Buying life insurance as mid thirty year old woman has its own peculiarities. You are not old enough to not need life insurance, but you are just about the age when the rates start to go up. Women live longer than men, therefore they often will pay less for life insurance than men. However since they live longer, often it can make sense for them to buy either a larger policy or a longer policy.

Quick Info - Sample Rates 35 Year Old Woman

About Health Classes:

The three major factors that quickly go into life insurance rates are: Policy Length, Coverage Amount, and Life Insurance Health Class. The health class is a method of grouping people with different risks into specific cohorts for pricing purposes. It should not be looked upon as a good or bad thing, more of a shorthand for pricing. Each companies health classes tend to be slightly different, but somewhat similar.

Often the best way to find out what your health class is likely to be is to speak with a licensed insurance agent. The agent may be able to quickly assess what health class you may qualify for.

Health classes take into account much about your and your families past history, such as: Health History, Pharmaceutical History, General Health Conditions, Past Medical Ailments, Your Career, Driving and Arrest History, and What you like to do for fun. There is much more, but these are just a few of those.

There are four main health classes: Preferred Plus, Preferred, Standard Plus, and Standard. Hopefully you will qualify for one of these four. Lower than those four are so called table ratings. Table ratings are reserved for more challenging underwriting cases.

Health classes are also broken up into non tobacco and tobacco. This article deals exclusively with non smokers.

The preferred plus rating class for thirty five year old is allowed for only those women that are in tip top life insurance shape. Although a certain height to weight ratio is required, preferred plus is often what some women think it will be. In other words you do not have to be in great "shape" so to speak, but likely you will exercise, not be overweight, have no past major medical histories, have a clean family history, arrest record, and little if any driving infractions.

But that is usually still not enough to qualify for preferred plus. You will also not perform any of the dangerous hobbies and not have involved with a dangerous occupation.

If you qualify for preferred plus - take it. It will only get harder to qualify as time goes by.

Preferred Plus- Sample Rates 35 Year Old Woman

Below please find sample rates for women at age 35 at preferred plus pricing at three different levels: $500,000 - $750,000 - and $1,000,000. Not all with qualify for these rates:

Sample Rates-Life Insurance 35 YeAR Old - Female - Preferred Plus - $500,000 in Term Life Coverage

Female California Rates, $500K in Coverage | |||||||||||

Preferred Plus Non Smoker:

|

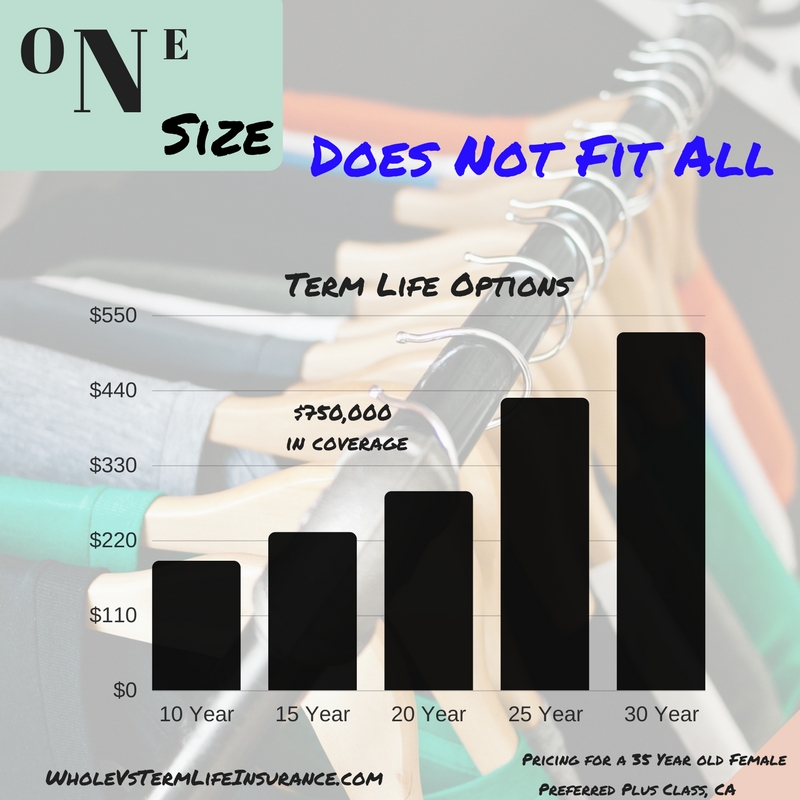

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - PREFERRED PLUS - $750,000 IN TERM LIFE Coverage

Female California Rates, $750K in Coverage | ||||||||||||

Preferred Plus Non Smoker:

|

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - PREFERRED PLUS - $1,000,000 IN TERM LIFE Coverage

Female California Rates, $1MM in Coverage | |||||||||||||

Preferred Plus Non Smoker:

|

The preferred life insurance health class is an awesome deal for women in their thirties if they can grab it. It is still a fair price and has some slight accommodations for people that have one, maybe two minor issues. These issues could be a slightly higher blood pressure or cholesterol number or a past family history of an early death. Knowing nothing else about a thirty fiver year old that I speak with, you should probably be quite happy if you qualify for it.

As with preferred plus, clients that qualify for the preferred rating should probably accept it, as it may not be likely they will somehow requalify at the preferred plus at this age.

This life insurance class is a good solid rate.

Preferred - Sample Rates 35 Year Old Woman

Below please find sample rates for women at age 35 at preferred pricing at three different levels: $500,000 - $750,000 - and $1,000,000. Not all with qualify for these great rates:

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - PREFERRED - $500,000 IN TERM LIFE Coverage

Female California Rates, $500K in Coverage | ||||||||||||||

Preferred Non Smoker:

|

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - PREFERRED - $750,000 IN TERM LIFE Coverage

Female California Rates, $750K in Coverage | ||||||||||||||

Preferred Non Smoker:

|

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - PREFERRED - $1,000,000 IN TERM LIFE Coverage

Female California Rates, $1MM in Coverage | ||||||||||||||

Preferred Non Smoker:

|

Standard plus pricing is a common middle ground for lots of Americans. It can accommodate people that have some weight issues, possibly diabetes, higher and un-managed Cholesterol, possibly breathing issues such as asthma. As with most medical conditions - life insurance underwriters generally prefer to see a problem managed by a doctor. And they like to see the client sticking to the protocol, in other words doing what the doctor says.

Therefore, although more costly, the Standard plus class can be a deal for certain people. Often clients are presented with this as a proposed policy only after finding out that one of their medical tests came back with an undesired number.

Standard Plus - Sample Rates 35 Year Old Woman

Below please find sample rates for women at age 35 at standard plus pricing at three different levels: $500,000 - $750,000 - and $1,000,000. Not all with qualify for these standard plus rates:

.

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - Standard PLUS - $500,000 IN TERM LIFE Coverage

Female California Rates, $500K in Coverage | |||||||||||||||

Standard Plus Non Smoker:

|

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - Standard PLUS - $750,000 IN TERM LIFE Coverage

Female California Rates, $750K in Coverage | |||||||||||||||

Standard Plus Non Smoker:

|

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - Standard PLUS - $1,000,000 IN TERM LIFE Coverage

Female California Rates, $1MM in Coverage | |||||||||||||||

Standard Plus Non Smoker:

|

The standard life insurance class is the lowest life insurance health class. Although it is the lowest it can be for many the best life insurance class they may ever be offered. The four underwriting classes are preferred plus, preferred, standard plus, and standard. Beyond those are the table ratings. Table ratings can be a lot more expensive than standard life insurance rates.

This rating class allows for multiple issues and some of them far more serious. Occasionally it can allow for breathing issues such as Asthma, High Cholesterol, Obesity, Possibly Diabetes, Some Dangerous Actives, Dangerous Jobs, Etc. If you are have a hard to write life insurance need - this is the underwriting class that you should be shooting for.

Clients that are accepted at the standard pricing - often are forced to make the difficult decision of cutting down their life insurance bill by either choosing a shorter coverage period or a lower face value. Good insurance agents will want to review these options with you.

Standard - Sample Rates 35 Year Old Woman

Below please find sample rates for women at age thirty five at standard pricing at 3 different levels: $500,000 - $750,000 - & $1,000,000. Not all with qualify for these good rates:

SAMPLE RATES-LIFE INSURANCE 35 YEAR OLD - FEMALE - Standard - $500,000 IN TERM LIFE Coverage

Female California Rates, $500K in Coverage | ||||||||||||||||

Standard Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Standard - $750,000 in Term Life Coverage

Female California Rates, $750K in Coverage | ||||||||||||||||

Standard Non Smoker:

|

Sample Rates-Life Insurance 30 Year Old Female - Standard - $1,000,000 in Term Life Coverage

Female California Rates, $1MM in Coverage | ||||||||||||||||

Standard Plus Non Smoker:

|

Term Life Policy Length Considerations for Females:

Women live longer than men. This is a general fact. Shape magazine states it succinctly: "Today, women are outliving men in every country in the world." This plays out with pricing. This article discusses pricing for female non smokers, not male non smokers. Had it, you would be able to see that men almost always, with everything else being the same, will pay more for life insurance.

That men live shorter lives can be viewed as both good and bad. The bad is that well, women live longer, therefore they have an increased need to save fore retirement and all that goes with that.

In consideration of purchasing term life insurance, since women live longer and since they pay less for term life insurance, it can make good sense for them to purchase a slightly longer term length than their male counterparts. How much more is up for conjecture and debate. Perhaps 5 or 10 years more in many cases.

Does it really make sense for a 35 year old women to buy a 30 year term life policy? I believe it does, assuming that she qualifies for one of the better rates through one of the better insurers.

Often it can make the most sense to shoot for the time period required to get your youngest child out of the house and possibly through college.

The choice and decision are yours.

Coverage Considerations for 35 year old Women:

The term life policy length is just one of the major decisions ahead for thirty five year old women shopping for level term life insurance. The other main consideration is one of death benefit amount. In other words, what size policy should a female of this age procure?

This is certainly one of the most common questions that life insurance agents get - but the answer is not simple. There are lots of ways of calculating how much term life one needs. The simplest method often involves multiplying by ten your income. As an example if you make $50,000 per year than you would want $500,000 in insurance. However this is simplistic.

A much better method may be to calculate in your 1. Current Assets 2. Your Debts 3. Your future earnings and 4. Your future financial needs. Throw this all into a calculation and come out with an ideal amount.

Questions about Life Insurance 35 Year Old Female?

Can I Get Life Insurance if I am Pregnant?

Yes you can get life insurance if you are pregnant, but it is more difficult. Also you may not be able to qualify for the higher class that you would have before you pregnant. If you are going to buy it during pregnancy - but it sooner rather than later.

Why is Term Life Better for most Americans?

Term life is a simple, pure form of life insurance. The other competing types of life insurance, such as whole and universal life are complex and add in an investment component. A typical whole life insurance policy may cost you anywhere between 8 to 20 times more.

How do I know What Health Class I Qualify for?

An insurance agent can issue their "opinion" after speaking with you. After you the complete the first application they should have more of an idea. However, insurance agents do not know everything. Often we can consult with the insurance company and gauge on certain metrics, but we will not know the exact rate until after all of the full underwriting is completed.

I am 35 and Don't have kids, Do I Need Life Insurance?

Thirty five year old women, who do not have kids, may or may not need life insurance, depending on their given situation. Do you intend to have children? Do you have debts that you wold like to be paid off with the money? It really depends on your situation.

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!