Do you Take Statins for High Cholesterol and Want to Save Money on Term Insurance?

If you are shopping for term life insurance and have noted that high cholesterol and statins change your underwriting criteria - you are not incorrect...

Statins are a type of medicine that is most often prescribed to assist consumers in fighting high cholesterol numbers. Some life insurance companies will increase your term rate based on taking just about any medicine, while others are more open to this common medicine. This is why buying life insurance with statins is more complicated than many consumers can realize.

All About Life Insurance with Statins:

Statins are used worldwide to fight high cholesterol. Cholesterol a way substance is both created by the body and taken in while eating. High amounts of this waxy substance are linked with numerous heart and other coronary issues. Physicians often prescribe medicines such as Zocor and Lipitor to fight high cholesterol. Some insurers price users of statins higher than others. It is in the consumer's best interest to shop around when they take statins.

There are seven common statin medications, they include: Crestor, Lipitor, Zocor, Livalo, Lescol, Altoprvev, and Pravachol.

About Statins and Cholesterol:

The Mayo clinic states that Statins lower your cholesterol. "They work by blocking a substance your body needs to make cholesterol." It is also claimed that statins 'may; be able to assist "your body reabsorb cholesterol that has built up in plaques on your artery walls, preventing further blockage in your blood vessels and heart attacks." Therefore the use of statins are clear for those suffering from elevated levels of bad and good cholesterol.

About Cholesterol: Cholesterol is "found in every cell of the body and has important natural functions when it comes to digesting foods, producing hormones, and generating Vitamin D." It is both manufactured by the body and taken in via food. This 'waxy substance" can be both good and bad. If concentrations get too high "it can put people at risk of heart attack." Medical News Today.

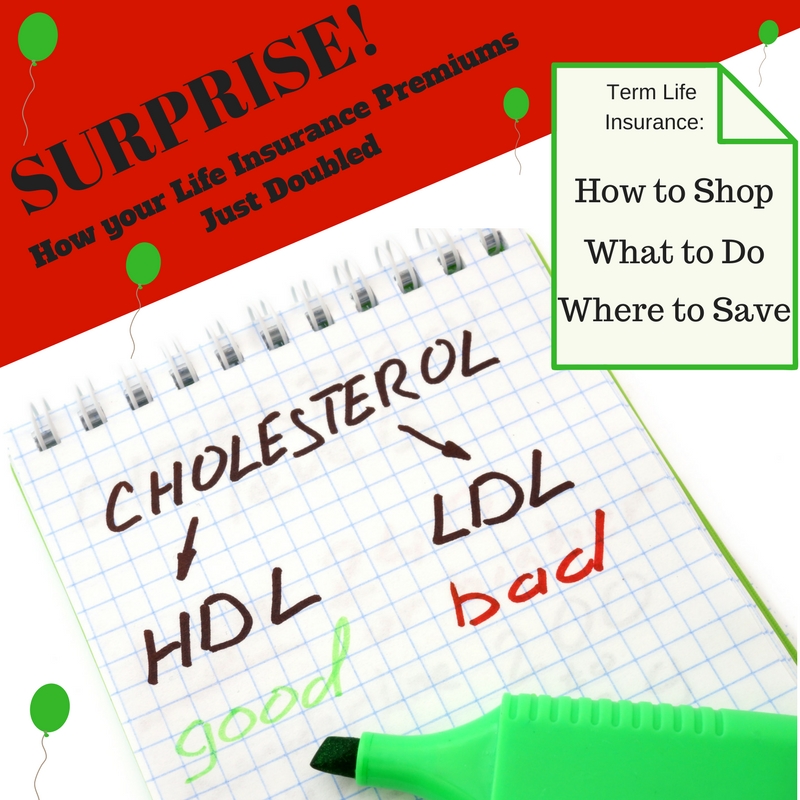

There are multiple types of cholesterol. For the purposes of life insurance, there are two main types. HDL and LDL. HDL is also sometimes called the good cholesterol while LDL is also known as the bad cholesterol.

A Note About Statins:

Statins lower your cholesterol. "They work by blocking a substance your body needs to make cholesterol."

Types or Kinds of Statins:

Likely there are other statins available as well.

Why typical medicines have two names. Many american pharmaceuticals are developed with a true scientific name that is not easily marketable. So as you can imagine they are rebranded with something that you can say. Would you rather say 'simvastatin' or just zocor?

Procuring Term Life Insurance when you are on Statins:

Many people incorrectly assume that by taking medicines you increase your cost for life insurance. Although this may be an issue some of the time with some of the carriers it it not always the case.

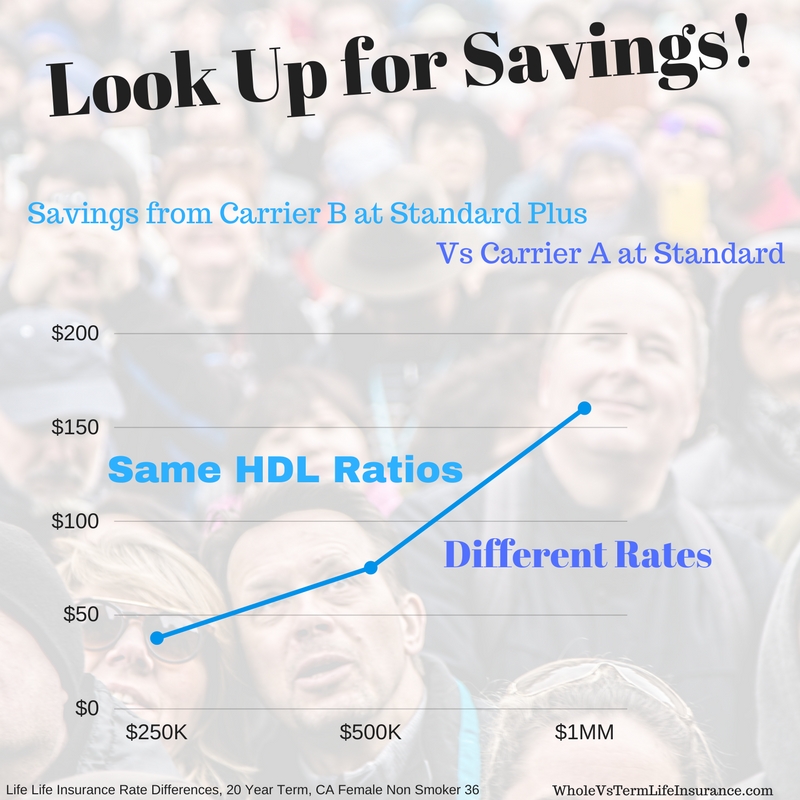

For consumers that have elevated cholesterol levels: IE HDL Ratios higher than about 5 or Total Cholesterol Numbers in excess of between 220 and 250, sometimes being on the prescription is the way to save money. In other words being on statins can be a good thing.

A simple example could be an insurer that requires an HDL ratio of 4.5 and below at the preferred plus level WITH Statins. Compare this with a carrier that has similar HDL ratio underwriting criteria with the exception that they do not allow a statin such as Lipitor at the preferred plus level. In other words, consumers need to understand which carriers allow for Crestor or Lescol at the preferred plus health class. The price difference could be immense.

A more detailed analysis could be (theoretically) if Client A had a 310 total cholesterol vs Client B who had a 220 and was on a statin such as Zocor. Who would likely pay more for a twenty year policy? All things being equal Client B taking the Zocor probably has a better chance of securing a preferred plus or preferred life insurance rating from select carriers.

That is not to say that you must be on statins to get lower term insurance pricing. But in certain situations it can help. Knowing nothing else, the best way to save on life insurance is many/most situations is to simply follow the instructions of your physician. Life insurers like people that see their doctor. They prefer people that follow through on the physician's advice. They like people that take their prescription medications. They like it taken on time. They would prefer to see the medications filled on time.

It is not uncommon for patients to have a physician meeting and fail to follow through on an item or two. Then when they apply for a life insurance policy, the insurer asks why? Why did not you do this? Often patients / customers just have forgotten. Depending on the suggestion, this can be a real issue.

"The Best Way to Save on Life Insurance in many situations is to simply follow the instructions of your physician."

"For consumers that have elevated cholesterol levels: IE HDL Ratios higher than about 5 or Total Cholesterol Numbers in excess of between 220 and 250, sometimes being on the prescription is the way to save money."

Which Insurers are Good Options for Consumers with Controlled Cholesterol with Statins:

There cannot be a complete list here because these things change. However here are a few of our go to options for consumers that are on statins to control high cholesterol:

Banner Life Insurance

Banner life insurance is a perennial favorite of ours for their low prices and speed to process life applications. This company is absolutely open to consumers that take statins.

Foresters:

Foresters may be a great option to use if you have high cholesterol and take statins, but it will depend on your exact details. We love foresters for their terrific non med and fast term products.

Lincoln Financial:

Lincoln Financial is a storied life insurance company that was named after one of our greatest presidents. Lincoln may be a great choice for those with higher cholesterol and taking statins.

Principal Financial:

Principal is a great life insurance carrier and may be the best fit for consumers that are on statins for cholesterol. Principal, often will allow for statins during the underwriting process. Principal also has super fast accelerated underwriting in some situations.

SBLI:

SBLI is another potential insurer that allows for cholesterol levels upwards of almost 300 in certain situations. They will often allow for statins

Are those all of the carriers that allow for statins to control for Hypercholesterolemia?

Of course not, but these are a solid sampling. Truth be told its more detailed and exact than this. We will need to know your full medical history, your HDL and total cholesterol number, and the name and dosage of your statin. From there we will review with all of these carriers (and more.)

How to Save Money on Term Insurance while on Statins:

Will these simple bullet points work for everyone that uses these medications? Of course not! But they will help numerous people buy cheaper term insurance. Many people will want to know why I suggest that you have and maintain a relationship with their physician. My 'opinion' on this is that doctors that remember you are probably more likely to quickly and more accurately submit life insurance related paperwork. It make sense.

Why should consumers be patient with this process? Because a good insurance agent may go out and check with three four or even five carriers before coming back with a suggestion. This can take time.

Questions About Life Insurance with Statins:

Should you have any life insurance questions - kindly feel free to contact us directly.

scott @ marindependent.com

Question: If I take Statins, can I still get term life insurance?

Answer: Generally speaking your can get term insurance when you take statins for cholesterol reasons. However many insurers look at statins in different ways.

Question: Are you saying that Statins can lower my life insurance bill?

Answer: Well, it depends on your exact situation. Its possible that taking statins could in theory lower your cholesterol and possibly bump you up to a better life insurance health class. So in that way - possibly some have saved on term insurance this way. But I would never suggest that anyone do this without their doctors approval. And I would not suggest that you do this just to save on term insurance.

Seven Common Statins:

- Crestor,

- Lipitor,

- Zocor,

- Livalo,

- Lescol,

- Altoprvev,

- Pravachol

| *wholevstermlifeinsurance.com/life-insurance-with-statins/ |

Conclusion of Life Insurance with Statins:

Statins are an amazing medical tool to assist consumers in lowering their overall cholesterol. Cholesterol is linked to all sorts of diseases and health issues and are one of the underwriting considerations that most insurance companies consider. Having high cholesterol and using statins can end up costing you more money for life insurance. However not all term insurers view statin medications in the same manor. It is in your best interest to speak with an independent agent that is able to shop your policy around.

Thank you for reading out post: Life Insurance with statins.

Speak with an experienced advisor!

Speak with an experienced advisor!