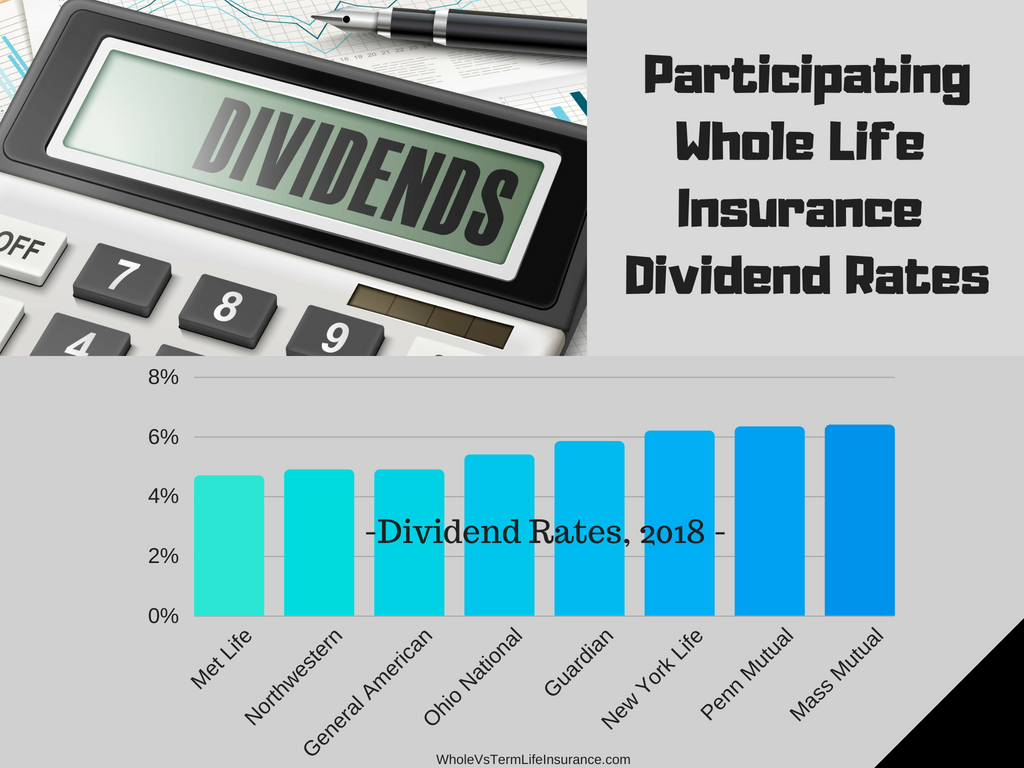

Typical Participating Life Insurance Dividends according to the Wall Street Journal in 2012, were paying "4% to 6% annual dividends." Furthermore these policies often had "guaranteed minimums of 2% to 4%."

According to a document from Mass Mutual, a top rated Mutual Insurer, they have paid Dividend Rates of 6.4% in 2018 and 6.7% in 2017. Mass Mutual had higher rates in 2016 (7.1%), 2015 (also 7.1%), 2014 (yet again 7.1%), and 2013 (7%.) Those are not the highest rates paid out. In 1985, 1986, and 1987 Mass Mutual paid out dividends of 12.2%. It should be noted that interest rates in those years were at a high level for all facets of our economy, so what might seem like a high payout was in reality not as high as you might imagine. The inflation rate in 1987 was about 4.4%.

There is not such thing as a typical participating policy dividend. Past history is no indicator of the future.

In fact the very first year that Mass Mutual provides detailed dividend payout percentage is 1980, which is an interesting year to start with. In 1980 the firm paid out a dividend rate of 8.27%, however the inflation rate in that year was an astounding 12.5% which had come down from 13.3% in 1979. Source.

Therefore this example demonstrates that in some rare instances participating whole life insurance paid out contract dividends below the inflation rate.

The lowest rate since the 1980 document moving forward on a dividends paid out are in this past year 2018 (6.4%.) This makes perfect sense given our low current rate of inflation and current extremely low federal funds rate. It should be noted that historical information of dividend payout from Mass Mutual is some of the easiest to find on the internet. They are also one of the highest, if not the highest dividend paying major life insurers on record. In 2018 many participating life insurers, paid in the high fours: General American (4.9%), Met Life (4.7%), and Northwestern Mutual (4.9%). Some paid out in the fives: Guardian (5.85%) and Ohio National (5.4%). Some participating life insurers paid out in the sixs: New York Life (6.2%), Penn Mutual (6.34%), and of course Mass Mutual which came in with 6.4%.

Of the largest and highest rated Participating Insurers, in our opinion, is Mass Mutual which seems to have consistently paid out the most dividends over the past ten years with Guardian having paid out the second highest average. Penn Mutual appears to have been the most consistent. This analysis is limited.

Dividend Selections:

Dividends are exclusive to Participating Life Insurers. Dividends are generally exclusive to Mutual Insurers. Dividends are generally the reason that whole life insurance is sold as a possible investment vehicle. Although I do not believe that whole life insurance is a true investment vehicle, it does serve as a pseudo investment in my opinion.

Each life insurance policy will have specifics about how exactly its dividends and policy works. Here are some basics of how this can work. Dividends can generally be used in one of four or five ways:

* Not All Insurance Companies offer this option.

Dividends are a good thing. Dividends are not truly guaranteed, typically. In fact if you read through their product literature a common policy will say as much. Even if insurers do or would claim that a dividend is guaranteed, that does not make it guaranteed in reality. What is really guaranteed in life? There is always the possibility of something out of this world happening.

You will want to speak with your agent and or insurer about your potential dividend choices. The five dividend options: Cash Payment, Premium Reduction, Paid up Additions, Accumulate Interest, and Additional Term Insurance may not be available from all insurers. Contact your insurance company to discuss details about your specific contract.

Historical Participating Life Dividends:

Historically speaking many of these A+ and A++ carriers have consistently paid out policy dividends. Northwestern Mutual has paid out dividends for 147 straight years.

Mass Mutual has paid out a dividend every year since 1869.

New York Life recently paid out its 164th straight yearly dividend.

Ohio National, in 2010 paid out it dividends for its 87th consecutive year.

However I would caution clients in assuming that just because a dividend has been paid out for hundreds years that it will remain that way until eternity. There is no reason that many storied insurers cannot go out of business.

One often not discussed requirement of dividends being paid out is the requirement that insured be considered in good standing with the insurer. In other words you have to pay your yearly premium bill every year, in full. Failure to maintain this good standing certainly will either lower or end your potential dividend.

Why should clients not count on them being paid out? Clients should not assume and depend on dividends being paid out for the same reason that clients should not assume that a bond payment will be paid, because it is possible that the insurer will fail to be able to make the payment. The reasons for this are quite numerous.

Participating Life Insurance Dividend Taxability:

Taxability refers to whether something can be taxed. As in, are dividends typically taxed by federal income tax? The best answer to this question is to ask your tax planner this question about your specific situation. However in general, dividends from participating whole life policies are considered a return of premium and often not taxed. However, blanket statements like this can be wrong. There are taxes other than federal income tax. There are situations where multiple parties are involved. There are situations where life insurance policies become deemed a Modified Endowment Contract.

Types of Taxes that 'Could' be involved with life insurance:

- Federal Income Tax

- Multiple State Income Taxes

- Federal Estate Tax

- State Estate Tax

- State Inheritance Tax

- Local Income / Local Inheritance Taxes

- Others

We list out the potential taxes involved to assist in your understanding that the comment that something is tax free, depends on which tax you are referring to. Buying a stick of gum could be a tax free purchase, that is income tax free when you purchase it. However that does not necessarily mean that buying that stick of gum is sales tax free.

There are numerous other situations such as court orders where I can imagine this simple answer is not correct. Therefore I hesitate to give the simple and assuming answer that is often repeated in numerous financial articles. The New York Department of Financial Services states: " Dividends generally are considered to be a "return of premium" and are not taxable as long as the dividends you have received do not exceed the premiums you have paid....state inheritance taxes and federal gift taxes may also apply to life insurance policies/proceeds under specific circumstances." They too, go on to suggest that you seek counsel from your tax professional.

Typically Dividends are considered a return of premium and are income tax free. There are, however, exceptions to this.

Consumers have to look long and hard to find detailed information about the taxabiliy of Dividends as there is little concrete information out there. From our research and professional experience here are the slightly more common reasons that a whole life dividend might somehow become federally taxable via income tax / capital gains tax:

- The Policy is owned by some other entity.

- The Policy becomes a modified endowment contract.

- The Dividends exceed the premiums paid in.

My guess is that there are more ways that these things can be taxed without even discussing the obvious elephant in the room: Current Tax Law. All of these statements are based on current US Federal Tax Law. In my view there is nothing to prevent the Congress and the President from changing these rules. If they were to change these rules does that mean that older policies would be grandfathered in? Perhaps or Perhaps Not. Some agents may claim that making this statement is fear mongering or worse. However when your time horizon in an 'investment' is irrevocably forever, such minor chance events need to be considered.

Direct vs Non Direct Recognition:

If you were going to skip just one section of this article, this may be the one to glance over, unless you are truly interested in buying a whole life insurance policy.

Direct Recognition Companies consider any loans taken out from a given insurance contract's cash value when paying out dividends. In non direct recognition whole life policies the insurer will NOT consider the loan amount. Contrary to numerous articles that you can find on the internet, neither is necessarily better as both have positives and negatives.

A simple example of the difference between Direct Recognition Vs Non Direct Recognition is thus:

Client has $100,000 in Cash Value with $20,000 in a Loan, Netting a $80,000 Recognized amount.

A Direct Recognition Contract might pay out a given Dividend of Say 4% on $80,000 or $3,200.

A Non Direct Recognition Contract might pay out the same Dividend 4% on $100,000 or $4,000.

This is, again, a simplistic example. The convoluted version is far more complex and nuanced. Although I do not have the statistics to back this up, I am of the belief that the Non Direct Recognition concept is unable to match (all other things being equal) the same dividend as the direct recognition concept. Therefore its unlikely that the Non Direct Recognition company would pay out the same 4% but a lower amount, perhaps 3.9%.

Why this is the case comes down to basic financial loan costs. Cash Value loans are not free of charge for insurers to issue. Although they typically do charge clients small costs for access to the funds, they are removing money for insurance purposes that more than likely could be put to better use than being loaned out to clients. The only way that this debate could get settled would be to peel open the books of a few major life insurers and ask certain what if questions. Alas this to my knowledge has never been done and hence a strong vehement debate rages in the whole life insurance agent's world.

A few companies that practice Direct Recognition include: Northwestern, Penn Mutual, Guardian.

A few companies that practice Non Direct Recognition include: Ohio National, New York Life, and Metlife.

Mass Mutual has both direct and non direct recognition programs.

For most general consumers simply understanding the difference between the two and being intelligent enough to ask the question of a future whole life insurer is the real important take away. Is this company a direct or non direct recognition whole life insurer?

Whole Life Insurance & the Financial Strength Rating:

A financial strength rating is an expert opinion provided by a rating agency of an insurer's ability to meet and pay claims. When shopping for any type of insurance it is advised to focus on the higher rated carriers. With permanent forms of insurance, such as dividend paying participating whole life insurance policies it is imperative that you work with the highest rated carriers.

In general, assuming your underwriting criteria, typically there is no reason to consider a whole life dividend paying account with a AM Best Financial Strength Rating (FSR) of less than A. This would include purchasing a policy through only the following AM Best FSR letter grades: A, A+, and A++.

A well versed financial strength rating may be able to assist you in ascertaining the financial worthiness of a given insurer and their ability to pay out dividends for the rest of your life.

"Checking the Financial Strength Rating of a Par Insurer is of Paramount Importance."

A couple of other best practices with regards to this are to check the financial strength rating history for ten plus years and to check the rating with another rating agency as well. Fitch Ratings, S&P, and Moodys are the other three rating agencies along with insurance specialist AM Best that provide these ratings. Lastly I see no benefit to relying solely on the agent or the insurer for this information. Attempt to check FSRs yourself independently online.

The full story of financial strength ratings is a bit more complicated. This site has numerous other articles about this important topic which is often not discussed by other insurance agencies. There are about three major ratings that go along with every insurer: The FSR, the ICR, and the Size Category. Leaning on just the FSR is probably not a great idea, however it is the most important consideration of the three. The ICR stands for Issuer Credit Rating.

The Secret Participating Policy Back Door:

If you are really interested in participating life insurance but cannot afford it, there is a hidden way to procure one. This may not be a secret, but it is not discussed nearly enough.

The simple solution to this problem is to choose your future participating insurer and purchase one of their convertible term policies. These policies may allow you to "convert" or "transfer" from one policy form (a term product) to another (a participating whole life contract) within a given period of time and sometimes with no further underwriting required. This last part is the key to the value of a convertible policy. Remember to ask and confirm that the policy requires no further underwriting. If this is available it can be a terrific potential solution.

Some firms charge a fee via an endorsement, for these types of term policies and others offer it for free. The general idea with this type of policy is that when you are younger making less money you choose the convertible term and at some later time when you are making more money you will then be able to pay the higher whole life prices. Assuming the cost difference between the regular term and convertible term are minimal there is no real harm if you never end up converting the contract at a later time.

Convertible term policies are a great back door entrance to participating whole life insurance policies.

Life Insurance State Guarantee Funds:

This is the part of the article where you ask, well What happens if my life insurer goes out of business?

First off, insurance companies in the United States are not allowed to just close their doors and go bankrupt. Second insurance companies are mostly regulated by the independent states. Third life insurers are required to pay into state guarantee funds and each states guarantee fund is different. State guarantee funds act as a sort of financial backstop to an impending disaster.

Each State Guarantee Fund has different potential Coverage Amounts.

State Guarantee Funds are not that similar to FDIC bank insurance. State guarantee funds typically will cover a larger amount of death benefit and much smaller amount (potentially) of cash value. As an example, California will provide "$250,000 in life insurance death benefits." Also " 80% of what the insurance company would owe under a policy or contract up to $100,000 in cash surrender values." Another additional and important footnote here: "A maximum of $250,000 for any one insured life no matter how many policies and contracts there were with the same company, even if the policies provided different types of coverages." I read this to mean in the state of California (only) you may be covered for up to 80% of $100,000 in cash value. That is not a lot of coverage.

Each state is different. You should be able to look up your state for details at NOLHGA.

Why Par Polices are a Good Thing:

Participating life contracts can be a good thing because they allow consumers to share in insurer's profits in a potentially tax free model. In general par policies are the preferred choice, assuming the client can afford the products, and are able to fulfill all of their other financial goals. All things being equal a participating policy is the best form of whole life insurance.

Conclusions about Participating Whole Life Insurance:

Participating whole life insurance is an incredible, yet expensive product. The ability to accrue yearly dividends after paying into a policy often takes about three years or more. These policies may be able to assist you in becoming wealthier, however not until years twenty or thirty of the contract. Understanding your dividend policy options and how the insurer calculates them should be paramount in your search.

No promise of guaranteed payouts should be assumed to be 100% accurate - there really is just no such thing as a guaranteed dividend. Care should be taken when shopping for par insurers by selecting intelligent and knowledgeable agents and diligently independently researching Financial Strength Ratings.

Many consumers that are approached by pushy insurance producers might be better served by a longer term term life insurance policy that is also far cheaper. Not all clients are best served by term insurance.

Questions about Participating Whole Life Insurance:

Question: You reference dividend paying whole life insurers not being able to pay out an amount over the inflation rate. Banks could not pay out that much either.

Answer: Generally you are correct. Bank Savings accounts were not able to beat the extreme inflation rate, according to our research, either. However the point is that these so called high dividend rates were not high at all, rather low.

Question: I am confused by your commentary, Do you suggest the purchase of a Par Policy or Not?

Answer: The selection of a par policy is not one to be taken lightly. I would only consider it if, you are filling up your savings in 401Ks, Roth IRAs, 529s, Building Up a six month short term reserve fund, paid off all debts including school debts, already have term insurance, and are paying down extra money into your mortgage each year. Only after that do I believe that WL policies can make much financial sense.

Question: You reference Mass Mutual a lot, but I prefer Northwestern Mutual:

Answer: Great, both Mass Mutual and Northwestern are excellent companies to consider.

Question: I was told that a whole life insurance policy could be used to pay for my kids college, which dividend selection is that?

Answer: I am sorry that you were told that. In theory this is possible, in practicality a 529 Savings account is far superior for this purpose. There is no specific dividend selection for paying for your child's college education from a Whole Life contract. The way that some people achieve this is to take a loan out from your own policy.

Question: What is the best dividend option?

Answer: This is a difficult question because it requires a detailed discussion with the client. For a small percentage of consumers, buying additional whole life insurance may make the most sense, however for many I believe that receiving the income tax free check may be the best option.

Question: Who are the largest and most well known of the mutual dividend paying insurers?

Answer: I would say the largest and most well known par insurers are: New York Life, Mass Mutual, Northwestern Mutual, Guardian, State Farm, Penn Mutual, and TIAA.

Question: If an insurer such as Mass Mutual or New York Life has paid out dividends for a hundred years or more doesn't that mean it will definitely continue as such?

Answer: No, it does not.

Question: Why don't many par policies pay out a dividend in the first year?

Answer: Participating policies pay out dividends based on the money that is in the 'cash' account, not the total money paid in. Therefore since no money is typically added to a par policy cash account in the first year and sometimes the first two or three years, no dividend is received.

Question: How Long will it take before my participating insurer starts paying me dividends on my policy?

Answer: The only place you will find the answer to this in the guaranteed chart from the proposed or current life insurer. In other words it depends on the contract. Often it is around year three that a small amount of dividend cents begin to become realized.

Question: Since I am sharing in the profits how can I lose out when I am buying one of these policies?

Answer: Simple you can lose out if you purchase the policy and fail to pay the required premium payments.

Question: Why should I worry about the Financial Strength Rating when there is a State Guarantee Fund?

Answer: You should not depend on the state guarantee fund for numerous reasons. First off the coverage from many state funds is not great. Second the process for you receiving your money can be unknown and could be laborious. Third, if an insurer starts to have issues, certainly it will lower their dividend rate and potentially have no dividend payment. There are numerous other reasons.

Question: I cannot afford a participating policy for the death benefit that I need, what should I do?

Answer: Easy - buy a term life insurance policy for a nice long length, perhaps thirty years. Consider a convertible version. Term policies often allow clients to be ten, twelve, even fifteen times the amount of coverage for the same premium yearly cost. This is a big reason term is so popular.

Thank you for reading our article. Should you have any questions, please feel free to ask them in the comment box or email us directly.

Speak with an experienced advisor!

Speak with an experienced advisor!