Preferred Plus Life Insurance refers to the best life insurance health class available through all life insurance carriers. Although this health class is often the most likely shown in quote format, they are relatively rare for American consumers to qualify for. However with a knowledgeable agent your chances of qualifying for this best in price product will be dramatically increased.

Preferred Plus Life Insurance:

Preferred plus is one of four life insurance health classes. It is the lowest priced (best rate) of these four options. The four main health classifications are:

Standard non smoker is considered the most expensive health class. Obviously as the name would imply it is the regular term insurance offering. Standard Non Smoker is not the most expensive offer that a term insurance can make. Beyond Standard are "Table Ratings." Table Ratings are reserved for those with much more complex and complicated life insurance underwriting conditions.

Preferred Plus could can also be called Ultra Preferred Pricing by a few carriers. However preferred plus is the far more common name and description than ultra preferred.

- Preferred Plus = Best Rate Available -

The Benefits of Preferred Plus Life Insurance:

There are really innumerable benefits to qualifying for best in class pricing: preferred plus. The list of financial benefits are endless. You can buy either a higher face value policy or a longer term length policy. You can used the money saved to save for college in a 529 account. Perhaps you can pay down your mortgage just a little bit more. You may, possibly be able to convert the policy at a later time with the added savings. The possibilities are endless.

One interested consideration is that spending less on your life insurance allows you to save money elsewhere. As your savings increased, your need for term insurance decreases. Therefor all other things being equal a lower priced term policy allows for less insurance, possibly, later on.

The Drawbacks of Preferred Plus:

It is a bit of a stretch to suggest that there are really any drawbacks to qualifying for preferred plus life insurance pricing. Because frankly there are not any real true negatives. There are only two that I can think of and both of them are based on expectations. Consumers constantly see preferred plus pricing but many do not qualify for them

One important note with preferred plus pricing is that if you qualify for it, I would encourage you to grab as much life insurance as you can. It may make sense to increase the coverage requested in certain situations.

How do you Qualify for Preferred Plus Pricing?

First off, this list is different for each life insurer. In other words these are commonalities but not the same with all of the carriers.

It is not possible to list out all of the underwriting requirements because the differing insurers do actually maintain different lists.

The lists for dangerous jobs and careers is much more expansive than this sampling. The lists for dangerous hobbies is also much more advanced than this.

An additional note here: With all of these health related issues, some insurers will take you at preferred and another insurer will offer you preferred plus. Therefore it is imperative that you discuss your exact situation with an competent agent.

The same can be said for dangerous activities and international travel.

So If I meet all those Criteria, I will be Preferred Plus?

Sadly No, not necessarily. However there is a fairly good chance. There are many health conditions not listed specifically that do matter, such as Asthma, Sleep Apnea, and Diabetes, that can knock you out with some carriers as well.

- Preferred Plus = Best Rate Available -

An Example of the Differences / Disparities between Insurer A vs Insurer B Preferred Plus:

Want to know about a secret of life insurance underwriting? Each Insurer has their own tables for just about everything. But these tables are not really public information. Generally the insurance agents may get to see them. Intelligent agents will sell with them. Below are a few conceptual examples:

HDL CHOLESTEROL Ratios Allowed

with Five life Insurers:

Various American Life Insurance Companies:

| Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

An A+ Insurer | 4.5 | 5.5 | 6.5 | 8.0 |

An A+ Insurer | 5.0 | 6.0 | Not Stated | Not Stated |

An A+ Mutual Insurer | 5.0 | 6.0 | 7.0 | Not Stated |

An A+ Insurer | 4.5 | 5.5 | 6.5 | Not Stated |

An A- Insurer | 5.0 | 5.5 | 6.0 | Not Stated |

This above chart is massively simplified so that consumers can understand a concept. Many insurers not only look and cholesterol rations, but the total cholesterol numbers as well. Some take into consideration age and sex. There are also considerations for medications, such as statins. There are numerous other underwriting not discussed.

All Financial Strength Ratings = AM Best.

In the above example you can see the major differences here. Now, as noted in the fine print, we have greatly simplified this chart, so everyone can understand the concept. Lets say that you are interested in qualifying for Preferred Plus with an A rated (or better) carrier. If you had an HDL ratio of 5.0 who would you NOT want to apply with? Consumers do not know this information, but again, some agents do know this. A slight difference between carrier A vs carrier B can cost you a boatload of money. Of note none of these carriers are home - auto insurers which often are more stringent.

Blood Pressure Readings Allowed

by five life insurers

Various American Life Insurance Companies:

| Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

An A Insurer | 140/85 | 145/88 | 150/92 | Not Stated |

An A+ Insurer | 130/80 | 140/90 | Not Stated | Not Stated |

An A+ Insurer | 130/80 | 135/85 | 140/90 | Not Stated |

An A+ Insurer | 135/85 | 140/85 | 145/90 | Not Stated |

An A+ Mutual Insurer | 140/85 | 145/90 | 150/90 | Not Stated |

The above chart is massively simplified so that consumers can understand a concept. Most insurers look at more than just the systolic and diastolic numbers. Some take into consideration age and sex. There are also considerations for medications. There are numerous other underwriting not discussed.

All Financial Strength Ratings = AM Best.

In this example, which is also simplified, you can see the variance from one insurer vs another insurer. If you only health issue was a slightly elevated blood pressure reading, which carrier would you choose? How would this consumer best qualify for Preferred Plus pricing? Of note none of these carriers are home/auto insurers which often have some of the most stringent underwriting.

So is Preferred Plus Pricing Unattainable?

Preferred Plus Pricing is Not unattainable. But.. with many carriers and insurers it is far harder than with others. If you desire to qualify for Preferred Plus pricing and you have just one or two minor marks against your underwriting portfolio it may make sense to get on the phone with a solid agent and do a case walk though. A case walk through would involve the few things working against you for preferred plus life insurance pricing,

A Preferred Plus Weight & Height Chart:

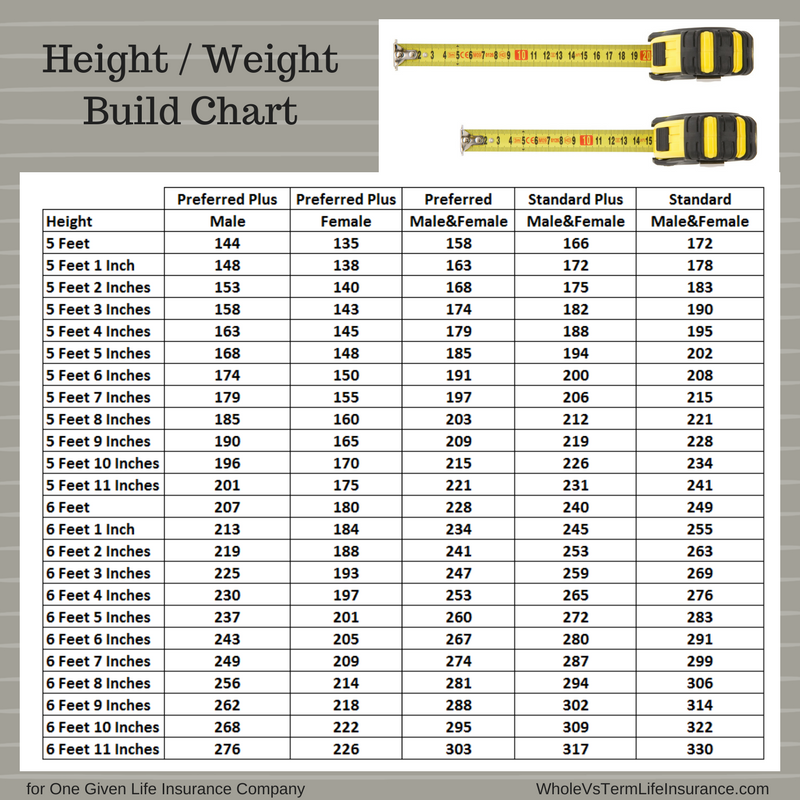

In the Life Insurance Weight Chart to the left you can see Preferred Plus Pricing as well as others.

You will note the obvious fact that the taller you are - than the heavier that you are allowed to be for preferred plus.

This Preferred Plus Height Weight Chart is just one example of a given insurer's requirements.

Each potential insurer has their own chart just like this.

It pays to speak with an agent.

So what does it mean if you are a few pounds over? Not much really, either lose a few pounds, or find a different life insurer.

A somewhat common question that is asked is why is my weight such an important consideration for preferred plus term pricing? The short answer is that your height / weight is probably the number one item that an insurer can look at to get a glimpse of your overall health. Overweight, even modestly overweight people have are at risk for numerous medical conditions

Obesity is associated with "breathing disorders,certain types of cancers. (heart) disease, depression, diabetes...high blood pressure, high cholesterol, joint disease, and stroke." Among others. Therefore having a lower body weight can potentially protect you from numerous other health issues.

Strategies to Qualify for Preferred Plus Life Insurance:

Yes, there are strategies you should use if you want to qualify for Preferred Plus Life Insurance pricing. Some of the below examples may not pertain to you. However if just one or two help you - than you could save hundreds...

So what exactly does "work on your underwriting weak spot" mean? Well, if you are overweight, than know what the preferred plus weight required is and lose a few pounds. If it is your cholesterol, consider taking action on this. If a carrier will not accept Scuba Diving in the past two years, than wait out this time period. Etc.

For some that have numerous underwriting weak spots this strategy may not be as helpful. However going through the list and speaking with your agent you may end up being able work on one issue in order to qualify for the next best rate which is preferred pricing. For many american consumers preferred pricing is a great deal.

Many consumers wonder why I suggest that they start off with a life insurance quote from their home auto insurer and a simple answer is that its often the insurance agent that they know. This can be a great place to start. Why? Because in many low dollar figure contracts, they can be a deal. The typical issue with the home insurer policy is the underwriting. Often their underwriting can be very very stringent.

After you have an 'actionable quote from the home agent, make sure you will qualify, in their opinion for preferred plus pricing. Next meet with an independent agent and allow them a few days to shop around your underwriting condition. They may be able to get a limited approval from a carrier at the preferred plus pricing. The cost savings from Home Insurer A at preferred vs Independent Insurer B at preferred plus can be astounding.

Questions about Preferred Plus Life Insurance:

Do you have a more detailed question about life insurance? If you do, please send us a private message via email: sales at marindependent.com. We would be more than happy to assist you in securing your own preferred plus policy.

Please only add 'general questions' to our content box below. Again, thanks for reading.

Preferredplus, might not be for everyone, but with a little help, it can be available for more people.

Speak with an experienced advisor!

Speak with an experienced advisor!