What is the Face Amount of Life Insurance?

Are you confused about the face value of your life insurance contract or lost while shopping?

Frequently asked and often misunderstood, the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. In the case of a typical level term life insurance the Face Amount is the amount of insurance for the guaranteed length of time. In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual reasons. There are other types of life insurance where the concept of the Face amount is more complex. The average Face amount of life insurance for calendar year 2017 was $163,000.

The Face Amount of Life Insurance

In most situations, the concept of the Face Amount can often commonly be replaced by Death Benefit. It is the amount of money that will be given to the beneficiary at the time of the insured's death. The face amount indicates the initial coverage as indicated on the policy. In some forms of life insurance the death benefit is changeable in a number of different ways depending on the type and kind of life coverage chosen.

In general and for many situations the Face Amount is the Death Benefit.

The face amount is often confused with the Death Benefit. The two are very similar but not technically the exact same. The simple explanation would be to say that the Face Amount is the amount of life insurance that a policyowner has.

Face Amount Vs Death Benefit Definitions and Concepts:

Many forms of life insurance, term and whole life allow for increasing and decreasing death benefit amounts. As an example a consumer may purchase a whole life insurance policy with a $100,000 Face amount. The Face Amount will be listed in the policy contract. However in some situations the death benefit can be less. As an example if an insured has an outstanding policy loan of $10,000 than the ultimate death benefit paid out would be the $100,000 less 10,000 resulting in a $90,000 amount. In this example the face amount could be said to be $100,000 while the death benefit was $90,000.

$100K - $10K = $90K

Face Amount = $100K

Death Benefit = $90K

For level term policies, the death benefit and the face amount are the exact same.

Smart Asset, might just have the clearest definitions on both terms:

Face Amount: " The amount of insurance that an individual buys. The Face Amount will be paid in the event of the policyholder’s death or when the policy reaches maturity. It does not include any extra benefits that might be payable under accidental death or other special provisions. Face Amount can also be called Amount of Insurance, Coverage Amount or Sum Insured."

Therefore according to these definitions the Face Amount is really the amount of insurance, as stated on the contract (not including certain special benefits.) While the death benefit is the end amount of money that a beneficiary receives less policy loans.

Statistics about Face Amounts:

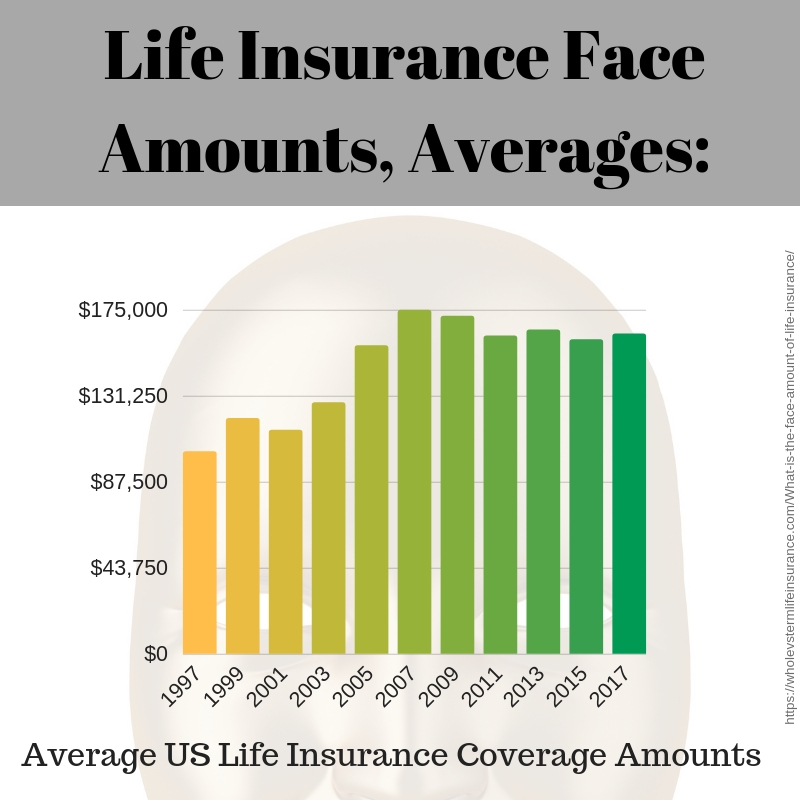

According to Statista, the average Face Amount of Life insurance purchased in the United States in 2015 was about $160,000. In 2017, that number grew to about $163,000. Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. These statistics are compiled from individual and not group life policies in the United States. All in US Dollars.

Average US Life Insurance Coverage (Face Values) Amounts,

From 1997 to 2017:

1997 $103,000

1999 $120,000

2001 $114,000

2003 $128,000

2005 $157,000

2007 $175,000

2009 $172,000

2011 $162,000

2013 $165,000

2015 $160,000

2017 $163,000

So what do past statistics tell you about life insurance face amounts? Well for demographers or a financial analyst it can tell you a lot. From a consumers point of view, it may tell you that the average American that is buying life insurance may not be keeping up with the amount of life insurance that they once purchased. Although an increase of 60% from 1997 to 2017 may seem like a lot, it probably does is not. Just accounting for a 52.75% total inflation during this time period (Source) may not be enough.

Much of the costs that death benefits are used to replace have gone up far more than this. Think College Educations and Homes. Second Consumer debt really has gone up pretty significantly during this time frame.

Regardless this does help you get an indication of how much life insurance many are purchasing.

Face Amount of Life Insurance:

Simply put the Face amount of a Life Contract is the initial amount of insurance coverage.

Technical Reasons that Life Insurance Coverage Amounts Change:

There are any manor or reasons why life insurance contract coverage amounts change. In our attempt to fully explain why we have compiled our list of reasons for coverage amounts changing. For the purposes of this section we are sticking to term and whole life insurance.

Policyowner Chooses to End Coverage: For all types of life insurance this is somewhat common. The policy is either no longer needed, forgotten (lost), or cannot be afforded. Regardless of the exact reason when it is non payed it cancels and no the face amount drops to zero.

Insured Dies or reaches the end of the Contract time frame (Now typically age 121.): When the policy ends at the time of death or the maturation of the contract (which may be 100, 101, 120, or now 121) the policy is paid out and the face value goes to zero.

Policy is cancelled by the Insurer for Non Payment, Other: The reverse can happen where the insured does not choose to end coverage but rather the insurance company does so. On a term policy this is typically pretty simple: don't pay the bill than the policy cancels. For whole life policies that have built up cash value, this gets complicated. However just know that insurer will lay out in the contract what exactly happens in this situation.

Policy grows in size by the use of Dividends through PUAs: Paid Up Additions are a dividend option that allows policyowners to increase their death benefit with yearly potential dividends. This is often what full time whole life agents pitch to clients. If you have a functioning whole life policy, this may be a great option for you.

Policy Coverage grows in size by the use of a somewhat obscure dividend option: Some whole life policies allow for the purchase of small amounts of additional temporary insurance (term insurance.) Regardless of if this technically raises the face value or not, is from our standpoint irrelevant. The point is that this option allows you to have more insurance, temporarily put into force.

Policyowner and Insurer Reconfigure Policy and Lower Coverage Amount: In many situations with permanent insurance policyowners find that they are unable or unwilling to pay future yearly premiums. Laid out in the contract are you options. One option may be to lower the death benefit with a low (or even zero) yearly premium. This a pretty common reason that death benefits get lowered.

Other: Yes, there are other reasons. However the above list is pretty thorough.

"In general and for many situations the Face Amount is the Death Benefit."

Face Amount Vs Cash Value Vs Surrender Value:

We have discussed, extensively the concept of the Face Amount and Death Benefit, however there is another value associated with permanent policies: Cash Value. Cash Value does not pertain to term insurance. It does pertain to Whole, Universal, and Variable Life Insurance. Products that contain market exposure technically also have a "cash value" although the monies may not be in cash.

What is Cash Value: Cash Value is the excess money set aside in a whole life insurance policy as a type of pseudo savings account. The accounts are notorious slow growers. Meaning not nearly as much money as consumers think they should they should have, do they. In general Cash Value is NOT paid out at the time of death. The Face Value or current Death Benefit is.

Cash Value is there to access for policy loans, receive yearly dividends. Cash value accounts are often presented as a type of saving account for which the account holder may access. The truth is that they are rather difficult, often to gain access to. Typically policy loans require an interest payment be made by the policyholder.

The Surrender Value or Surrender Cash Value: To add more to the confusion here consumers need to know that if you end your policy and want to cash out, you will not get your Cash Value. Rather you will get the Surrender Cash Value. I prefer the term Surrender Value for numerous reasons. The Surrender Value can simply be defined as the amount of money an insured will receive if they choose to close out their whole life insurance contract, prior to the end date.

So how does Cash Value get lowered to the Surrender Value? Basically there are contractual costs in the contract. Basically Fees. Fees for early termination, Other Fees.

Surrender Values and Taxes: If you close out your Whole Life Insurance policy before the contractual end or your death - there 'may' be taxes associated with this event. Basically dividends paid out are generally paid out as tax free as they are seen as a return of premium paid. However when a policy gets shut down, that tax free provision can end. Of course, its not this simple either. If you have specific questions, go see your tax specialist.

Are Face Values Taxed When Paid Out?

Generally when Death Benefits (the face amount) are paid out to a beneficiary at the time of death, the dollar amount can be tax free. Can Be, but not Always. Generally as long as you are not in violation of the Goodman Triangle most people end up in a good situation with life insurance. However that does not incorporate estate and inheritance taxes being tax free. In other words life insurance death benefits may be taxed from that angle. (See your tax adviser.)

Questions About What is the Face Amount of Life Insurance:

Question: So if my contract says the Face Amount is $125,000 does that mean that I will have this amount of insurance forever?

Answer: No, not at all. The Face amount listed on your policy is just the initial amount of insurance assuming your contract is paid and in good standing. There are any number of reasons that this amount of coverage can and will change. Please reread this article.

Conclusion What is the Face Amount of Life Insurance:

Thank you for Reading our article. Should you have any questions please do hesitate to contact us.

The simplest way to understand face values is to think of them as the death benefit. Although there are numerous technical reasons that this is not always the case, it is a useful way to consider it if you are new to life insurance.

Speak with an experienced advisor!

Speak with an experienced advisor!