Geico Life Insurance Review

Geico is a terrific company that writes Auto Insurance in all fifty states and Washington DC. Their advertisement mascot gecco has made them famous in popular culture. Although at one point in their history they had a sister company that sold life insurance, technically speaking Geico no longer offers life insurance directly. Our article Geico Life Insurance Review is intended to answer common consumer questions about this large and important insurer.

If Geico Does Not Offer Life Insurance directly, who is selling It?

If you look at Geico's website, you will see a footnote down at the very bottom: it states that if you choose a quote from Geico "you will be taken to the Life Quotes, Inc. website." The footnote continues: that this site is "not owned by GEICO Insurance Agency." Therefore its perfectly clear that Geico will not be selling you a life insurance policy. Therefore when you go and buy a policy through Geico, you are working with a truly separate company.

About Geico

Originally GEICO stood for Government Empoyees Insurance Company, today Geico is one of the largest Auto Insurers in the United States. Recently they were listed as the number two behind State Farm. As of 2017 they have about six percent of the overall US auto market share. Number three is Liberty Mutual that has about 5.3% of the market. They write automobile insurance in all fifty US states. Geico's mascot the gecko is relatively famous for its commercials that seem to play endlessly on television.

The History of Geico

Leo Goodwin Sr started Geico in the 1930s in San Antonio Texas. Texas was also the location of his former employer USAA. Goodwin's initial philosophy at the time was to focus on Government employees which he believed constituted a less risky model of insurance. Geico insurance was quickly relocated to Washington DC. The company went public in 1948. About 1996 Geico was purchased by Warren Buffet's Berkshire Hathaway.

Geico did have a life insurance division, a sister company known as Government Employees Life Insurance Company or GELICO. This sister company was sold off to Legal General. Legal General is the owner Banner Life Insurance, among others.

Geico's Financial Strength Rating

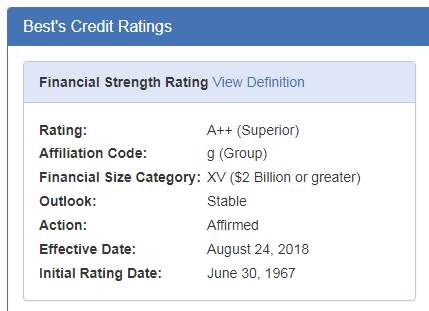

Geico Indemnity, has a financial strength rating of A++. This A++ rating is considered the highest that AM Best gives out. This puts Geico in the top of insurance carriers financial strength ratings, meaning that in the expert opinion of AM Best they are the least likely to have issues paying out claims.

Geico's Financial Size Category is a XV, $2 Billion and greater. This is considered the largest of sized insurers.

Will You Save 15% or Less with Geico Life?

The truth is that you can save 15% or less if you buy auto insurance with numerous insurers, sometimes. You can save 15% with life insurance any time you shop for multiple reasons. Often the difference between a fully underwritten policy and an express issue life insurance policy is simply 15%.

However there is nothing truly special about clicking through Geico's website to purchase life insurance as opposed to anyone else's in our opinion.

That all being said since you can not longer buy life insurance through Geico, you cannot really save 15% on your life insurance when you buy it through them.

How to Save Money with Life Insurance:

We have written numerous articles about saving money with life insurance in the past. However it is always good to recap how this can best be done. Often the best first place to start is to start with your budget. Do not buy any form of life insurance that you can not easily afford each and every year. Buying life insurance on year one and then not paying it on year two is a biggest missuse of insurance money.

Step Two is to stick with term life insurance for 90% or 95% of people. Yes there are examples of when buying whole life insurance can make good solid sense, but not in most.

The third method to saving money with life insurance is inquire with an experienced agent about your overall life insurance health class. A health class is a simple level of pricing that you may qualify for. If you have some sort of health condition is best to shop the condition. An experienced agent will know which carriers may be able to offer more competitive pricing.

A last simple method of saving on life insurance is often to stack various insurance policies together. Stacking and Laddering life insurance policies can save you lots of money. Often there is no reason to buy one big life insurance policy that last one big time frame.

How to Save on Life Insurance:

About Geico and Life Insurance:

Geico is a terrific company for auto insurance. They have simplified a necessary business model and have many happy customers to show for it. However they do not really sell life insurance themselves. If you are interested in saving 15% on life insurance, you should use an independent insurance agent/broker that can easily shop your proposed life insurance policy for you.

Geico is a terrific company for your automobile needs. It is really too bad that they do not offer life insurance. Perhaps if they did they could help lower life insurance for all american consumers.

In the end though, since you cannot save 15% buying life insurance with Geico, you can save that much money often by using our four step plan: Budget, Term, Health Class, and Stacking/Laddering.

Thanks for reading our review of Geico Life Insurance. Please check back often for updates. Please feel free to ask question in the comment box below or contact us at sales at marindependent .com

Speak with an experienced advisor!

Speak with an experienced advisor!