How Much Life Insurance Do I Need?

Determining how much life insurance that you and your family need is important. Truth be told there is no simple way to determine this. It is a cross between what you can afford and what you really could use. In this short article we will share with you some ideas, concepts, and provide you with copious examples of how you can begin to answer this vital financial question.

Depending on your Situation...

Many articles on the internet try to suggest that you merely need a calculator to determine how much life insurance that you need. Calculators may be helpful and methods of insurance requirement calculations more helpful, however they often fail to take into account the life stage that you are in. Our article How Much Life Insurance Do I Need focuses on the basics first and then goes into various different life stages and proposes different life insurance solutions for each of our candidates. Find out which life stage you are in and what others have done about it. Keep in mind that the average American lives till about age 78. However accidents happen and this is the true purpose of life insurance.

Start with your Budget:

Buying any form of insurance that you cannot afford, probably does not make sense. It may mean that you should either not own the item that you are insuring in the case of property insurance or that perhaps you will not be able to insure the very item. In the case of insuring our lives, this is more complicated.

Yearly, Monthly whichever form of budgeting method that you use, it is always a great place to start. Don't buy any form of life insurance that you will not be easily be able to pay. Missing just one yearly payment will typically end the policy. You do not want this. How Much Life Insurance Do I Need? Well you may need lots but if you can't afford it...its typically a bad idea to buy it.

"Only Buy the Life Insurance You Can Afford."

Stick with Term:

This website has dedicated to itself to assisting consumers in finding the optimal type of life insurance and in general term wins hands down for most people. Yes, there are scenarios when whole life is a better bet. And yes, most insurance agents will insist that whole is a better value. However you can usually either buy a whole life insurance policy at a later time or potentially convert an existing term policy to whole life if you are truly interested. Therefore based off a of a budgeting consideration I rarely find that a whole life policy makes more sense.

"You will almost always get more life insurance for your money with a level term policy."

Ask Around:

Many people believe that one of the best ways to decide how much term insurance to buy is to 'Ask Around.' This is essentially just like it sounds - ask your friends and neighbors how much life insurance that they have. Similar to following lemmings off a cliff the idea is to buy the life insurance coverage amounts most common in the area that you live. However unlike those little animals you will discuss these proposed amounts before committing to an exact amount with a good insurance agent.

Asking around is in an of itself not a bad idea, however depending on this so called method for an important financial number is not suggested as the complete methodology. Though it is worth noting as a starting point on your life insurance journey.

"Ask what you friends have, but do not solely base your decision on this."

How Much Life Insurance Do I Need, Calculation Methods:

There are numerous ways for consumers to determine either generally or precisely how much life insurance that they need. In this article we will review two main methods: the Simple and Imprecise Ten Times Method and the Complex and Detailed Needs Based Financial Analysis.

Ten Times Earnings METHOD FOR DETERMINING LIFE INSURANCE COVERAGE AMOUNTs:

There are many different iterations of this method. The basic idea is to take ten times your yearly earnings and purchase that much in life insurance. If, for example you make $50,000 per year this could warrant a $500,000 life insurance policy. Other iterations that you will see on the internet change the multiple from anywhere from 8 to 12 times earnings. However, professionally I still like ten times, and I like it for both spouses. Since term insurance is so inexpensive for many people, I cannot see why you would not strive to purchase ten times your yearly salary.

One note to this method. After doing the simple calculation and getting a few quotes you will want to buffer these costs against your budget and what you can afford. When in doubt, shoot for what you can easily afford.

An Example: Income of $40,000 - Ten Times Earnings Would be $400,000

The Detailed Needs Based Financial Analysis METHOD FOR DETERMINING LIFE INSURANCE COVERAGE AMOUNTs:

If the name of this sound complicated, wait until you complete your actual calculations. The idea behind this method is to insure what only that which needs to be insured and not to waste your insurance dollars. If you have no net worth, this method may not be worth your time.

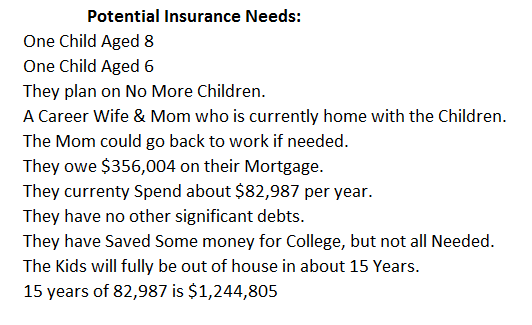

Step 1: Discover What your True Insurance Needs Are

Why are you buying life insurance? Is it to pay off your mortgage or get your kids out of the house and threw college? In case of buying a term policy to pay off the mortgage the coverage amount needed likely may be printed on your mortgage statement. However calculating how much it takes to get the kids out of the house and threw college can be difficult at best.

The basic idea in this step is to assess how you would use the life insurance money and combine it into one sub total. In our example to the left, we are using the life insurance to replace lost income for 15 years worth of time until the time that the youngest child is out of the house. They spend about $83,000 per year and have a $350,000 mortgage.

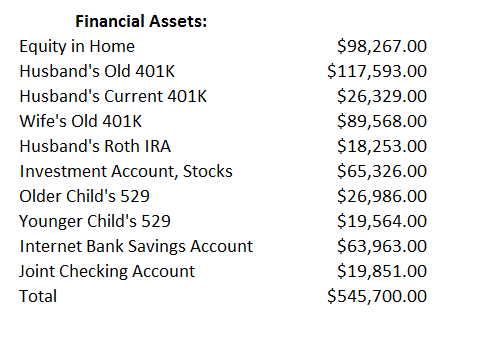

Step 2: Calculate What your Financial Reserves Are

First off, you will want to assess your overall financial situation and confirm that in general your total assets are going up year over year and not down. If your assets are going down then this analysis will limited value,

To calculate your financial needs - you will want to list out every major financial account you have on a spreadsheet and add it all up for a complete total.

In the above example we have listed out all of the major assets of one family, including retirement accounts. It should be noted that their retirement accounts constitute about 46% of their net worth while their college savings account constitute just 8.5%. This leaves them with $149,000 or 27% of their monies that would be able to be used in short and mid term savings needs.

There is a significant debate on if you should utilize any retirement funds in this part of the calculation method. This is partially dependent on why you are buying the life insurance as its possible that you may wish to exclude these from the calculation. However, to a limited extent I do believe that you should add retirement funds into this calculation but at the same time, consider what percentage of your funds are tied up in these funds and hence not available for shorter and mid term needs.

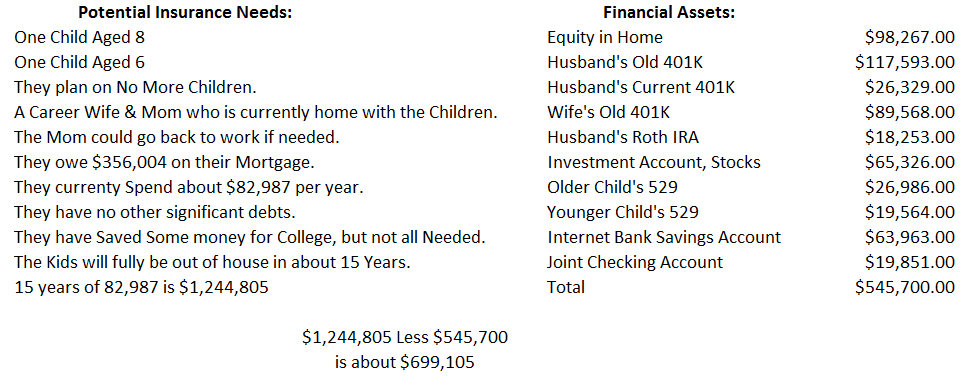

Step 3: Compare your True Insurance Needs vs Your Financial Reserves

Comparing Step 1 vs Step 2 should easily reveal how much life insurance your family could consider.

In our above example we see that this family has a total need of about $1.244 MM in funding to get their children through college. We assume that this is their life insurance funding goal. These funding needs are going down each and every year. They presently have about $545K in financial assets and those are assets are growing each and every year.

Therefore when we subtract out their current financial assets from their future financial needs we see a shortfall of about $700,000. In answering the question "How Much Life Insurance Do I Need" - this family might need a $700,000 15 year term life insurance policy.

There are numerous issues with this last method. First off, it attempts fully calculate your situation, but no analysis truly can. Second, some financial professionals may suggest that rather than focus on the short term needs of getting your youngest child through college you should instead focus on getting your children through college and the surviving spouse through retirement.

An important side note here: There are numerous different versions of this life insurance calculation method. This one being what I would call the happy medium method. You can certainly get more in depth and go into far more budgeting if you wish. A word of caution though is that the need for life insurance is a moving target. Really the moment that you calculate it - it changes.

Please Do Not Get Lost in these Methods, when in Doubt Shoot for ten times what you Make.

From here we move onto classic examples of how much life insurance American consumers need.

How Much Life Insurance- Young Child:

How Much Life Insurance Does a Young Child Need?

As a general rule of thumb, most children do not need life insurance. I could professionally suggest certain exceptions to this rule when specific children are earning real money such as child actors, but in general there is no need for it. The purpose of life insurance is to replace lost income in the event of an early death and if your child is not earning an income there is no financial need.

For those consumers that just have to have life insurance for your children, than I suggest a tiny amount be added onto a current policy via a rider. Perhaps $25,000 or less.

Children Typically Need No Life Insurance.

An Example: The Smith Family chose not to purchase life insurance for their boy Lucas instead opting to increase their own term policies by $100,000 a piece.

How Much Life Insurance - Older Child:

How Much Life Insurance Does a Young Child Need?

This answer is much the same, most children just do not need life insurance, whole. term or otherwise. Until a consumer hits the age of 18 or 20, I can't fine a good reason for kids to have life insurance. However if you must have a policy for your children, choose a a low inexpensive amount in the same manner as above.

The only remotely good reason that I am aware of for insuring children's lives is because it allows the surviving parents to take some time off of work to grieve.

Children Typically Need No Life Insurance.

An Example: The Lee Family chose to add their child Brandon on as a Child Rider to their Whole Life Insurance Policy through New York Life. These also both added small term policies through Protective Life Insurance.

How Much Life Insurance - College Student:

How Much Life Insurance Does a College Student Need?

The question of if college students need life insurance is an interesting one. Assuming that the "student" does not have any dependents I do not see much of a need. However, since most college students are beyond the age of 18, its possible that they can qualify for true adult policies. Therefore in certain rare situations when grandparents or parents wish to pay for them to get a long term (30) term life insurance policy or even a simple participating whole life policy it could be a consideration.

That all being said, college students generally do NOT need life insurance. Since most college students do not tend to generate any true real income the quantity of life insurance they would get would be quite low to nothing.

Low to Nothing.

An Example: Norman, a college student decided not to buy life insurance until he got his first job. Both of his surviving grandparents were not interested in funding a life policy for him. For him the cost was a put off in his determination.

How Much Life Insurance - 25 Year Old:

How Much Life Insurance Does a Twenty Five Year Old Need?

You are twenty five, out of college, and /or in your first job, should you buy life insurance? Perhaps now is the time, or perhaps you can wait a bit longer. Term life insurance for 25 year olds is typically dirt cheap because you are so young and healthy, therefore it is often advised that as soon as clients begin making plans to have a family that they begin to buy at least their first term policy.

If a given twenty five year old is adamant about starting a family a good amount of life insurance at least to start might be a small affordable five times earning amount with the understanding that you could get more when you have children.

Low to Five Times Yearly Earnings.

An Example: Karen, a stenographer with her first job as a law clerk, decided to buy a $100,000 in term life insurance through Banner Life Insurance. Being young and in good health she qualified for Preferred Plus pricing. She will purchase another life insurance policy at a later time.

How Much Life Insurance - 30 Year Old:

How Much Life Insurance Does a Thirty Year Old Need?

At age thirty, assuming you are planning on a family or have some other financial need for life insurance - most Americans should be considering a simple term life insurance policy. A level term policy will be very inexpensive at this age and given the typical increase in earnings it might be the optimum financial moment to go ahead and purchase your lifetime policy. After all a thirty year term policy will last until age sixty if you buy it at age sixty.

If a thirty year old is planning on not having children and or a family you may want to read up on some of the other case scenarios.

Ten Times Yearly Earnings.

An Example: Bryan an urban planner in New York, just purchased a $500,000 policy through Protective Insurance. He has a minor health issue but still qualified for preferred pricing. He plans on moving to a smaller city to get married one day and believes that this may be all the life insurance that he ever needs.

How Much Life Insurance - Newlywed Bride:

How Much Life Insurance Does a Newlywed Bride Need?

Your getting married, Best Wishes! Now is the time to get your financial order in good form. Generally reserved for after the wedding and honeymoon making long term financial plans make good sense. If you have put off buying term insurance, now that you are married and assuming you are planning on having children, you should now get term insurance. Even though you do not yet have children there is still value in naming your spouse as your beneficiary.

If you are not planning on having children, check the section below: How Much Life Insurance DINKS.

Ten Times Yearly Earnings.

An Example: Karen, a bride, decided to buy a convertible term life insurance policy before her wedding, she just could not help herself. She opted for a convertible Ohio National policy of $600,000. This may allow her to convert it to a whole life insurance policy at another time. Karen absolutely is planning on having children.

How Much Life Insurance - Newlywed Groom:

How Much Life Insurance Does a Newlywed Groom Need?

Your getting married, Congratulations! Just as with your new spouse above, consider sitting down after your honeymoon to review your situation. Assuming you too are planning on having children aim for ten times your earnings, for you and your spouse. Yes, you both need your own spouse listing each other as the beneficiaries.

Is there a difference between how much life insurance the Groom needs vs the Bride? No, not at least based on their sex. There is typically a difference based on their income.

Ten Times Yearly Earnings.

An Example: Timy, Karen's Groom already had a $500,000 whole life insurance policy through Northwestern Mutual. He is planning on purchasing another $500,000 life insurance policy, but wants to make it a twenty or twenty fiver year term policy as he thinks they are far cheaper. He plans to do this when they get back from the honeymoon.

How Much Life Insurance - DINKs:

How Much Life Insurance Does a Double Income No Kids Man or Woman Need?

DINKS stands for Double Income No Kids and it refers to married couples that do not have (or plan on having) children. This is a growing trend in American society. The simple answer is that if you both work and earn a good wage and you have saved money, you might not need a term policy. However there is argument that can make for buying a small policy, relative to others with kids, just to potentially allow your spouse some breathing room in the event of a tragedy.

Therefore the argument about having term insurance for people with both kids really can go either way and there is no hard answer to this one.

Nothing to Five Times Yearly Earnings.

An Example: Sarah a single female living in Los Angeles, is loath to start a family. She is 38 years old and has chosen not to purchase any term products after meeting with her financial adviser.

How Much Life Insurance - Single Working Dad:

How Much Life Insurance Does a Single Working Dad Need?

If you have children that depend on you - Voila - you need life insurance. The fact that you are married changes very little. Get a term policy. Work with any other parents or caregivers in the children's lives to figure out the beneficiary situation. Working Single Dads need life insurance. Please do not allow your married status to deter you from completing this vital task.

Ten Times Yearly Earnings.

An Example: John, a construction worker is single with two children, one fifteen and one eight. Due to the dangerous nature of his job, he had to pay more for life insurance and ended up opting for a $150,000 ten year policy through Prudential.

How Much Life Insurance - Single Working Mom:

How Much Life Insurance Does a Single Working Mom Need?

Working Single Moms need life insurance too, just like working single dads. If you have children that depend on you in any financial or other way than you should have a simple term contract. Coordinate with the other important adult in your child's lives to discuss possible beneficiaries. Just because you are single does not mean that you should have a good safety net for your family.

Ten Times Yearly Earnings.

An Example: Joan, a single mom of one, says that the father is "not really in the picture." She has a good job that provides a wopping $160,000 in life insurance, so she opted for another $500,000 in 20 year term life from Mutual of Omaha. She does not want to depend on her job for all of her life insurance needs as she is slightly worried the company will go out of business.

How Much Life Insurance - Working Mom:

How Much Life Insurance Does a Working Mom Need?

The working mom who is married to a working dad - needs her own life insurance policy. She should shoot for ten times her yearly earnings. If you have more than two kids, read below, but you probably should consider the needs based analysis. Both working moms and working dads need term.

Ten Times Yearly Earnings.

An Example: Aaliyah works as a corporate consultant in Atlanta and has one child. Her husband works and has his own life insurance policy and Aaliyah opted for a thirty year term policy from AIG.

How Much Life Insurance - Dad with 2 Kids:

How Much Life Insurance Does a Working Dad with Two Kids Need?

The working Dad with two kids needs, you guessed it, around ten times yearly earnings. The either working or non working mom needs a term policy as well. When you have two children you will want to assess if you plan on having any more children at some later time. If you are planning on more a more thorough deep financial analysis may be required. Working Dads with two kids need term insurance.

Ten Times Yearly Earnings or Do a Needs Based Analysis.

An Example: Phil is the sole provider of his family and he is a physician. He has one times earnings life insurance through work and purchased a $1,500,000 twenty year term life insurance policy through SBLI.

How Much Life Insurance - Stay at Home Mom:

How Much Life Insurance Does a Stay a Home Mom Need?

First off, you need life insurance. Both Stay at Home Moms and Stay at Home Dads need term. What is more complex with homemakers is how much coverage to shoot for. This is not simple. The easiest way to do this is to shoot for five times your working spouses earnings. There are multiple reasons to shoot for this. A more complex method would involve a needs based analysis analyzing how much it would cost to replace all the work that you do. This would include costs to hire a nanny (perhaps 2), a driver, a cook, personal shopper, etc. Often this analysis though can lead you to the high conclusion.

Five Times Spouses Yearly Earnings Or Perhaps More.

An Example: Judy is Phil's wife and provides a real value to her family and three children. Although Phil has over one million dollars in life insurance, Judy secures a $500,000 thirty year term policy of her own through home insurer: State Farm. Although the product costed more, she knows her agent very well and decided to give him the business.

How Much Life Insurance - Dad with 4 Kids:

How Much Life Insurance Does a Dad with Four Children Need?

Once your family grows beyond two children, I fail to see how a life insurance short hand calculation will work. A working dad (or mom) really will have to sit down and run the numbers. And yes, you need life insurance if you have four children, in fact you really need it. You need life insurance when you have just one child, let alone four.

The difficulty in this situation is determining how much exactly is needed. With an eye towards what you can afford, its possible that a calculation will come back with quite a large number. You may have to get a lower policy than the required coverage amount just so that you can afford it.

A Life Insurance Needs Based Analysis is Required.

An Example: John is an attorney in Chicago and is extremely busy. His law firm has a small life insurance policy for him, and he also opted to take out a $1,200,000 thirty year term policy from the Principal. He has a few minor health issues and had to spend more than he would have liked to. He settled on a slightly lower amount of coverage to save money.

How Much Life Insurance - Mom with 5 Children:

How Much Life Insurance Does a Mom with Five Children Need?

Wow, five kids - congrats! When families grow to this size it is not uncommon to not be able to afford all of the life insurance required. Your first step should be to consider your budget, how much can you afford per month? Next complete a needs based analysis, shown above. Now pick a number that is affordable yet that serves to at least begin to protect your family. Remember with five kids, each year you will be dramatically knocking off expenses and lowering the need for life insurance.

It may be the case that you can flat out not afford what is needed. My simple advice in this situation is to at least get something, even a very small amount. Generally any term policy is better than none in this situation.

A Life Insurance Needs Based Analysis is Required.

An Example: Susan a busy working mom of Five lives in suburban Detroit. She needs over $1,000,000 in term coverage but she and her husband just cannot afford it. She opts for a $600,000 Banner Term Life Insurance product for twenty years.

How Much Life Insurance - Latter Career Professional:

How Much Life Insurance Does a Latter Career Professional Need?

When you approach age sixty and the end of your working career comes into sight, often the need for life insurance will start to go away. However this may not be the case. This situation can be the most tricky in terms of general suggestions. The answer to the question is found in the combination of answer to several questions:

Do you still have children that depend on you?

Is your financial situation in a general bad condition?

Will you have a pension that requires you to be alive for you to receive your paycheck.

If any of these answers are yes, than the need for a term policy may still be evident and you probably should consider having one. However,

Suggestions as to what type of life policy to have include: upgrading what is offered at your place or employment, sticking with any residual term life that you currently have, or purchasing a small ten year term policy.

A Life Insurance Needs Based Analysis is Required.

An Example: Stu a successful businessman still has a twelve year old daughter at home. He needs a life insurance policy to get her to colleges and opts for a ten year Protective policy in the amount of $400,000. He other term policy, a twenty year from North American only has eight years left on it.

How Much Life Insurance - Newly Retired Person:

How Much Life Insurance Does a Newly Retired Person Need?

For Americans that are newly retired, the need for life insurance should be dramatically decreased. The best uses of life insurance during retirement are few and far between. If you have a well funded whole life insurance policy, I would typically suggest that you keep that going. However paying for other forms of life insurance while you are retired is not optimal.

A couple of reasons that you may want to keep a life insurance policy in place during retirement include:

- As a pension backstop. An example of this may be a pension that goes away or is dramatically reduced after the death of the pensioner leaving the surviving spouse with little or no income.

- To assist in paying off a small mortgage.

- If you cannot afford your final expenses, such as burial expenses - a final expense life insurance policy may be necessary.

As with all people of advanced age, if you still have a residual life insurance policy, whole, term or otherwise, in place it is generally advised to keep it in place.

A Life Insurance Needs Based Analysis is Required.

An Example: Alfred just retired three months ago and doesn't think he needs an insurance policy. However after calling the company that issues his pension check discovers that if something were to happen to him his wife would only receive have his monthly amount. He opts for a $100,000 ten year term life insurance product through Foresters. The product is competitive but life insurance is seniors is more expensive than he is happy with.

How Much Life Insurance Latter Retired Person:

How Much Life Insurance Does a Latter Retired Person Need?

We have split the retired candidates here into two different categories, younger / newly retired vs an older retired person. Does an Older Retired Person Need Life Insurance? Hopefully not - but possibly.

Latter retired individuals should generally not be out shopping for life insurance, except if they have no money in order to pay for burial services and need a final expense policy.

If you already have an insurance policy in place, it is almost always advised to keep it in place if you can afford it.

There are still a few acceptable uses of life insurance during retirement:

- A final expense policy as previously stated.

- As a pensioner backstop in case the pension recipient dies and the surviving spouse is left with nothing.

- Possibly to be used as a backstop for a small mortgage. Although this probably will not make good fiscal sense.

In general life insurance purchases will hopefully not be required during the end of your retirement.

Typically Retired People do not Require Life Insurance.

An Example: Earl has been retired for nine years and gets a sales call urging him to buy life insurance, he hangs up knowing that he has no need for it. Besides, he knows from his neighbor that it is super expensive at his age eighty four. He has diligently saved his money and has a net worth of $3,200,000 and has no mortgage on his house and has over $15,000 coming in every month in pension, 401K receipts, and other investments.

How Much Life Insurance - Not Getting Married and Never Having Children:

How Much Life Insurance Does a Man or Woman that is not going to get married and is not going to have children Need?

Much of this article has been focused on people that have families. Either spouse or children, but family that depends on them in one form or another. However not everyone gets married and not everyone has children. Statistics show that households without children in them have been steadily rising for decades. The current levels are more than twice what they were thirty years ago. Reasoning aside, if you do not plan on getting married or having children you might very well not need life insurance.

The concept of not getting life insurance because you are planning on a family has one issue with it though: For some, your plans could change. Most obviously you could change your mind. Or, conditions could change. Obviously there is a point in all of our adult lives when it becomes all but impossible to rear children. If you are steadfast in your desire not to have a family then life insurance could be something that you do not procure.

Some savvy personal financial planners might suggest securing a small policy that you can drop at a pre determined point if it ends up not being needed.

None to Five Times Earnings.

An Example: Kala, forty, is not married and if it is up to her she will never do so. She has saved her money but wants to quit her job one day and travel the world. Since she has no need for life insurance she decides against buying it.

How Much Life Insurance - Broke and Unemployed:

How Much Life Insurance Does a Broke Person Need?

Almost completely regardless of how much life insurance a totally broke person needs, if they cannot afford a term policy than likely they should not buy one. It makes little sense to buy life insurance if you do not have a job and have no savings. All you will be doing is wasting your time.

A sensible solution would be to work to get your financial situation back on track and get a job, only after that time could you consider a very low cost term policy.

Do not buy life insurance if you are broke and unemployed.

An Example: Lauren, twenty eight, just lost her second job this year and is couch surfing at a friends house. She has no real savings and no real job hopes. She is adamant that life insurance, for her at this point in her life, is useless and too expensive, she decides not to get it.

How Much Life Insurance - C Level Executive:

How Much Life Insurance Do I Need as a Well Paid Corporate Executive?

You might be of the impression that C Level executives do not need life insurance, however you could not be more wrong. Actually executives need life insurance more than most and often for different reasons.

Most high level executives suffer from decreased job security. Once they lose their job, finding a new one can take years. Sometimes high paid executives will be out of a job forever. Depending on the life insurance from their employer this could be a big mistake. Your first plan of action should be to contact your human resources department and ask about life insurance portability. In other words, if you lose your job either with or without cause can you take your corporate life insurance with you?

However regardless of this answer, the case can be made to purchase your own independent term life insurance policy. A whole life insurance policy might also be a consideration. However you want something separate from your company.

With C Level Executives the question of how much life insurance to buy is a complex consideration. Often these executives make seven figures per year and hence the need for ten million dollars in term life is usually not warranted. A much lower three, four, or five times ratio seems more fitting, depending on the specifics. One additional consideration is that C level execs probably have one or two times life insurance for work so the theory is to get one from work and three from an independent policy resulting in about four times earnings. There is no hard rule about this as the level of annual compensation varies dramatically in these important roles.

Very Case Specific, but often Three to Five Times Earnings.

An Example: Kendra is a thirty eight year old power exec. On the national speaking circuit and the CFO of a Fortune 500 company she is provided an employer provided life insurance policy of two times her salary, not including bonuses. She opts to procure a $2,000,000 twenty year term policy that independently through a life insurance specialist because she has sleep apnea. The policy is held through Prudential.

Final Thoughts on How Much Life Insurance Do I Need:

The amount of life insurance that you need depends on a confluence of your financial situation, your current and future plans, your employment, and even factors such as your health and various other underwriting criteria. The ideas and suggestions here may make it appear that there is a simple answer to this all important question but there really is not. There cannot be enough said about the difference a well qualified and knowledgeable insurance agent can make on your eventual outcome. If when you speak with an agent and do not feel comfortable with them, move on. Kindly consider us for your life insurance needs.

At WholeVsTerm we strive to provide useful, relevant, and accurate information to our clients and the general public. We believe that for most people almost any term life insurance policy is better than no life insurance policy and to that end sometimes settling on a smaller or lower coverage amount which might not be perfect - may be better than waiting to long and having nothing.

Questions:

Do you have questions? You would not be the first person to have a situation that falls outside many of these categories and I did reference that many of these scenarios were case by case decisions. Please feel free to lob your specific question out to us either via the comment boxes below or direct by email.

Thanks for Reading How Much Life Insurance Do I Need?

Speak with an experienced advisor!

Speak with an experienced advisor!