The Life Insurance 30 Year Old Female Considerations.

Considering purchasing life insurance as a 30 year old American woman?

How Policy Length, Death Benefit amount should be considered when clients are young and healthy.

Planning on having a family but don't know how long to buy that policy for?

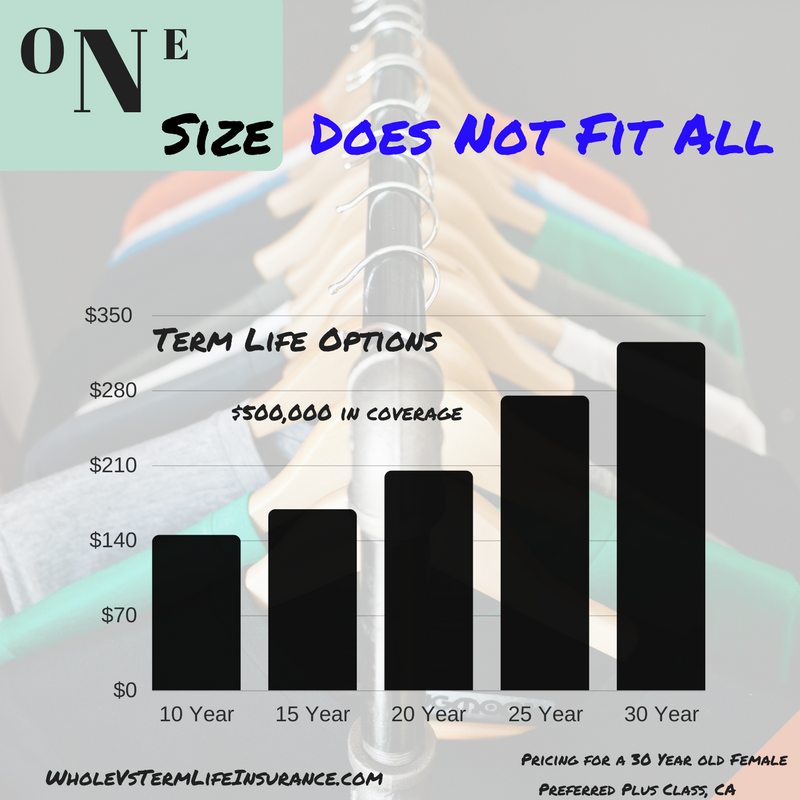

Sample life insurance rates for five lengths at two different amounts.

Quick Info to Go - Life Insurance 30 Year Old Female

When shopping for Life Insurance for a 30 Year Old Female, consumers should be aware of some the specific considerations for women of this age:

About Life Insurance Health Classes:

Life insurance underwriting is written on the basis of health classes. These health classes take into account numerous considerations, such as: current health, health history, families health history, medicines, and even driving history, career, and hobbies. Clients will save the most money by learning a bit about health classes and speaking with a specialist before applying for life insurance.

Life Insurance 30 Year Old Female - Preferred Plus

Preferred Plus Term Life Insurance pricing is reserved for those thirty year old women who are in top notch health. All of your labs will need to come back extremely clean, such as cholesterol. Participate in no dangerous activities such as scuba diving, hang gliding. Have a completely clean driving record.

For many age cohorts securing a preferred plus rating is rare, but for 30 old females I find it happens much more often. Securing this life insurance health class is a real benefit to applying for life insurance both as a woman and at a young age.

Sample Rates-Life Insurance 30 Year Old Female - Preferred Plus - $500,000 in Term Life

Female California Rates, $500K in Coverage | ||||||||||

Preferred Plus Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Preferred Plus - $750,000 in Term Life

Female California Rates, $750K in Coverage | |||||||||||

Preferred Plus Non Smoker:

|

Life Insurance 30 Year Old Female - Preferred

Preferred pricing for thirty year old women is terrific pricing as well. Preferred pricing allows for some minor health issues, such as higher weight or higher cholesterol. It may even allow for a ticket or other special considerations. Sometimes woman can be bumped down to this level based on some family health issues.

Female preferred life insurance pricing is terrific and if offered, usually it is best that clients accept the policy. Once again, buying life insurance at a young age is often rewarded with this lower pricing option.

Sample Rates-Life Insurance 30 Year Old Female - Preferred - $500,000 in Term Life

Female California Rates, $500K in Coverage | |||||||||||||

Preferred Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Preferred - $750,000 in Term Life

Female California Rates, $750K in Coverage | ||||||||||||||

Preferred Non Smoker:

|

Life Insurance 30 Year Old Female - Standard Plus

Standard Plus and Standard pricing is the real meat and potatoes of term pricing. Standard plus allows for some negative past family health history and even some current health issues such as possibly asthma, diabetes, and other ongoing health issues. Or it may allow for a higher BMI (heavier weight), higher cholesterol, or the other ongoing health concerns.

As a general rule of thumb, most life insurers would prefer to see a health issue being treated by a doctor and that you are following their prescribed plan than one left untreated.

The Standard Plus life insurance pricing for 30 year old women is still solid pricing, obviously it is not as good as both the Preferred Plus and Preferred premium costs, but depending on the clients situation it still may be their best option.

Sample Rates-Life Insurance 30 Year Old Female - Standard Plus - $500,000 in Term Life

Female California Rates, $500K in Coverage | ||||||||||

Standard Plus Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Standard Plus - $750,000 in Term Life

Female California Rates, $750K in Coverage | |||||||||||

Standard Non Smoker:

|

Life Insurance 30 Year Old Female - Standard

Standard pricing is the lowest of the 'non table rated' pricing for both smokers and non smokers. Lower than standard pricing are the so called table rates. Standard life insurance 30 year old female may be a great price, depending on their health situation. Often clients that have ongoing health issues such as asthma or other health disorders will be very happy to receive this term pricing offer.

Often clients are dismayed at getting an initial life offer at this price point. However receiving this health class is not necessarily the end of the road. There are still lost of options.

Sample Rates-Life Insurance 30 Year Old Female - Standard - $500,000 in Term Life

Female California Rates, $500K in Coverage | ||||||||||||

Standard Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Standard - $750,000 in Term Life

Female California Rates, $750K in Coverage | |||||||||||||

Standard Non Smoker:

|

Term Life Policy Length Considerations for Women:

One of the most common questions that life insurance agents and brokers receive in regards to term life insurance, is How Long Should I Get a Term Life Policy For? There is no simple answer. Clients should choose a policy term length that fits their own and their families needs. For parents this can be quite simple: Buy enough length of life insurance to get your kids out of the house and potentially through college.

For non parents, you must ask yourself, why are we buying life insurance? If you are buying it to pay off some debt, then how long will the debt, such as your mortgage, last. For female thirty year olds that are buying life insurance, because they are planning on having a family, then you can just apply the term policy length to get your future children out of the house and through college.

In general thirty year old women can get life insurance relatively inexpensively, therefore it may make sense to consider the longer 25 and 30 year term policy length.

Coverage Amount Considerations - 30 Year Olds:

Another common question that life agents get about insuring thirty year old women, is How Much Life Insurance Should I Buy? This question is often simpler to answer. There is an old rule about buying life insurance - Shoot for ten times earnings. For example if you make $25,000 per year, ten times that is $250,000 in term life insurance needs. In reality this is a massive simplification, but it works better than any other general rules that I know of.

A more complex method to calculating life insurance needs for 30 year old females is to consider your current assets, your income, your debt, and your future financial needs. Often this is best done with pen and paper.

It gets more difficult when we are talking about the non working spouse. Yes, non working spouses, who have kids generally need life insurance. They should shoot for less than the working parent. Non working spouses that do not have kids may or may not need life insurance.

Questions about Life Insurance 30 Year Old Female?

If you have questions about life insurance rates, want to know if you qualify for one of these rates, please either email us, fill out a quote form, or add a comment below. We will happily respond to all inquires.

sales@marindependent.com

Thanks for reading this article about sample pricing for 30 year old women. Please read our privacy policy. Always speak with a licensed agent when considering any form of insurance.

Speak with an experienced advisor!

Speak with an experienced advisor!