The Policyholder Surplus and What Consumers Should Consider:

The Policyholder surplus is a little noticed financial metric that is often hidden in detailed financial reports on insurers, It should not be skipped over.

Ignored for far to long, Policyholder Surplus (PHS for short) is an important financial metric found most often alongside insurance companies Financial Strength Ratings at AM Best, Moodys, Fitch Ratings, and S&P. The metric is a dollar measurement of how much surplus capital is available at the end of a given year.

Policyholder Surplus and the Consumer:

Numerous financial articles exist about the the differences between life insurer A vs insurer B. Typically the differences that are presented are minor marketing differences (such as silly commercials) or key ingredients in various policy forms, such as important riders. On occasion well written articles will discuss the underwriting differences. But the discussion of financial metrics and ratings such as Financial Strength Ratings, Issuer Credit Ratings, and Policy Holder Surplus are not discussed often enough. For they are truly important. (Especially if you wish to keep your insurer for life.)

Both Financial Strength Ratings, abbreviated FSR and Policy Holder Surplus, abbreviated PHS - are presented alongside each other. Few consumers understand FSRs and fewer still PHS.

Please note that you can use and see the word(s) Policyholder as one word and Policy Holder as two words, they are essentially interchangeable.

PHS metrics are very important for analyzing insurers.

Who Should Be the Most Concerned About PHS metrics:

Simply put - the longer you intend to use an insurance carrier the more important the metric. For owners of Home and Auto insurance policies, these policies can almost always be renewed with new companies yearly and often you can even cancel them mid term. Therefore it would seem that Policy Holder Surplus metrics matter less for these types of consumers.

For consumers that purchase level term life insurance policies in lengths of 10 and 15 years, PHS metrics matter more. Although given these low quantity of years, perhaps it is important a medium amount.

For American consumers that purchase longer term term products, 25 and 30 year policies, the PHS score of your future insurer is certainly important.

Lastly for those that are considering buying permanent life insurance or annuity contracts which by definition are forever, Policy Holder Surplus is incredibly important.

How to Consider a Policy Holder Surplus when Shopping for Life Insurance?

- 1Consider the length and type of Insurance.

- 2Reference the PHS at AM Best.com

- 3Ask your Agent lots and lots of Questions.

The Definition of Policy Holder Surplus:

There are no terrific definitions of policy holder surplus. Basically the definition of Policy Holder Surplus are the assets less the liabilities of an insurer. If this sounds similar to the concept of Net Worth, it should. That definition though does a very poor job explaining what a PHS really and truly is.

The terms 'policyholder' and 'policy holder' have been used interchangeably in this short article about PHS. It should be noted that the current more academic method/term is 'policyholder.' But... since this is a consumer site, its certainly reasonable to use the term policy holder as it seems more straightforward. After all we often reference policy owners not 'policyowners.'

What Exactly is a Policyholder / Policy Holder Surplus?

Other than the definition it is important to realize that PHS is essentially "extra money." Or money that has been generated that is not spoken for. A high PHS may allow an insurer to do all sorts of theoretical things. This could include: lowering yearly premiums. It could include increasing policy dividends (for mutuals.) Perhaps it could mean larger bonuses for employees. Or it might be a larger cash payment to stockholders (in the case of an American Corporate Insurance Company.)

PHS can also be viewed as a "cushion." A preventative amount of money that can help the company in the event of either a foreseen (although not highly anticipated) catastrophic loss or an truly unforeseen loss.

The concept of Policy Holder Surplus can also be seen as an underwriting ability. One could consider it free money that backs up current policies. Or free money to take on new insurance contracts.

This brings us to one key thing that needs to be understood. Insurance companies can be constituted along various entities. The two that you are most likely to hear about are Stock Companies and Mutuals. Mutuals are owned the policy holders and Stocks Companies are not owned the policy holders. Therefore there is a vast difference about how a policyholder surplus might be used for a consumer that owns a insurance policy in a mutual vs. a stock company.

The exact more specific definitions of PHS vary slightly between Mutuals and Stock Companies. For the purposes of this article, we have ignored those - just to keep this article understandable.

This brings us to the all important question of what you should look for with Policyholder Surplus when evaluating which insurer to choose a long term product from:

One thing to keep in mind if this subject seems confusing is that having a policyholder surplus is a good thing for insurance companies. Generally more is better.

What to Look for with Policyholder Surplus:

An insurer must maintain an amount of Policyholder Surplus to stay in business. This is important to understand. Any insurer that fails to have a policyholder surplus likely will have its' Financial Strength Rating downgraded. A sinking PHS and/or one that is completely gone could lead to insolvency. Therefore what you do not want is an insurer with a low PHS. To really do not want an insurer with no policyholder surplus.

What a consumer should want is an insurer with a high and relatively stable policyholder surplus. All things be equal, a higher PHS is probably better. However a PHS that suddenly jumps up, could be problematic. Life Insurance carriers obviously know this and aim to maintain a high and level policyholder surplus.

"You want a High and Stable Policyholder Surplus"

So what is the best method to discover how high of a policy surplus a given insurance carrier has? Is one supposed to contact the insurance company, call the state department of insurance, or ask their financial adviser? The best method to learning the policy holder surplus to to check the AM Best Financial Size Category. This can also be called the Financial Size Category Ranking.

AM Best Policy Holder Surplus Size Category Rankings:

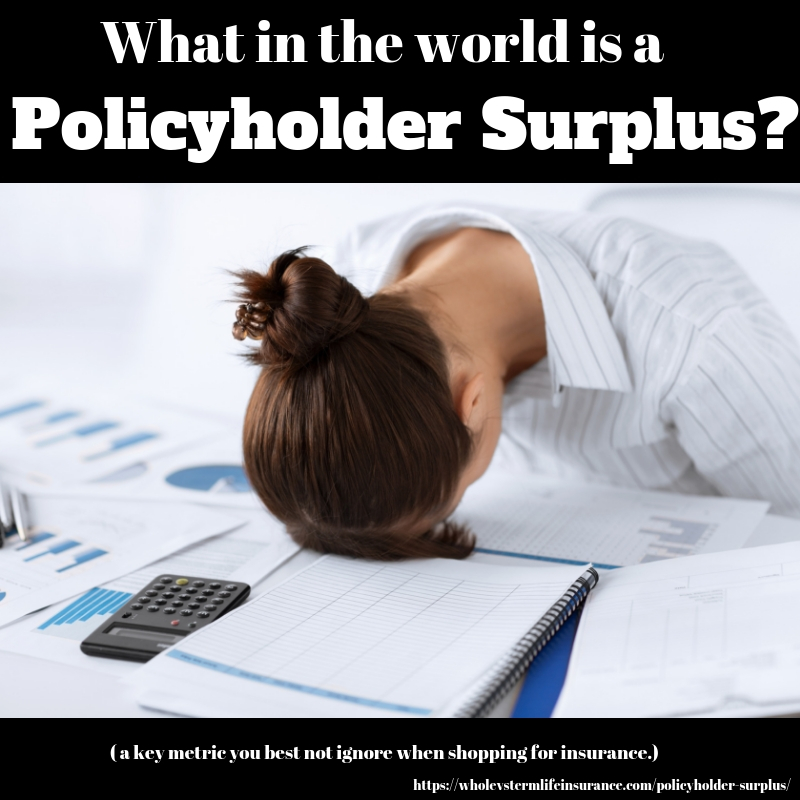

AM Best, the rating agency that specializes in Insurance, categorizes policyholder surplus. They use Roman Numerals.

The Roman numerals start at I (which is less than $1 Million in PHS) and goes all the way up to XV (which means more than $2 Billion in PHS.)

These PHS Size Categories are often overlooked when consumers look up the Financial Strength Ratings. Financial Strength Ratings are an opinion of an insurers ability to meet and pay claims. FSRs are also very important.

This brings us to the inevitable question that many will ask: What is the optimum amount of PHS that I as a future policy holder should look for? Unlike with FSR ratings whereby it may be simple and sufficient to suggest that you should focus on an A+ or A++ rated carrier, doing this with PHS rankings is not that simple.

For the general consumer the only guide I may be able to provide I have already stated. You want a large and stable policyholder surplus with your future insurer.

The issue though with suggesting that you only look at companies that have high PHSs is that it gives an unfair advantage to larger insurers. Since larger insurers have more policies and hence by definition have more surplus, than you are unfairly recommending them.

This is completely true.

For the more advanced its possible to consider other metrics of a potential insurer, such as the Policyholders Surplus Ratio (PHSR.) This is a ratio of the Net Premiums divided by the the Policyholder Surplus. This ratio is often used to assess an insurers ability to take on new policies.

This ratio too, though is subject to fluctuations. Alas there really is no perfect way to assess an insurers financial situation.

The one thing that does remain certain is that more information about your future insurance company is generally better than less. If you are able to ask your future insurance agent more detailed questions about PHS and PHSR you may not get much actual information, but you may be able to see if your agent even understands your question.

I reiterate my initial comments about Policy Holder Surpluses. It is not as important for short lengths of term policies as it is is for permanent policies such as Whole Life. This is my opinion.

I make no recommendations as to Annuities, since we really do not offer them.

What is Policyholder Surplus?

Policy Holder Surplus, abbreviated PHS is a measure of an insurer's assets less its liabilities.

The Term is often abbreviated as PHS.

There is another closely associated term: Adjusted Surplus. Adjusted surplus is the Total Assets Less the Adjusted Liabilities. The definition of what is the adjusted part comes down to insurance regulation and to some extent beyond the scope of this article. Since few consumers are likely to view an Adjusted Surplus vs an Policyholder Surplus, we are only noting it here.

Conclusions on PHS:

Policyholder or Policy Holder Surplus is an important financial metric for almost all insurance companies. Consumers should reference the PHS direct from AM Best to determine the overall financial health of a given insurer. For buyers of whole, universal, and variable life insurance contracts - IT IS IMPERATIVE that they do detailed research on the surplus of their future carrier. Especially if they are expecting to receive potential future policy dividends from a participating mutual insurer. As they say: "Measure Twice, Cut Once."

The concepts involved in this article are not simple. But the message should be. You want an Insurer with a high PHS. A high PHS indicates and insurance company that is more prepared. Prepared for both unexpected and expected future claims. Future possible Dividend payouts. A possible long and financially healthy future.

Should you have any questions concerning this matter or any other matter about life insurance, please feel free to contact us directly. scott at marindependent dot com.

Speak with an experienced advisor!

Speak with an experienced advisor!