But they learn Fast!

When the Jacobs fail to check a Financial Strength Rating for an Insurance Company, they almost make a big mistake.

But they quickly recover and make an informed intelligent decision.

The need to buy life insurance is important. But almost as important is the Need to Check a Financial Strength Rating of the potential insurance company.

All of the Decisions that need to be made:

- Type of Life Insurance

- Death Benefit Amount

- Policy Length

- Beneficiary

- But what about the life insurance company. How do you know which company to buy life insurance from?

Given all these important decisions to make about the type, length, amount, etc of the life insurance policy, many clients ignore one of the most central decisions to buying life insurance = The Life Insurance Company itself. But how do consumers evaluate a life insurance company? Do they use some sort of life insurance rating?

Consumers of Insurance Need to Check a Financial Strength Rating:

Meet the Jacobs:

The Jacobs are a Kansas family that is getting their financial act together after having their first son: little ray. Recently they saw an attorney and had a simple revocable trust established for probate reasons. During their meeting with their Attorney Jesus, they discussed the need for life insurance.

"You Really Should Get a Life Insurance Policy" Said Jesus to Ray senior.

"I know, we just have not had time with the the addition and running the farm."

At the end of the family conversation Raymond Senior agreed to put it at the top of his to do list.

Time goes by, first a couple of days and then a couple of weeks before - Judith his wife asks him about the status of getting life insurance. Ray admits that he, again, has been too busy. Judy threatens to take the project over the term life hunt herself if he does not immediately start in on it. Ray agrees and begins making life insurance calls that very night.

The next night during a sleepless night, Judy sees an ad from an insurance company - that offer "Easy to Buy Life Insurance" from a company that she has never heard of. She scratches her head not having thought about the complexities of even qualifying for life insurance. Can Ray qualify for a simple life insurance policy?

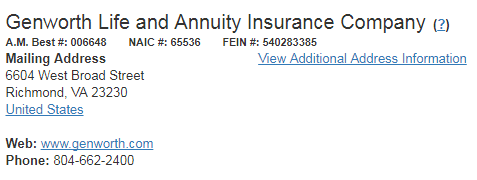

The next day a friend suggests that she consider getting a life insurance policy from Genworth Life Insurance. She googles Genworth life insurance and calls the insurance company that day to get a quote.

For her husband a twenty year level term policy with a $400,000 death benefit amount might cost:

The agent on the phone helps her choose the twenty year term policy partially because they have a brand new baby and partially because her husband is 30 years old. Judy thought it over and decided that life insurance until he was 50 was necessary, anything more might be much more expensive.

Judy struggles more with the benefit amount. She hates thinking about losing her husband Ray - but she wants to be financially secure if anything happens to her husband and lord knows she would not be able to work the farm alone, let alone pay the mortgage. There are really too many reasons or benefits to life insurance to even get your head around she thinks.

Since she is currently not working and since on average her husband has made about $40K per year she and the phone agent somehow arrived at the $400K number. After thinking it over though she realizes that that number is not enough to cover the entire mortgage on their farm. But perhaps they would sell the farm?

When Ray gets home the two of them speak while she feeds little Ray. Raymond Sr again admits that he has done very little but did not a good name of an independent agent from his friend Roy from the club. Judy tells him that she doesn't really care where they get the life insurance coverage from, but that she got a full quote from Genworth life insurance. The name sound familiar to him and he asks her to get the thing done. "OK" says Judy.

The next day Judith calls into the insurance company to "buy insurance." The phone agent tells her that the husband is going to have to call in to do this. Judy groans under at the chance that her lazy husband will actually take care of this.

Judy waits two days to tell Ray that the insurance is not done yet and that he must call in. "Oh" he says - I called that independent insurance agent lady. Shes a broker and she said to stop what we are doing."

"What?" asks Judy.

"She says that Genworth rating ain't so good!" retorts Raymond Sr.

"What Rating?"

Ray answers: "I don't know, but something to do with a rating that is not as good as it used to be."

"What is this Insurance that Brokers name?"

Ray swaggers a guess: "Kristen, Kirsten, Christine, I don't know hun... She is coming over Sunday night to talk with us." he continues - "I put it on the family calendar - it says 'Talk with Agent'"

The Insurance Agent's Visit:

Almost immediately both Judy and Ray are impressed with the independent insurance agent who seems to have a good feel for exactly what they need. They all get along very well. She reviews with them the various decisions that they will have to make about buying life insurance, including the type of life policy, the length, and the death benefit amount. But she also brings up the option of deciding What Insurance Company to buy the policy from.

"Why does it matter what insurance company we buy the policy we from?" Asks Judy.

"Yah - I thought all insurance companies were pretty much the same." Adds Ray.

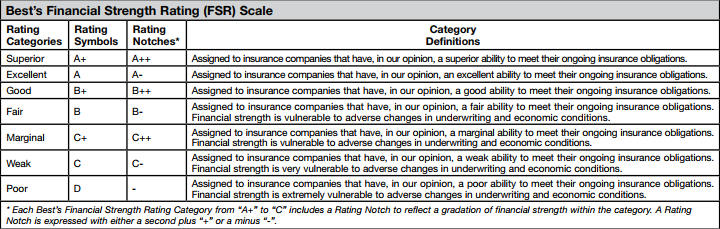

Christine answers: "No, not all insurance companies are the same. There are different ways of rating insurance companies. Such as Consumer Reports, Some States have Insurance Regulators which may rate insurance companies, and the insurance companies Financial Strength Rating."

"Oh, a Credit Rating" Rays says.

"Not exactly a credit rating, but a financial strength rating. A Financial Strength Rating is similar to a credit rating - but its created to measure an insurers ability to meet and pay claims and other obligations, its much more specific to insurers." Answers Christine the Independent Insurance Agent.

Christine than proceeds to explain to the Jacobs the intricacies of Financial Strength Ratings, who writes them, how you should check multiple ratings from multiple rating agencies.

"We were about to buy a policy with an insurance company, Genworth, that you cautioned us about not doing because of this rating, right?"

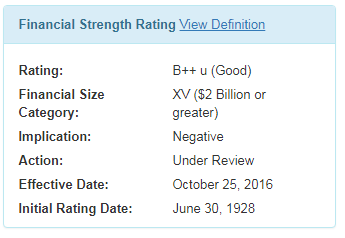

"Yes, Genworth is currently a B++ AM Best Financial Strength Rating." Answers Christine and shows them a print out of the Genworth from AM Best. "A B++ is still a good rating, but we might be able to do better."

"Is that a bad Rating?" Asks Raymond Senior.

Christine then flips the page to the Master Rating Chart, again from AM Best.

Judy speaks up - "It looks kind of OK."

"Yes" Christine agrees, "it does seem good and average, but what if we can get you a life insurance policy for about the same price from a higher rated company. Would that be good too?"

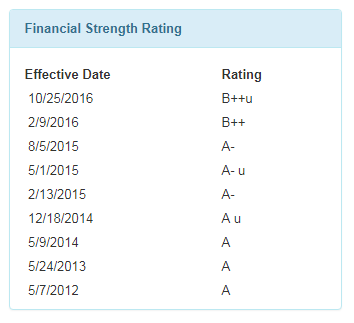

"Well, err, that would be better" Say Ray. "But wait, maybe this company just had a bad month or a terrible one year, a one off so to say."

"Thats possible, so I also printed off their multi year history for you to see and it doesnt look like a one off, Its a definite multi year downward trend." Christine.

"Wow - Game Over" Says Sally "I mean what happened?"

"A's are better than B's, that is all I know" says Ray.

Little Ray wakes up and starts to cry and Raymond Senior runs in to check on him. Judy and Christine have an in depth discussion about AM Best and the Financial Strength Rating model. Judy learns that there are three other rating agencies: Standard and Poors, Fitch, and Moodys that also produce FSRs (as Christine prefers to call them) but that they each use their own rating system. She also learns that these are really just opinions, however highly educated opinions and that the AM Best Rating could be wrong.

As Ray comes back into the room, Judy asks another question: "Is it possible that the Financial Strength Rating is wrong for this company?"

"Perhaps, but the trend is clear." The agent responds.

The Insurance agent then provides the Jacobs with Six different term life insurance quotes for the exact same death benefit amount, $500,000 and the exact same term length, 20 years. However they are from six different insurers. All with different prices and with different financial strength ratings.

She provides them quotes from Banner Life Insurance, Reliastar, Prudential, John Hancock, Transamerica, and Ohio National.

Now the Jacobs begin asking about financial strength ratings for all of these, "Which one is rated the highest are any of them A++?"

"No, none of them are A++., they are all in the A range though, A and A+"

Ray inquires "So what is the difference between A and A+, I mean does that difference matter?"

Christine answers truthfully, "I imagine its a very small difference, I have researched this very question, but I have never been given a satisfactory answer as to what the difference between an A and A+ are. Obviously an A+ is slightly better."

Christine then advises them that at least as a 20 year term policy is concerned, really she believes that the most important thing is to be aware of the Financial Strength Rating and unless you have an unusual situation whereby you can't get a term policy from a A rated carrier, than you should try and avoid the B rated or lower carriers, or any carrier that is experiencing a rapid rating loss. In other words A, A+, and A++ rated carriers are the way to go. Sometimes A- might be OK.

"Well should we stick with the A++ Financial Strength Rating?" Christine Asks

"You know, if you are were buying a permanent life insurance policy, such as whole life policy the A++ financial strength rating might be a bigger consideration, but for the twenty year term, I don't really see it as requirement. Also, often the A++ carriers term policies are more expensive. And there are so many A+ and A rated carriers." Christine Answers

The Jacobs now thank Christine and agree to speak tomorrow about what they will choose now with six different A and A+ rated life insurance carriers to choose from. They reference the AM Best Rating scale while they talk.

The next day Ray Senior Calls up Christine the Independent Agent and completes a 20 Year Term with a $500,000 death benefit for an A rated carrier. Three days later a paramedical comes out to his house to conduct some medical tests and within three weeks the proposed policy is fedexed to his door for signature and payment.

Ray and Judy make sure all of the paperwork is completed, signed, and payed for. The life insurance policy is put into force two days later and then Judy says "OK, now I need life insurance too..."

Ray chuckles.

About this Article: A Real Life Example of the Need to Check Financial Strength Ratings.

This article contains no real life people and is intended to be a story. But the story is intended to be a real life example of a husband and wife learning about financial strength ratings and why they are important as it relates to their need for term life insurance.

You will notice that much of the typical life insurance topics were skipped over or just not addressed in depth, such as how to determine which type of life insurance to buy, what length policy to buy, how much death benefit to procure, or whom to name as the beneficiary. All of those topics and subjects are of equal importance and are discussed in other articles on this site. But this article wanted to deal almost exclusively about how Financial Strength Ratings matter to American Families.

All Financial Strength Ratings and Charts pulled direct from their website at AMBest.com

Thanks for reading this Whole Vs Term Life Insurance article. #wholevsterm

Feel Free to Contact us for a Quote at 415-294-5454 or email us here.

Speak with an experienced advisor!

Speak with an experienced advisor!