The Columbus Life Insurance company has been around since 1906.

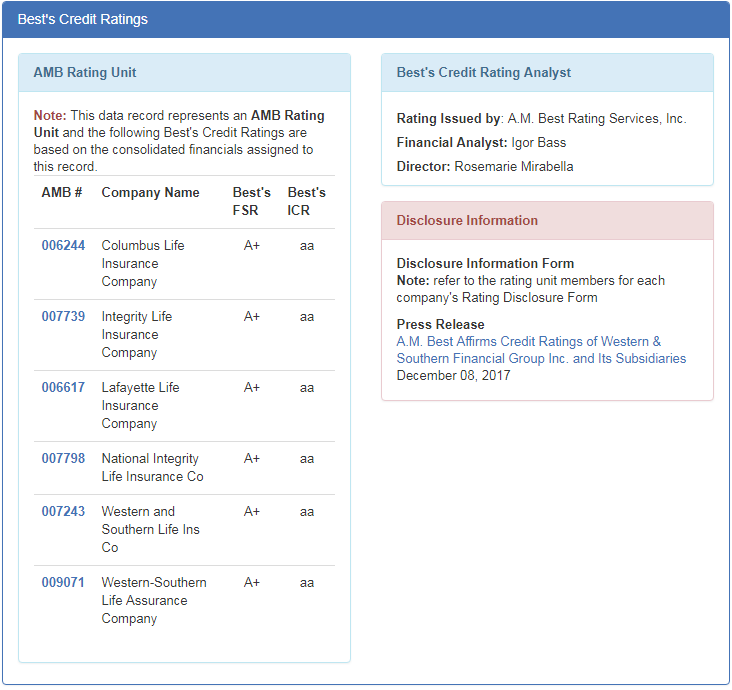

The insurer carries an A+ Financial Strength Rating with Insurance Rater AM Best.

They have similar ratings from S&P, Moodys, and Fitch Ratings.

They specialize in Annuities and Universal Life Insurance products.

Columbus Life has a Very Solid and Growing Balance Sheet.

Columbus Life Insurance

Headquarters and Contact

Information:

The Columbus Life Insurance Company Headquarters is located at: 400 E 4th St, Cincinnati, OH 45202.

Columbus Life Web Address is ColumbusLife.com

Columbus Life Phone Number: 513-361-6700

Columbus Life Fax Number: 513-629-1871

Columbus Life Insurance Company - NAIC Number is: 99937

The Company is owned by Western and Southern Mutual Holding Company, which is also a Cincinnati based insurance company. The company is occasionally referred to as the Columbus Life Insurance Co or the Columbus Life Insurance Co Inc.

Columbus Life Insurance should not be confused with Knights of Columbus Insurance.

Columbus Life Insurance History

The columbus life insurance company was incorporated in 1906 by Channing Webster Brandon under the original name the "Columbus Mutual Life Insurance Company" in Columbus, Ohio. The company had over $100 Million Dollars in life insurance policies by 1927 and survived the Great Depression. The company had a 19 year alliance with the Ohio State Life Insurance company, starting around 1961.

By 1980 the company reached over $4 Billion Dollars in life insurance policies and was considered one of the largest in the country. In 1982 the company was purchased by the Western and Southern Financial Group. In 1996 the company moved to Cincinnati, Ohio.

Columbus Life Insurance is no longer a mutual company.

Columbus Life Insurance

Life Insurance Products:

The Columbus life insurance company offers numerous products available in most, but not all US states. They sell and service both life insurance and annuity products.

Columbus Life Annuities:

The insurer offers numerous annuities which are listed below:

Columbus Life - Life Insurance Products:

The insurer offers numerous life insurance products as well, which are listed below:

*Most of these are registered terms.

Columbus Life Insurance

Financial Strength Rating:

Columbus Life Ratings are listed below. In general with life insurance the Financial Strength Rating is more important than the Credit Rating.

*All ratings taken direct for AMBest.com as of January 17th, 2018. Please confirm your financial strength ratings direct with AM Best of other raters whenever considering purchasing or changing any type of insurance.

Columbus Life Past AM Best Ratings:

Columbus Life Insurance Financial Strength Ratings History with AM Best:

July of 2013: A+

July of 2014: A+

September of 2015: A+

November of 2016: A+

December of 2017: A+

It is advisable to always look not just the financial strength ratings currently - but also the FS ratiings of the past to determine if a trend is developing. In this situation the only trend that appears common is one of consistency.

Other Financial Strength Ratings for Columbus Life:

AM Best is the sole rating agency that specializes in the life insurance industry, however there are other financial strength ratings done by the other Big Three Ratings Companies: Moodys, S&P, and Fitch Ratings. It is a best practice to check FSRs (as Financial Strength Ratings are often abbreviated) with more more than just one rating agency.

Fitch Ratings: AA

Standard and Poor: AA

Moodys: AA3

*this rating sheet is taking directly from Columbus Life's Website

Columbus Life Insurance Review

and Best Uses:

Our Columbus Life Insurance review is based off of public information.

Columbus life might not be a company that you have heard of, as they do not spend that much on branding in comparison to other companies. However branding does not make a good company. With an AM Best A+ and a 96 comdex ranking, Columbus life is a solid choice for your your insurance needs.

The company seems to heavily rely on Universal life and Annuities, which are not often our focus here at WholeVsTermLifeInsurance. However if you are considering a Universal life insurance company, from a corporate structured company - Columbus life may be the best product for you and your family.

Columbus life also has their Nautical Term series which appears competitive in the market for term life insurance. Their products and services are sold mostly nationwide through a network of thousands of life insurance agents. New York is one state that they do not conduct business in.

If you are interested in one of their term or universal life insurance policies it is always advised that get multiple insurance quotes from different insurance companies.

In their 2016 Annual Review Document: Spirit of Discovery, they state that in 2016 was their 128th year of operation as in insurance company. For the second year in a row: "combined life and health premiums and annuity sales exceeded $3 billion. For the full year, we earned $387.7 million of GAAP net income on total revenue of $3.3 billion." This is an impressive feat for any insurance company. They also state that there balance sheet is the largest "and strongest in" their history.

The insurer's Consolidated and Condensed Balance Sheets show total assets growing from $3.8 Billion in 2015 to just $4.17 Billion in 2016, while their liability and equity grew at the expected same amount. On an approximate similar amount of revenue of $276 Million the company was slightly less profitable in 2016 at $20.9 Million vs $28.5 Million in 2015. A review of Columbus Life Insurance Company's balance sheet alone make it a worthwhile consideration for your insurance and potentially your annuity needs.

The Insurer is very bullish on new technologies moving forward which is a refreshing change from the industry standard. New technologies "combine to make Columbus Life a technology pioneer."

One aspect that is important to many consumers when reviewing and considering insurance companies is in contemplating the technologies they use.

“We have dedicated our focus to technologies specific to how producers do new business with us. By concentrating on this, we’ve been able to invest our time and resources to impact the whole value chain.”

Although Columbus life may not be the most well known life insurer, its terrific financial strength rating empowers it to be a solid consideration, especially if you are considering a Universal or Indexed Universal life insurance policy.

Thanks for reading our post and review about the Columbus Life Insurance Company. At this time we are not appointed with this company, however provide this information as a courtesy to our clients.

Should you have any questions or suggested changes, please feel free to contact us directly:

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!