Annual Premiums - What are They?

What is an Annual Premium?

"A Payment Mode for Insurance Contracts."

What are Annual Premiums? An annual premium is a payment mode for insurance contracts. Typically an annual premium payment is considered the full yearly payment or a Paid in Full amount. The term can be used with all types of insurance, including: Life, Health, Auto, Home, and various Business insurances. Annual Premium payments are often the most popular option and typically offer the lowest associated payment fees.

What is an Annual Premium?

Annual Premium payments or modes are one payment frequency that consumers can choose when paying their yearly life insurance bill. Most life insurance plans allow for various payment frequency options.

As it relates to term insurance the annual premium election tends to be the most popular with larger sized insurance contracts. With smaller insurance policies the automatic monthly payments tend to be the most popular. There are often numerous other payment modes available.

Mode of Premium - What is It?

A mode of premium is the election of how you pay for the given insurer contract. Depending on the type and kind of insurance, the various modes offered may include:

For the purposes of Life Insurance, most carriers allow at least the following payment modes: Monthly or Full Annual Payment.

It should be noted that the mode and methods of payment are much more closely aligned than in previous decades within in the insurance industry. Thus many forms of modes may require a certain method in order to sign up with a giver carrier. For life insurance this can often happen when clients select the Monthly payment mode that may require a monthly automatic EFT draft. EFT stands for Electronic Funds Transfer. This is the method where the money is automatically drawn out of your checking account.

Therefore when someone asks: What is an Annual Premium? What they really are asking is What is an Annual Premium Mode?

Annual Premium Mode allows for One Easy Full Payment for the Year.

Of Special Note, premium payment mode options can and do vary widely by country and type of insurance. Property casualty insurers will often allow for more payment modes.

What is a Premium, a Mode, and a Method:

Simply defined a premium is an amount of money an insurance company charges for an insurance policy.

Premiums are usually associated with modes of premium or methods of premium payments. Premiums can be thought of as merely bills. However given the complexities of life insurance policies, premiums represent far more than that. A premium is also an important facet of all life insurance contracts.

Premium = The Amount of Money due to the Insurer.

Mode = The Frequency of the Insurance Payment.

Method = The Way in which the Premium Gets Paid.

Often consumers will identify all three of these terms together in one statement. An example would be: An $82 Monthly Credit Card payment for term policy #68203. Another example could be: An annual $1,623 check payment for insurance contract #9762640. An additional method "modifier" is also sometimes attached to state if the payment is set up for "auto pay." An example of this could be a $83 credit card monthly auto pay for term contract $68204.

An annual premium is by definition paid once per year. The method of payment though is not defined by the term nor is the modifier of automatic payment or not.

Mode Premium & Payment Fees:

Some modes of payments contain fees. Fees for making more than the one annual payment. These fees, sometimes as little as $3 or $5 can often be waived when automatic billing AND payment are enacted.This is often the case with automatic bank payment methods.

For the monthly payment mode, a seemingly small $3 fee, each month can add up. Over the course of twelve months a three dollar fee can add almost $36 over the course of a year long policy.

An Example of Premium Payment Fees and the Main Benefit of Annual Premiums:

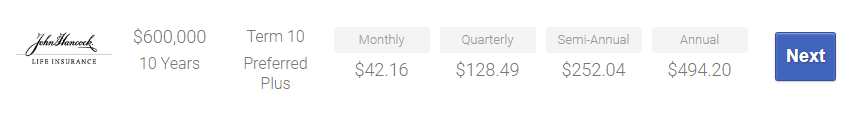

In the below example from John Hancock Life Insurance, a $600,000 ten year term policy shows multiple different numbers: Monthly, Quarterly, Semi Annual, and Annual. These are all payment modes available in our Annual Premium Example:

Paying $42.16 per month for twelve months nets you a total yearly outlay of $505.92. But the Annual Premium payment amount is only $494.20. Therefore it is $11.72 more expensive per year. At least in this situation. Different Insurers have different costs.

The example highlights the main benefit to Annual Premium Payments - Lower Costs. The same can be said, to a lesser extent, about the costs associated with the other payment modes.

This premium mode example is typical for most insurers. However many insurers are different and this information my not be the same with your insurance company.

Annual Premium Payment Benefits:

As previously stated the primary benefit is the lower cost, which does save you some money. Another main benefit is the peace of mind with the annual payment method. Once you make your annual payment, you are entirely done for the next twelve months. In the world of life insurance, peace of mind is important.

When you pay a life insurance bill once annually it easily allows for you to place the figure in your annual budget.

In our professional opinion paying your yearly term insurance bill once yearly, or annually is the best method. For consumers that are a bit more pinched than monthly ETF payments are likely the second best option. In general we prefer this yearly premium payment method for its simplicity.

Annual Premium Payment Drawbacks:

Paying your yearly life insurance bill all at once is not necessarily all good. There are a few minor drawbacks to it. In my opinion the biggest drawback is that it requires policy owners to be more adept at financial planning and budgeting. In other words you have to be able to budge for a year and not just a month.

When you pay annually you are also fully committing (often but not always) for the entire year. Therefore if you are buying a type of insurance that you may not want for the entire year, this could be an issue. Of note is that many types of insurance allows for you to cancel mid year even if you have paid for the entire amount previously. This is not necessarily the case with life policies.

The obvious main drawback with annual premiums is that it requires you to write one large check. And for many this can be difficult. For some this is not an issue. For others it is.

What is an Annual Premium?

"A Payment Mode for Insurance Contracts."

Similar Terms with Annual Premium?

An annual premium can also be known as an Annualized Premium. An annualized premium is potentially slightly different in terms of an true definition in the sense that the word annualized, infers that the choice of premium mode has already been made. In other words, it is a past tense. However in reality the differences are so minor and often misused as to essentially mean the same thing.

Therefore...

We consider Annualized premium and Annual premium to be the same definition.

Insurance Contract Requirements:

There are several insurance contract duties that owners of insurance policies are required to perform to keep the policy in good standing. Among other requirements, a consideration must be made. The consideration is the premium payment. If the premium payment is not made and kept up to date than the policy can be removed from good standing. In the case of Term Insurance this can mean that the policy becomes cancelled. In the case of cash value policies, such as whole and universal life contracts this can also mean cancellation. With permanent policies such as whole and universal policies a cash value may have built up which could, in theory, delay the cancellation of the contract.

Should You Pay your Term Policy with one Annual Premium Payment?

In general, assuming you can afford it, I see no reason not to advise clients to make the full yearly payment each and every year. In fact, since life insurance is so important, if possible I would recommend that you set up this automatic payment to be automatically deducted from your checking account, via ETF. EFT stands for Electronic Funds Transfer.

Since there are so few negative to making the once yearly annual payment, I see it as the best choice for most budget wise Americans.

Annual Premium Equivalent:

Annual Premium Equivalent is a mathematical corporate calculation used by Insurers. It is not a common term used by and for consumers. Annual Premium Equivalent is abbreviated as APE. It is mostly used in the United Kingdom. It is a sales measure used to estimate both regular and single premium insurance contracts. Again, APE is not a common term used by consumers. We only add it to our article for clarity's sake.

Questions about What is an Annual Premium?

Do you have a question about Annual Premiums? Please feel free to send them to us. Often the best questions come straight from our clients and friends. Sometimes what we feel is clear, in reality is not clear. Certainly if you have an additional question about Annual Premiums, others do also.

Question: For Life Insurance, why would I want to make the yearly payment all at once?

Answer: For Life Insurance often it is cheaper to pay your life insurance bill all at once than it is to pay it monthly. However each insurer can handle this differently.

Question: I want to pay online all at once automatically through an EFT payment, can I do this?

Answer: Generally yes you can set up automatic annual payments with your life insurer, but it depends on the carrier. Please check with them.

Question: How do I pay my annual life insurance premium?

Answer: It depends on your insurer. In general you will mail them your annual check and use the address located on the bill. Some companies allow you to login in to their portal to pay online.

About Whole Vs Term:

Whole Vs Term Life Insurance is an independent insurance agency based in California. A certified green business, Whole Vs Term believes in presenting consumers detailed information and allowing them to make their own life insurance decisions.

sales at marindependent .com

Speak with an experienced advisor!

Speak with an experienced advisor!