Banner life insurance is one of the premier life insurance companies selling policies in the United States. They are often cited as having some of the lowest term life insurance rates. Banner is owned through a corporate conglomerate by Legal and General Group PLC.

Banner Life Insurance Company

Headquarters & Contact Information:

Banner Life Insurance Headquarter in Maryland, United States.

Banner Life Insurance Address: 3275 Bennett Creek Ave, Frederick, MD 21704

Banner Life Insurance NAIC: 94250

Banner Life Insurance Phone Number: 301-279-4800

Banner Life Insurance Fax Number: 301-279-4178

Banner Life Insurance web address: lgaamerica.com

President and CEO LGA America, Inc: Bernie Hickman

Banner Life Insurance is owned by Legal General Group PLC, a British Company. A PLC is a British Limited Liability Company. It typically stands for Public Limited Company. William Penn Life Insurance company is also owned by Legal General Group.

Chairman Legal General Group PLC: Sir John Kingman

Stock Ticker Symbol of Ultimate Parent: LGEN

Sometimes known as Bannerlife or simple Banner.

Banner Life Insurance

Company History:

Banner life insurance was originally called the Government Employees Life Insurance Company or GELICO. The company was chartered in 1949. At that time the company had an affiliation with the company we know as GEICO. This is no longer the case.

Legal General was founded in England around 1836. The original founders created an Association. Soon the company was named Legal and General Assurance Society. The Legal & General Group formed in 1981 when it purchased Banner in 1983 and William Penn in 1989.

Banner life insurance is licensed in about 49 US states as of 2018.

Banner Life Insurance Company

Financial Strength Ratings:

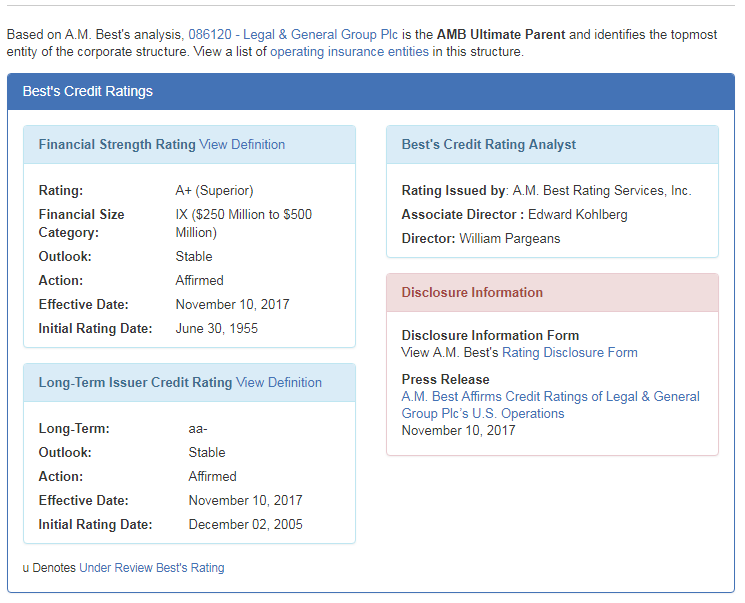

As of February 9th 2018 Banner Life Insurance has an AM Best A+ Financial Strength Rating. A rating of A+ is one notch from AM Best's best rating which is A++. Their AM Best number is 006468. Banner is owned by Legal General Group PLC, which is considered their Ultimate parent.

Banner AM Best Rating History:

A great way to consider financial strength ratings is not just to look at the current rating by the past historical financial strength ratings.

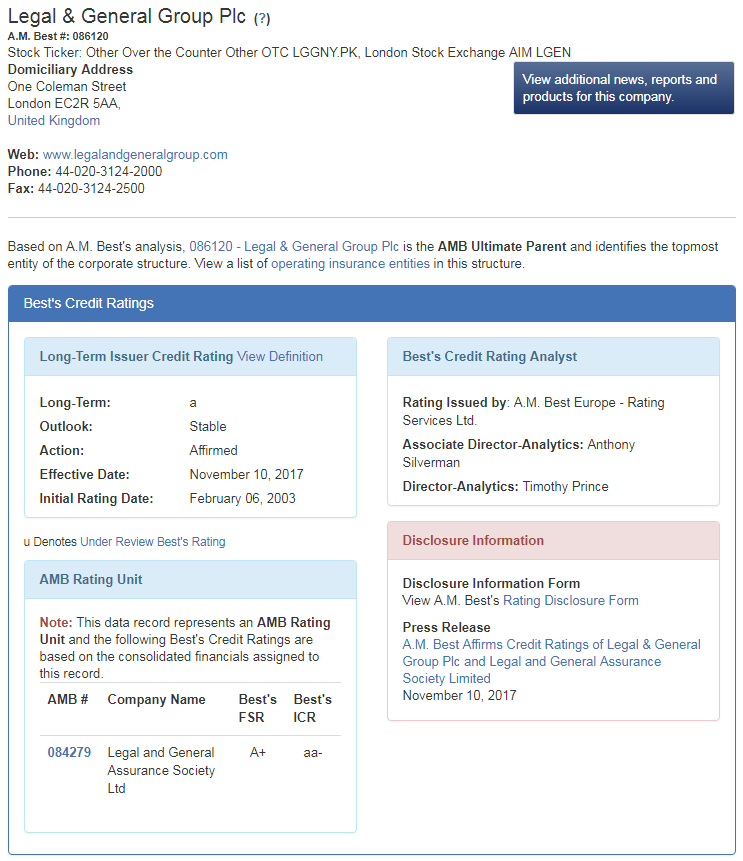

Since Legal General Group PLC does not have their own Financial Strength Rating we consider their Credit Rating which is listed an A.

Both images taken direct from AMBest.com February 2018.

Banner Life Insurance, L&G America, and Legal General PLC:

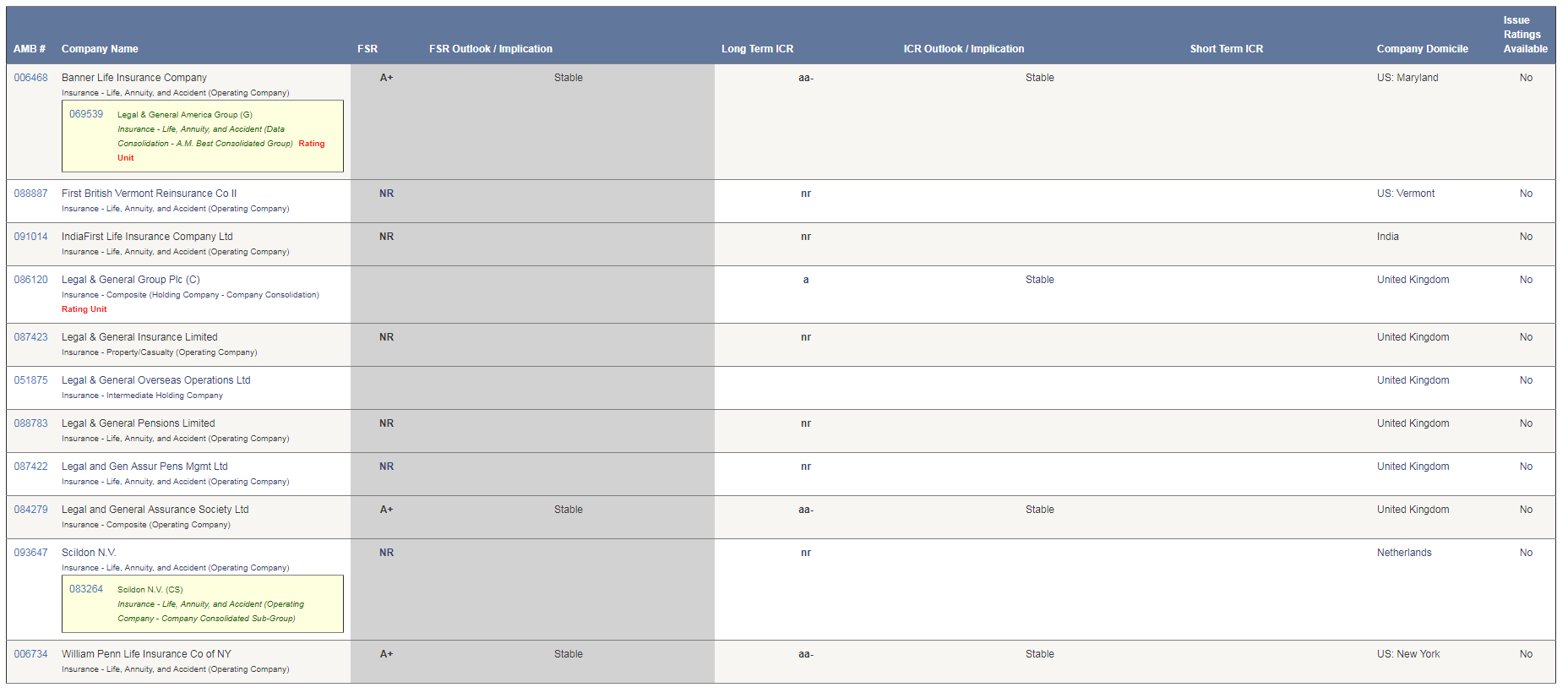

The exact corporate configuration of Banner Life Insurance is pretty confusing. Below is a chart of various entities and subsidiaries from AM Best and their Financial Strength and Credit Ratings. Also listed is their domicile.

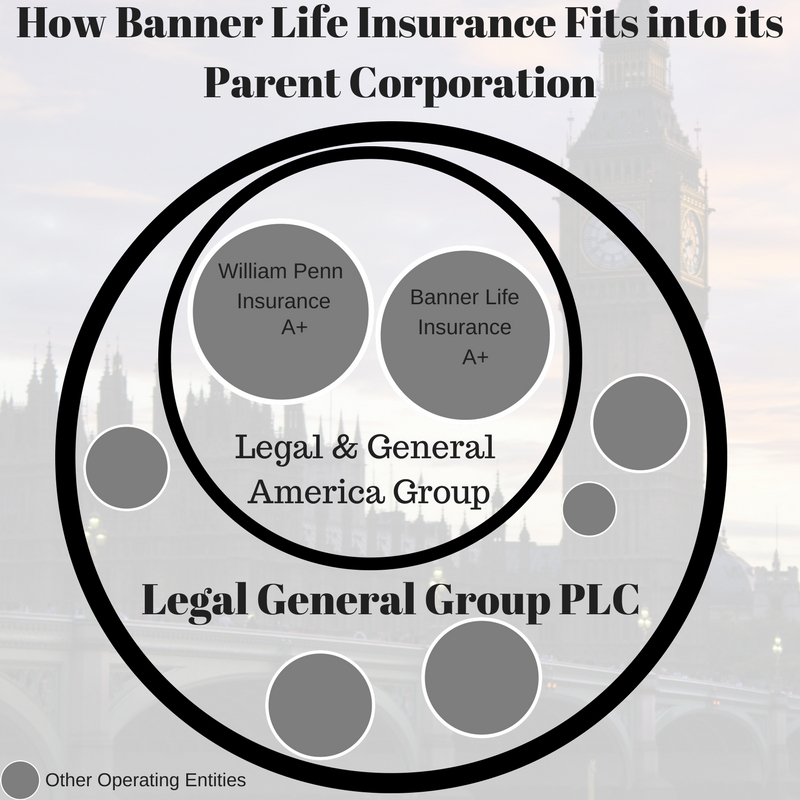

Below is a simplistic graphic of how we understand the corporate structure to work. Legal General Group PLC is the ultimate parent company. You can see from the chart some general information about banner life insurance subsidiaries. Actually its probably more accurate to consider banner life insurance to be a subsidiary.

Banner Life Insurance Company

Insurance Products:

Banner life insurance is certainly a low cost leader. Their pricing is often either at or near the bottom. They and a few other insurers seem to be consistency checking and changing market pricing. If they are not the lowest bidding insurer they are often near the lowest.

Bannerlife also produces some of the quickest turn around for life insurance policy issuance. With certain underwriting cases, typical paramed underwriting can be waived. This office has seen astoundingly fast turn around in certain underwriting situations.

However even if you had an underwriting health issue, Banner may also be a best bet for you. They are frequently willing to underwrite certain health classes are more preferred (hence less expensive) rate classes than numerous other competitors.

Banner Life Insurance Underwriting Opportunities:

Each of these cases are naturally case specific. Meaning it depends on all of the specifics. If you are considering applying for a term life insurance policy with Banner life, than you will want to have all of your medical information with you when you speak with you when you speak with an experienced life insurance agent. As an example if cholesterol is your issue you may want to know our total cholesterol numbers and your HDL ratio. Also the name and dosage of any medicines you are on.

If, for example, you are a scuba diver wanting to get term insurance with banner, you will want your scuba specific information available. How often do you dive? To what depth? Where do you dive? Are you licensed? Do you dive as a hobby or profession?

Banner Life Insurance General Products:

Banner has three main life insurance products. Their flagship term product is the OPTerm. The OPTerm is a level term life insurance product. The product is issued from ages 20 to 55, 60, 65, 70, and even 75 years old for certain term lengths and underwriting situations. The Banner life OP Term is indeed a market leader and we believe it is their strongest product. The OPTerm is typically convertible during the life of the policy.

- 1OPTerm

- 2A List Term

- 3Life Step Universal Life

Banner life also has another term product known as the A List Term. This product is for certain highly compensated individuals. This is an increasing term life insurance policy and is part of a group term insurance program.

The Life Step UL or Life Step Universal Life Insurance policy is the third main product from Banner. This product is a flexible premium universal life insurance policy. If you are interested in converting your OPTerm policy than more than likely this is what you would convert it to.

The Banner OPTerm:

The Banner OPTerm is their premier product. This level term life insurance policy is renewable and convertible. They are issued in policy lengths of 10, 15, 20, 25, and 30 year periods. The premium prices are guaranteed through those years and then increase (dramatically) after the last year of guarantee. As an example the 30 year opterm will dramatically increase in cost on year 31.

Opterm is issued in coverage amounts as low as $100,000 and goes into the millions of dollars. Convertibility is generally allowable through the guaranteed years of coverage (IE the term period) OR until age 70, whichever comes first.

Banner Life Insurance Riders:

A rider is simply an endorsement to a life insurance policy that slightly modifies it.

For term life insurance policies these are generally additional policy features. These policy features may have a small cost or they may be free.

Banner Life Insurance Riders:

Banner Life Insurance Company

Sample Rates:

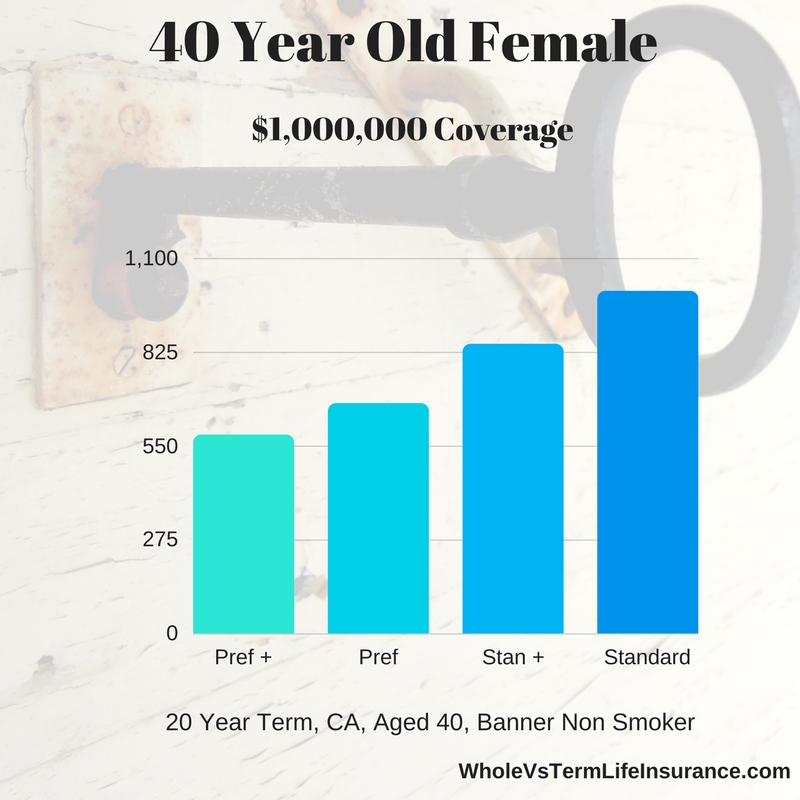

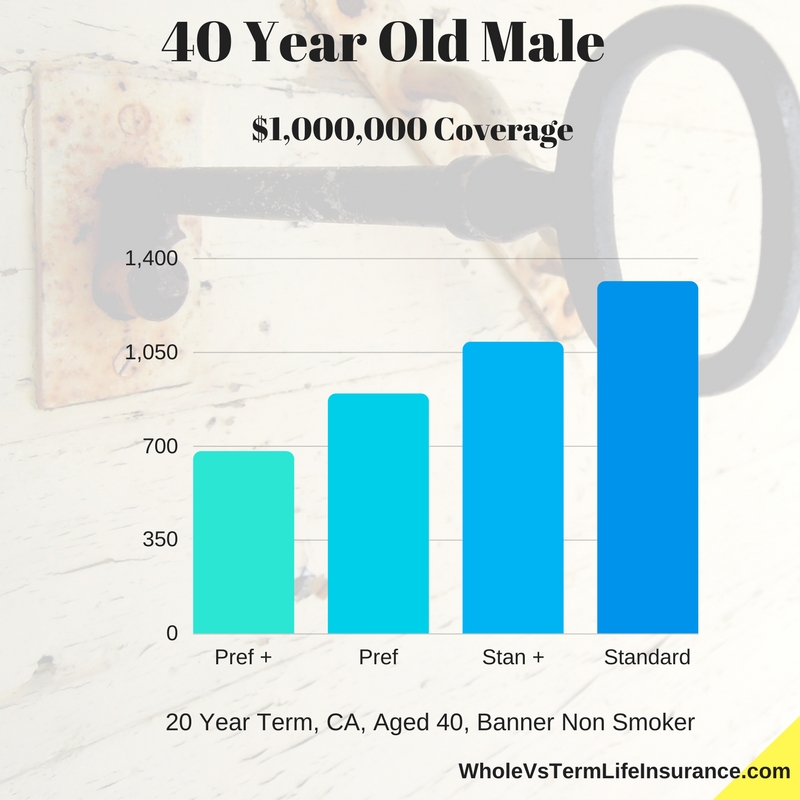

Banner has some of the best priced term life insurance products in the industry. Their level term life insurance policy, known as their opterm, is often a leader of the pack.

Banner Life INsurance Sample Life Insurance Rates $500,000 Non Smoker

Various Ages, CA, 20 Year Term, Female

$500K 20 Year | Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

Female Age 30 | $204 | $244 | $334 | $374 |

Female Age 35 | $215 | $284 | $372 | $400 |

Female Age 40 | $296 | $370 | $474 | $549 |

Female Age 45 | $450 | $530 | $739 | $850 |

Female Age 50 | $645 | $790 | $1,064 | $1,259 |

*all sample pricing - subject to change.

Of note with any of these sample rates from any insurer: the market for term life insurance is changing fast and quotes change quickly. These are sample rates provided at one specific point in time and these rates will change.

Banner Life INsurance Sample Life Insurance Rates $500,000 Non Smoker

Various Ages, CA, 20 Year Term, Male

$500K 20 Year | Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

Male Age 30 | $235 | $309 | $383 | $445 |

Male Age 35 | $254 | $325 | $414 | $499 |

Male Age 40 | $380 | $439 | $597 | $694 |

Male Age 45 | $575 | $690 | $948 | $1,095 |

Male Age 50 | $880 | $1,045 | $1,402 | $1,650 |

*all sample pricing - subject to change.

Banner Life Insurance Company

Best Uses:

There are so many good reasons for clients to consider using Banner life insurance that it might be easier to describe instance when they are not the best candidate. Banner life insurance excels at term policies for three simple reasons. Those three reasons are: Affordable Price, Great Underwriting, and Speedy Process.

Banner Life Insurance is a great product. It offers some of the lowest prices, with pretty lenient underwriting combined with fast underwriting.

There are lots of good reasons for consumers to shop and select Banners Term Life Insurance policy. It is one of the most popular products on the market. Below are some excellent candidates for Banners OPTerm policy.

Banner Term Life Insurance Best Candidates:

A Single Earning Couple, Whose Father and Husband are in perfect health but currently has no life insurance. They are expecting their second child and need a $400,000 term policy and fast. They live and work in North Carolina.

The Divorced New Jersey Father who cares for his five children. He has a group term life insurance policy through work, but met with their financial adviser who told them he was probably is under insured. He is looking for a stand-alone $1,000,000 Banner term policy. He is in good health, but has had some past history of issues.

The working Mom and Wife in, who works at a local hospital as a physician in Kansas. She has a past history of asthma, but it is perfectly controlled with two different medicines. She has a small group term policy through work, but is interested in supplementing with another $600,000 or $700,000 stand-alone term policy with Bannerlife. She is concerned about layoffs and what would happen to her group policy.

The childless Uncle who wants to assure his nieces that he will have the Michigan lake front cabin paid off so that they can someday have it. Although this may seem like a potentially frivolous goal to many, the cabin has been in the family for over 80 years and he loves his nieces. He is young and plans to pay it off via savings and regular mortgage payments, but is concerned of what would happen if had an accident happened.

The Financial Planner living outside Los Angeles, that is interested in a low cost term life insurance policy that has a convertibility option. He "may" wish to convert it at a later time, but does not have the time to consider such things right now. He enjoys limited scuba diving each year on their Mexico trip.

The Traveling Executive Mom and Wife, living in Denver Colorado who really worries when she travels for business. "My God - What Would Happen if I Never Came Home - How Would my Husband Pay the Bills?" She is shopping for a $2,000,000 30 year term life policy with Banner.

Two Married Moms - who just adopted their first child. Both are interested in $500,000 20 term life policies and both want it fast. They are considering adopting a second child and are worried about needing more life insurance. They live outside Atlanta and love Banner's pricing.

Should you have questions regarding life insurance or Banner Life Insurance - please either contact us via email or phone or ask a question in the comment box below.

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!