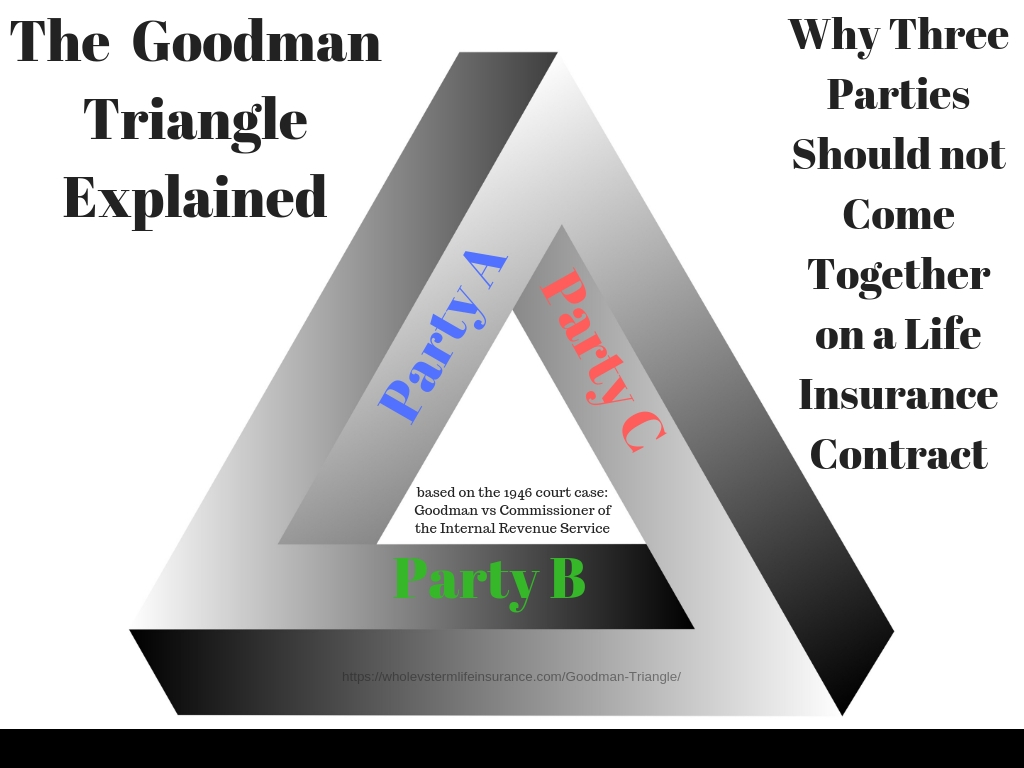

The Goodman Triangle, occasionally referred to as the Unholy Trinity, is a financial concept surrounding the potential taxation of benefits on life insurance contracts. The name stems from a 1946 case, Goodman Vs The Commissioner of the Internal Revenue Service, which clarified guidelines for the best quantity (and type) of parties allowed on life insurance contracts that would still allow for an Estate Tax Free Death Benefit. This seminal case still serves as the classic example of What Not to Do with Life Insurance Creation.

Life Insurance is Tax Free:

The statement that Life Insurance is tax free can be found all over the internet and on the lips of insurance agents. Sad as it is to say, this statement is massively over simplified and is often wrong. A more accurate statement might be that the death benefit associated with life insurance is income tax free, often. That statement may be accurate. Life Insurance may also often be estate tax free, when properly set up. That statement also may be accurate.

However, there are instances with the tax benefit will not actually be federally income or estate tax free. The most common example involves the so called Goodman Triangle with the Estate Tax. The term unholy trinity is also used, which we dislike. If you are unfamiliar with the various types and kinds of taxes, please view this article about the Tax Treatment of Dividends from Participating Insurance.

The so called Goodman Triangle represents just one of numerous tax traps that exist with life insurance policy creation. There are others (such as the MEC), however this is probably the most common.

The issue of the Goodman Triangle may matter less today (for some) than just twenty or so years ago due to the increased Federal Estate Tax limits. According to Forbes: "2018 federal estate and gift tax limit is $11,180,000." Also of note "the annual gift exclusion amount is $15,000 for 2018."

"This eponymous case is a simple study in what not to do with life insurance policies."

What is the Goodman Triangle?

Court Case: 156 F.2d 218 from the US Court of Appeals, Second Circuit, dated June 20th 1946. In this case the defendant, Mrs Goodman transferred several life insurance policies into a Revocable Trust. The beneficiaries of the trust were her children AND sister in law. In 1939 her husband died. The trust then became an irrevocable trust. The total amount of coverage from the life insurance contracts was $503,314.15.

The court was asked to rule on the form and value of the "gift tax": "The sole question presented by this petition for review of a decision of the Tax Court of the United States is the value for gift tax purposes of certain policies of insurance taken out by the taxpayer on the life of her husband." Therefore once the trust became irrevocable, it can be seen as another 'new' entity.

The court decided against her. Judge Smith declared: "The gift tax applicable to the year 1939 is imposed by the Revenue Act of 1932 as amended." The defendant was forced to pay gift tax on the entire insurance death benefit and not the past insurance premiums paid. In other words - was the gift tax to be paid each year the yearly premiums were paid - or when her husband died netting the full insurance death benefit coverage amounts? This came at a great cost.

This eponymous case is a simple study in what NOT to do with life insurance policies.

For those that are buying simple term insurance plans, it might be general good advice to just stick to keeping the insured and policyowner as one and the same person on the contract. For those that are purchasing more expensive and complicated whole life insurance policies this should serve as a reminder that often your best defense is a good lawyer.

The Goodman Triangle without the Trusts:

The presence of the trust(s) in this case further makes this situation more complex than it needs to be in order to understand it. Essentially what happened is that the wife owned the policy on the husbands life. The policy paid out equally to four people. Three of which were her children. If you remove the trusts for simplicity, then There were three different parties to this Goodman case: 1. The Husband (Insured) 2. The Wife (Policy Owner) and 3. The Three Children and Sister in Law (Beneficiaries.) This is a clear modern violation of what is now known as the Goodman Triangle.

When setting up life insurance policies, lawyers, accountants, and informed insurance agents seek to avoid this classic Goodman mistake.

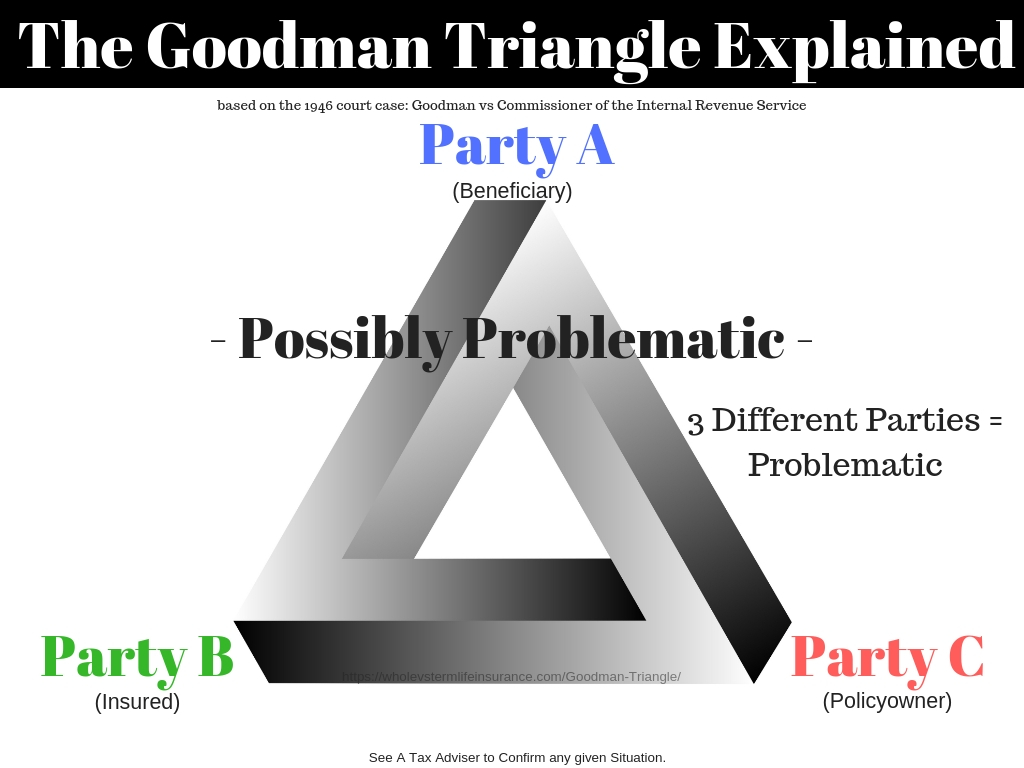

The Goodman Triangle Graphically Explained:

Below is a graphic of what Not to do with when setting up life insurance contracts:

In the above graphic, three different people are involved. And it is often possible that the IRS will view this arrangement as being in violation of the Goodman Triangle. This could force you and / or your loved ones to pay heavily, when it comes time for taxes.

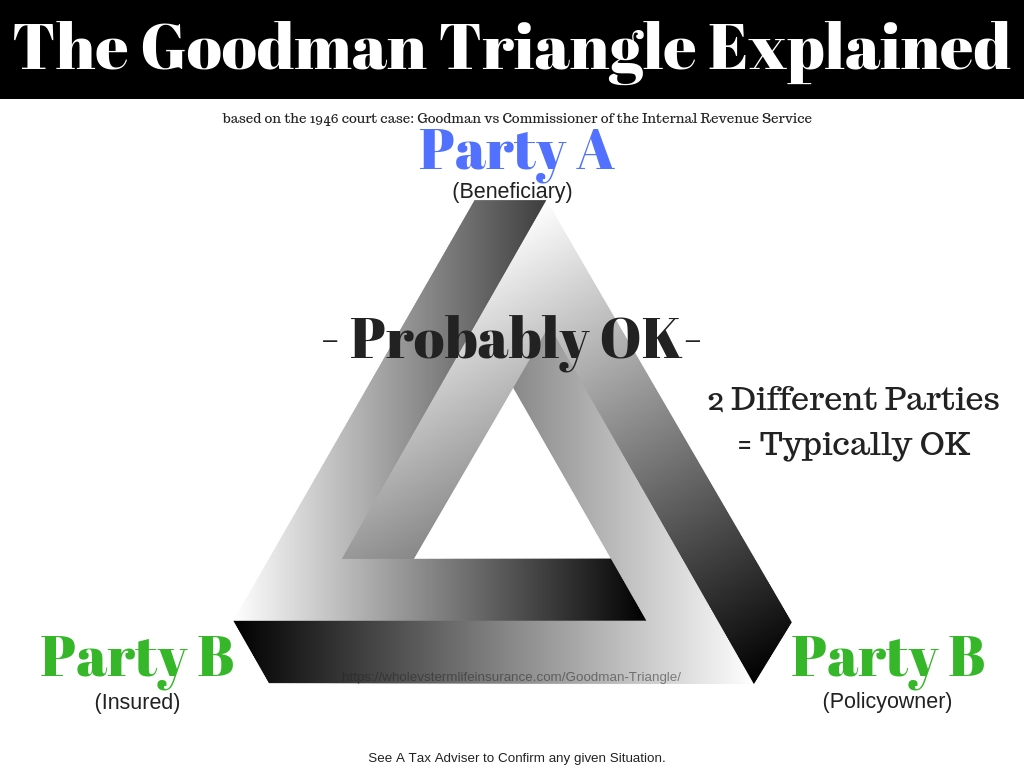

Below is a graphic of a Better Plan to Potentially Avoid the Goodman Triangle:

In the above graphic you can see that only two parties are now involved. This both simplifies the situation and clears up (potentially) the Goodman triangle issue. By having only two parties thus the Goodman tax triangle can be avoided and hence removed.

The Goodman Triangle-A Question of Trusts:

If you read the further details about this case you will likely focus on the Trust aspect of it. My advice on life insurance trusts has always always remained the same: Speak with a Lawyer and Do Not Do it Yourself.

The focus of this article is on people that have life insurance in individual's names. People that do not have a trust or cannot afford a trust.

For the these people that have a trust, the simple and best advice I can give you is - don't depend on any article on the internet for tax advice. Call and speak with your attorney about the best practice for your life insurance policies. Specifically who should be the beneficiary?

If you doubt this advice just realize that part of the issue with the original Goodman case involves a Trust that transferred into an irrevocable version of a different entity. Also know that the word Trust is often used on the internet, but it has perhaps hundreds of definitions. There really is No one type of trust, rather dozens.

How to Check if the Goodman Triangle may be an Issue for your Life Insurance Contract:

This is the obvious conclusion to this article. Are my depends going to get hit with a massive tax bill? How can I avoid the Goodman Triangle? If you already have a trust established, contact your attorney and ask them. However if you do not, you may consider the following:

Checking on Potential Goodman Triangle Issues for Current Policies:

How to Check if the Goodman Triangle may be an Issue for your Life Insurance Contract:

Doing all of this will not necessarily mean that you can not get hit by this tax trip.

Even if you do all of these things - its always possible that you could still get caught. After all the tax laws do change. In general the best that we can all hope for is a good setup.

Proper Set Up of Life Insurance Policies in order to Avoid Goodman:

Doing all of this will not necessarily mean that you can not get hit by this tax trip.

Does the Goodman Case Apply More to Whole Life or Term Life:

The Goodman case applies to both. In fact it applies to all life insurance contracts. For term policies, since they are rarely paid out, due to their very nature, it could be argued that this case matter less. However that will not be the case in the event of a death and payout of the face amount of a thirty year term policy.

Since whole life insurance policies are set up to pay (in theory no matter what) It could be argued that the Goodman case is all the more important. With permanent policies there is also the additional matter of the cash account / participating dividends. Conceptually speaking, this can make your considerations more complex and nuanced. For those that are considering buying large million dollar whole life contracts setting up a form of a trust, sometimes known as a life insurance Trust (OR ILIT) could in theory be your best bet. I advise you to speak with an attorney at this point before even considering doing this or NOT doing this.

Does the Goodman Triangle Still Matter with the new Higher Federal Gift Tax Limits? Well, it probably matters less than it once did, but... there are still state estate and inheritance taxes. Also as we have all seen the Federal Gift tax limit has constantly been changing. One important note is that if you are buying a whole life insurance policy at age 40, the final end death benefit might not come for 40, 50, or even 60 years. Doesn't it make sense to plan (as best as you can) with what we know today? Laws can change.

The Goodman Triangle from a Modern Perspective:

The presence of a Goodman triangle tax trap is not the end of the world. It will not mean that you are in violation of some law. Likely you will need only to pay more in tax. Its possible that it will not be an issue based on your overall financial situation. For Insurance Agents, it can easily erode the basic selling tenets that life insurance is tax free. Well, Life Insurance Can be Income and Estate Tax Free, (but not necessarily.)

See Also: Estate of Goodman v Commissioner of Internal Revenue, Google Books, Cornell Law.

Speak with an experienced advisor!

Speak with an experienced advisor!