This is a whole life story of whole life insurance.

A family considers the complexities of purchasing whole life insurance and compare their specific numbers with simple level term life insurance and are surprised at the savings.

- Why is Whole Life so Expensive?

- Do we need life insurance during Retirement?

- In order to buy whole life, we would have to stop saving elsewhere or use a lower benefit amount?

Meet the Smiths: an all American Family based in California. Joe (34) works as a mid level manager for a distribution company as a Director. Sally works part time, as a clerk at a Grocery Store, but also spends all of her free time taking care of their three kids.

They have three girls, the youngest of which is Karen, age 3. Their Oldest Sue is 14. The middle child, the budding photographer, named Kim is 8.

Their Financial Situation:

The Smiths make about $82,000 per year between their two jobs. They own a $425K house in a nice neighborhood and carry a $295K mortgage on it. Of the $82,000 per year they make they save about $11,000 per year, but it is not easy. Sally works hard to save the money by cutting coupons and shopping for the lowest prices. Joe helps out with the kids so that Sally can get the most hours at the grocery store.

Their three kids never seem to stop growing and things are constantly needed for school and other activities. Their $11K in yearly savings is mostly put into tax differed accounts through work. Joe and Sally are most concerned about saving enough for retirement. Sally plans on going back to work full time when their youngest gets into school.

The Smiths do well financially mostly because they check all of their costs and they ask lots of questions. But Insurance is one thing that neither of them either likes nor fully understands.

Their Assets:

The smiths not only have the equity in their home, but significant savings for a couple in their 40s. They include $167,000 in a 401K savings account and $29,000 in Roth IRA. Sue also has an old 401K from a previous job, back when she had a more full time career of her own. It contains $35,000 in it. They also have a small stock account with $22,000 in it and about $11,000 in a rainy day fund at an online back account that earns as good of an interest that can be found.

Their Insurance:

The Smiths have always been well insured through an insurance agent that is also a family friend, Cindy. The family friend agent has always been suggesting to them that they need to consider purchasing a Whole Life Insurance policy. All of their Home, Flood, and Auto policies are held through this captive insurance agent. Being a captive insurance agent just means that the insurance agent works with one family of insurance companies. The Auto Insurance has them covered up to $500,000 and $500,000 in bodily injury and $100,000 in property damage coverage. There home insurance covers them only to $300,000 in liability and they have no umbrella insurance.

Current Life Insurance Situation:

Currently the Smiths rely on a group life insurance policy from Joe's work. He pay for extra life insurance so it carries about two times his salary. About $150,000 in coverage. Sally used to have life insurance through her part time job, but when she quit after the birth of their second daughter she never got it back. The Beneficiary of the term life insurance policy is currently listed under Sally's name.

Life Insurance Needs:

Nightly Sally and Joe have discussed the need for life insurance. However, given all the confusing terms and the commercials they have been too scared to even think about it. They are also extremely scared of the price of life insurance. Some of their neighbors have discussed what they pay per year and Joe was turned off. That being said, Sally feels that there is no way that she feels secure with three daughters and only $150,000 worth of life insurance.

The Whole Life Insurance Pitch at the BBQ:

Cindy the life insurance agent has always enjoyed her time with the Smiths, especially Sally. They love to gossip about the husbands and laugh about how silly they seem with the kids. Lately Cindy has felt weird even bringing up life insurance to them because she has prodded them so much. Cindy the insurance agent is an ardent supporter of whole life insurance. As a general rule she believes the only form of life insurance that really works is whole life insurance because it lasts forever basically.

Avoid the Pitfalls of a Life Insurance Presentation

Read 19 Questions to Ask your Life Insurance Agent!

When she catches a moment with Joe, she pushes again. "Joe why haven't you gotten more life insurance yet, you know Sally wants you to?" "I know" he retorts "Its just too dam confusing, maybe... you could email me the numbers." Cindy has always been taught to never just email over premium costs to clients because whole life insurance needs to be sold, not just transacted.

"I won't just send you the numbers Joe...but I will sit down with you and explain the numbers and costs and benefits." Joe accepts and they agree to meet at his office. Joe quietly wants to keep his wife out of this discussion.

The Whole Life Life Insurance Presentation:

Joe welcomes Cindy the insurance agent into his office expecting a friendly meeting, but he is immediately surprised that Cindy has brought...a coworker for the "presentation." Cindy says "I hope you don't mind?" What can Joe say. The coworker, Cindy explains is a new saleswomen and she is here for a ride along. Adding to the discomfort of having a guest in on their meeting, is the fact that this is a formal presentation seems weird to Joe.

The presentation is all very formal and based on what Cindy thinks Joe should have, this immediately puts Joe off. Cindy explains that only PERMANENT life insurance will last for your whole life. She explains that about $250K in whole life would probably be appropriate in their situation. She is quick to explain that the policy can grow a cash balance and possibly earn dividends that allow them to save for college and retirement. Joe asks what the cost is but, Cindy does not want to share this until the end of the presentation.

The entire meeting bothers Joe, who feels like he has been led into a weird sales meeting that he never intended on joining. She keeps asking questions to confirm seemingly obvious details, such as "Don't you think it makes sense to financially care for your family?" or "Can't you see that I am here for your family?"

The presentation finally ends with Cindy finally coughing up some yearly costs. The cost for the $250K is $3,095 per month. Joe is astonished at the cost.

The Home Discussion about Life Insurance:

Joe sheepishly admits to his wife that he talked to Cindy at his office about life insurance and that is was surprised at the cost. Sally asks "Well did you talk about Term, I hear its far cheaper." No, he admits. "I was too afraid to ruin her presentation." Sally admits that she does not really like when Cindy gets into sales mode, but admits that she does not truly understand whole life insurance. "What do mean, you can save for college with it?" Joe shrugs his shoulders and says its got something to do with a loan...

The conversation ends with Sally insisting that Joe just needs some simple cheap life insurance and that she will take care of it.

The Next Day:

First thing in the morning when the girls are off at school, Sally goes online and runs some level term life insurance quotes. She scratches the computer screen as the lowest pricing seems to be just a fraction of the price that Joe got. $157 for $250,000 in coverage...Can this be true? Term Life insurance for 5% of what the proposed whole life policy was? She calls up one of the insurance agents and speaks with them via the phone to confirm that the numbers are accurate.

The Life Insurance Agent is quick to point out that they would need to speak with her husband, because he is the proposed insured, but that assuming he had no major issues that these were real prices. Sally reads up on term life insurance and believes either a 15 or 20 year term policy is what Joe needs. She also considers herself for a 20 year term life policy as well.

The Call to Cindy the Captive Insurance Agent:

Column 1

Sally emails and then calls Cindy, to ask for a quote for just term life. Cindy immediately corrects Sally and says, "Oh you mean whole life." "No" says Sally " I mean term life."

Cindy counters that only whole life will allow them to have life insurance for their entire life and be able to build up savings over the years for things like college and retirement. Sally is adamant that she just wants a term life quote.

The conversation ends with Cindy agreeing to send over a non recommended 20 year term life policy quote. But, she indicates that she wants to meet with Sally first. This irks Sally.

A couple of days later Cindy does indeed get the 20 year term life quote from their captive insurer. Its only $233 per year for Joe to receive $250K in coverage. This makes Cindy very happy.

The Second Phone Call to the Term Life Agents:

Joe is instructed to call the term agents via phone when he gets home to confirm his eligibility which he quickly does. He confirms that he is probably able to qualify for Preferred Plus pricing, which is best in class.

This makes Joe happy as he knows underwriting is a large part of life insurance.

The Three Different Set of Numbers:

Armed with three sets of numbers, The Captive Whole Life, The Captive 20 Year Term, and the Independent 20 Year Term, the Smiths sit down for a meeting.

With three different sets of preliminary numbers the couple discusses their options. Whole life... term life, it all seems so confusing to both of them. Mostly however they are confused why the more expensive option is pitched by their so called friend the insurance agent? Why would she offer up something that is so much more expensive. Because they need life insurance for their whole life? Why do they need life insurance for so long. Althgouh Cindy the Insurance Agent knows them, she does not know them that well.

It would seem to both of them that in order for her, or any insurance agent really to recommend a Whole Life Insurance policy, then they would need review their financial needs. And their Assets. That was not done. In fact at no place during the sales presentation did they ever go into that line of questioning. Such as: how much money do they make? how much insurance do they want? For How Long do you want life insurance? Why do you want life insurance? Admittedly Cindy is a friend and does know them to some sort, but she does not know their entire situation.

Cative Home Auto Insurer

Whole Life Insurance Offer

A+ AM Best Rated

Whole Life $250K

- Lasts Forever

- The Insurance Agent Suggests it

- Premium Lasts Forever

- Very Complex

- Not Affordable

$3,095/Year

Underwriting Required

Captive Home Auto Insurer

20 Year Term Life Offer

A+ AM Best Rated

20 Year $250K

- Guaranteed Rate for 20 Years

- Very Simple

- Affordable

- Premium can End after 20 Years

$233/Year

Underwriting Required

Independent Insurance Co.

20 Year Term Life Offer

A+ Am Best Rated

20 Year $250K

- Guaranteed Rate for 20 Years

- Very Simple

- Affordable

- Premium can End after 20 Years

$157 / Year

Underwriting Required

Avoid the Pitfalls of a Life Insurance Presentation

Read 19 Questions to Ask your Life Insurance Agent!

Their Life Insurance Decision:

Writing down a list of comparisons of the insurance products with the price - the answer suddenly becomes very clear to Sally and a little more clear to Joe. Since they still can not understand why someone in their shoes would want a life insurance payment for the entire lives, including retirement - the pitch the whole life option overboard quickly. Now the focus on the difference between the Captive Home Insurer and Independent Insurance Co.

Joe entertains the idea of buying the slightly higher priced twenty year $250,000 level term life insurance policy from Cindy their Captive Insurance Agent. But Sally responds "She didn't even want to give me that quote?"

Why Term Life Insurance Makes Good Sense for the Smiths:

Cindy and Bob are a relatively well off middle class family and have saved diligently. One of the best features of term life insurance is its low cost and its ability to allow the couple to continue to save money in their tax free (Roth IRA), tax differed (401K), and other (investment and bank) accounts. While its technically true that you can save money in Whole Life accounts, the return of savings tends to be rather low compared to tax differed and tax free accounts. Although it may be possible for whole life accounts to beat out typically savings accounts that pay 1% that is likley only the case after "saving" in it for more than a decade or more.

Since the Smiths would be able to qualify for term life insurance and since they still have some more room to save in various tax free investment accounts, such as Cindy getting a Roth IRA, and using a 529 account for college savings, the added cost of whole life policy probably does not justify the increased cost.

"Its Almost $80 more per year?"

"Why should we buy it from an agent that does not want to sell it to us?" She continues. Joe slowly agrees and they begin their discussion about the internet insurance agent offering Independent Co insurance.

Sally asks "Do we trust this insurance company?" Joe responds "Their licensed by the state."

Joe and Sally agree to go ahead and get the $250,000 20 year term life insurance policy and apply at once.

The Basics of Life Insurance

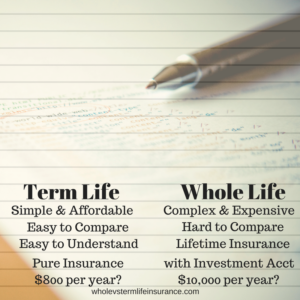

Term Life:

Simple, Affordable, Easy to Understand and Quick to Purchase Pure Insurance.

Whole Life Insurance

Complex, Expensive, Hard to compare Life Insurance with an Investment Component.

Why Term Life Insurance Makes Good Sense for Most Americans:

Term life, which is a form of temporary insurance provides coverage for a specified period of years to cover the loss of loved ones income. It is considered pure insurance and as thus is extremely simple to understand. This simplified version of insurance is somewhat immune to mis-selling of the product that the whole life marketplace is known for. Comparing term insurance from one carrier to another is simple and easy as the products can be lined up and compared.

A Simple Way to Determine Life Insurance Needs:

In this article about a whole life story, the smiths more or less shoot from the hip, but that is not necessarily the best way to determine how much life insurance you need. A good simple rule is ten times earning for the working spouse and slightly less than that for the non working spouse. However, you need to keep in mind the life insurance that may already be in place through work. In the case of the Smiths, Joe already had some life insurance through work and Sally does not.

When doing this form, one of course needs to keep affordability in mind.

The Best Way to Determine Life Insurance Needs:

As with everything there is a more complex method. Basically the complex method involves understanding the total financial needs of the family's future requirements less their current net worth. Sound simple? Its not.

If a family is forecast to have needs of $75K per year for the next 16 years and then slightly less when all of the kids are out of the house, say $64K per year for the next 30 odd years plus inflation. You would need to subtract out a total net savings of all of your current accounts. Special considerations should be taken if you will be providing college funding. Some of these calculations are best done with a financial planner.

If you are able to compute these numbers yourself, congratulations. You may quickly discover why people like the ten times earning rule of thumb.

The Possible Benefits of Whole Life:

Whole Life Insurance can be good for people that are: not able to qualify for term life. People that are in need of a Special Needs Trust. Folks that need the use of a Whole Life policy in conjunction with a complicated estate plan or for people that makes loads of money.

For more information consider reading Best Uses of Whole Life Insurance.

However if you do not fit these criteria, its unlikely that Whole Life will make the most sense for you, or your family. I advise all families that are considering the purchase of whole life insurance to do their homework and lots of it. Run your own numbers.

The Drawbacks of Whole Life:

There are numerous drawbacks to whole life insurance which include, but are not limited to:

- High Cost

- Complex and Confusing Fee Structure

- Deceptive and pushy selling method with this product category.

- Inability to independently shop and compare one companies policy vs another.

- Medium amount of time that it takes for a whole life insurance policy to come above water.

- Long period of time required for the policy holder to own it for it to make any sense.

- Lack of liquidity

- Antiquated Nature of the Product

The Whole Life Story on Whole Life:

The real story of Whole Life Insurance is that it may be an antiquated product. One that really should not be offered up to Americans that can qualify for level term life insurance. Its Expense and Complexity make is seem out of place for the American Consumer. Unfortunately, whole life insurance sales provide good commissions for national insurance agents. Whole Life has been called the scourge of the middle class. Weather or not that is true is debatable. What I can tell you is how many people have called me wanting to learn how to get out of their whole life insurance plan.

A common complaint of people seems to have been that I was told that I needed life insurance for my entire life... Why do you need life insurance for your whole life? Do you want a mortgage for your entire life? With the added savings from buying a term life insurance policy many Americans would be able to pay off their mortgage and no longer need either.

Notes:

This is not a real family, but it might as well be a real story. Why is is made up? Because its impractical to expect a family to come forward and allow publishing of financial details such as these. The story made up, but the scenario is real. This scenario plays out on kitchen tables across America. Families that must make tough choices. Families that sit through deceptive sales presentations.

Avoid the Pitfalls of Whole Life Insurance:

Insist on a Term Life Quote and compare the numbers.

Ask yourself, How Long do we really need life insurance for?

Only buy what you can afford.

Check numbers with multiple insurance agents.

About Whole Vs Term

Whole vs Term Life Insurance was created with the idea that clients should not be pushed to buy any insurance product that they do not need want or see fit. We suggest that clients learn about the various forms of life insurance and calculate their own needs and best uses of their money.

Green Certified Business

We are Certified as a California Green Business.

Accomplishing our green certification takes an initial amount of time and a yearly ongoing commitment. We have removed over 95% of our waste of this business by moving to electronic signature capture and electronic data files. We are proud to utilize green cleaning products and full recycling. We have been certified by the State of California.

Speak with an experienced advisor!

Speak with an experienced advisor!