A suburban Stay at Home Dad searches for Life Insurance - and argues with his wife the whole time.

Will Rudy Eldgridge, a stay at home dad buy life insurance more because he truly needs it or because his wife insists on it?

Do Stay at home parents really need life insurance?

How can stay at home dads compute the necessary coverage?

The one thing to look out for!

Rudy Eldridge is a former government official that decides to give up his job after wife Elaine Eldridge has their second child, little Lady. His wife Elaine has a budding career as a Physician in an affluent community outside Denver. Their older boy Smith just started third grade and seems to be falling behind his classmates. Rudy and Elaine are extremely concerned about this and believe that their son is spending too much time on the computer playing video games and watching Television. Rudy thinks that by being home more he can both help focus the boy on his school work AND stop him from watching so much TV and video game playing. Besides the cost to rehire a nanny to watch little Lady are outrageous. Elaine figures that after all is said and done the cost for Rudy to quit his much lower paying job is not much given the increased costs now with their second child.

There are multiple other reasons that the family wishes to make this change, but those are the most salient. Elaine believes that with just one of them focusing on their career, she will finally be able to grow her practice, besides Rudy lasted long enough at his local government position to be able to leave with a 50% pension once he reaches 65.

So now the Eldriges have made their life change, but Elaine realizes that one calculation that they did not make was the fact that Rudy would lose his generous 3 times income group life insurance policy, which was about $150,000 in group life insurance. "Holy Cow" She exclaims. She discusses this Rudy, but he does not believe that Stay at Home Dads even need life insurance. Elaine interrupts them as they speak and Insists that Stay at Home Dads Do Need Life Insurance. From here the conversation begins:

"What do you mean I need life insurance?"

"You need it hun!"

"For what? In case I cannot babysit? I don't make any money?"

"But we would have to hire a nanny if you were not doing your job! Right hun?

"Ehhhhh, yahhh"

"What happens to your pension if you die before you reach 65?"

"Don't Know!"

"Did you read the terms of the pension? Do I have rights of survivor ship?"

"Ellen- Bob's wife, says I get nothing!"

"We have savings.... loads of savings, you make a good wage. Besides they say you should have ten times earnings for life insurance. I already got that. Ten times nothing is NOTHING!"

"Oh sweetie - I wish you were as funny as you are cute!" a long pause of a possible truce ensues. "Will you call Nancy our State Farm Agent, and ask her?"

"Ugghhhh, I hate insurance! And life insurance is just so morbid.... Besides Nancy, she is such the PTA Mom."

"I don't care - Call your Uncle from Northwestern Mutual for all I care about, just call someone for life insurance!"

"Now that was dirty... You know I can't stand uncle Ed. He is always talking about mortality tables and how Smith can poke his eye out playing ping pong, I mean what normal person worries about that!" Pause... "He lives so far away and we never see him"

"What about Garth from the Elks Club?"

"Yah, I can ask him, I cant remember what company he does insurance at? Booner, Banner, Bramner, I don't know." Says Rudy

"I read online that you need to check a credit rating called a Financial Strength Rating - just get an A rated insurance co... K?" Elaine Adds. She tries to continue speaking but is interrupted.

"This sounds so much like school its almost funny. Here I am quitting my job so that our son can get better grades and now I got to worry about grades. Its not like I was an A student you know. You didn't know me in my youth, I was out of control and watched way to much television."

She cuts him off" And we are going to change that with our son, just go get some A rated life insurance will you?"

"OK" Rudy says.

A Week Later:

A week goes by before Rudy contact Garth from the Club. The initial conversation goes very well and Garth clears up the Confusion and states that he sells life insurance with all sorts of insurance companies but yes "Banner" is the name of one of the life insurance companies that I love. "They are pretty good to write insurance with" he says.

"But Rudy" he says "We got to talk about your 'health' and 'medicines' and 'other stuff.' Not everyone can get life insurance he shares with Rudy and it really depends on the underwriting factors.

"Although I know you Rudy, I don't know everything about you. You know there are certain things that guys don't want to know about other guys. I really really really try and not pay attention to life insurance underwriting stuff with my friends, otherwise my whole life becomes work."

Rudy and Garth agree to meet in a week not over beers as Garth does not like to mix beer with business he says, but at a local Starbucks. "Ill buy" insists Garth.

A couple of days go by and Elaine, the wife follows up with her husband about the needed life insurance for her stay at home husband. "Did you get the insurance?" Rudy tells her about the discussion that she had with Garth and about the coming meeting. "He says, it can take some time to buy life insurance."

"I read online about life insurance that you can buy immediately, it sounds fast."

"Ill ask him about that." Rudy Says.

"Are you sure I need to buy life insurance, can we even afford it?"

"We can not afford NOT to have life insurance hun. My practice is going well, but I would be deep trouble if it were not for you. I mean I cant work AND stay at home with the kids. We would have to hire an Uber driver full time for Smith's schedule: Soccer, Swimming, Violin, Karate. You just wait till Little Lady's schedule starts up and she is finished with her napping schedule."

"I know" the husband responds.

"Besides, what about that 529 plan? - it only has $8,000 in it, not the $36,000 that we had hoped to have in it by now. And the $265,000 in mortgage. I would be all alone paying off that and THOSE Property taxes... oh my gosh, I could go on!"

"I am sure you will" Mutters Rudy.

"The Car payment, what about hiring a handy man, how would I get things fixed around here? The computer, we would need our own geek squad, I can barely turn on the TV. Besides the volunteer time required at Smiths old preschool, that gave us a 50% discount, heaven knows how we both did that while we both worked. Rud - our finances would be a disaster if you died!

She Continued "I NEED SOME PIECE OF MIND!" Rudy's wife have screams!

"OK< OK- I will get Life INSURANCE - got it. I understand."

The Life Insurance Meeting:

Garth is first to arrive and has smartly arranged a private table outside where no one can hear them. He has a couple of forms listed out and a few informational packets.

Rudy starts out: "Hey good to see you -thanks for meeting, what is with all the forms? Thought we were just talking."

"Oh we are, just want to make sure I do not waste your time, sit sit - sit down, got you a black coffee."

"Thats the way real stay at home dad's drink it."

"Oh did you leave the County? Didnt know that"

"Not something that I brag about, but ya. The pay was not worth it compared to raising the two kids."

"Cool good for you, my wife Lucile stayed home with our three girls - may have been the best decision that we ever made. Now she had life insurance on herself also."

"Cool, that was something that I wanted to discuss with you. As a stay at home parent do I even need life insurance? My wife and I keep arguing about it and boy was she hounding me last night about buying a term policy.... GEEEZE!"

"Yep you need it, but generally we make sure the coverage amount is less than what she has..." Garth the insurance agent pauses and then continues: "That is for underwriting reasons, Some life insurers, actually most, prefer that the working spouse has more life insurance than the non working spouse- make sense? I sure hope it does."

"I guess so." Rudy states.

"Now, did some agent try to push you into buying whole life insurance?"

"Why do you ask that?"

"I get that all the time. I'm happy to sell it to informed people, but for most people around these parts, especially those on a budget, I find Term life insurance is so much more affordable and can get you more coverage, the coverage that you actually need."

"Term life can get you more coverage than Whole?"

"Well because of the cost. Sometimes its 8 to 12 times the cost, so a corresponding whole life insurance policy can be astronomically expensive! Whereas a simple term life policy can be dirt cheap." Garth sips his frappachino and continues "because I sell so much term life insurance other agents call me a Termite!"

"A Termite"

"Yep, but I don't care, I get so many more referrals and my phone rings off the hook. Term life insurance is modern insurance. Its simple, its pure, it does the job. Quiet frankly I don't understand while all those older insurance agents sell all that other stuff. Term Rocks."

"Yah I agree with you from the little I know about cash value life insurance. I think my uncle sells that stuff out in Arizona. He is always talking about having to sell the value of the life insurance policy and how people don't understand it, and can't commit enough money to their future, blah blah blah!"

"Listen whole life has its place. Sold one the other day to a family with a special needs child. Their family lawyer drew up this complicated trust to help the kid out if anything happened to the family. And I spent months shopping around for the best whole life insurance policy. But this was a very specific situation. That is rare." A long pause as they both drink some coffee and people watch "So, you?"

"Yah I used to have about $150K in group term, I think I need that."

"OK, that is a good starting point. Do you have any idea of how much you need? First off, how much life insurance does Elaine have?"

"Elaine has $400K policy through work."

"Payable to you guys?"

"Yes I think so... how else could it go to?"

"Well in theory it could go to her partner, the practice..."

"Boy Ill check on that. But we also have a $600K term life policy that we bought awhile back - I think its a 25 year term policy. So about a $1MM in total. Seems like overkill."

"Its probably not, i bet her $600K policy is pretty cheap. So your health, take any meds, have any conditions?"

"No not really, had a knee operation a couple years ago - you remember that. I take vitamins. Health conditions I am trying to think, nope I don't think so really."

"No past heart conditions, strokes, cancers, diabetes, asthma. You don't take any cholesterol meds, no phsych meds? Nothing."

"Oh no. Can people that take happy pills get life insurance?"

"Usually, it depends. Its actually quite common - so are the cholesterol meds man. I tell you you are lucky if you are not already on them." pause "tell me how is your cholesterol and blood pressure."

"Fine, as far I know of. I mean I go in at least once every other year and they did not tell me anything was wrong. Of course the doc said I could lose 10 pounds. Thought I could work on that while I am home now. Got an exercise bike for the garage. Doesnt't weight affect life insurance costs?"

"Sure does, whatt is your height and weight?"

"Wait a minute are you telling me that people on zocore or other statins can't buy life insurance? I am 5'10" and about 200 pounds.

"No, no they can get life insurance generally, but it depends and we need to know the dosages, all of your triglycerides, etc. I need all of the information on it. Your height and weight are OK. Lets check a chart to see if 5 foot ten and 200 pounds is a problem for which life insurance company."

"So do they each have the same rules?"

"For height weigth? No but they can be somewhat similar."

"No for statin medications..." Interupts Rudy

"Oh No, they are also all over the place. Actually the insurance companies sometimes would prefer to be treated and that you be on the meds and have lower cholesterol than not be treated and be on the zocore. But it depends on the given insurance company, the DB amount, length, age, etc etc etc...yada yada yada" Says Garth.

"So seriously, how much life insurance do I really need? Do I really need it? If my wife has One Million dollars worth, what really is the point?"

"Yes Yes Yes you need life insurance that is what I have been trying to tell you Rudy. Stay at home dads need life insurance, just like stay at home moms need term life insurance. Both Spouses, if they work and if they do not work, need life insurance if you have kids. They may both need life insurance even if they do not have kids. But if you have kids your certainly need life insurance. Get it!" Exhausted Garth pauses for a minute.

He continues, " As for how much life insurance that you need Rudy, I can't tell you for certain. To be simple about it, since your wife has One Millions Dollars in life insurance, of which $600,000 is a separate term policy, I could easily see you buying a $500,000 life insurance policy. You can think of it in many more complex ways, but here are the calculation I personally and professionally would look at"

Garth pulls our a piece of paper and begins writing and calculating why he talks: "If you hire a nanny that would cost you maybe $30,000. Your meal preparations costs will be much more expensive say $2,000, BBQ can be expensive." Garth laughs at his own joke "Additional Transportation of about $2,000 per year, An additional $4,000 per year to go see Elaine parents or to fly them out here, hire a handyman for $1,000 per year and tutors for the kids homework another $1,000 per year. You add up all of those costs and it comes to around $40,000 in additional costs per year, if you were not around. I am not factoring in laundry, cause I know you don't do any." Garth's stupid jokes seems to make Rudy more at ease with this horrible subject. "Not added in are Therapy sessions, College Expenses, or Allowing Elaine to quit her job, which I can not imagine her wanting to do."

Garth pulls our a piece of paper and begins writing and calculating why he talks: "If you hire a nanny that would cost you maybe $30,000. Your meal preparations costs will be much more expensive say $2,000, BBQ can be expensive." Garth laughs at his own joke "Additional Transportation of about $2,000 per year, An additional $4,000 per year to go see Elaine parents or to fly them out here, hire a handyman for $1,000 per year and tutors for the kids homework another $1,000 per year. You add up all of those costs and it comes to around $40,000 in additional costs per year, if you were not around. I am not factoring in laundry, cause I know you don't do any." Garths stupid jokes seems to make Rudy more at ease with this horrible subject. "Not added in are Therapy sessions, College Expenses, or Allowing Elaine to quit her job, which I can not imagine her wanting to do."

Rudy seems intent or looking and these numbers and is focused on Garth as he talks now: "All of those are about $40,000 per year as I have said, less those three numbers. Little Lady is your youngest child and as far as know she will be your last. She has about 20 or 25 years in your home, counting college, and possibly some time home afterwards. But 20 years times $40,000 is $800,000."

Rudy interrupts: " Yah but Lady won't need a Nanny when she is fifteen?"

"No you are right, but she will need a chauffeur or one heck of an Uber account. The point is is that $500,000 in term life is not a ton. You can probably scale back from that $800K number and get less, as I know that you guys have few debts and have a good savings."

"Will this account help me for our retirement? I have heard life insurance can do that?"

Garth quickly answers " No those are the Whole and Universal life insurance plans that do that, not term life. Term life insurance only supplies the death benefit for a limited amount of time, say the twenty years that we have discussed." he continues "Oh my, look at the time, I have to go. Think about a $500,000 twenty or twenty five year policy at the minimum Rude, I will send you some life insurance numbers." And just like that Garth runs off to his next appointment.

The Discussion at Home with Elaine:

The next evening Elaine and Rudy discuss what Garth had suggested. Elaine says:"I'd rather you got more life insurance say $750,000, but I would rather you have $500,000 than have no life insurance." Not sure that he even sees the need to buy term life insurance, after all he is a stay at home dad, Rudy decides to just do whatever is easiest to be done with this gruesome subject. So quietly he accepts that he will need to do it, now he just needs to get the insurance numbers from Rudy to buy it."

Life Insurance Options:

The insurance agent calls Rudy to set up another meeting, this time at their house.

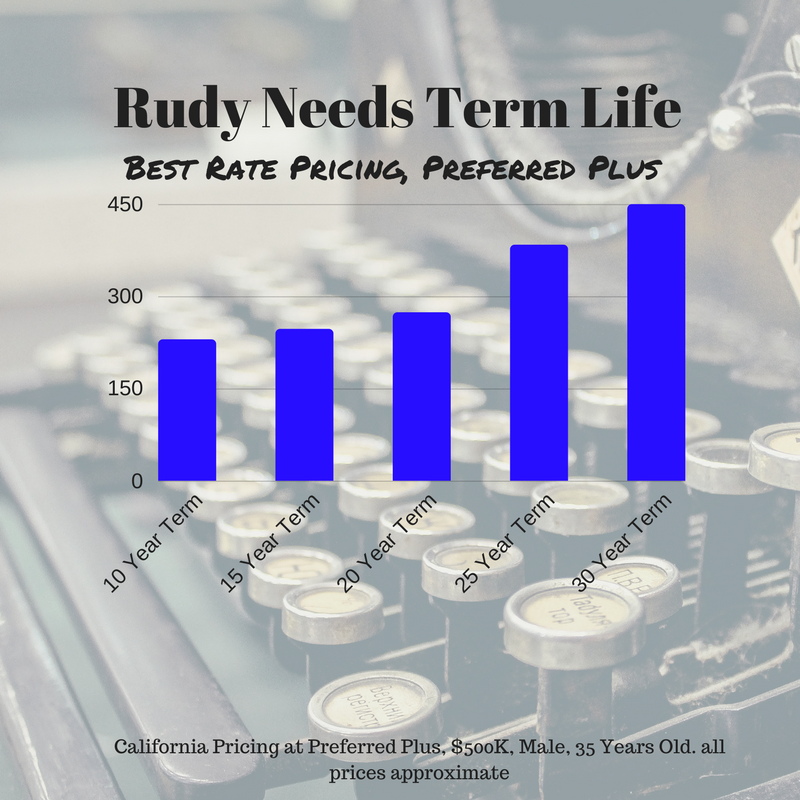

The next day they sit down to talk about some of the pricing options that they had both spoken about. "Rudy" he says "Banner Height Weight classification for you to receive their 'best' insurance classification 'preferred plus' is pretty close. If you could be a few pound less, you may qualify for it. But, there is no guarantee of that." Garth then shares with him a simplified pricing chart that he himself made.

"Oh thanks!" states Rudy emphatically. "This is helpful, especially with the colors on it, my eyes can understand this." Rudy pauses while reads the best rate pricing numbers "That ain't so expensive."

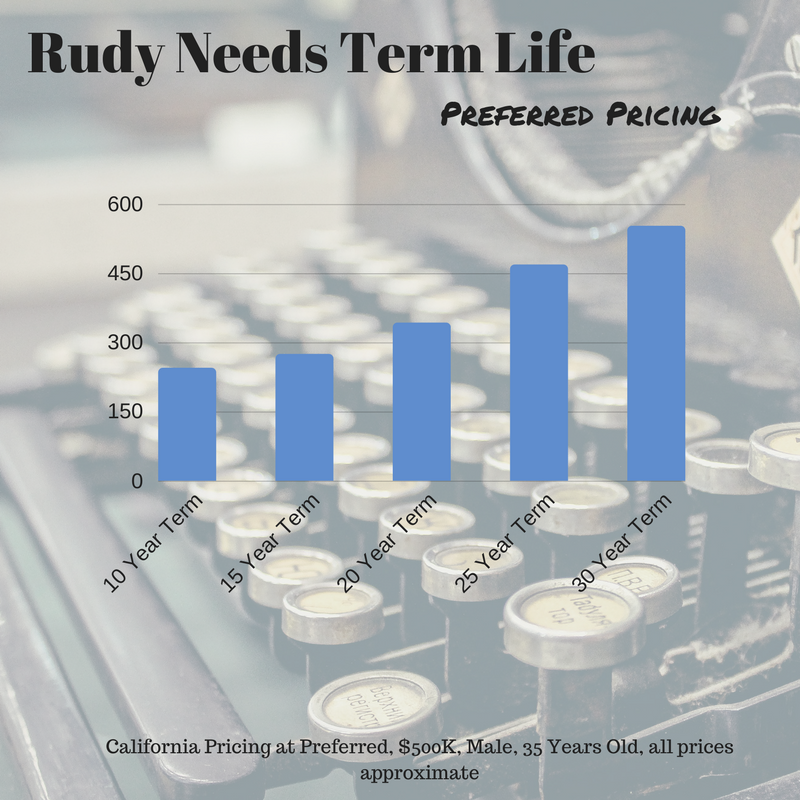

"Nope, I do not think so, that is the beauty of term life insurance, its dirt cheap compared to whole life insurance. That's part of the reason I sell it" Garth says. He continues "If you do not qualify for this preferred plus class, you may then qualify for preferred pricing, and this what some of the rates, generally speaking look like." Garth now hands him a second chart.

"Oh, so its more expensive if I do not qualify for the best rates... that makes sense. Now which company is this Garth?"

"Really its about four different rates mixed together, Banner and AIG are in there along with two other companies. However Banner is the most represented. It is not so much a quote as a chart I made for you to simply see some of your options here."

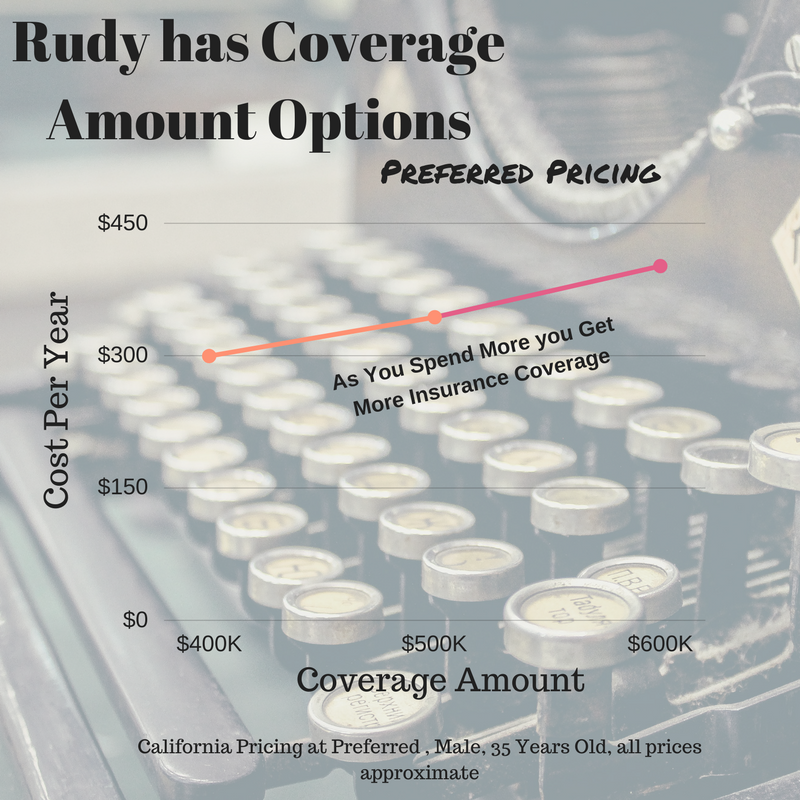

Rudy picks up: "My wife and I discussed it and we think the 20 year term is just fine for us. We plan on having college saved up for."

"Yah I sort of figured that, here is another chart based on 20 year term with $400,000 - $500,000 -and-$600,000 in death benefit coverage. I hate saying the word death but its what its for." Garth then hands him his fourth and final chart.

"Geeze you know -none of these insurance options are that super expensive. Before I came in here I was set on a $400,000 twenty year life insurance option. But after seeing this, maybe a $500,000 20 term policy is the right thing to do." He continues "Honestly I just want to be done with this - Sick of fighting with my wife about it. Lets just apply and be done with it."

Garth listens up: "Sure"

"What is the next step?" asks Rudy.

"Well, I have an application for insurance here, we can fill it out together. I am assuming we are going to do a fully underwritten product. Are you OK doing a medical "paramed" exam at your house?" Rudy nods in agreement "then we will fill out an insurance application and get things started today."

LIfe Insurance Shopping Tips for Stay-at-Home Dads

Life Insurance is needlessly complicated, but it does not need to be so, follow these simple rules:

How Much to Term Life To Buy:

- Aim for a lesser amount than the working spouse.

- Consider all the necessary expenses and angles of a life changed without the stay at home dad.

- Consider your future, will you go back to work at some point and become reeligible for a corporate group term life policy?

Life Insurance Best Practices:

- Unless you are in a special situation, shoot for a Level Term Life Insurance policy.

- Avoid complex life insurance schemes that you do not understand.

- Insure only what you need to insure and avoid mixing insurance with your investments.

- Work only with agents that you trust.

Three Types of Life Insurance:

Term Life:

Simple, Inexpensive, Pure Insurance.

Universal Life:

A Hybrid type of policy that is somewhere between a term and whole life. Carries a cash account.

Whole Life:

A permanent type of life insurance that mixes an investment component with insurance.

How to Save on Term Life Insurance

- Focus on Term Life Insurance. Term is far less expensive.

- Get Quotes from lots of agents.

- Don't just buy life insurance from your home insurance agent. Compare their numbers to independents.

- Ask about your health, work, lifestyle profile when speaking with an agent.

- Consider laddering life insurance policies.

The Stay at Home Dad Insurance End Game:

In the end Rudy applies for a 20 year $500,000 life insurance policy through one of the insurers that Garth works with. He is glad for the guidance that Garth provided and now he really does understand why Garth is so busy. Life Insurance is confusing and their are so many options.

Did Rudy buy life insurance more because he felt he really needed it, or because he was so sick of arguing with his wife over it? Its hard to say. But in the end, given the small amount of cost, he probably made a wise decision. Stay at home dads Do Need Life Insurance.

Thanks for Reading about a Stay at Home Dads Journey Purchasing Term Life Insurance:

Thanks for reading our short article. Should you have any questions concerning it, please feel free to contact us at anytime.

#stayathomedads #termlife

How to Contact Us

Email: sales@marindependent.com

Phone: 415-294-5454

PO Box 585 Mill Valley CA 94942

Twitter @marindependent1

Speak with an experienced advisor!

Speak with an experienced advisor!