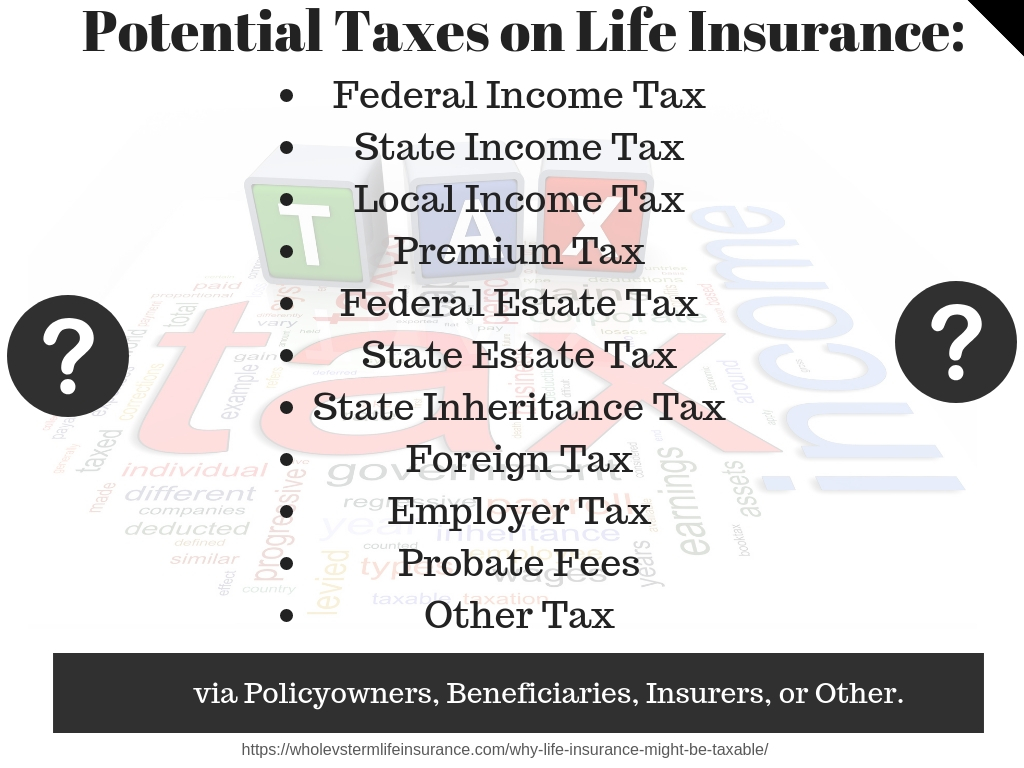

Life Insurance in the United States is absolutely taxable - regardless of whatever everyone else says. However in general - proceeds from a life insurance death benefit, are often considered to be Federally Income Tax Free. That income free tax status though, does not pertain to numerous other types and kinds of taxes. Even the federal income tax consideration is subject to numerous qualifications per the IRS. Other hidden taxes baked into some policies in certain states constitute another form of tax. In addition there are numerous ways that life contracts can become ensnared in various unintended tax traps.

Why Life Insurance Just Might Be Taxable - A Question of Questions:

The statement that Life Insurance is Tax Free is misstated so often as to even confuse google. The statement is often qualified with the terms "generally" or "usually." However even these qualifiers are ignoring huge tax considerations with regards to life insurance. Life insurance is absolutely taxable!

Here are true statements concerning Life Insurance and Taxes that I believe to be accurate:

Life Insurance is often not 100% Tax Free.

The Federal Government is not the only taxing agent in the United States.

The Federal Government levies taxes other than just Income Tax.

Taxes on Life Insurance can be required or paid by both the policy owner and / or the beneficiaries.

Each US State maintains their own tax laws which may apply to you.

Tax Laws change almost every couple of years.

How many other ways can life insurance be taxed? That is really the deeper question. There are so many types and kinds of taxes prevalent in our society today as to almost make this discussion comical.

When consumers are asking if Life Insurance is tax free, are they asking if the death benefit is federally income tax free to the beneficiary or if the yearly participating dividends are state income tax free in Texas that are paid to the policyowner? Its really a question of questions - to whom, and to which tax are you referring to?

In the IRS's own Words:

"Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them." Source: The Internal Revenue Service. The IRS also notes that: "any interest you receive is taxable and you should report it as interest received." In other words if the insurance company holds the money for you after (a death and) the death benefit is received then you owe money on that portion. And: "If the policy was transferred to you for cash or other valuable consideration, the exclusion for the proceeds is limited to the sum of the consideration you paid, additional premiums you paid, and certain other amounts."

In their own words the IRS admits that in general it can be an income tax free benefit, assuming you take the payout immediately, and did not purchase the contract from someone else, and the benefit was paid out from a death. I count three qualifiers with regards to federal income tax alone. Right off the bat they admit that there are three qualifying events that could make life insurance federally income taxed. The word generally though does not stop there. This is only speaking of income tax. And only Federal income tax.

Here is our list of the various tax types, tax traps, and other odd situations that occur that might lead one having to pay tax on life insurance:

***If you have any questions about taxes - please see a licensed tax adviser to inquire.

Premium Taxes:

A premium tax is "a type of sales tax assessed on insurance gross premiums. Insurance companies must pay the tax, but they pass their cost on to their customers." This section and the one below are very closely related, but not technically the same. One important thing for consumers to understand here: Generally State Premium Taxes are paid by the insurer NOT the insured. Therefore this is something most consumers would never see. California charges: "2.35% on most insurers' gross premiums: CA Source.

It is relevant to our discussion for two reasons, First off, every dollar of insurance premium in certain states is taxed when money is placed in a policy. Second, for the purposes of explaining why typical cash value policies are often bad investments, just know that premium taxes act essentially as a load fee acts against a mutual fund performance in certain states and in certain situations.

According to Immediate Annuity, seven states charge some form of Premium Tax on Non Qualified contracts.

Nevada 3.5%

California 2.35%

Maine 2.0%

South Dakota : 1.25% on first $500K

West Virginia 1%

Wyoming 1%

Florida 1% (Absorbed by Insurer)

Texas .04%

Sadly that is not the end of the state insurance tax drama with regards to premiums...

State Retaliatory Insurance Taxes:

I will freely admit that this category deserves to be more of a footnote. If you find premium taxes complicated, just skip over this section. The short version is that, similar to Premium taxes, some states charge some insurers (based on where they are domiciled) a "retaliatory" tax. These are also usually baked into the policy and consumers do not see them.

In a way State Insurance Retaliatory taxes are almost an interstate insurance commerce tax. Since insurance is regulated by the states and since most insurers sell across state lines, the individual states bicker over where companies are headquartered and who is paying what tax.

A footnote it might be if you are purchasing a term policy, but if you are "investing" in an Indexed Universal Life policy to fund a college education, these interstate commerce taxes create a real investment headwind. Hence their inclusion of this on our life insurance tax list.

State Income Taxes:

Yes its true, some states charge income tax. Many (not all) states follow very similarly federal income tax rules. Meaning your tax filing process begins with your completed federal income tax form and tax computed numbers. In a really basic sense, if you had to pay federal income tax on it, your individual state might also force you to pay state income tax on it.

Local Income Taxes:

According to the Balance, "Fourteen states and the District of Columbia allow cities, counties, and municipalities to levy their own separate individual income taxes in addition to state income taxes." Does that mean that local jurisdictions tax life insurance death benefits that meet the IRS guidelines for a tax free death benefit? Not that I a aware of, but with such a large list, who could keep up with it.

What I can tell you is that you if you had to pay federal income tax on your life insurance policy or dividend - and had to pay a state income tax, its also possible that you might have to pay a local municipality income tax.

INheritance Vs Estate Taxes:

There are two main types of taxes that are involved with the transfer of estates: Inheritance and Estate Taxes. The terms are often miss used and confused.

An Estate tax is a tax on "a tax levied on an heir's inherited portion of an estate if the value of the estate exceeds an exclusion limit set by law." Estate taxes are applied After assets are given. (Often the parents or grandparents.) The Federal government levies as estate tax on " combined gross assets and prior taxable gifts exceeding $11.18 million" for tax year 2018. The number has changed frequently. Some individual states also may charge estate taxes.

An Inheritance tax is a tax on a "tax imposed on those who inherit the estate of a deceased person." It might be easiest to think of inheritance tax as being paid by the beneficiaries which are often the children. The estate beneficiaries pay this tax. "The United States federal government does not have an inheritance tax." But some individual states do.

Inheritance Tax - Not Federally Charged - Some States Tax -for the Beneficiaries to Pay

Estate Tax -Maybe Federally Charged - Some States Charge - for the Estate Owners to Pay

***If you have any questions about taxes - please see a licensed tax adviser to inquire.

Federal Estate Taxes:

An estate tax is paid by the estate. Federal tax limits and laws change on this often. Currently combined assets of about Eleven Million US Dollars are excluded. Any money over this point may be eligible for the federal estate tax. Life Insurance Death Benefits are commonly considered to be part of the estate for Federal Estate Tax purposes. Thus, Life Insurance Death Benefit proceeds can and will be taxed by the federal estate tax when consumers breach this limit.

However there are ways around this. Including, but not limited to,a specific type of trust sometimes referred to as an Irrevocable Life Insurance Trust. An Irrevocable Life Insurance Trust is simply referred to as an ILIT. The general concept of ILITs are beyond the purpose of this article.

State Estate Taxes:

Not to be outdone by the IRS, various states also charge estate taxes of their own. The Tax Foundation reports that indeed about 14 or so states (including DC) have some version of their own estate tax. Each state has their own rate and exemption amount. "New Jersey has the lowest" at " $675,000" and "Hawaii and Delaware have the highest exemption threshold at $5,430,000." The rates vary from less than 1% to as high as 20% in the state of Washington.

Therefore if you had to pay a Federal Estate Tax than you might as well have to pay a State Estate Tax on your death benefit.

State Inheritance Taxes:

Not to be confused with its' cousin the estate tax, the inheritance tax is a tax more on the person that receives the estate. The term beneficiary is useful (if not confusing) to consider. Do Individual States charge inheritance taxes on life insurance death proceeds? It is unclear. But it is not all that likely. But...

There are about five states that charge inheritance taxes: Iowa, Kentucky, Maryland, Nebraska, New Jersey, Pennsylvania. Some of these states specifically single out that they do not charge inheritance tax on life insurance death benefits. And some specifically exclude certain individuals that are related to the insured.

However some states do appear to charge inheritance tax on life insurance death benefits. "The Nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate."

"The state of Kentucky considers a wide range of items taxable, including:...Life insurance payable to the insured or estate of the insured."

So yes, its possible that a state inheritance tax can tax you life insurance death benefit.

Foreign / Other Government Taxes:

Is it possible that a foreign government could tax in some way your life insurance policy? It is probably not all that likely, in fact it may never have happened. Although my guess is that is has happened on occasion. For the United States this situation seems most likely for two types of peoples: 1. Expats living abroad 2. Foreign Nationals living in the US.

Unlike most countries that have a territorial taxation system, the US has a worldwide tax system. There are a handful of other countries that have a similar type of system, including the Philippines. Is it possible that a foreigner that receives a death benefit from a US Life Insurance policy can be taxed? I cannot say. Perhaps the most likely scenario would be the reverse -if an American Citizen living abroad received a death benefit in another country. They then were forced to pay some type of tax on the death benefit, to the there foreign (the US) government? Although this seems crazy, it might be possible.

According to the Economist,The Isle of Man has a "growing business of life insurance for expatriates and the global rich that is under threat...The appeal is tax-efficiency: deferring income-tax liabilities or avoiding inheritance tax."

Another situation that could arise with life insurance is a Foreign Life Insurance policy: "Foreign life insurance that complies with the definition of life insurance through U.S. law falls under the same general tax treatment as one issued by a U.S. insurance company. As the cash value of a life insurance policy builds, it is tax deferred until the policy is surrendered. Once it is surrendered, any excess of the total premiums paid would be subject to the same taxation of standard income" Source.

My advice with this is to see an accountant and possibly multiple accountants in various jurisdictions to inquire.

MECs:

MECs are a malformed insurance contract. Or an insurance contract gone wrong, generally not on purpose. MECs are short for Modified Endowment Contracts. MECs are "a tax qualification of a life insurance policy whose cumulative premiums exceed federal tax law limits." A bit of history here: Life Insurance decades ago started to be used as a work around for certain tax laws, Congress Stopped it with the Technical and Miscellaneous Revenue Act in 1988.

TAMRA, as it is now known, required life insurance contracts to use the Seven Pay Method to continue to qualify as a legitimate life insurance contract and not a Modified Endowment Contract. "Policies become an MEC when the premiums paid to the policy are more than what was needed to be paid within that 7-year time frame."

MECs are a well known tax trap to insurance agents and they know very well of them. Beware when setting up any life insurance policy and paying it off or (too much) in seven years. If you policy gets deemed a MEC, prepare to pay significant taxes on it.

The Goodman Triangle:

The Goodman Triangle is also a tax trap, but probably less well known than the MEC. The Goodman triangle can also be thought of as a miss set up life insurance policy that potentially might incur estate taxes. The exact details of the Triangle involve having too many parties to a contract.

Generally speaking, if the insured and the policyowner are one and the same person - you will be in the clear. It can get more complicated with the inclusion of trusts.

Whole Life Dividends:

Participating whole life dividends are typically considered to be a return of premium for income tax purposes. However - "the most common reason that an individual could be forced to pay income tax on a life insurance contract dividend is when the interest received exceeds the annual premiums paid." Source. Put another way when you get more out than you paid in, expect to start paying taxes.

Closing Down a Permanent Policy Early:

The entire subject of contracts being closed down gets pretty confusing pretty quickly. For our purposes, let us just state that you if you cancel your permanent life insurance contract and received any sort of financial payout what so ever, (ever) - its possible that you could owe federal and state income tax.

Zacks says: "f you decide to cash out your life insurance, you will owe taxes on the cash you receive...When you cash in a life insurance policy, the insurer will issue you a 1099-R, which shows the gross payout you received from the policy."

Therefore be prepared to pay income tax if you have had an income producing permanent life insurance contract and decided to cash it out early.

Buying or Selling a Life Insurance Contracts:

An entire industry has popped up in recent decades known as STOLI or Stranger Originated Life Insurance. The National Association of Insurance and Financial Advisors defines STOLI as: A financial situation that "consists of transactions where investors entice seniors to take out policies, with the intent of all the parties to the transaction being to transfer most of the policy benefits to those investors. The sooner the policyholder dies, the greater the investor’s profit." Shortly put: The Insurance Industry hates this.

The IRS has clarified that many STOLI transactions constitute an income taxable event: "In Revenue Ruling 2009-13, the IRS addressed the income tax consequences of both surrendering a policy back to the insurer and selling it to an investor group. Where the policy is surrendered to the insurer, any payment received that is in excess of the insured’s tax basis in the policy is treated as ordinary income. For these transactions, the insured’s tax basis is the full amount of the premiums he has paid on the policy up to the time of the surrender, reduced by any untaxed amounts that he had withdrawn from the policy."

It continues: "The treatment of sale transactions is different. First, the IRS said that the insured’s basis in the policy must also be reduced by the portion of the premiums paid that is attributable to the “cost of insurance” under the policy. Many tax experts believe this position on the part of the IRS is not correct. The portion of the insured’s gain that does not exceed the cash surrender value of the policy at the time of sale is taxed as ordinary income. Any gain above that amount is treated as long term capital gain." Loeb & Loeb LLP on Lexology.

Buying and Selling Life Insurance contracts can absolutely lead to all sorts of taxes.

Selling Life INsurance Contracts - Viatical Settlements:

There is a form of life insurance contract sales that have their own set of Rules: Viatical Settlements. This is distinct and different than STOLI plans. Unlike STOLI, Viaticals are more accepted and understood in the insurance industry. According to Merriam Webster, a Viatical Settlement is:"an agreement by which the owner of a life insurance policy that covers a person (such as the owner) who has a catastrophic or life-threatening illness receives compensation for less than the expected death benefit of the policy in return for a turning over (as by sale or bequest) of the death benefit or ownership of the policy to the other party (such as a company specializing in such transfers)." These also go by the name Viaticals.

According to Life Settlements, "A viatical settlement made to an individual considered terminally ill (under HIPAA, one who has a life expectancy of 24 months or less) is entirely tax free....This favorable tax treatment generally applies only to individual viators -- and does not apply to companies viaticating life insurance policies covering the lives of their employees." There are numerous conditions that need to be met.

Although the website Life Settlements notes that it is entirely tax free, one must remember that: " life insurance...is included in that person's taxable estate." And hence being part of their estate keeps this open to taxes on the estate and inheritance.

Employer Paid Taxes on Group Life:

Does your employer offer you group life insurance? According to the IRS: "IRC section 79 provides an exclusion for the first $50,000 of group-term life insurance coverage provided under a policy carried directly or indirectly by an employer." But, "A taxable fringe benefit arises if coverage exceeds $50,000 and the policy is considered carried directly or indirectly by the employer. A policy is considered carried directly or indirectly by the employer if:

- The employer pays any cost of the life insurance, or

- The employer arranges for the premium payments and the premiums paid by at least one employee subsidize those paid by at least one other employee (the “straddle” rule).

"Because the employer is affecting the premium cost through its subsidizing and/or redistributing role, there is a benefit to employees. This benefit is taxable even if the employees are paying the full cost they are charged. You must calculate the taxable portion of the premiums for coverage that exceeds $50,000."

Therefore its pretty clear that group life insurance carries benefits that require IRS tax payments.

*Of note here - our discussion on taxes as it relates to group life is far more limited than it should be. Consult your tax department and good insurance agent on this discussion for your firm.

Probate Fees (Taxes) for Malformed Insurance Contracts:

According to an article written by Betsy Simmons Hannibal, Attorney on Lawyers.com - "Payouts from life insurance policies rarely go through probate." However - " if no beneficiaries are named or if none of the named beneficiaries are alive, then the life insurance will go into probate so that the court can determine the rightful recipient." Therefore, "if the insurance money must go through probate, the insurance company issues a check made payable to the probate court. The probate court then deducts any probate fees and attorney fees from the money and distributes the balance according to the will of the person who died."

Some states charge a percentage of the money that enters probate and others charge fees. According to Legalmatch "New York’s probate cost can range anywhere from 2% to 7% of estate’s value....Florida sets out a reasonable attorney fees schedule: depending on estate’s value, just the attorney’s fees associated with probate may be as low as $1,500 or as high as $165,000 with additional percentage taken off. In Connecticut, the probate court applies a schedule for determination of court fees: first $10,000 of estate is assessed $150, then 0.35% is applied to $10,000 - $500,000 range, and 0.25% to the estate’s value cutting $500,000 threshold." In other words, probate fees are all over the map.

Do potential probate fees serve as a tax? Maybe they do maybe they don't. Regardless if your life insurance policy has no legitimate beneficiary - expect to pay the state court. (Regardless of what you might call it.)

Other Malformations of Insurance Contracts:

I would be remiss in not telling you that a life insurance policy that was illegally set up, inappropriately created, or some other bizarre conditions met - could be open to all sorts of taxes and random government actions. Some of these could be illegal in nature. Some of them could have been more of a minor violation of a tax or insurance code. Others out of ignorance. None of these potential tax situations though are remotely common.

One consideration worth pondering is the American Citizen who renounces their citizenship. Then this former citizen dies. What is the tax treatment to their children that are still US citizens, if part of the money used to pay the policy was earned abroad and never paid US income taxes?

If money laundering is discovered in the creation or maintenance of a permanent life insurance policy only after it has been set up? Other than government seizure rules, would the remaining policy that gets closed out be force to pay income and estate tax?

A financial planner uses IRA monies to pay into a Universal Life Insurance policy and then is notified by a governing organization of a violation. How would this be taxed?

Some theoretical permanent life insurance company is sued during a class action lawsuit. The judge and jury find in favor of the plaintiffs and order the insurer to pay out $10,000 dollars to each policyholder. Policyholders have the option of placing their settlement dollars in their contract policies. What is the tax treatment of this?

Is Life Insurance Taxable - An Incomplete List:

I will guarantee you that this is not a complete list. There you have it, I admit that there is still work to be done on this subject.There are so many different taxing authorities and considerations here I feel that no list can be complete. Please see your own tax adviser if you have any questions.

So Is Life Insurance Taxable?

Contrary to what you read all over the internet, Life Insurance is absolutely potentially taxable. It can be taxable to the owners and it can be taxable to the beneficiaries. You can be taxed by the Federal Government, Your State Government, Your Local Government, and for some even the State Insurance Departments. Life Insurance is a wonderful product, but it is not simple. See a qualified adviser with specific questions about your tax situation. And choose a good life insurance agent when procuring a policy.

Speak with an experienced advisor!

Speak with an experienced advisor!