What is Decreasing Term Insurance?

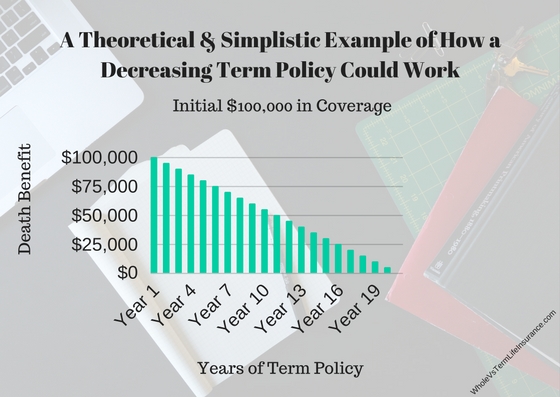

Decreasing term life insurance is a type of "annual renewable" life insurance whose premiums are typically level, but whose death benefit payout decrease each and every month or year. Policy length can vary depending on the insurer that you choose. A decreasing term life insurance policy, could be the type of insurance that one were to get if they purchased Mortgage Protection Insurance, whereby the coverage closely resembled that of the total mortgage. Decreasing term insurance is the opposite of level term life insurance. Level Term Life Insurance has essentially become the term standard.

Decreasing Term Insurance is almost always cheaper than Whole and Universal life insurance of the same coverage amounts. However it is not necessarily cheaper than level term life insurance.

When people reference "Term Insurance" they are usually referring to "Level Term Life Insurance."

Many clients ask What is Decreasing Term Insurance Used for? A decreasing term insurance policy could potentially be useful for a number of reasons. Consumers who are paying down their debt and building up their savings. Clients that want a lower death benefit each and every year. People who have an initial need for much more insurance, but less as time goes by.

However decreasing policies have some significant issues.

The Major Issue with Decreasing Term Insurance:

In theory decreasing term life insurance could make perfect sense for a family that is slowly paying down their debts and saving money. However - Decreasing Term Life Insurance is just not commonly purchased on the open market these days. In other words, many insurance companies no longer carry it. Therefore with a smaller pool of insurers it is not nearly as competitive. Given that numerous American consumers have some sort of health rating issue, usually the best option involves shopping instead for a carrier willing to accept each specific client with a level term policy.

There is another major issue with Decreasing Term policies. Typically these policies have the same annual premium for each and every year, even though the benefit decreases each year. Does that make sense to you? Year one might cost you $100 per year and provide $50,000 in insurance. Year ten will also cost you also $100 per year, but for only $25,000 in insurance.

On top of this, level term life insurance has come down in price over the last twenty years to the point that it is not that expensive for most consumers.

So - What is Someone that Wants a Decreasing Coverage Amount to Do?

A Better Way to Get a Decreasing Term Policy, but with Laddering Life Insurance Policies:

Ladder their life policies:

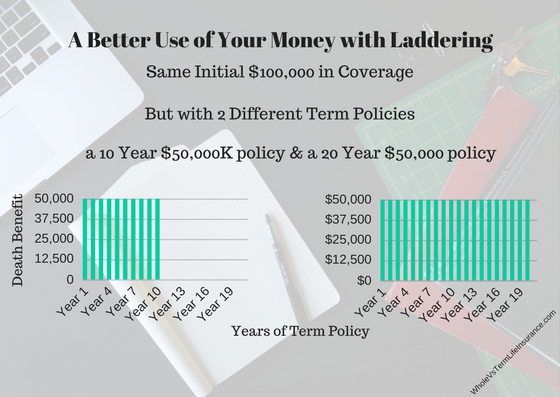

Laddering = Buying Two or More Level Term Policies at Different Lengths.

Laddering term life insurance policies involves buying two or more level term policies. The coverage amounts could be broken up based on client needs and insurer availability. As an example above the same $100,000 in term life coverage is purchased but with two policies, one of 10 years and one of 20 years. The benefit of doing this becomes greater, typically as the size of the benefit amount grows. This solution provides an initial coverage of $100,000 that is reduced to $50,000 at year ten and ends at year 20. In many scenarios this works out to be a less expensive option.

Other Potential Examples of Replacing Decreasing Term Life Policies with Laddering Level Term Life Policies:

Decreasing Term vs Laddering for a home Loan:

If a client wanted to achieve the same potential benefits as a thirty year decreasing term life policy to assist in covering their 30 year fixed, no arm, mortgage - then they could either:

Take Out a Decreasing 30 Year Term Life Policy

or

Take out Three Separate Term Policies, a 10 Year, 20 Year, & 30 Year.

These three separate term life policies would provide much more flexibility to the client. If for some reason they could not afford them all, perhaps if they lost their job, then they would, in theory be able to cancel the shortest ten year policy. They could also in theory do this if they were somehow able to make extra mortgage payments and get ahead on their total debt.

The $1,000,000 Laddering Solution:

Another potential use for laddering involves just securing all of the insurance a family may need, especially in an affluent area where ten times total earning can mean the potential need for several million dollars of term life insurance. A solution for this could be to purchase a decreasing life insurance policy in the amount of $2,000,000 over twenty years; with the benefit decreasing a bit every month. However a far cheaper solution usually involves the client purchasing a twenty year $1,000,000 policy coupled with a $1,000,000 ten year level term policy = netting them the same $2,000,000 in coverage but at decreased costs.

A $2,000,000 Decreasing Term Policy.

Vs

Two Separate $1,000,000 Level Term Policies, One a Ten Year & One a Twenty Year.

Why Decreasing Term Insurance Has Fallen Out of Favor:

There are numerous reasons that decreasing term life is not sold as often as it once was:

Questions about Decreasing Term Insurance:

Is Decreasing Term Life Insurance the Same as Variable Life Insurance?

No, Decreasing Term Life Insurance is a form of Term Life Insurance and Variable Life Insurance is an entirely different type of insurance. Although I can certainly understand the confusion around these two similar terms, they are in actuality completely different. Variable life insurance is a highly complex form of a Cash Value Life Insurance which mixes pure insurance with a true investment component. Variable life insurance is only sold by registered investment advisers.

Is Decreasing Term Insurance the Same Thing as Decreasing Term Life Insurance?

Yes, Decreasing Term Insurance is just another phrase for Decreasing Term Life Insurance

Do Decreasing Term Life Insurance Policies Generate Cash Value?

No, they do not, they are pure term life policies that accumulate no cash value.

Is there such a thing as Increasing Term Life Insurance?

Yes, Increasing Term Life Insurance has existed in the past and consumers may be able to purchase it. One type of policy that may be considered an increasing life insurance policy could be a Whole Life Insurance plan. Increasing life insurance policies, however, have many of the same drawbacks as decreasing policies do. Level Term Life Insurance is the current market standard.

Why should someone Buy a Decreasing Term Life Insurance Policy?

I cannot come up with a good modern reason in today's environment for someone to purchase one of these products. That does not mean that there are not good reasons out there.

| What is decreasing term insurance used for? |

Decreasing term insurance can, in theory, be used for a number of reasons. The best reason is likely is to pay down a debt that is slowly paid down such as a mortgage.

Have Other Questions about Decreasing Term Life Insurance?

Thanks for reading our article. Should you have any questions please feel free to email us or ask your question in the comment box below.

Speak with an experienced advisor!

Speak with an experienced advisor!