Whole Life Insurance is often proposed as a great mechanism to save money in an asset protected, safe, and tax advantaged method. Although all of this is partially true, rarely if ever do Insurance Agents discuss the alternative tax advantaged investment options available to many consumers. In this article we will review a full litany of tax free, tax differed, or otherwise tax beneficial options available to many Americans. We will demonstrate that the tax advantage of Permanent policies, such as Whole Life are really not that unique and in many cases inferior to numerous other options.

"Life Insurance is one of the last Tax Free Investments!" This statement is just not accurate. Countless insurance salesmen tout the tax advantages of Whole, Universal, and Variable Life Insurance. (And they do have them.) But - The underlying issue is that most insurance agents are just NOT knowledgeable about the alternative universe of other investments. Specifically the other tax advantaged investments.

After all most life insurance agents only sell life insurance. If you are selling me a tax beneficial investment, shouldn't you compare it to other tax advantaged options? With that idea in mind, we will explore the alternative tax free, tax differed, and otherwise tax advantaged options in comparison to whole life insurance attempting to assist consumers in understanding if "investing in whole life insurance makes good solid sense." We will finish up with a Brief description of the various kinds of tax protection strategies.

Editors Note: The author of this article is himself, an insurance agent and Not a registered adviser, a tax consultant, nor an attorney. After years of hearing consumers complain about their overpriced whole life policies, that they originally believed to be a great savings account, only later to find out that many of the benefits sold to them turned out not to be true; he began to dig into all of the other options and considerations. What I have found is exceptionally revealing:

401Ks vs Whole Life Insurance:

401Ks and their cousins 403Bs and 457 Plans are federally qualified retirement accounts that are amazing investment opportunities for many Americans. If you have the ability to save in a 401K, 403B, or 457 account (Regular or Roth) it is difficult to see whole life competing with them.

401K,Roth 401K, Solo 401K:

The mother ship of investing, the 401K and its similar cousins provides what most financial gurus consider to be the best single investment option available to most Americans. Some corporations generously match a small percentage of employee's initial savings effectively doubling returns in many situations. Where else can you invest a dollar and earn a corresponding dollar?

The Roth 401K allows for post income tax paid dollars to grow income tax free when taken out during retirement. The Solo 401K is for tiny one man businesses and offers many many similar benefits of typical 401Ks. Confusingly enough Solo Roth 401Ks also exist.

403b and Roth 403b:

Offered "to private-nonprofit employees, government workers, and church employees" they "allow participants to shelter money on a tax-deferred basis." Source. They are very similar to 401Ks and Roth 401Ks, in that they allow for either pre or post income tax contributions for use during retirement.

457 and Roth 457:

Another variance on 401Ks are 457 plans. 457 and Roth 457 plans are only offered " offered to state and local government employees" says Investopedia. One of the most interesting and salient details of 457 and 403b plans is that some governments entities simultaneously offer both! And according to numerous sources including Remove the Guesswork: "Yes, If your employer offers both, you can contribute to (and max out) both...403(b) and 457 plan."

For any government employee (earning a government wage) that is in this scenario I find it hard to imagine that a Whole Life Contract could serve better than a combination of these two savings plans.

IRAs vs Whole Life Insurance:

Individual Retirement Accounts a qualified investment account that can often work in combination alongside 401K type plans. Consumers should not overlook IRAs just because they have 'another' retirement savings account.

Roth IRA:

The grand daddy of tax free investments is the vaulted Roth Individual Retirement Account. Simply known as just a 'Roth', they allow "tax-free...Roth distributions...when you follow the rules." Roth IRAs essentially allow you to save tax free for retirement. Money is placed into a Roth IRA on a post tax basis and growth is then tax free, when pulled out during retirement. Simply put a Roth IRA "is one of the best places to save for retirement — you put money in after paying income taxes on it, but then your account grows entirely tax-free." Source.

The main drawback to Roths are that Significant laws limit who is able to place money into a Roth IRA and how much they are able to add per year. But, there is the backdoor option...

Backdoor Roth IRA:

The backdoor Roth IRA is a legal method of getting around typical Roth IRA income limits. The backdoor Roth IRA "is a two-step process that provides a way for high-income earners to make annual Roth IRA contributions." These two steps are: First off, "Make a current year non-deductible contribution to a traditional IRA." Then: "Conduct a tax-free Roth conversion of the contributed amount at a later date."

This two step method allows millions of Americans the ability to access Roth IRAs. If you do not qualify for a Roth IRA, you just might qualify for a Backdoor Roth IRA.

Standard IRA & SEP IRA:

A 'standard' Individual Retirement Account is a qualified investment: "Your contributions to a traditional IRA are generally deductible* on your tax returns. Since you get the tax break up front, when you go to withdraw the money in retirement, you will pay income tax on those funds, including any earnings." Several types and kinds of peoples are not allowed to use standard IRAs: "When you or your spouse have access to an employer-sponsored retirement plan AND your modified adjusted gross income (MAGI) exceeds a certain amount, you can be ineligible to deduct the IRA contributions on your tax return. Your IRA then becomes known as a non-deductible IRA."

Investor Junkie states that SEP IRAs are: "a type of IRA that works well for the self-employed or the small business owner." Most small business owners that consider SEPs also look at another option the Solo 401K.

Non Deductible IRA:

Tobias Financial reports that Non Deductible IRAs are not "the first line of defense for contributing to retirement accounts, but it may be the most suitable option for some, especially high-income earners." Non Deductible IRAs are great for those that " are covered by an employee sponsored retirement plan" and "are ineligible to contribute to a Roth IRA due to income limits."

Non Deductible IRAs can be used in conjunction with Backdoor IRAs or to allow " the earnings on [the] contribution [to grow] tax deferred." Non deductible IRAs can be a great addition to families that are already maxing out their 401K plans and wish to invest additional funds in a tax differed method.

Rollover IRA:

A rollover IRA is, according to Finance Gourmet, " nothing more than a traditional IRA....Certain types of funds cannot be transferred into a 401(k) account. By designating an account as a rollover IRA and only transferring eligible dollars, such as those from other 401k plans, into the account the taxpayer creates a segregated account that can be transferred at some time in the future into a 401k plan."

A rollover IRA is basically a 401K that has been removed from the 401K account and been placed in individual retirement account. It should be noted that similar rollover IRAs can also exist for other qualified retirement accounts such as: 403bs and 457s.

The real purpose of rollovers is for "the purpose... segregate[ing] retirement funds that are eligible to be transferred back into a qualified retirement plan such as a 401k, from those that are not."

Rollover IRAs are not really a competitor for your Whole Life Insurance savings dollars. Their inclusion in this list is for completeness sake. The real competitor to whole life insurance contract dollars are 401Ks, 403Bs, 457s, and their roth equivalent.

Inherited IRA:

Inherited IRAs are a messy term for an IRA bequeathed from someone's passing. Often this a parents remnant IRA account or a Spouse's account. According to Money with a Purpose: "Rules are different for spouses and non-spouses." These accounts typically do not allow for additional savings, but can in some instances be held for long periods of time, depending on " required minimum distributions."

The inherited IRA is not so much in competition for new dollars vs whole life contracts as much as it is in competition for existing dollars. I can not imagine suggesting that someone cash out an inherited IRA in order to fund a whole life contract.

Pensions vs Whole Life Insurance:

A pension is typically thought of as a forced retirement plan, whereby the employee or worker has little choice or say in the matter. However this is only partially true. Although Pensions are becoming more rare in today's world, Some employees still have the option to participate in these highly valued and coveted programs.

Pensions often function by taking out a small amount of money each pay period and setting it aside into a general pension account.

When given the choice of a guaranteed stream of income, often pensions serve as a terrific use of savings capital in comparison to a whole life insurance policy. Some pensions are protected (backstopped) by various Guarantee Corporations that "serve as a backstop for private-sector pension plans." Many of these guarantees are underfunded and hence have their own issues. However depending on the mechanics and finances of a given pension, some are still in terrific shape, especially those funded by the US or Various State governments.

The other partial consideration or choice that some employees have with these plans is with the ability of closing out their pension upon a retirement or some other agreed upon date. Employees are sometimes allotted a dollar specific one time payment in exchange for a release of all future payments.

Deferred Compensation Plans (NQDC) vs Whole Life Insurance:

According to CPA Practice, Deferred Compensation Plans are: "small business employee benefits that let employees reduce their immediate tax liabilities. Both employers and employees can contribute to deferred compensation plans. Deferred comp can be broken down into two categories: non-qualified and qualified deferred compensation plans."

Non-qualified or NQDC plans typically have no income limits and are considered much more flexible. There are numerous types and kinds of these plans with Supplemental Executive Retirement Plans being one of the best known. SERPs, as they are known, allow senior executives to postpone income. "Employees who defer part of their compensation also defer taxes on that income." This is an important and noteworthy tax advantage. Some non-qualified deferred comp plans place the funds into pseudo investment accounts that potentially can grow.

There are of course serious disadvantages to these types of programs as well. However for C level executives that has access to these corporate plans, its difficult to see how this might not be a better place to stash your surplus money than in a whole life contract.

Is a permanent policy really potentially a better use of your savings than a Pension? I do not think so.

HSAs vs Whole Life Insurance:

Healthcare Savings Accounts (HSAs) have exploded onto the market in recent years and may now serve as one of the best tax advantaged uses of your dollars. According to Barons, "HSAs are arguably the most tax-friendly way to save for retirement since they offer the “triple tax benefit” of an upfront deduction, tax-free growth, and tax-free withdrawals for all qualified medical expenses. Plus, HSAs aren’t subject to requirement minimum distributions (sic.)"

HSAs are complex. They were set up in 2003 to "offset the out-of-pocket costs associated with high-deductible insurance plans." But after several years on the market, " accountants...came around to the idea that their real value isn’t in paying for current health-care costs but in letting money in these accounts accumulate for retirement."

So how do HSAs work? Women Who Money explains it as thus: "The simplest way to describe Health Savings Accounts is that they are tax-advantaged savings accounts for medical expenses. The money in the HSA is not taxed when it is deposited, similar to a traditional 401k deduction. This reduces your taxable income for the year and means you keep more of your hard-earned money." There are several requirements to open up a Healthcare savings account. These include: Having a High Deductible Health Insurance Plan, Not being claimed as a dependent, and Not being on "medicare."

If you have access to one of these incredible savings accounts, its hard to see how a whole life contract can beat it. After all how exactly do you access cash accumulation in a Whole Life contract for medical expenses? After all the Washington Post reports that Health Care if often the biggest expense in retirement. “For many families, health is the ultimate wild card,” says Andy Sieg, head of Global Wealth and Retirement Solutions for Bank of America Merrill Lynch."

Children's and College Savings Plans vs Whole Life Insurance:

There are a multitude of ways that American families can save for their children. Save for college, technical schools, or even for some other purposes.

529:

A 529 Savings plan is the Cadillac of College Savings accounts. Created by the Small Business Job Protection Act of 1996 - the 529 is considered unparalleled in its's ability to assist consumers in saving for college. 529 plans are a technically a type of Qualified Tuition Program or QTP for short. There are basically two different types of 529 plans: Prepaid 529 plans and College Savings 529 Plans.

Prepaid 529 plans are probably less well known. " These plans are offered by states and private colleges....They let parents lock in current tuition rates at participating universities and slowly pay them off." Capital One.

The alternative (and in my opinion preferred option for most) is the 529 Savings Plan are only offered by the States. These combination State Approved Private run mutual funds allow for tax free withdrawal for qualified education expenses.The ownership and control of 529 plans can be a bit complex but in essence the owner of the fund names a beneficiary. So if you have multiple children, multiple 529 plans may be your best bet.

Both forms of 529 plans have contribution limitations, says Money Geek.

One important consideration is that if the 529 plan owner dies "the successor named on your 529 account application becomes the account owner for all purposes."

Coverdell ESA:

Wells Fargo states that Coverdell ESAs are available for consumers whose income is below $110,000 for single earners or $220,000 for dual earners. A maximum of $2,000 may be deposited per year. ESAs are a "tax-deferred account with earnings and withdrawals free from federal income tax if used for qualified education expenses. Contribution limits apply."

ESAs have slightly different rules than 529 accounts and both potentially can be useful. The Military Wallet states: "The Coverdell ESA and 529 Plans each have their own list of qualified withdrawals. For Coverdell ESAs, you can use money for any educational expense from kindergarten to grad school. Tuition, fees, books, computers, internet access for education, transportation to get to school, private or public school fees, etc."

UTMA & UGMA Accounts:

Custodial accounts, such as those set up through the "Uniform Gift to Minors Act (UGMA) account or a Uniform Transfer to Minors Act (UTMA) account" can also be "an option" to save for children's college, says the NASDAQ.com. The situation with UTMA and UGMA accounts is very different from Coverdales and 529 plans. It works like this: "Any parent, grandparent or other adult can transfer assets to an UTMA or UGMA account. The donor can serve as custodian on the account..." The tax benefit for parents transferring assets are clear: "the first $1,050 of unearned income in an UTMA or UGMA account is tax free. The next $1,050 in income is taxed at the child's tax rate (assuming she has no additional income)."

This simple method allows minors to receive $1K in tax free income each and every year. Of course this requires you to essentially put the money in their name, with no real way to take the money back. However if you are planning on sending your children to college, than the money can be used for that purpose. Also the money is not limited to use for college alone.

Beyond the initial tax free amount - The situation with UTMA account changed (somewhat) for tax year 2018. However, the "Kiddie Tax" as it is often known, allows for a tax rate that is often lower than their adult counterparts. According to market watch the initial tax rate (beyond their standard deduction) is only 10% for up to about $2,500 in income.

In comparison to whole life contracts, this method of earning tax advantaged dollars is potentially a much better choice. The money remains in a brokerage account where the child, under your control, has access to it.

Annuities vs Whole Life Insurance:

Annuities can have tax advantages. Annuities, both qualified and non-qualified are exceedingly complex. Depending on the type and kind of product that you purchase "you don't have to pay taxes on the interest earned until you begin making withdrawals. This tax-deferral period can have a dramatic effect on the growth of an investment." Source.

After reading this, please do not go off and buy an annuity. There are numerous negatives to annuities including their complexity, cost, sales process, and less than stellar returns. Without a doubt annuities are not for the faint at heart. And, there are just so many other (and often better) tax advantaged options out there.

But there are real world uses for these products and some types of annuities potentially could better serve some people such as: Longevity Contracts and Immediate Fixed Annuities.

Property Investment vs Whole Life Insurance:

Looking for other ways to stash cash in other tax advantaged options. Look where you live and all around you as direct property investment has a lot going for it.

Equity from Primary Home Sale:

Did you know that if you sell a home that you live in that you might be able to pocket up to $500,000 tax free? This might just be the largest method of income tax free gains in the US tax system.

Financial Samurai states: "According to the IRS, most home sellers do not incur capital gains due to the $250,000 and $500,000 exclusion for single and married couples." There are multiple qualifications for this huge tax free rule: "You must have owned the home for at least two years during the five years prior to the date of your sale. You must have used the home you are selling as your principal residence for at least two of the five years prior to the date of sale. You have not excluded the gain on the sale of another home within two years prior to this sale."

For the lucky few that have the ability to sell their primary home for a tax free gain, it is unquestionable that this offers up a far superior method of tax avoidance than just about any other option, including life insurance.

Paying Down the Mortgage:

This is obviously not an investment. But excluding this from our discussion could be a huge issue. By paying down your mortgage early, consumers can instantly earn a guaranteed rate of return. The guaranteed rate of return is the interest rate on the note that would no longer be paid. Better still, pay off a second mortgage. Or any part of the mortgage that is over the current income tax deduction limit, that has recently changed. (The reasoning for this is simple, if you are not getting a tax benefit from of your mortgage - than best to get rid of that part.)

So are you better off using an extra $2,000 in a permanent contract or paying down your mortgage? Up to a point paying down your note early brings you increased financial flexibility with a guaranteed tax free rate of return.

Rental Property:

The inclusion of a rental property may appear to be a bizarre option for those considering a whole life insurance contract instead. But rental properties have an almost super tax advantaged status. According to NOLO, Landlords have all sorts of tax deductions to use for tenant occupied dwellings. These deductions include "Interest,...Depreciation of Rental Property,...Repairs,...Insurance,...Travel..." and there is much more.

According to Smart Asset: "Property owners enjoy a variety of perks at tax time" and "they have the opportunity to substantially reduce their tax bill." This of course comes at a constant cost of monthly mortgage payments and the headache of being a property owner. But some of this can be put on auto pilot such as by hiring a property manager and via auto-pay.

Rental properties may allow property owners a hugely significant current tax deduction, while a whole life contract is a potential tax differed play. One of the main headwinds to rental properties are liability and the final sale of the property which can incur major tax charges. But there are potential options for those tax charges as well...

1031 Exchanges:

As a subset of the Rental Property Investment idea, the addition of the 1031 could be considered just a footnote. "A properly structured 1031 exchange allows an investor to sell a property, to reinvest the proceeds in a new property and to defer all capital gain taxes." Source. This exchange is named after a specific IRS tax code: IRS Section 1031.

The reason for the inclusion of this sub item is to demonstrate that even a long held rental property is potentially tax differed via this 1031 method.

[Of note a 1031 should not be confused with 1035 life insurance exchanges.]

Paying Down Any Other Debt vs Buying Whole Life Insurance:

It makes very little sense, typically to invest money when you owe money. Exceptions can be made, possibly for making 401K or Roth IRA contributions when you have an auto debt, or if you have a loan on a home, but other than that...

I just do not see it. If you owe money, on an Auto, a Credit Card, and even on Student Debt - I do not see the benefit to buying a whole life contract. The returns on that contract will almost certainly not be better than interest rate you will be paying, when adjusted for taxes. Credit Karma reports: "According to their June 21, 2017, release, the national average credit card rate across all types of cards was 15.96 percent." If you pay down your credit card earlier, you could potentially receive about a 16% tax free rate of return. How will you beat that?

Municipal Bonds vs Whole Life Insurance:

Municipal bonds can be Federally Income Tax free and potentially State Income Tax Free. According to Fidelity - Municipal bonds are: "debt obligations issued by public entities that use the loans to fund public projects such as the construction of schools, hospitals, and highways." Muni bonds as they are known fall into two distinct types: General Obligations and Revenue Bonds. Some municipal bonds are "insured by policies written by commercial insurance companies."

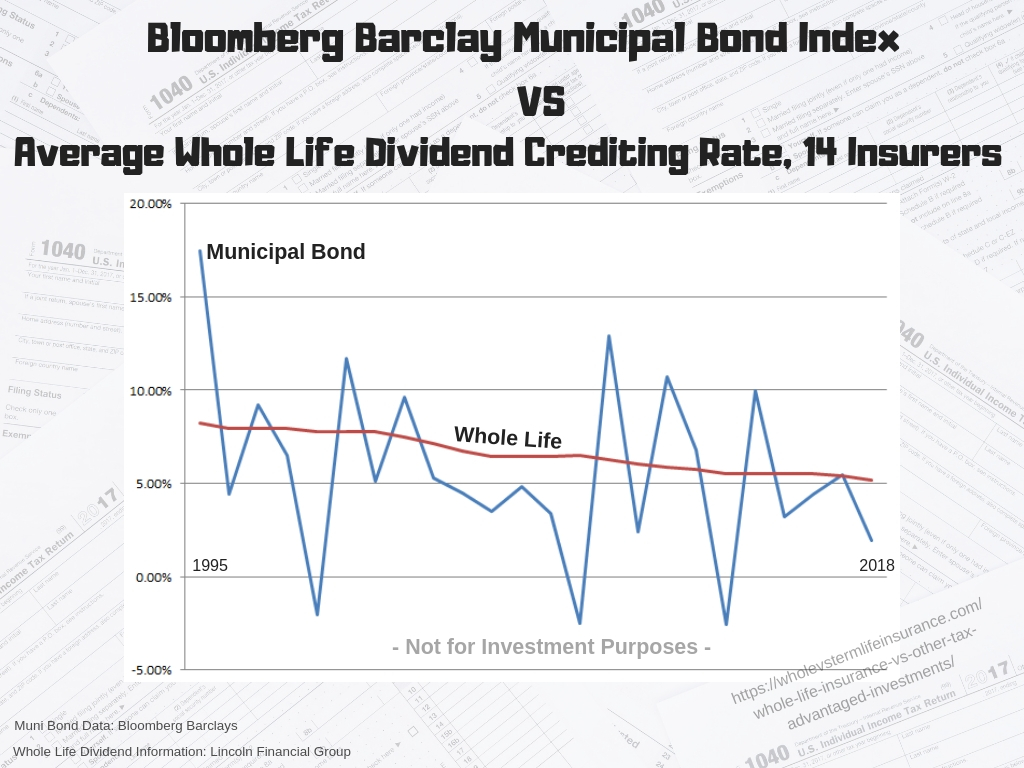

Not all Municipal Bonds are Federally or State Income Tax Free. However there are significant options for those that want tax free income from municipal bonds. In year 2016 a typical municipal bond paid out around "4.43%" according to the Balance. (See you financial adviser for more information.)

As an insurance agent and consumer it is difficult for me not to consider the average rate of return of Muni Bonds as the under/over starting point for all whole life insurance "investment" considerations. In other words how much more can a participating whole life dividend pay out? Since a tax free muni bond is instantly tax free vs the long term lockup of a whole life contract, which is not.

Note: In theory there are a few other Government issued bonds that technically can be tax free. So called Treasury Bonds are generally State and Local tax free, but not federal income tax. There are others as well.

Tax Managed Funds and ETFs in Non Qualified Brokerage Accounts vs Whole Life Insurance:

The simplest way of explaining this tax deferral method is to start by looking at an individual stock. In general, when you buy a stock you only pay yearly income tax on the dividends and any other income derived from it that year. You do not have to pay an income tax on the appreciation of the stock until such time as you sell it. "A gain is not realized until the security that has appreciated is sold." Source. Therefore the yearly dividends are taxable, but the stock appreciation is said to be differed.

The situation is very similar for Mutual Funds and Exchange Traded Funds. First off, Tax Managed Mutual Funds: The use of tax managed funds "applies if you have a brokerage account, or invest in mutual funds, stocks, and bonds that are not inside a retirement account....Tax-managed funds put you in control of when you incur taxes on gains because they deliver most of their capital gains in the form of unrealized gains. This means you don't pay taxes until you sell shares of the fund." The Balance: How Tax-Managed Funds Help Lower Your Tax Bill.

Certain ETFs are somewhat different: "Two of the great, underappreciated advantages of ETFs are their transparency and tax efficiency." The tax deferral reason for ETFs does get rather technical. "ETFs are vastly more tax efficient than competing mutual funds." ETF.com's Education Center has a good explanation: "If a mutual fund or ETF holds securities that have appreciated in value, and sells them for any reason, they will create a capital gain. These sales can result either from the fund selling securities for a tactical move, due to a rebalancing effort, or to meet redemptions from shareholders. By law, if funds accrue capital gains, they must pay them out to shareholders at the end of each year....

The average emerging markets equity mutual funds paid out 6.46 percent of their net asset value (NAV) in capital gains to shareholders, every year. ETFs do much better (for reference, the average emerging market ETF paid out 0.01 percent of its NAV as capital gains over the same stretch)." So it may reason to calculate that that average ETF is massively tax differed.

Essentially there are numerous tax deferral methods that can be used in ordinary brokerage accounts with tax managed funds and some ETFs. If you hold these funds until your time of death, further benefits may appear.

The Stepped Up Tax Basis after Death vs Whole Life Insurance:

According to the Kitces: "When a beneficiary inherits property from a decedent, the asset receives a step-up in basis to its value on the date of death– which is both a tax perk for inheritors, and a form of tax simplification." As an example " if [an] original owner purchased an investment for $40,000 and it appreciated to $100,000, and was bequeathed at that value at the death, the beneficiary would inherit the property at a $100,000 cost basis and the $60,000 gain would vanish forever."

Wait - What, how can that be?! I can hear whole life insurance consumers already asking this important question.

We Build Your Trust, a Law Firm in Anaheim, states "Assets that Qualify for the Stepped Up Basis...[includes] Stock, Mutual Funds, Bonds, Businesses, Equipment, and Real Estate." They further explain: "Those concerned with the tax impact of transferring assets to their beneficiaries may be relieved to know that our tax system allows for a step-up in basis for some items. The basis in the asset is equal to its fair market value at the time of your death, rather than the amount that you paid for it during your life. This means that your loved ones could potentially avoid, or at least minimize, capital gains tax. Taking advantage of this step-up in basis can be a valuable tool as you create your estate plan."

How does a whole life contract compare to that?

Term Life Insurance vs Whole Life Insurance:

Technically speaking the death benefit from a term life insurance policy is every bit as potentially tax free as the death benefit of a whole life contract. Therefore there is often not a real tax benefit if the insured dies within the coverage period with a whole life policy vs a term policy. This valid point is so simple that it needs to be brought up. Term life insurance is in no sense an investment, but its inclusion in this list is technically almost required. Of course by virtual definition a term policy typically ends, while a whole life contract can last until ages 100, 101, 120, or 121 (usually.)

The point is that Term Life Insurance is in a way a valuable place to spend money during times of needed temporary insurance coverage.

Proper Liability Coverage vs Whole Life Insurance:

I realize that technically speaking liability coverage is a form of risk management and not an investment. However no list would be complete without referencing the need for this. A typical $1MM umbrella policy can cost as little as just $200 per year and may adequately protect all of your assets from unforeseen 'personal liability events.' Events that you had almost nothing to do with, although you might get sued for. Will a whole life contract protect you from a liability claim? Permanent contracts may be able to protect your assets that are held in the actual policy but they are not able to protect your other assets, such as your stock accounts and or a rental property, for example.

For those that have a net worth that is beyond their limits of their home and auto insurance, a well rated umbrella policy might just be the "best use of their money."

Other Investment and Financial Considerations vs Whole Life Insurance:

Undoubtedly there are other tax beneficial investment ideas that are either unknown or too exotic to mention. Given the complexities and capriciousness of the tax code is it any wonder?

What Exactly does Tax Free Mean?

This article focuses mostly on federal and to a lesser extent state income tax. We have avoided various discussions of other types of taxes, of which there are numerous types and kinds. Federally Income Tax Free often means that when you pull the money out of the account no federal income tax is required.

What does Tax Deferred Mean?

Simply put, tax differed means that you do not have to pay an annual income tax on something in the initial year. Tax deferral is actually a far more complex topic than many realize. In some instances with some types of investments taxes are due each and every year. On other types of investments, only the money pulled out as a gain or dividend are income taxed. And in yet other types of accounts, such as qualified accounts such as the 401K, taxes are not due until the money is pulled out of the account.

What Is Tax Destructibility?

This subject is immensely complicated. Since there is really only one investment so far as I can tell that this pertains to for our discussion, I will not go into it too much. In theory certain expenses can be used to lower your overall tax burden. A fine line exists between tax deductibility and tax credibility. They are not the same, but can be viewed as somewhat similar.

And Tax Advantaged?

A catch all phrase we have chosen to use that refers to most investments that have various tax benefits that delay, absolve, or deduct future or current tax payments. Some might be tax free, while others are tax deferred, and still others are tax deductible. The term tax advantaged is terrific in comparison to other tax related terms as it has much more open ended meaning. Simply put tax advantaged means there is a taxation reason to do an activity in one manor over the other.

Qualified Vs Non Qualified?

Follow the Money says that there are " two types of money in the eyes of the IRS: Qualified and Non Qualified....Qualified Money is 'before tax money'...This means you did not pay taxes on this money when you invested it." While Non Qualified accounts are paid with after tax monies. "When you invest outside of a “Qualified” plan, you do not get to write off this investment on your taxes.... Additionally, the investment earnings could be taxable each year. It all depends on the type of investment you use."

Summation of Whole Life Insurance Vs Other Tax Advantaged Investments:

There you have 26 suggested general kinds of alternatives places to place your savings dollars in other than Whole Life Insurance. Doubtless there are more, possibly many many more. Are all of these suggested options better than Whole Life Contracts? Simply put - no way. But if just two or three of them are better than whole life - than that could mean that permanent policies are then reserved for the wealthy and/or special situations. If five or six of them are better options for you - than you would need to rake in a whole lot of yearly compensation for it to make good sense.

Quickly

If you decided that maxing out the following accounts: (1) 401K, (2) Backdoor Roth IRA, (3) HSA, (4) Municipal Bonds, and a (5) Low Cost Vanguard ETF Fund. For two earners, each with their own 401Ks and each with matches and assuming you are putting in about $5,000 in the Backdoor, $7,000 in the HSA,and $3,000 each in muni bonds and an ETF fund. I come with a number of about $61,000 before an employer match. Add in about $2,000 for that for each spouse and you get to about $65,000. In other words after saving $65,000 per year it could start making sense to consider a whole contract for pseudo investment purposes, maybe. That is assuming that they only found 5 of the 26 suggestions better than a permanent policy.

Personally and Professionally I count the following as almost always better than Whole Life: (1) 401Ks/403b/457, (2) Roth IRAs/Backdoor Roth IRAs, (3) HSAs, (4) UTMAs,(5) 529s, (6) ESAs, (7) Term Life, (8) Elimination of All debt, and (9) Paying down mortgages.

These I believe generally to be better than whole life for savings: (1) Standard IRA, (2) Muni Bonds, (3) Low Cost ETFs, (4) Proper Liability, (5) Deferred Comp Plans, (6) Pensions and (7) Inherited IRAs.

These I believe will depend greatly on the individual situation: (1) Ownership of Rental Property, (2) Stepped up Tax Basis, (3) Primary Home Sale, (4) Non Deductible IRAs.

The following I believe could possibly be inferior to in some situations to whole life contracts:(1) Annuities and (2) 1031 Exchanges.

Rollover IRAs I did not include, as they are essentially a reformed 401K.

Some might argue that this analysis focuses on the wealthy, this is true, for they are financially the best candidates to be investors in whole life. But, quickly lets consider two working class blue collar Americans making $50,000 per year in total. They have no work sponsored plan - Shouldn't they purchase a Whole Life policy to invest with?

Quickly lets do the math on this one as well:

No, no they should not. First off, they should put their money into a Roth IRA, both of them. After paying off all of their non mortgage debt; They then should set up an emergency fund and start paying down their mortgage. (Remember the guaranteed rate of return thing?) Next consider a term policy, even a bit of college savings via either an ESA or 529 plan. After providing for all of that, they are not likely to have very much money left over.

But many wealthy people do not have access to all of these accounts, they own their own businesses! OK, Ill be honest with you. Many of the contribution limits that I shared with you were for just corporate employees. For those owing their own single person business or multi employee business, technically speaking they may be able to contribute significantly more. According to My Solo 401K.net the income limits for a Solo 401K [for those that are over age 50 (and over)] are about $62,000 for tax year 2019.

See Your Tax Adviser and Or Accountant:

Writer and Editors Note: I really do hope you enjoyed this article. It was painstakingly created in December of 2018 and January of 2019. If you are reading this article and thinking, "Hey I should go buy a muni bond" - I would caution you. I am not an accredited financial adviser. I pulled numbers and quotes direct from other legitimate resources though. My point in creating all of this is generally to point out the plethora of other legitimate tax beneficial options available to most, rather than to get you to invest in any one of these. So if you want to invest see your financial adviser. If you do your taxes see your accountant.

Speak with an experienced advisor!

Speak with an experienced advisor!