Life Insurance for Dummies

Welcome to our simplified guide for life insurance. This is the place for those that want simple and straightforward information. In this article we will cut down on our usual jargon and get down to the real basics. With life insurance for dummies we try and not treat people like dummies, but rather value their time and need for life insurance in a simple manner.

The Basics of Life Insurance

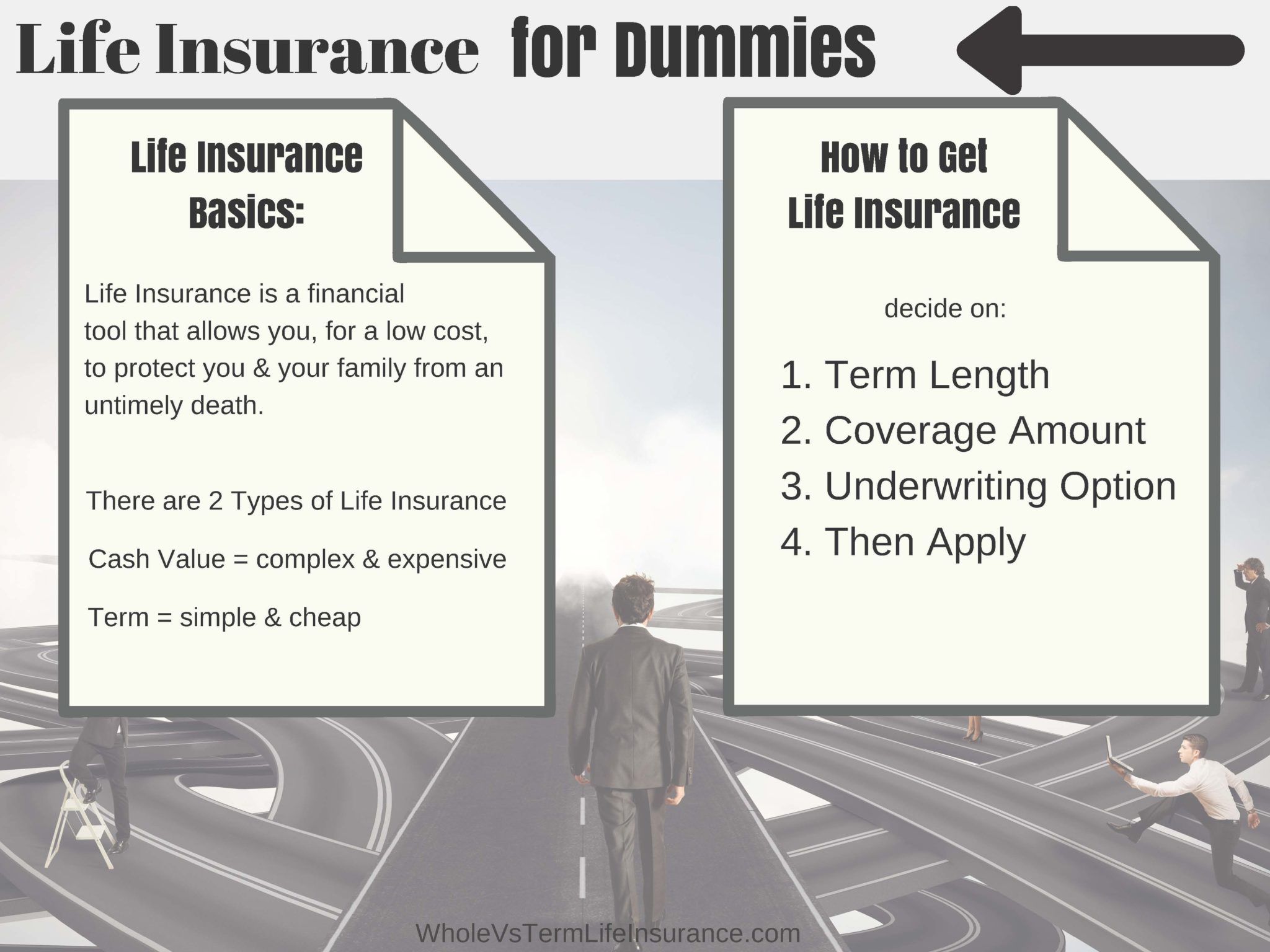

Life Insurance is split into two forms of insurance:

Cash value life insurance, goes by many names including whole and universal life. These forms of life insurance are expensive and coverage and premiums last typically for your entire life.

Term Life Insurance is pure insurance. It lasts for only a limited period of time. It costs less money.

Since term life is so cheap it is generally considered the simple solution for life insurance needs.

How to Build a Term Life Insurance Policy, in 4 Easy Steps:

Step 1 - Choose a Term Length

Term insurance lasts for the life of the term. After the term is over, generally the policy is over. So choose a length of time that will cover the entire length of time you would like coverage for.

Options for term length are: 10, 15, 20, 25, and 30 years of coverage.

Are you a parent wanting coverage for your kids? = Choose a quantity of time until they are out of the house on their own. Often this is 15 or 20 years of term coverage. If you are planning to have children perhaps consider 25 or 30 years.

Are you a spouse wanting coverage for your non working spouse? = Choose the length of time until your retirement. This may be anywhere from 10 to 30 years.

Don't have children or not married and no reason for insurance? You can wait to purchase this important coverage until the time arises. However if your health or lifestyle changes you may not be able get it at a later time.

Step 2 - Choose a Coverage Amount

Next choose an amount of coverage. A simple way of doing this is to consider ten times your yearly earnings.

An Example: $50,000 X 10 = $500,000 in term coverage.

Step 3 - Choose a Medical Underwriting Option

What is your medical condition? Have you been hospitalized? Do you routinely take any medications?

You have options when you buy term insurance. All insurance has basic underwriting questions. However not all life insurance requires a medical exam. Do you want to have a medical exam if it can save 15% or 20%?

Apply

There you have it. Now you have selected a term length, a coverage amount, and a medical underwriting option. Call one of our agents or fill out one of our contact forms.

An Example: 20 Years + $500,000 + No Medical Exam

There you have it the easiest four step guide to buying life insurance.

The Basics of Life Insurance - Life Insurance for Dummies:

In presenting the life insurance process in such a simple and fast manor, we have of course skipped much of the information out there about life insurance. Does that matter for most people? For some people it does not matter at all. For others it may matter a little.

One thing that is certain is that many Americans need life insurance - but yet do not have it. Given term's low cost, I have come to the conclusion that the reason that many people do have proper term coverage is because of two reasons: Apathy and Confusion.

Both Apathy and Confusion are the enemies of simple life insurance. I can not do too much about people's apathy other than to nag clients that I meet. However as far as confusion is concerned, that is what this website was created for. Educate people and allow them to make their own informed decisions. Sometimes what is needed for those clients is a simple guide and that is the purpose of Life Insurance for Dummies. This is part of the reason that we wrote this article about life insurance basics: Life Insurance for Dummies.

In this article we briefly explained whole life insurance. You will notice though that we did not go into how to buy whole life insurance simply. The reason is that there is no way to purchase whole life insurance easily. At least in our opinion. Whole life insurance is very complex and has lots of moving parts. My opinion again, but if clients want a super simple life insurance policy than non medical exam term is more than likely the way to go.

So what are some of the other Life Insurance Basics not discussed in this article?

In this article we have gone over the life insurance basics, but only to a point. I have written countless articles discussing the in depth calculations that clients can do in configuring how much term coverage they need. How to calculate it. How to think about it. Using varying amounts to create the perfect coverages.

I have also written plenty of articles about length of term policies needed. How to stack coverages together. Sometimes suggesting that certain clients need two or three term policies.

I have discussed at length the need to check financial strength ratings when buying term. Financial strength ratings are opinions issued by credit rating agencies.

We have written numerous articles on considering your budget. Overspending when you buy life insurance is a big no no. People that overspend often fail to keep their policy in force.

We have discussed in depth the differences between using an independent agent and a captive one. The differences between home / auto insurers and pure life companies.

I have presented numerous warnings. Warnings about agents miss-selling insurance policies. Often overpriced and sometimes not needed. Warnings about buying an insurer that has a poor overall financial health.

Does this mean that all of this information is not needed?

Not at all. Please do not let the simplified nature of this post fool you. I believe that details matter. They matter a lot. However for some - a simple article is the best point of origin. Kindly contact with questions via email or leave a reply below. Thank you for your time.

Speak with an experienced advisor!

Speak with an experienced advisor!