Deciding on buying a Whole Life Insurance Policy is extremely complicated.

Deciding on buying a Whole Life Insurance Policy is extremely complicated.- The Complex world of Whole Life Insurance requires hard work.

- You won’t learn what you need to by just trusting one insurance agent.

- The Boat Anchor that could be Whole Life.

- The Numbers are Just Half the Story.

- How One Affluent Family did a Full Self Analysis.

An Affluent Family Considers Whole Life Insurance:

Meet Jenny and Tom Wang an affluent and successful couple residing in a wealthy Southern California neighborhood. Jenny is a prominent lawyer and is a partner with her firm. Tom is a semi famous physician who owns his own practice and can be heard on the local radio station as a guest star dispensing medical advice. Jenny has just gone back to work after having given birth to their second daughter. The say this family is well off would be an understatement. To say this family is not well financially organized would be laughable. But even the classic well off family struggles with the possibility of buying whole life insurance.

“An Affluent Family Considers Whole Life Insurance”

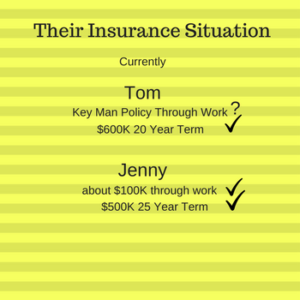

Their Life Insurance Situation:

Both Jenny and Tom have multiple insurance policies. Jenny has a group life policy at her firm and a small $500K 25 year term policy that she purchased when you she first got pregnant with her oldest daughter. Tom owns a small key man life insurance policy through work, which is used for business purposes. He also has a small 20 year policy of $600K for his personal use.

The Rest of their Insurance Situation:

When Jenny and Tom first purchased their new house 8 years ago, they found their old insurance company was unable to write the insurance due to the value of the home and the proximity to a wildfire area. The home is currently insured with one of the higher cost affluent insurance companies. Their three autos are also covered by the same insurer. We will refer to this company as PRP Home and Auto insurance. When they met their Property and Causality insurance agent he quickly assesses that they had a real need for purchasing and maintaining an Umbrella policy. The Umbrella Insurance policy sits over their main home, second vacation/rental home in Colorado, and three cars. It is written in the amount of $3 Million US Dollars with an additional $1 Million US Dollars in excess uninsured motorist coverage.

Both Jenny and Tom maintain Professional Liability Insurance due to the nature of their licenses and work. Both of their businesses are fully insured.

Their Financial Situation:

Their Financial Situation:

The Wangs are financial savers… They met at local investor conference and with the suggestion of a friend, Tom initially asked out Jenny. After the fourth date they quicly became inseparable and married a year or so later. Both Jenny and Tom love investing and saving money. Tom is more interested in risky investments and Jenny is more interested paying off every debt they have. However both of them agree in living well below their means. Because they both save so much, there biggest financial problem is deciding where to invest or save their extra dollars.

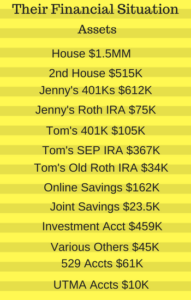

Their Assets:

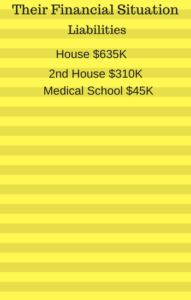

Because the couple saves upwords of 20% of their pretax take home pay, the couple has amassed quite an array of savings. Their home, purchased just eight years ago was originally purchased for $1.2 Million Dollars, but has risen in value to something in the nature of $1.5 Million Dollars. Because they make at least one, if not two, extra mortgage payments per year and because they put so much down when they bought it, their mortgage sits at around $635,000. They have a very competitive mortgage rate.

Their second home, is mostly rented out during the year and is located in a ski town in Colorado. It is a condo, which is valued at about $515,000 and they carry a $310,000 mortgage on it. Since it is mostly rented out, the Wangs CPA has advised them that they are getting a small tax advantage from owning it.

Other than their two homes, the couple has numerous other assets, including two 401Ks for Jenny valued at about $612,000 and a Roth IRA of $75,000. Tom has one 401K in the amount of $105,000, SEP IRA valued at $367,000 and an old Roth IRA in the amount of $34,000.

As impressive as that all sounds the couple also has ample non retirement savings as well: An online savings account with 162,000 and a local joint saving account held at the local bank with $23,500. They have a investment account held with a national investment company that is mostly invested in passive ETFs and municipal bond funds in the amount of $459,000. They have various other small investments totaling about $45,000.

Their oldest daughter has a 529 account that lists her as a beneficiary with about $51,000 and the youngest daughter has a brand new 529 with her listed as the beneficiary. This account has only $10,000. Both 529 accounts receive automatic monthly deposits of $1,000 per month. The couple is confident that between the current balance and future monthly deposits will be able to cover most of their children’s undergraduate costs.

Both of their daughters also have less than $10K (8K, 2K) set aside for them in California UTMA accounts through their national broker. Whenever Jenny receives gifts for her two girls she immediately deposits the money into the accounts.

Their Debts:

Other than the two mortgage listed above, the only debt that the couple has is a small residual amount of medical school debt in the amount of $45,000. Jenny was lucky in having saved enough and was helped by her parents to pay off law school long ago. But her husbands medical school debt is a source of anxiety for her. Both Tom and her argue about it often. Tom thinks that they should just allow it to be paid off on time, while Jenny would like to write a check and be done with it.

Income and Spending:

The Wangs are cash flow positive, meaning they are easily taking in more money than they are spending. They drive nice autos, but plan to drive them until they are at least ten years old. They have few things that they consider luxuries and do not enjoy the expensive lifestyle of many of their children’s parents friends, preferring to spend time with extended family.

The take in excess at least $550,000 per year and sometimes up to $650,000 per year.

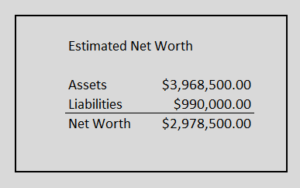

Their Net Worth Calculations:

Including their homes, 529s, children’s UTMA accounts, they have total assets of about $2,678,500 not including the increased value of their primary home of about $300,000. This net worth does not take into account numerous things including, but not limited to: Their Autos, There general possessions, Their small art collection, nor the potential use of social security at retirement. It also completely excludes Tom’s Physicians practice and Jenny’s Law partnership as these businesses are extremely hard to value. However, they do have value.

Even with this amazing amount of savings Jenny does not feel secure. She worrys constantly about Tom getting sued for the medical advice he shares on the radio as well as his practice Being a lawyer herself, she knows that the barrier in the United States to merely begin legal proceedings against someone is rather low. And although Tom carrys Malpractice insurance, she worrys that it may not be enough.

Tom is not worried about this too much and claims that getting sued is part of being a business owner. He is however, slightly concerned about the stock market and is constantly looking for investments outside of stocks. He believes that between their investment accounts and retirement accounts, they are over placed into the market as a whole.

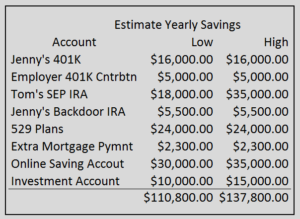

The Wang’s Yearly Savings:

Both Tom and Jenny save the maximum allowable amount into their Work Retirement plans. About $16,000 plus an employer contribution of $5K for Jenny and Tom with a SEP IRA contribution of somewhere between $18K to $35K per year. Jenny also puts money into a non deductible IRA yearly and converts it to a Roth IRA. They squirrel away about $24K per year into the kids 529 plans, make extra mortgage payments, and are fully insured. They add at least $30K to $35K per year to their online saving bank and deposit the rest of their savings joint the National Investment Company buying up Muni ETFs and Passive Stock ETFs. Soon they worry that their oldest child’s 529 will have all it needs and then what should they do? But what else to do with their money?

Tom reads some stories and meets a pushy insurance agent at a golf outing who has been trying to convince him that a whole life insurance policy is the best thing since the sucher. This Life Insurance agent sponsors events and specializes in Life Insurance policies for wealthy doctors. All the doctors joke about him, when he not around. However, one of the wealthiest older docs in the group, tells the group that his ideas are not entirely wrong.

The Whole Life Pitch:

The Whole Life Pitch:

Not wanting to approach the life insurance agent, Tom does some research online and finds general condemnation for whole life insurance and its ugly cousins Universal and Variable Life. However in his reading he does see claims that Whole Life Insurance can serve as a form of asset protection and this appeals to him. More Life Insurance is probably a good thing, thinks Tom. After reading this he calls and schedules a quick meeting in his office with his golfing insurance agent. One of the things that immediately bothers Tom about the insurance agent is the lack of needs based questioning that the insurance agent has with him. The insurance agent is adamant that whole life insurance is the best thing in the world for most families and that term life insurance will run out, leaving the Wangs “life insurance less.” Tom immediately thinks this is funny because the insurance agent has no idea what his net worth is, nor their need for life insurance after their term policies end. He wants to end the meeting right then and there, but gets diverted by an incoming emergency phone call. After the phone call he allows the patient salesmen to continue.

The conversation continues with the insurance agent reviewing some key reasons that doctors really should consider a whole life policy, including possible asset protection and a small interest rate paid through dividends in the participating whole life policy. Caught off guard, not knowing what dividends are in relationship to life insurance, Dr Tom, immediately starts taking notes. The insurance agent brags that his A+ carrier has paid out dividends for decades. After learning about the dividends, Tom Wang learns that this insurance agent has only one insurance company that he sells for. Tom is slightly concerned about this and decides its time to read up and speak with more people.

The conversation continues with the insurance agent reviewing some key reasons that doctors really should consider a whole life policy, including possible asset protection and a small interest rate paid through dividends in the participating whole life policy. Caught off guard, not knowing what dividends are in relationship to life insurance, Dr Tom, immediately starts taking notes. The insurance agent brags that his A+ carrier has paid out dividends for decades. After learning about the dividends, Tom Wang learns that this insurance agent has only one insurance company that he sells for. Tom is slightly concerned about this and decides its time to read up and speak with more people.

An Alternative:

Tom, discusses the presentation with his wife who in intrigued with the concept of a contract based saving plan but is confused by the combination with an insurance product. She suggest that Tom reach out to the their P&C Insurance Agent Bobby. Bobby is more than happy to discuss Permanent Life Insurance options, mostly offered by PRP Insurance Holdings and after a medium length needs based discussion, zones in an Indexed Universal Life Insurance policy insisting that it is all the rage these days. Tom is a bit put off by this as in their original phone discussion he had mentioned wanting a non stock market savings plan and the Indexed Universal Life insurance policy is somewhat tied to market performance. Also when asked about how it was linked, Bobby the P&C agent explained it, but not well. The whole thing seemed too confusing to Tom and he was not comfortable with the agents level of knowledge on the situation.

A Second Alternative:

Tom then reaches out to a former Wealth Manager that had long ago drawn up a fee for service financial plan for Tom, back when he was single. Tom’s recollection was that her work was terrific, but that the Wealth Manager wanted him to let her manage his assets. Not wanting to pay 1.1% per year for this service Tom demurred. With a renewed interest from an old Client, Sally the Wealth Manager quickly surveyed the landscape and did hint that a Whole Life Insurance plan could… be useful to someone in their financial situation. They discussed Indexed Universal Life plans, but she suggested that these life insurance policies were laden with high fees and confusing calculations of investment limitations and caps. Sally hinted that Participating Whole Life, if nothing else, was less complex than Indexed Universal and was indeed less market sensitive. Although she did bring up her belief that although Participating Whole Life Insurance companies were not stocks and did not usually own too many in their portfolio, they were at risk of bond performance since they usually had many in their portfolios.

In the end the Wealth Manager really thought a better move was one of investing in new markets for the couple. She suggested a portfolio of Emerging Markets, and High Yield debt, feeling that the Wangs did not hold these types of investments currently.

The Frustration Grows:

Frustrated, now Tom does not know what to do. He was not going to hire a Wealth Manager and was certainly not going to be pushed into an Indexed Universal policy. He still felt his best option lay with the Golfing Insurance Agent, but wanted someone to review his needs from multiple companies. Tom tables the discussion with his wife and faisl to decide what to do.

Initiation Again:

A year goes by and Jenny no longer wants to put any more money into their oldest daughters 529 plan as she calculates that it is probably enough for their daughters future education in about 13 years. She doubles up on the contributions to her youngest daughters 529 plan from $1,000 to $2,000 per month. Both children are invested in the age (graduation) based portfolios so they are essentially on autopilot. Jenny is concerned that they now really have more money to invest than they know what to do with. A good problem to have, but it keeps her up at night.

Jenny starts a small project of looking at the Alternative World of Investments that they can make with their small pile of money. She considers purchasing a $100K rental property near where her parents live in Arizona. Buying into a Hedge Fund. Investing in a small local restaurant through a friend. All of the options scare her though. When Jenny and Tom discuss the subject its clear that she is the safe investor and Tom likes to push the risk meter. Jenny brings up the whole life option again to Tom.

A New Life Internet Option:

A New Life Internet Option:

Although by this time Tom has been referred to multiple other insurance agents, he fails to find one that really knows his stuff and is able to work with multiple carriers. Tom finally, via the internet, discovers an Insurance Agency licensed in multiple states, including California, that really seems able to review their situation.

The very first thing that the Insurance Agent, Eon from the Internet firm, asks after carefully reviewing their case is: Are either of their Term Life Insurance policies convertible? Tom has no idea what he is asking and asks him to repeat the question and then explain. Impressed they end their discussion, with Tom going out to explore if indeed either of their term life policies have this option.

Tom calls Eon the life agent back to tell him that none of their term life policies are convertible. Eon assures him, that its OK, that he can get either or both of them – a small whole life policy with an A rated participating carrier. Tom inquires about the value of the credit rating and Eon insists that its more important with whole life than it is with term life. Tom then stops Eon to tell him that he would like a large whole life policy, something in excess of One Million US Dollars. Eon, states that he will happily show him the numbers for a range of options, but suggests that they look at smaller options as well.

The internet insurance agent also spends a few minutes to politely educate Tom in his ideas of asset protection which was one of the original fundamental reasons that Tom had sought out Whole Life. Eon, the internet agent shares with him that asset protection is “extremely state specific” and that California does not have terrific bankruptcy asset protection. He suggests that he engage an attorney in a detailed discussion, but emails him a website that lists some basics about California whole life “cash value” creditor protection.

Next Eon and Tom discuss Tom’s health, his activities, profession, and numerous other underwriting criteria. With the phone call getting to be over an hour long they stop short of reviewing Jenny’s health and underwriting information. Tom later regrets this.

The Second Whole Life Insurance Call with Eon:

Eon, presents to both Tom and Jenny various whole life insurance options with A and A+ rated participating whole life carriers. He insists that they both understand the difference between the guaranteed and assumed value charts. The assumed value chart use numbers that are less than the past dividend rates.

He thoroughly explains why clients of his pretty much only purchase whole life insurance, in this type situation, with participating carriers. How participating carriers are owned by their insureds and the use of the dividends. Tom is now fully at home with all of the reading and speaking about whole life and assists in explaining some of the finer points to Jenny.

Eon, also brings up a “Waiver of Premium Rider” and explains its value if the insured is unable to work. Being a doctor, Tom immediately smiles and is turned off by the idea not liking insurance companies definition of disability. Eon, the internet agent engages Tom, the Doctor and assures him that there are many definitions used for disability and that he might be able to find a definition that he can live with.

The presentation goes pretty well, but the cost of the Two Million and even One Million dollars plans shock Jenny and slightly surprise Tom. Both of them, were surprised how much more it costs than level term life insurance. Tom, quickly remember that the internet insurance agent had suggested the $500K option as a “smaller plan” and is glad that his proposal include this option. Eon has proposals for both of them and he states that since they have not had the opportunity to discuss Jenny’s underwriting the price estimates are really not that accurate.

That being said, Jenny’s yearly costs seem lower, partially based on the fact that she is a woman (generally women live longer), and and possibly based on the lack of negative information about her health history since they have not discussed it. The presentation ends on a high note, with both Tom and Jenny feeling confident in having found a knowledgeable agent that has conducted a full needs based analysis on their situation.

The Discussion at Home:

The Discussion at Home:

Jenny first remarks to Tom, that she thinks its too expensive and that she doesn’t understand why they would want insurance once the kids are out of the house and they retire. Tom, who is usually not the safe investor in the house knows that Jenny loves safe investments so he uses this persuasively in his argument about the ability to put a small amount of money in a whole life policy that will easily be affordable for them, even during retirement. Jenny, not fully agreeing, at least agrees that $500K is the most she is interested in. They both wonder about the suitability to insure Tom vs Jenny vs both of them. Jenny is appalled about the thought of both of them buying a whole life policy. For internal political reasons, Tom thinks they he will press forward with the smaller whole life policy for just himself. Jenny thinks they should invest more in the market in safe mutual funds and stocks such as some of the options she saw last night on CNBC, such as Utility stocks which tend to pay out safe dividends.

Tom’s Financial Thinking:

Although the girls are getting older, in a couple of years the younger daughter will be done with preschool and be enrolled at the local elementary school cutting their costs a bit. They still have about, on average $35K per year in excess investment money in which to use. On occasional years it can balloon depending on bonuses of the two workers to something much higher. When they are done fully investing in their youngest daughters 529 plan though it will mean a possible additional $24K per year needing an investment home. After speaking with Jenny he is concerned about one of the objections she brought up and that this only makes sense if they are both able to keep working and continue to make the same amount of money. If one of them were to lose their jobs or their businesses became unprofitable the whole life option might weight on them like an unwelcome anchor.

Tom thinks long and hard about what a non working situation could look like. He is not alarmed by it, but it is concerning. Perhaps he should just drop this.

Pen and Paper:

Not liking computers Tom, sits down with Pen and Paper to review his options with the proposed whole life policy. At $7K per year it would be one of their biggest yearly expenses after property taxes on two properties and mortgage payments. Perhaps he can abandon his term life policy? No, that does not make sense. At $7K per year, 30 years of payments will amount of $210K in total. Not the end of the policy but a good chunk of it. And he already has more than $210K set aside, so even if he losses his job…somehow, he could still afford to make the life insurance premium payment, right? Wait, how would he make the mortgage payment? The Property Tax payment? The last think in the world he is going to want to do with his money is pay for a forced savings plan. But wait, his wife works.

It would really only be a major issue if they BOTH lost their jobs, at the same time. She is a partner at a law firm and he owns his own business, is this possible? Tom gets up from his self discussion convinced that it would require a black swan event to make this a reality and he believes these types of swans can not be prepared for.

He does get a chuckle out of imagining buying this product on a much lower income as a few of his younger and less successful neighbors have done. He wonders how they really pull it off. Do they ignore their 401K? Not make extra mortgage payments? Skip the college savings plan? Seven Thousand Dollars per year, for life, for whole life insurance! Wow that just sounds like a lot he thinks.

The Spreadsheet:

Tom knows that Jenny keeps accurate spreadsheets for her assets, so he sits down to do what she would do. He creates columns, adds rows and numerically himself researches how this policy would look with the help of the whole life guaranteed and assumed value charts. He compares returns both taxable and untaxable in his spreadsheet with those of the life insurance companies.

His Decision – Their Decision:

After Jenny returns from a business trip and over wine they sit down during the fifteen minutes they have free to review what Tom wants to do. Jenny says that she is OK with him moving forward on the $500K front but is just too financially concerned abut anything larger than this. She also admits that if were not for his dogged determination, she probably would never have followed through with the purchase. Tom tells Jenny his concerns about lower earning people buying whole life and Jenny remarks that that is a really good point. “I don’t know how others do it” She says. Tom chuckles knowing his wife knows the finances better than he does and if she is OK with it, than it probably is the best decision.

NOTE:

Jenny and Tom obviously have their financial act together. They do not represent the average American family. Yet even in their situation the decision to purchase and fund for the rest of their lives a whole life insurance policy is really not easy.

- They make in excess of $500,000 dollars per year (each and every year.)

- Add in an excess of $100,000 per year, each and every year, to new savings.

- Both of them work. Both working could serve as an odd form of disability self insurance for each other.

- Broadly invested they are.

- They keep spreadsheets and records.

- They talk about the finances.

- They are paying down their homes with extra payments, adding to retirement and college saving plans.

- Have a huge reserve of cash (enough to fund, possibly, the entire life of the whole life contract.)

- They do a lot of homework, meet with numerous experts to find just the right product.

- They have spent dozens of hours, maybe fifty hours researching Whole Life and its Options.

Are the Wangs correct to assume that their proposed whole life insurance policy might protect their assets in the case of something happening with their business? Perhaps, asset protection and bankruptcy laws are very state specific, these clients happen to live in California. And According to California law Whole Life Insurance Asset protection is somewhat limited. Clients are advised to always speak with a lawyer in their state when considering this.

The point to all of this is that these make believe people, The Wangs, are NOT average Americans. They make a ton of money! They have save like the Millionaires Next Door. They are not middle class workers. They took years to carefully make their decision. For most people that do not fit this profile… Term Life Insurance is more than likely the way to go. Yes, there are some exceptions to that rule, for example families that need a Special Needs Trust, but in general Term is the best Option.

The point to all of this is that these make believe people, The Wangs, are NOT average Americans. They make a ton of money! They have save like the Millionaires Next Door. They are not middle class workers. They took years to carefully make their decision. For most people that do not fit this profile… Term Life Insurance is more than likely the way to go. Yes, there are some exceptions to that rule, for example families that need a Special Needs Trust, but in general Term is the best Option.

Help I have Questions!

Should you have questions or not understand something, please feel free to contact us directly at sales@marindependent.com. Whereas Term Life Insurance is simple and inexpensive, Whole Life is complex and complicated. It is really in your best interest to do your own homework on the subject of life insurance. Please see our disclosures. Thank you for reading An Affluent Family Considers Whole Life Insurance.

The above example about an Affluent Family Considers Whole Life Insurance is fiction. Any similarities between actual people is purely confidential. Names and Insurance Company names are fictional. Why is it fiction? Well, first off, it would be very hard to get clients to allow an insurance agency to use their exact financial information. Second, its not practical. Third, I wanted to illustrate a potential client that I believe, barely qualifies to make a whole life policy make sense.

Speak with an experienced advisor!

Speak with an experienced advisor!