Pruco Life Insurance

Company Headquarters

& Contact Information:

Pruco Life Insurance Company Address: 213 Washington Street 9th Floor, Newark, NJ 07102.

Pruco Life Insurance Company Phone Number: 973-802-6000

Pruco Life Insurance Company Fax Number: 973-367-8204

Pruco Life Insurance Company Web Address: prudential.com

Chairman and Chief Executive Officer of Prudential Financial: John Strangfeld.

Pruco Life Insurance Company NAIC: 79227

Pruco Life Insurance

Company History:

Pruco Life Insurance is a division of Prudential Financial.

The Prudential had its beginnings in 1875 in Newark, New Jersey, which lies just outside of New York City, New York, as The Windows and Orphans Friendly Society selling burial insurance. The company was founded by Mr John Dryden who ran the company for the first 37 years. His son Forrest then ran the company for another ten years.

Between 2000 and 2001, Prudential modified its incorporation and went through demutualization from a Mutual Insurance Company to an American Corporation traded on the New York Stock Exchange under the symbol PRU.

Prudential is one of the largest american insurance and financial companies in the world and has diversified into a number of financial sub categories and corporate holdings. It is no longer a simple insurance company that merely sells one form of life insurance.

Pruco Life Insurance

Company Financial

Strength Ratings:

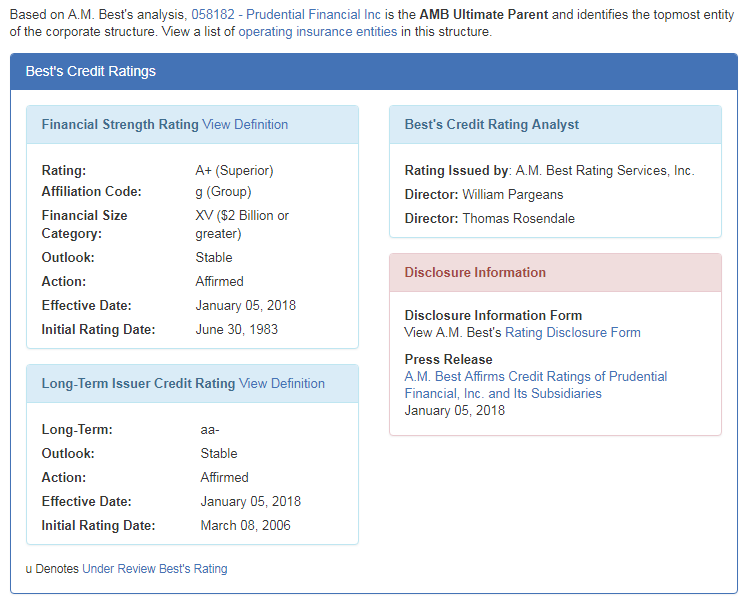

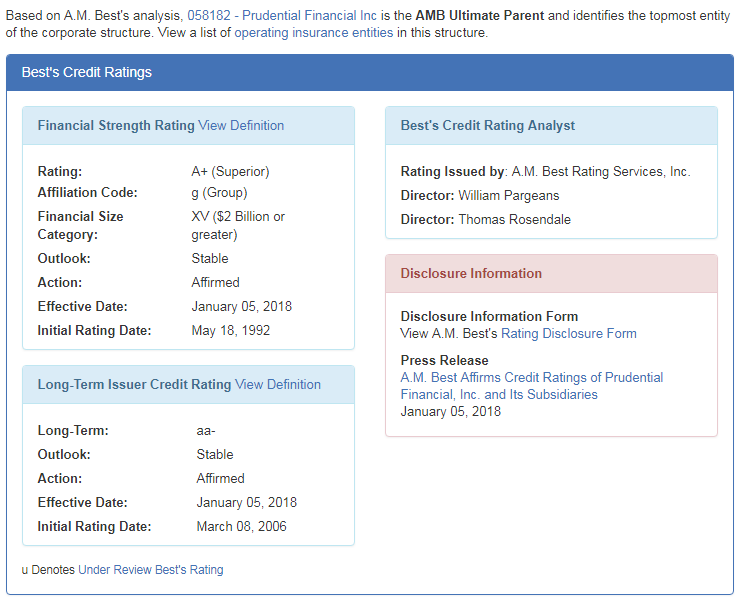

In order to understand the Financial Strength Ratings for Pruco, it is best to consider its parent child relationship. Both the Pruco Life Insurance Company of NJ and the Pruco Life Insurance Company are operating companies of Prudential Financial. Prudential Financial has numerous other operating companies such as Prudential Annuities Life Assurance Company and Prudential Insurance Co of America. However for the purpose of this article we are discussing both Pruco of NJ and the Pruco Life, both of which have the exact same AM Best Financial Strength Rating.

Prudential Financial's balance sheet has grown significantly in recent years from $11.4 Billion dollars at the end of 2013 to more than $14.1 Billion dollars by the end of year 2016. Their total liability have grown as well from about $695 Million in 2013 to about $738 Million at the end of 2016. Due to Prudential's size, heft, and market percentage it is one of the very few financial insurance companies that was designated with a "Too Big to Fail" designation. This designation carries numerous government regulations. The status may be up for reconsideration, so says an Investopedia article: Prudential May Lose Too Big To Fail Label (PRU)

AM Best Ratings of Pruco:

Pruco Life Insurance Company - Financial Strength Rating: A+

Pruco Life Insurance Company of NJ- Financial Strength Rating: A+

*these ratings from Jan- 2018. Source AMBest.com

AM Best Pruco Rating History:

May 2013: A+

May 2014: A+

June 2015: A+

Sept 2016: A+

Jan 2018: A+

Other Financial Strength Ratings for Pruco:

Standard and Poor's Financial Strength Rating Pruco Life Insurance Company: AA-

Moodys Financial Strength Rating Pruco Life Insurance Company: A1

Fitch Ratings Financial Strength Rating Pruco Life Insurance Company: AA-

*this chart was pulled direct from Prudential Financials Investor relations page and is as of November 1st, 2017.

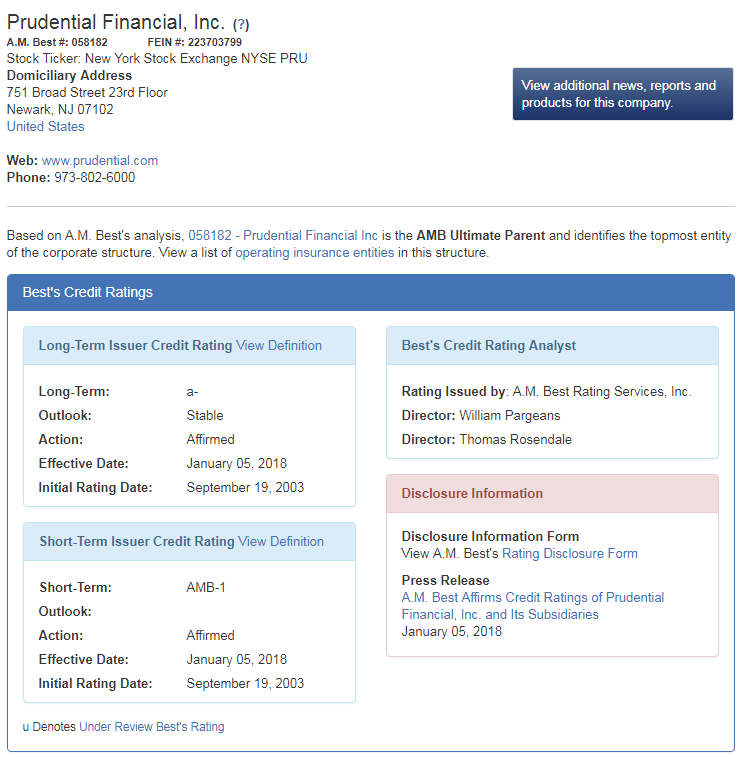

Long and short Term Credit Rating of the Ultimate Parent: Prudential Financial INc:

Since the company is owned by a large corporate financial and insurance conglomerate it can also help to review its own Financial Strength Rating, however, in this situation it does not have one. Therefore It is best advised to review at least the Credit Rating, which is distinct and different from a Financial Strength Rating, of the Ultimate Corporate Parent.

Prudential Financial Long Term Credit Rating: a-

Prudential Financial Short Term Credit Rating: AMB-1

*this ratings from Jan- 2018. Source AMBest.com.

Pruco Life Insurance

Company Insurance

Products:

Pruco offers numerous different type of life insurance products. Their best options seem to be in the Term Essentials program and their PruLife Universal policies. These two options are listed below.

Pruco Term Essentials:

Prudential Term Essential plans come in the following lengths: 10 Year, 15 year, 20 year, and 30 year. The minimum coverage amount is $100,000. Pruco Term Essentials may be convertible.

PRULIFE UNIVERSAL PROTECTOR:

A form of a Universal Life Insurance policy, these policies allow for a potential cash build up. Universal life insurance is similar to Whole Life Insurance policy however the yearly premiums have the ability to be flexible.

Prudential MyTerm:

The Prudential MyTerm is a special non med term life insurance policy that Prudential is starting to offer. The Prudential MyTerm competes against other non medical options such as Foresters. The Prudential MyTerm is not a convertible offering.

Pruco Life Insurance

Company Insurance

Riders:

The exact riders that you are available on a given policy will depend on the specific Pruco life insurance policy that you choose. However, below are a few of the Rider / Endorsement Options:

- 1Children's Protection Rider

- 2Accidental Death Benefit

- 3Waiver of Premium

- 4Living Needs Benefit

What is a Rider?

Pruco Life Insurance

Company Insurance

Best Uses:

Pruco and Prudential through all of there various corporate operating entities write lots of different types of insurance: Whole Life, Universal Life, Term Life, Disability, Accident, and many others. If you are looking for a particular type of insurance there is a good chance that Pruco or Prudential will have a product that fills your need.

However it would be a mistake to look at the Pruco Life Insurance Company and just think of it as just another corporate insurance behemoth. Under all those operating layers and names lie some really terrific life insurance products.

Why we love Pruco:

The Pruco Company really has some terrific underwriting characteristics that other insurers either refuse to write policies with or will only accept clients at a more expensive underwriting health class. In fact there are so many specific underwriting hot spots for Prudential and Pruco that it is almost too hard to list them all. Needless to say, WholeVsTerm loves Pruco in numerous life insurance underwriting situations.

A few of these include clients that have well treated sleep apnea. Sleep Apnea is a condition whereby patients experience quick bursts of non breathing during their sleep. If not treated this can be rather dangerous. If you have well treated sleep apnea, Pruco might be a good consideration for you and your family.

In the past Pruco has done a solid job of underwriting non US residents who work in the US or possibly Americans working overseas in some situations.

Prudential and Pruco can be more open to certain high cholesterol situations where other insurance companies will rate you at a higher and more costlier premium. It is very important to know your specific and general cholesterol numbers and ratios when applying.

The Pruco Insurance Company is also more open to medical marijuana usage based on the reasons the prescription was written for.

This is not the end, by any means, of all of the underwriting advantages to working with the Pruco Life Company.

In the end it is really best to speak with a licensed life insurance specialist that can assist you in choosing the correct and best insurance company based off of your health situation. We really love working with Pruco and feel that their excellent overall financial health (A+ AM Best Rating) and openness to many underwriting conditions can indeed make them one of the best financial choices that you can make. Pruco is not just another giant insurance conglomerate.

Pruco Sample

Term Life Rates:

Pruco Sample Male Rates, Preferred Plus, $500k and $750K

Age 35

Term Length | $500,000 in Coverage | $750,000 in Coverage |

|---|---|---|

10 Year Term | $355 | $490 |

15 Year Term | $380 | $528 |

20 Year Term | $390 | $543 |

30 Year Term | $450 | $633 |

*sample rates only

Pruco Sample FEMale Rates, Preferred Plus, $500k and $750K

Age 35

Term Length | $500,000 in Coverage | $750,000 in Coverage |

|---|---|---|

10 Year Term | $270 | $363 |

15 Year Term | $295 | $400 |

20 Year Term | $320 | $438 |

30 Year Term | $385 | $535 |

*Sample Rates Only

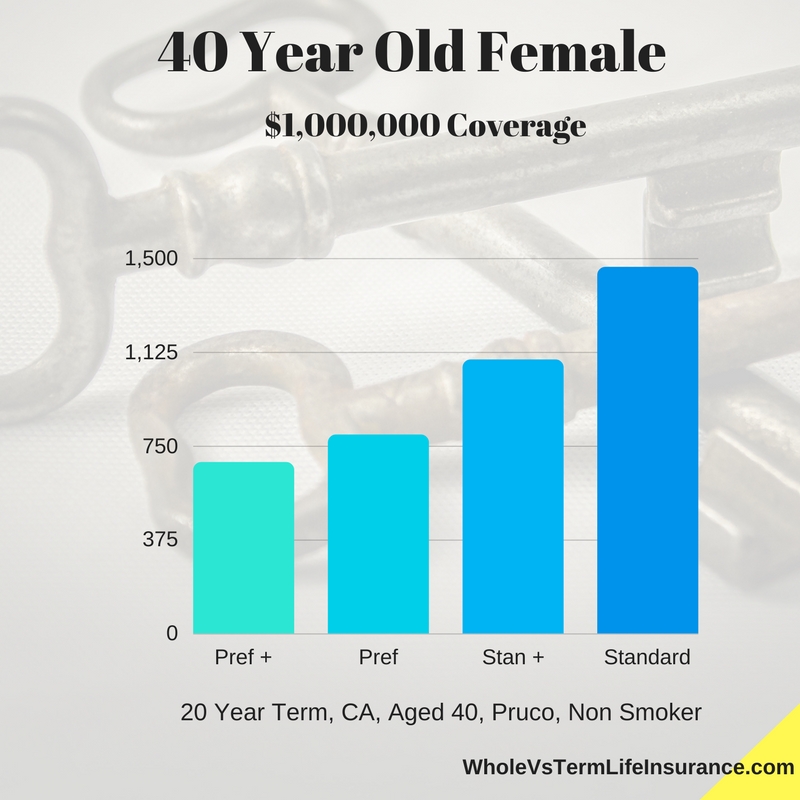

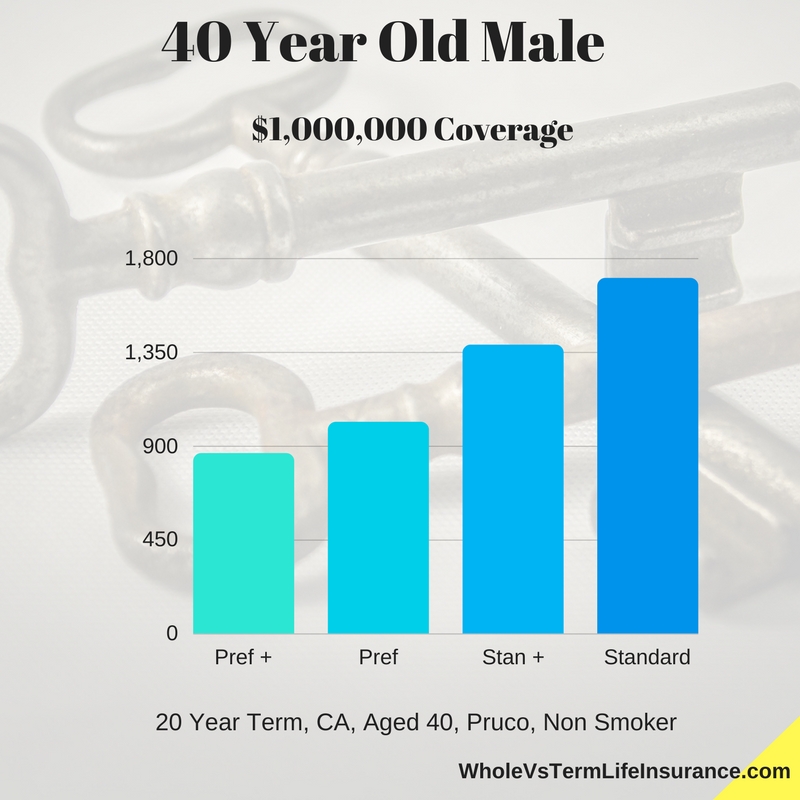

Pruco Sample FEMale Rates, Preferred Plus, $1,000,000

Pruco Sample Male Rates, Preferred Plus, $1,000,000

Thank you for reading about the Prudo Life Insurance Company. Whole Vs Term is authorized to sell their products in some US States. Check back here often for updates.

Should you have any questions, comments, or concerns - please feel free to send us a private message or to add a comment in the comment section below.

Speak with an experienced advisor!

Speak with an experienced advisor!