Young Family Learns About Life Insurance (and Leaves their Agent Speechless):

- Meet the Garcias a family learning about life insurance.

- Learn about the Special Life Insurance Option - that most agents may not tell you about.

- And how they ended up saving over... $3000 per year

Meet the Garcias:

The Garcias are a young american family that resides in California. Both parents work and like most Americans their budget is extremely limited. John and Mary are working to make their kids life everything that they imagine it can be.

- John, 32, the Husband and Father. Works as a foreman at a construction company.

- Mary, 29, Wife and Mother. Works part time as a clerk and takes care of the children.

- Kim, Oldest Child and Daughter, Age 5. Loves dolls and teasing her brother.

- Joey, Youngest child, Son, Age 2. Uses crayons on the walls.

- Speckles the Cat, unknown age, estimated about 8. Loves hiding under the family couch.

A Financial Discussion with Friends:

John and Mary were sitting down to a special night out with their friends the Smiths. Both families had found neighborhood baby sitters to watch their kids while the four adults went out for Pizza with beer and wine. Somewhere along the evening the discussion turned to the topic of financial planning.

Mary disliking talking about money attempted multiple times to get the discussion to start about something new. But both the men seemed to like the discussion and Alice, the other wife, seemed mildly interested as well. After awhile Alice broke in and said: "I think saving for our kids colleges is important too, but what I am most concerned about is what happens to one of us... I mean what about life insurance - Isn't that something that we need?" Don't we need some sort of family life insurance policy?

Mary now was slightly more interested and retorted: "You know- ummm - I am concerned about that too John!." Just then the thin crusted pizza arrived and the financial conversation ended. Too bad though.

Another Discussion:

After that dinner discussion, Mary brings up the subject to John Garcia about needing and wanting life insurance of their own. John tells Mary that he has life insurance of his own through work. Mary is confused by this, so she does some digging. She was under the impression that people purchased life insurance themselves.

Mary's Family Life Insurance Research:

First off, since Mary does most of bill paying, she looks through John's employment paperwork and does find some information concerning life insurance. John's employer does provide a small amount of group term life, about $40K per year.

Next up, Mary does some reading on the internet and quickly determines that ten times earnings is usually the suggested amount.

Johns makes about $40K per year, therefore the Garcia household would need almost $400K in life insurance.

That means that they still need $360K more in insurance.

The Next Day:

Mary asks at her part time job if she also has life insurance. The manager tells her that she does not, but explains that if she ups her hours to full time for six months, it would probably kick in. Mary's manager though is not certain of this and explains he will have to speak with HR.

Since there is no way she can work full time, nor would it make sense. She'd have to find someone to watch the kids... She decides that adding hours would definitely not work for her family.

The Family Scare:

While playing outside, little Joey almost gets hit by a car. He ends up hurting his toe and has to go the emergency room to get it looked at.

This frightens everyone in the family, but most of all John. This gets John thinking... he could have been the one crossing the street. What would happen to his family?

John approaches Mary and says that he thinks they should get life insurance for their family. Mary, happy states that she will do research online before her shift begins.

Mary's Family Life Insurance Research:

Mary quickly becomes confused about the different types of life insurance and which one would be best. She finanally finds and authoritative site that lists the general categories of life insurance:

- Whole Life Insurance

- Universal Life Insurance

- Term Life Insurance

- Group Life Insurance (such as Employer Provided.)

- Variable Life Insurance

Mary finds a great set of video definitions about life insurance that helps her out as well.

After watching the life insurance videos Mary reads a few more articles about life insurance and determines that their family probably need a simple term life insurance policy. But she makes a detailed list of all the options with notes:

- Whole Life - 'Seemed Very Complicated, but it lasts forever.'

- Universal Life Insurance - 'Wow, confusing, like whole life insurance but premium changes.'

- Term Life Insurance - 'Cheaper, Limited Time Frame, Suze Orman recommends.'

- Group Life Insurance - 'What her husband has at work.'

- Variable Life Insurance - 'like a whole life plan but invests in the market? Confusing.'

John's Life Insurance Research:

John talks to a couple of friends and coworkers about insurance.

He learns that life insurance is not only complicated in form, such as whole and term, but its sold by all sorts of vendors.

You can buy life insurance form your home/auto insurer. You can buy it online. You can buy it from a life insurance specialist.

Boy he thinks, this sounds so complicated - but who can I trust?

Well John thinks - I trust my home insurer ABC Home Insurance.

John has been a client of ABC Home Insurance for over ten years so he is certain that he will qualify for great rates. He believes that they deserve the first life insurance phone call. Besides they already have all of his information.

Life Insurance through their Home Insurer:

John calls his home and auto insurance agent and asks him about life insurance. The agent that they have been using for ten years, but have never met insists that they all sit down for a life insurance presentation.

John, thinking this is slightly unusual discusses it with Mary. They do both agree to a meeting at their home.

The ABC Home Insurer agent starts the meeting by presenting them with a Whole Life "solution" as the agent puts it.

Mary is immediately put off by the meeting partly because the agent fails to review their needs and because she has done her research and knows that term life is the far more inexpensive type of insurance for them to purchase. After sitting through a twenty minute discussion about this type of life insurance, Mary interrupts with a question.

"Why Do We Need Life Insurance for the Rest of our Lives?" Mary asks.

Agent: "You won't have financial protection if you don't have it for your whole life."

"We just need life insurance until the kids are all grown up.... show me some term life insurance numbers - please" Mary.

"I didn't bring those numbers with me...Ill have to send them to you." Agent

The agent then starts back where he left off, presenting his solution with whole life insurance. He states that whole life insurance is a form of asset protected savings account that can be used for all sorts of financial needs.

Mary is now infuriated. She has done here life insurance research and watchs Suze Orman weekly. She now knows that whole life insurance is very very expensive when compared with term life insurance.

Mary has seen illustrations where whole life is 12 times more expensive than a 20 year term life policy that she thinks she needs. She doesn't want a whole life policy and she does not want to sit through a meeting about one either!

She is also very frustrated about the agent coming unprepared.

She stands up and tells the agent: "Well then, send us those term life quotes." Then walks out of the living room leaving her husband to show the agent out of the house. The agent is a bit surprised.

Mary's Additional Life Insurance Research:

Mary spends a few hours online watching Suze Orman Youtube videos and reads an article to prepare her for her next conversation with a life insurance agent.

The Ohio National Option:

Mary gets referred to a life insurance only agent. One that does not sell auto and home insurance.

She calls him up and he too wants to set a meeting to "review their needs." Although Mary is indeed interested in discussing their financial needs, she is not willing to sit through another life insurance presentation. She tells the agent that she wants term life insurance quotes and that is it.

The Ohio National insurance agent, seems fine with that. Although he attempts to explain to Mary that although Whole Life can be a great investment he is perfectly willing to sell them a term life insurance policy. They can even consider one that has a "convertibility option" to convert the policy to a whole life policy if they so choose later down the road. Mary is happy as this suggestion.

She is also a bit confused because her research did not reveal information about convertible life insurance plans.

What is a Convertible Life Insurance Policy?:

Investopedia defines Convertible Insurance as: "life insurance that allows the policy holder to change a term policy into a whole or universal policy without going through the health qualification again."

This really appeals to Mary Garcia.

Bob the Ohio National Life Insurance Agent sends over the following Term Life Insurance Quotes:

Ten Year Term Life Insurance from Ohio National Insurance, Preferred Plus, Convertible $131.50.

Fifteen Year Term Life Insurance from Ohio National Insurance, Preferred Plus, Convertible $152.50.

Twenty Year Term Life Insurance from Ohio National Insurance, Preferred Plus, Convertible $212.

All of these are paid annually.

More Research from John:

John reads online that the following are important considerations when purchasing life insurance:

- Check the Financial Strength Rating Each and Every Time you Buy Life Insurance

- Consider purchasing ten times earnings

- Both spouses, working or not, should have life insurance.

- Buy Term Life and Invest the Rest.

- Be careful buying a form of life insurance that you do not understand.

- Insurance agents are licensed by the individual states.

John is surprised to read that Mary will need life insurance too, but he figures they can do this later - first he needs some. He is also somewhat confused by the concept of Invest the Rest. But both he and Mary believe that a twenty year $350K level term life policy is a good option for them.

A Term Life Quote from Banner Life Insurance:

John secures a twenty year life insurance quote from Banner Life Insurance company.

Twenty Year Term Life Insurance From Banner Insurance, Preferred Plus is $196 per year, paid annually.

The numbers are pretty comparable to what Mary had found through Ohio National.

Term Quote from Transamerica Life Insurance:

Mary calls up and gets yet another twenty year term life insurance quote from Transamerica for a similar amount. The agent she gets on the phone is pretty helpful and not pushy about purchasing a whole life policy. Although the pricing for John is a bit higher:

Twenty Year Term Life Insurance from Transamerica, Preferred Super 20, Convertible $236. Paid Annually.

A comparison of all three 20 year term life insurance options:

Mary and John review the options on a piece of notebook paper.

| Ohio National |

| 20 Year Term $350K |

| $212.00 |

Convertible

| Banner |

| 20 Year Term $350K |

| $196.00 Not Convertible |

| Transamerica |

| 20 Year Term $350K |

| $236.00 Not Convertible |

More research into Whole and Term Life Insurance Options:

Mary reads a great article online about Best Uses of Whole Life Insurance and another one about Best Uses of Term Life Insurance. Now she feels completely at ease with their decision about deciding on term life vs whole life. It seems that whole life insurance is the form of life insurance that many insurance agents prefer to sell because they essentially get more money out of it. Vs Term Life insurance where insurance agents make less money.

There does seem to be a lot of positives for whole life insurance, but given that it is so expensive and that her family is not flush with cash, shes not sure it makes any sense for her family. They just need inexpensive short term protection.

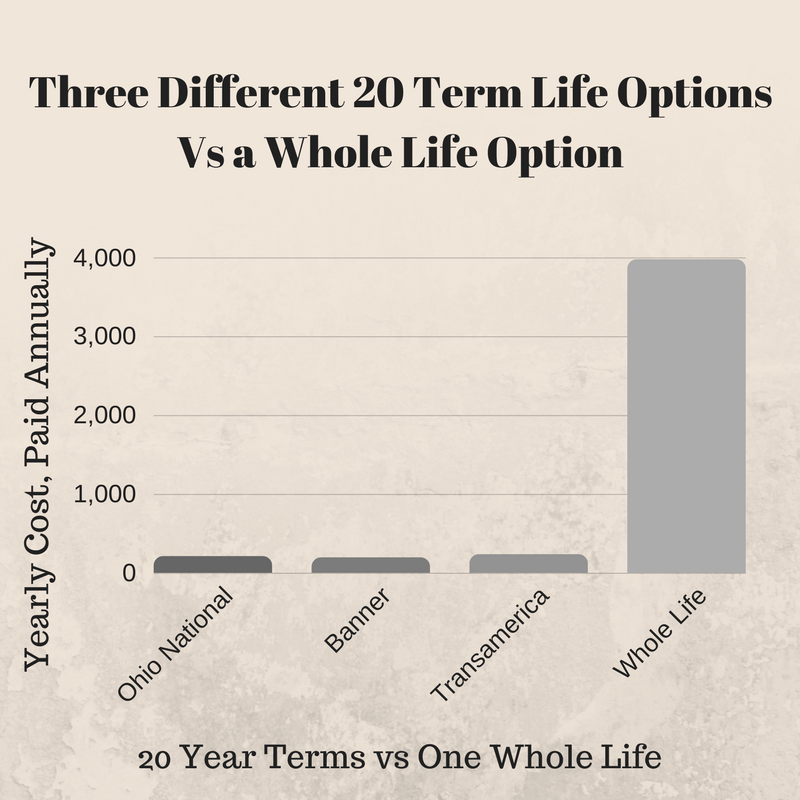

A comparison of all term life options vs the whole life option:

They now add in the whole life option and the AM Best Financial Strength Ratings.

| ABC Home |

| Whole Life $350K |

| $3,977.00 No Need for Converting AM Best = A++ |

| Ohio National |

| 20 Year Term $350K |

| $212.00 Convertible AM Best = A+ |

| Banner |

| 20 Year Term $350K |

| $196.00 Not Convertible |

AM Best = A+

| Transamerica |

| 20 Year Term $350K |

| $236.00 Not Convertible |

AM Best = A+

The Garcia's Needs:

After much sole searching the family has decided that just need to get some life insurance in place. They want and need the following:

- 20 Year Term Policy for John.

- Around $350K in term life benefit coverage.

- An A rated carrier or better.

- Mary to be listed as the primary beneficiary and the kids as secondary beneficiaries.

- They will opt for one annual payment to keep the cost the lowest.

The family agrees to go ahead and do John's life policy first and then focus on Mary's later.

The Garcia's Life Insurance Decision:

The Garcias quickly discard the option of buying whole life insurance as they fear it is way to expensive and unfavorable for them. They ditch the Transamerica quote seeing that it is slightly more expensive. They are unsure if it makes more sense to purchase the Banner policy or the Ohio National policy with the idea of one day deciding to convert it.

The difference in cost is only $16 per year and although they feel that its unlikely that will choose to change their term plan to a whole life plan, the opt to go for it.

Therefore John Garcia calls up the Ohio National Life Insurance agent to get the application process started. They choose the 20 year, $350K term life plan.

A Short Review of the Garcia's Life Insurance Decision:

- The Garcias need additional financial protection to supplement John's Group Term Life Plan.

- Ten times earning means that the Garcias could use an additional $360K in life insurance.

- The family grew very frustrated with the shopping process and therefore educated themselves.

- Due to their self education, they saved themselves potentially thousands of dollars per year.

- In the end they choose a form of term life insurance that not all insurance companies even offer.

- They checked financial strength ratings through a credit rating agency and only considered A category of above rated carriers.

- They will need to circle back and purchase Mary a life insurance policy as well to complete their full family life insurance.

Questions about Whole Life, Term Life, Life Insurance Policy Length, Financial Strength Ratings?

Call or email us with your questions, we are happy to help. We believe that informing consumers of the reality of life insurance is our duty. We believe that most families need life insurance, but not all.

Phone 415-294-5454

Fax: 415-294-4555

Email: sales@marindependent.com

Notes about this article:

This article is based on a 32 year old male purchasing life insurance for his family. These are fictional characters but the life numbers are relatively accurate. Life insurance rates change constantly. In this particular article we ignored the general life insurance classification rates such as Super Preferred, Preferred, Standard Plus, and Standard to keep the article simpler. This client was assumed to be in essence in perfect health, non smoker, no pharmaceuticals with no accidents and tickets, and no dangerous activities or career. There are other assumed values.

We have also greatly simplified, again for brevity's sake the discussion of the term length of life insurance. A twenty year term policy, often considered the most obvious, could have easily been displaced by a 15 or 25 year policy. Each Families Life Insurance needs will be different.

ABC Home Insurance is obviously a fictitious home auto insurer. However the numbers are accurate for a highly rated home/auto insurance company.

Please seek licensed assistance by insurance agent whenever making decisions about any type of insurance.

About the Creation of this Article:

This short article about family life insurance was created during a two week time frame. The intent was to explain in significant detail (but not too much) the trials and tribulations of a family deciding what type of life insurance to purchase for themselves. Everyday tens of thousands of Americans are faced with this very same decision. We used real numbers with fictitious people. The graphics were created on a simple free drawing program online. As usual we have used the Thrive content builder to help this article appeal to clients eyes. Speckles the cat was added at a later version of this article.

Speak with an experienced advisor!

Speak with an experienced advisor!