Control Shift your Risk

Benefits of Life Insurance

There are so many benefits of buying and keeping life insurance. These benefits may be used to pay off a home mortgage or other debts at the time of death. Life Insurance can be used to rectify a complex personal financial situation. Or it can be used just to provide some peace of mine.

In this article we explore the age old question: What are the benefits of life insurance?

What are the Benefits of Life Insurance:

Simply put the benefits of life insurance are peace of mind combined with a powerful financial risk management tool. This risk management tool, the death benefit, allows you to fund financial solutions in the event of a tragic loss of life.

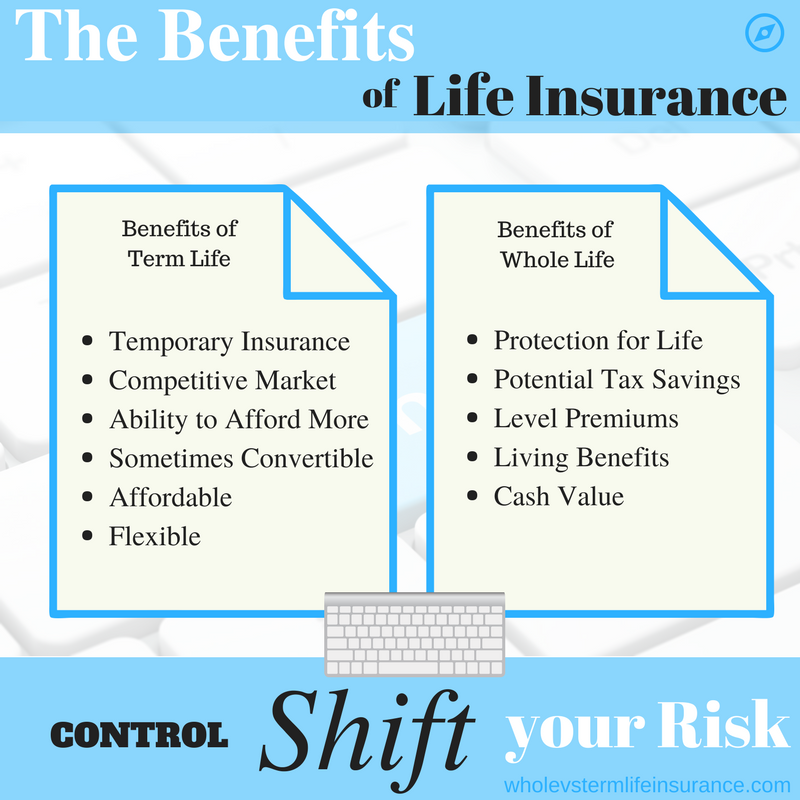

The real benefit of life insurance for many is the life insurance death benefit itself. The benefits of whole life insurance and the benefits of term life insurance though are not the exact same.

Benefits of Whole Life Insurance

The benefits of whole life insurance are similar but not the exact same as the benefits of term life insurance. Whole life insurance is insurance for your entire life. Whole life is often also called permanent life insurance. Clients should expect to pay their whole life premiums for the rest of their lives.

Because premiums with whole life insurance are level. (Meaning the same each and every year) these policies often build up a cash account, which is a pseudo savings account. From participating insurers, these cash accounts are open to receive dividend payments. This is a rather unique benefit of whole life insurance = their dividend payments.

Another unique benefit of whole life insurance is really the ability to insure yourself...forever. For some, this is the right call, but for others not.

Whole life insurers also, may on occasion, allow policy loans to be used for any number of purposes. This may also be considered a benefit. These loans are typically not available until the whole life cash account had accumulated quite a few years of premium payments. Perhaps 10-15 years worth.

Another claimed benefit of whole life insurance is the so called Creditor Protection idea. This claim contains a kernel of truth but is a much more complicated and nuanced consideration. Although possible that a whole life insurance policy could protect some of your wealth, its really going to depend on the actual situation. This site does not believe this potential benefit to be worthy of consideration. However it is listed in the interests of thoroughness.

A terrific benefit of a whole life insurance policy may be to fund a special needs trust. A special needs trust is a legal vehicle created to assist in caring for people that will need special help, usually for their entire lives. Whole life insurance policies become the funding mechanism for these trusts.

Benefits of Universal Life Insurance

The benefits of universal life insurance are by and large the same as whole life insurance benefits.

Universal life allows for a flexible premium but also allows for potential cash build up. The flexible premium is indeed one of the main specific benefits of this type of policy. This approach may allow you to increase or decrease your yearly premium payments. In certain years, when perhaps other large financial bills come through, Universal life insurance may only have to receive a minimum premium payment.

There is a bit of a danger in these policies as has been exhibited in the past. Universal life insurance policy holders are beholden to yearly potential premium increases. For this reason (and others), universal life insurance is often sold by universal life specialists.

Benefits of Term Life Insurance

The benefits of term life insurance are similar to the benefits of whole and universal however they have a shorter period of coverage. The reason for this is that term life insurance is sold in bands of time where the guaranteed coverage is in force. After that time, the life insurance typically ends and the benefits of it will end as well. Term is the most pure form of life insurance.

One of the most well known benefits of term life insurance is its low cost. Term insurance is so low that it often allows you to buy up to the amount of coverage that you truly need. Due to the low cost of term insurance, often clients will choose to ladder or stack policies together of different policy lengths.

Another specific benefit are the brief lengths available. Life insurance is often best used for the periods of time when the coverage is needed and not when it is not required This is exactly why term life insurance is such a popular choice for millions of Americans.

Term life insurance is easily 'shoppable' and comparable. In other words its easy to compare a twenty year term A+ rated insurer to another twenty year term A+ insurer. Apples to Apples. This is a great benefit of term life - easy shopping.

There are numerous other hidden benefits to term such as it allows you to save money in your other non life insurance accounts.

Full List of Life Insurance Benefits:

There are really so many benefits to buying life insurance. We mix together in our list the benefits for both temporary forms of insurance, such as Term - with full life policies, such as Whole and Universal life.

Hopefully, God Willing - you will never need to realize many of these life insurance benefits. But, wouldn't it be nice to be able to if you needed?

A Special Note on our Full List of Life Insurance Benefits (and features.) In the world of marketing there is a distinct difference between features and benefits. They are not the same. My goal with creating this list is to assist consumers in understanding many of the positive sides of life insurance, not to conform to a definition. Therefore some of my sub categories below are technically features, yet listed as benefits.

Life Insurance Advantage 1 - Pay Off the Mortgage

Life insurance benefits may be used to pay off a home mortgage or other debts at the time of death. Without a doubt, paying off the mortgage after an untimely death is one of the best reasons for buying any life policy. Temporary or Whole. When procuring a policy, the total mortgage debt is often one of the most important considerations in calculating coverage needs.

Mortgages usually go down over time, which often requires a bit of dynamic considerations.

Life Insurance Advantage 2 - Pay Off the Family Farm

Although similar in nature to the benefit of paying off the mortgage with the life insurance policy, paying off the family farm may be a totally different size and character. Often family farms are much more expensive than typical homes and far more complex.

The ability to pay off the farm and allow the surviving family members to move in, are one of the many benefits of life insurance. Paying off the family farm also sometimes involves estate planning tools such as paying off inheritance or other taxes in order to keep the farm.

Life Insurance Advantage 3 - Pay off other debts

There are so many debts that the typical american can amass that it requires its own general category here. Think car payments, credit card debt, student loans, etc. Wouldn't it be nice to settle all of these up so that your spouse, left all alone, can focus on raising your family?

The types and kinds of debts to settle are potentially endless. Of course, I would advise anyone that was buying a life insurance policy purely to pay off debts to inquire about the exact legal requirements of which debts need to be paid off at someone death. In other words, if your spouse dies, do you really need to pay off their college debt? Some of this discussion is best had with an attorney.

Life Insurance Advantage 4 - Fund College

In the event of an untimely accident, term, universal, and whole life insurance can all be used to assist in financing a child's college education. In fact the money could also be used to fund private high school, or graduate level degrees.

This benefit is not to be confused with the claim that whole life insurance cash accumulation funds can be used to fund a college education during the insureds lifetime. This claim is of a somewhat questionable value in comparison with a 529 account. What is not questionable is using the funds to pay for college after an untimely death.

Life Insurance Advantage 5 - Settle Up an Estate

One of the benefits of life insurance that many clients don't spend enough time considering is the ability for the policy to assist in settling an estate. The estate tax benefit is listed below. However beyond just paying off the taxes, the policy can provide money to assist in equally splitting certain real items, such as machinery, collections, etc. Life policies can also be used to pay needed attorney's fees.

An example of this benefit may be helpful. Two adults lose their last parent, their Mother. The younger of the two children wishes to inherit a piece of art worth about $75,000. The older of the two children does not want the art piece, however would like a somewhat equal amount in cash. The life insurance policy can provide for that.

Life Insurance Advantage 6 - To Pay Estate Taxes

Estate and inheritance tax laws change constantly. Not just federal, but state and even potentially local taxes. Life insurance proceeds can be used to assist in paying these. Estate and Inheritance taxes if not properly planned for can be overwhelming in some situations. Speak with an estate attorney for more details.

Life Insurance Advantage 7 - Replace a Spouses Income

This life insurance benefit might just possibly be the most popular reason for buying life insurance. Term, Whole, and Universal life. All of them can assist in replacing a loved one's income. An old and consistent rule of procuring life insurance is to shoot for ten times yearly earnings. This is not the best calculation method but it is a simple one. A more nuanced approach would involve total assets, total debts, future expenses, current income, and time and income needed till retirement.

Replacing your spouse's income with life insurance is the number one reason to consider purchasing level term life insurance.

Yearly Income X 10

Life Insurance Advantage 8 - Buy Sell Agreement

Buy Sell Agreements are a type of partnership legal agreement that determines how a partnership will be split up and how that will be funded. The life policy is the funding mechanism. The agreement should be a legal document. In my opinion Buy Sell Agreements fall under the category of Business life insurance policies. There is a serious value for business owners, specially partnerships to hold policies for just this reason.

Buy Sell agreements are rather unique and you will likely need an entire team of advisers to assist you in creating one.

Life Insurance Advantage 9 - Key Man Usage

Key man insurance is another form of business use life insurance. Key man insurance provides a life policy on certain key members of an organization. This benefit can potentially assist a business survive (financially) after the loss of the owner or other highly valued members.

Special considerations exist when shopping for key man insurance, so inquire with your agent.

Life Insurance Advantage 10 - To Fund a Special Needs Trust

This is one of the very best answers to the question What are the benefits of life insurance? Specifically Whole Life Insurance. Using a whole life policy as the funding mechanism for a special needs trust is a truly smart idea. If well planned and organized - this may be able to significantly enhance your situation. Of all the benefits of whole life insurance, this may be one of the very best.

Special needs trusts can also be referred to as a Supplemental Needs Trust. These can loosely be defined as "To help families provide financial assistance for disabled children..." With all legal trust considerations - these things are pretty complicated and vary widely in how they are set up - so speak with an attorney about them.

Life Insurance Advantage 11 - Tax Free Death Benefit

Generally speaking the money that comes to the beneficiaries after a death is income tax free. Often it is also inheritance tax free, however that depends on the size of the estate. Tax free money is hard to come by in these days and this remains one of the primary benefits of insurance. A tax free death benefit is one of the most common reasons that many people should buy whole life insurance, say many insurance agents. Although these agents are not incorrect, life insurance is not the only method of passing down money from one generation to the next tax free.

Life Insurance Death Benefit = Generally Income Tax Free

Life Insurance Death Benefit = Not Inheritance Tax Free

The tax free death benefit is generally universal to Whole, Term, and Universal Life Insurance policies. The one exception is when permanent life policies become over-funded and developed into a Modified Endowment Contract or MEC.

Life Insurance Advantage 12 - Living Benefits

Living benefits can loosely be defined as benefits from the life insurance policy that apply during the insured's lifetime. This term usually refers to specific policy riders and features, not thematic values of life insurance.

The accelerated death benefit rider is one example of "Living Benefits" from most types of life policies. An accelerated death benefit rider may be able to provide some of the cash payout if you are deemed critically ill and fit the insurer's definition of a certain health situation. As an example if you are diagnosed with a type of deadly brain cancer, perhaps you can receive part of your payout early to help in fighting the cancer with an experimental treatment. ADB riders change the timing of the payout but not the actual payout amount. The ADB rider is available on many types of life insurance policies including term life.

There are more riders and endorsements available, most of which are more exclusive benefits of whole life insurance.

Life Insurance Advantage 13 - Portability & CONVERTIBILITY

Depending on the type of life insurance that you have - yours may be either portable or convertible.

Portability is often a feature that is available with group life insurance policies through your place of employment. Portability may allow you to take your policy with you after you leave your company. The policy in essence is 'ported' from a corporate policy to an individual or personal life insurance policy. Portability is a great potential feature and benefit of group insurance.

Convertibility is different. Convertibility allows a consumer of a personal life insurance policy to convert the policy from one type of life insurance to another. Covertability is often either sold as an endorsement or is part of the standard term policy. This 'conversion' feature could allow you at a later time to change the policy from a ten year term policy to a whole life insurance policy. The conversion may or may not require further underwriting. Adding a conversion feature to a typical term life insurance policy sometimes is a great way of striking some middle ground during your decision. This allows you the benefits of low cost from the term policy but also may leave the door open for a whole life policy at a later time. Convertibility is sometimes included free with some insurers.

Portability and Convertibility are typically considered benefits of term life insurance.

Life Insurance Advantage 14 - Add your Child

Some life insurance policies allow you to add your child with their own coverage. This coverage is typically added via an endorsement. Sometimes called a Kiddie Policy or a Child Life Rider -they are available in small dollar amounts.

These riders may or may not be a good financial decision for a specific family. Child life riders are often sold with the idea that grieving parent will be able to take some time off from work to grieve. However as a general financial rule of thumb, these coverages rarely make good financial sense. However for the peace of mind associated, they can be a good choice for some.

Life Insurance Advantage 15 - Cash Growth / Investment

It is technically possible for whole and universal life insurance policies to build similar to an investment with policy dividends. This is generally only the case with participating life insurers. I caution readers about seeing this and going out and buying a whole life insurance policy. In general I have found again and again that whole life policies are not a great investment unless you are fairly wealthy.

An example of Dividend Rates paid out by Whole life insurance companies in 2015, a compilation of ten different life insures paid out dividend rates of between 4.9% to 7.1% on the cash value of the policy. Keep in mind that that was 2015 and the rates have become lower due to the low rate environment that insures and financial firms have been stuck in. You should also be aware that the dividends are only paid out on the money in the cash account and not the total money paid to the insurer.

Life Insurance Advantage 16 - Potential Tax Savings

This one is added with a bit of trepidation. Only available with Cash Value Life Insurance policies and they are really only effective and useful for the wealthiest of Americans. Life insurance policies can allow certain high net worth individuals to cut down on their tax bill, at least theoretically. If you are not worth several million dollars I find it hard to begin to image this making any sense. However for a select few, life insurance perhaps can be considered a potential asset class or investment account in its own sense.

So how do Whole Life policies save wealthly Americans on Taxes? There are a number of different techniques and methods to this, but the basics look like this:

A proposed client buys either an A++ or A+ Whole Life Insurance policy and makes all of their required yearly payments on time for decades. They use policy dividends to either buy more whole life insurance, assuming they can afford it, or pay their yearly premiums. At a certain period, perhaps year 45 or 55, the policy starts producing enough dividends to almost pay for the premiums itself. When they die the death benefit is paid out to the children income tax and hopefully inheritance tax free.

The policy has tax advantages because the yearly dividend payments are generally considered return of premium and life insurance death benefits are tax free.

There are other much more complex methods of using cash value life insurance involving life insurance trusts.

Life Insurance Advantage 17 - Sleep at Night / Peace of Mind

It is true that buying life insurance takes some pressure off of your shoulders and allows you to sleep at night. By shifting the risk of an untimely death off to an insurer, you are doing the smart and mature thing. Buying life insurance is the right thing to do when you have dependents. Knowing that you have done right by your family, will allow you some peace of mind.

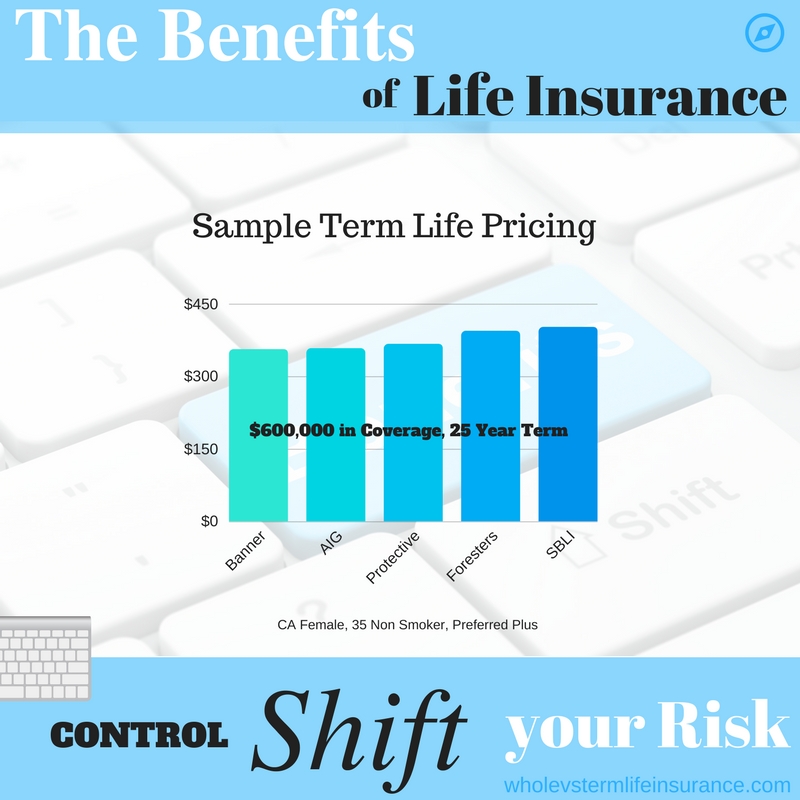

Sample Pricing:

As with all of our blog posts and articles, we like providing some simple term life insurance numbers for you to consider. Kindly please use are quoter, available to the left to see what your life insurance options are.

Questions about the Benefits of Life Insurance

Should you have any questions about this article about life insurance benefits - please feel free to ask us.

Either use the Reply / Comment section or email us:

sales@marindependent.com

Speak with an experienced advisor!

Speak with an experienced advisor!