Is Permanent Life Insurance worth it as an Investment?

Will Whole Life Insurance Make you Wealthy?

Seven Important Considerations as Whole Life Insurance as an Investment:

Whole life insurance is constantly sold as a great way to save money. Often it is stated that whole life insurance is a tax differed or tax free method. The question is permanent life insurance worth it deserves an article dedicated to the often not discussed issues with it. Whole life insurance is a great product, it certainly has its place, but when considering it as an investment - there are several drawbacks.

Professionally speaking I believe that whole life insurance is a great product for: Clients that have a Special Needs Trust, Clients that cannot quality for typical low cost term life insurance, and Clients that are extremely wealthy and already filling up all of their qualified savings accounts and that consistently making lots of money and saving lots of money. However the product is sold to a much wide variety of American.

This article deals with a much larger comparison that this site has made on numerous occasions, which is - Is Term or a Participating Whole life a better product for me and my family? In this short article we will review seven (actually 8) important facts or reasons that permanent life insurance might not be worth it for you and your family.

One important note here - only participating policies pay policy dividends (generally speaking.) If you are considering purchasing a "Non Participating" Whole life insurance policy - this article is not for you.

Whole Life Key Fact 1: Dividends are Not Guaranteed

Permanent life insurance dividends are not truly guaranteed pay outs. Contrary to what numerous insurance agents say - most insurer contracts do not guarantee them. How can they? To better understand whole life dividends you must first understand what a dividend is. Dividends are paid out from participating life insurance companies. These companies use their profits to pay dividends to policy holders. If there is no profit for a given year, than there can be no dividend. Most of the better Participating carriers state that they have paid out policy dividends for dozens of years and this is often the case However just because an insurer has paid out policy dividends for thirty years is no guarantee that it will continue to do so.

In fact when considering this as an investment this is can be a very foolish assumption. General Electric was the only company continually listed on the list of Dow Jones Industrial Average for over hundred years until... it wasn't. Kodak was also a member of Dow Jones Industrial Average until it also wasn't and then in 2012 it filed Chapter 11 which is a form of bankruptcy. Assuming that the future will be similar to the past is not guaranteed, and neither are permanent life insurance dividends.

In my professional opinion, I believe that A+ and A++ Financial Strength Rated Carriers are some of the soundest of financial organizations in this entire country, however that does not necessarily mean they are impervious to a large scale financial or other type of event in the future.

Whole Life Key Fact 2: Whole life cash value could take ten years or more to be equal what you paid in

For many american consumers that already have a whole life insurance policy this often comes as a shock. Sadly many people do not discover this little factoid for years after the purchase.The reasons for this are numerous. Reason number one is that whole life insurance pays out large marketing and commissions expenses in the first couple of years - and those expenses must be paid out before much money is allocated to the cash account. Second, permanent policies have to pay for life insurance expenses the entire time. Contrary to what some agents might say - Whole Life Insurance is actually insurance. It is insurance that is in a way wrapped with a pseduo investment component.

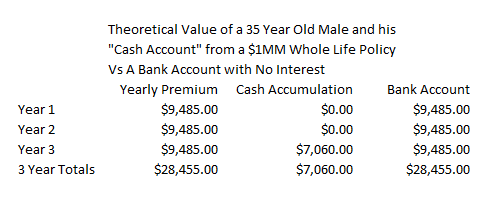

The above example demonstrates the cash build up from a theoretical permanent life insurance policy from a well known A+ Financial Strength Rating carrier. You can see that after just three years - only $7.060 has build up vs $28,455 with no interest paid out in a bank savings account.

Whole Life Key Fact 3: Not all of your premium is used for the savings account.

This important permanent consideration is very similar to point number two from above. Marketing and Commission expenses take a huge bite out of any potential cash value that could build up in your account. Mortality expenses also take a chunk out of your yearly premium.

In the above example you can clearly see this. Note not all permanent life insurance policy are exactly similar to this, however this is a fairly common example. In the above example you can see how after two years of spending over $9,000 on a whole life contract that NO cash value builds up in those first two years, none. It is only in year three that a small amount of cash begins to accumulate.

"Investing" in whole life insurance is nothing like investing in a stock mutual fund nor bank savings account. Do not be confused. "Investing" in a permanent life insurance policy is in reality buying a life insurance policy with a small separate sub account that may accrue a small interest in some distant future.

This is not to say that you cannot earn a fair rate of return on a par life insurance policy, however it is certainly not a short term savings account. In reality participating policies are the longest of possibly most investment options.

Whole Life Key Fact 4: Many insurance agents cannot explain cash value insurance policies accurately.

Admittedly this may be more opinion than fact - but in my experience many of the insurance agents that are out selling these complex products - really do not understand how they work. Whole life insurance for the correct person can be a terrific product. However when sold incorrectly - it can be a real issue. If an insurance agent does not fully understand the product how is proper placement made? The central question in this article Is Permanent Life Insurance Worth It - well it is unlikely that it is worth it if you are dealing with an insurance 'professional' that does not understand the product.

When procuring a whole life insurance policy it is generally best to deal with a specialist and avoid agents that sell home, auto, etc. Sometimes it is also in your best interest to work with an independent agent and sometimes it is best to deal with a captive insurance agent. It really depends on the policy and what you the client are looking for. One important thing to look for (and ask for) is a guaranteed chart. Focus on this chart while you sit through the sales presentation.

Example of life insurers that work typically with independent agents are Banner, Protective, Prudential, AIG, etc.

Examples of life insurers that typically work with captive agents are: Nationwide, Northwestern Mutual, New York Life, State Farm, etc

Whole Life Key Fact 5: Permanent life lags 'buy term and invest the rest' for the first 15-20 years in most situations.

I realize that this statement might require some data to back it up. However we have shown on numerous occasions on this site that Buy Term and Invest the Rest is the way to go for most consumers in most situations. However attempting to quantify the percentages of times that one outperforms the other is rather difficult. Therefore we need to focus on our past experience with it.

The average or standard participating policy essentially falls behind because of two main factors. The first factor are the high fees / commissions that get paid out upon the beginning of the policy. The second factor are the average dividend rates which although not as low as bank rates, rarely over the long haul beat market performance. An additional third issue is that permanent policies only pay out dividends on the money held in the cash account.

It may be possible to procure and set up a par policy that alleviates this by building it and using it withe goal of maximizing dividend gains early in the contract life, however the off the shelf permanent policy may not be built like this. Even the contracts that are set up in this fashion though, may short change you in other ways.

Whole Life Key Fact 6: 40% of buyers of whole life insurance cancel it in about 10 years.

You need look no further for evidence of the issues that whole life insurance face than this factoid which have been repeated over and over on this website. An alarming percentage of people that choose the more expensive option of life insurance fail to keep it until they can actually create a true cash value.

Why is this? Why do so many Americans drop their whole life policy? Perhaps it is the fact that it takes so long for a typical WL policy to develop an actual cash value. Perhaps it is the fact that a policy may seem affordable in the beginning but ends up being more than the client can continue. Perhaps it is low rates of return. Perhaps it is the fact that relative to term insurance it provides a smaller face value of insurance (as opposed to a larger face value over a longer period of time.)

Regardless of the exact reasons - this dirty dark secret of permanent life insurance sales is salient.

Whole Life Key Fact 7: Some states charge Premium Taxes.

Yes it is true that great investment that you have heard of may be charged a state premium tax. Typically these taxes are baked into the quote that you are given, but they are there.

"An insurance premium tax is a form of gross receipts or excise tax; it is not based on profits or earnings, and is not affected by the cost of ceded reinsurance or other expenditures, of an insurer" Insurance Law source.

"hidden inside your insurance bill is a 2.35% CA premium tax — essentially a sales tax."

Here are Seven States that Charge a Premium Tax:

Wyoming: 1%

California: 2.35%

West Virginia: 1%

South Dakota: 1.25%

Nevada: 3.5%

Maine: 2%

Florida: 1%

To be truthful the concept of premium taxes and so called "retaliatory taxes" are far more convoluted and confusing than an article presented to the public can demonstrate. Suffice it to say that many agents may merely mention these seven states leaving you to believe that the remaining 43 states do not charge a similar tax, however this is not the case.

Mind you that the rules can be different if an insurance policy is held in a qualified account. This could theoretically be the case for annuity held in a some-sort of IRA. This premium tax, in California, is levied of most forms of insurance such as home insurance and in those situations is not likely to be a big consideration. However for Annuities this is a HUGE financial calculation. For term life insurance policies this could have a small effect but for permanent life insurance policies purchased as an investment this seems to me to be a large headwind.

Some could counter that since these premium taxes are 'baked' into policies - it doesn't really matter. It is after all somewhat similar to a corporate tax. However since the premium tax calculates into the bottom line of the insurer and since permanent life insurance policies make money off of the policy dividend (which is essentially a portion of the insurer's income) than anything that lowers the bottom line, essentially ultimately lowers the dividend payment.

The media has spent considerable amounts of time calculating and broadcasting various income, sales, and property tax statistics - however on the subject of premium taxes - I rarely hear anything about it.

Therefore in states such as Nevada and California, its hard to imagine these products performing well with this tax as currently charged. In other states not listed here, consideration of their independent state department (or their version of a department) taxes might be helpful.

*This list is subject to change. This is not a complete nor comprehensive list.

Whole Life Key Fact 8: Dividends are only paid out on the cash value in your account.

I realize that I only listed seven reasons in the headline, but yet I am sharing with you an additional 8th reason. I prefer to over deliver. This important fact should be something that all consumers understand when they purchase any whole life insurance policy. However I find an astounding percentage of people that already have these policies that do not know this. Only the money IN your cash account is eligible for participating dividends. In other words the money that is used to pay for the insurance and marketing expenses are not eligible.

This fact is one of the true things that holds back life insurance policy growth. When compared with a typical internet savings bank that begins paying a much lower interest rate on the entire deposit - whole life insurance lags in growth. Regardless of what dividend rate is being paid out yearly the dividend is ONLY paid out on the balance in the cash account.

The Ultimate answer to Is Permanent Life Insurance Worth it.

Those eight reasons are the main reasons that permanent life insurance is often just not worth it, at least as an investment. How many other investments do you know of that can be charged a fee for merely making a deposit on your money? How many other investments are you aware of that can take three years before a single dollar is deposited in your account? How many other investments can take 15 years to break even? As an investment whole life insurance is often not worth it, especially for the first 20 or 30 years. Beyond that permanent life can make a good somewhat safe store of wealth, but you likely will not get rich off of it.

You will specifically note that we did not attempt to answer the question: Is Whole Life Insurance Worth it if you want Life Insurance for your entire life? We shall attempt to review this, slightly less complex question in another post.

Speak with an experienced advisor!

Speak with an experienced advisor!