Do Attorneys need Life Insurance?

Although its easy to think that since Attorneys make lots of money that they may not need life insurance, this line of thinking is completely incorrect.

Life Insurance for Attorneys:

Attorneys, like all of us, need life insurance. However they often have special needs and different considerations. With their relative high income combined with increased law school debt - Lawyers present an interesting life insurance situation. In general attorneys can often benefit from a simple term life insurance policy.

About Lawyer's Life Insurance Needs:

According to indeed.com the average attorney in the state of California is about $93,000 per year. US News and World reports puts the National Figure closer to $118,000 per year. The 25th percentile earning about $77,000 and the 75th percentile earning more than $176,000 per year. Regardless of the exact income these wages are far superior to that of the average American.

That is the good news, the bad news concerns the increasing debt load that attorneys need to take on to make their high income. Above the Law cites that "the average law school graduate borrowed about $112,776 to finance their degree." But this is just for their law degree and may not include any undergrad debt.

These two financial concerns make the concept of purchasing life insurance a tricky one for attorneys. How to properly insure their families when they already owe so much money.

Unfortunately just because someone has a high wage yet owes money does not mean that their family will be taken care of if disaster were to strike. Therefore we still believe that attorneys need a fair amount of life insurance. Typically this is term life insurance.

What Makes Lawyers Life Insurance Needs Different:

More details on each of these reasons can be found below.

The High Income of Attorneys:

As we have shown, attorneys can make good money. But this is far from a universal result. Not all lawyers make hundreds of thousands of dollars per year. Many are out of work, Some have changed industries. However for the lucky few that do have a high annual yearly income, than having a term policy to replace lost income could truly be useful.

Law School Debt::

Attorneys often have a high level of debt. Should you buy life insurance to pay off your law school debt? As funny as this may sound, I would speak with an attorney before you do this. This site does not attempt to give financial estate and bankruptcy advice. I will just say that it is not clear to me that there is value in buying a term policy to cover your debt. Unless your spouse or other family member is responsible for it as well. This can be a very complex topic.

On the flip side, just because you have law school debt does not mean that you should just skip life insurance, if you truly have a need. I rarely advise consumers to purchase term (or any other type) insurance if you can't afford it. However for those that have a lot of student debt, they still may need to consider a term policy. Especially if they have children and / or other dependents.

Business Life Insurance Policies:

Lawyers and their law firms can often benefit from business life insurance policies. There are two main types that may be of value for this profession: Buy Sell Agreements and Key Man Insurance. These policy types are more or less beyond the scope of this article. Just be aware that these contract types could be in your future.

Higher Rate of Self Employment...:

Attorneys often work for either themselves or are the owners of their own companies. Not always, but often. For these individuals, they might not have the often beneficial corporate group life policy that numerous C level executives have. This is a real issue for millions of attorneys.

What this means is that these business owners should probably have more term insurance than others.

Employment Duration:

For numerous careers: Doctors, CPAs, Architects, and Attorneys, once you have set up your own company and start your own practice, you may be gainfully employed until your dyeing days. Put another way, you may be able to work as long as you like. Viewing it from this standpoint, perhaps attorney need less life insurance.

The Best Type of Life Insurance for Attorneys:

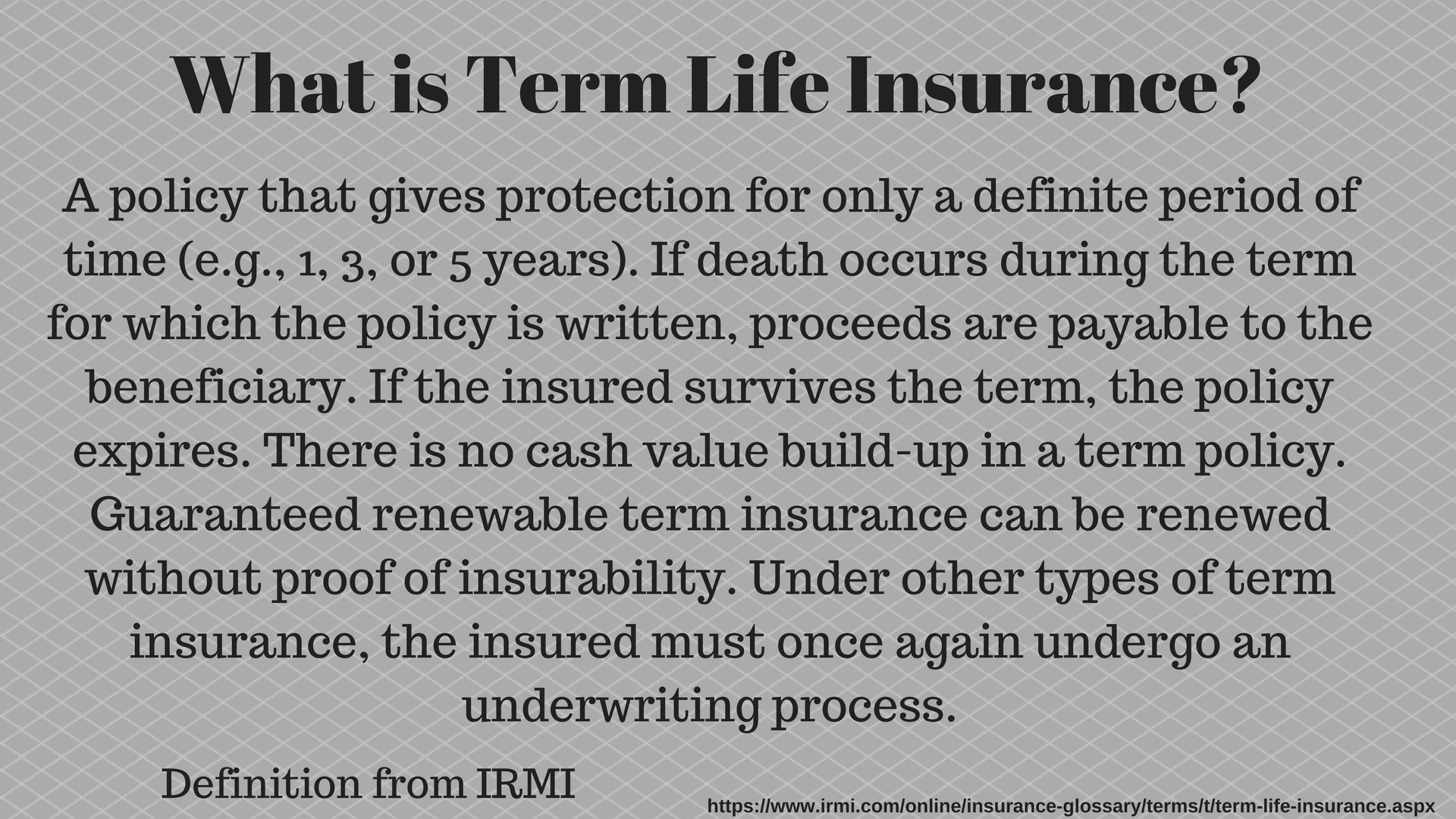

The summary judgement for attorneys is that they should probably just choose a simple term life insurance policy. Choose a length of time that lasts until all of your dependents (children) are out of the house. Choose a coverage amount that fills the missing void if you do not come home one day.

Getting deeper into the details on this subject. Lawyers should know that lots of financial professionals specialize in selling cash value policies specific to attorneys. Legions of them exist. There are two different types of life insurance out there.

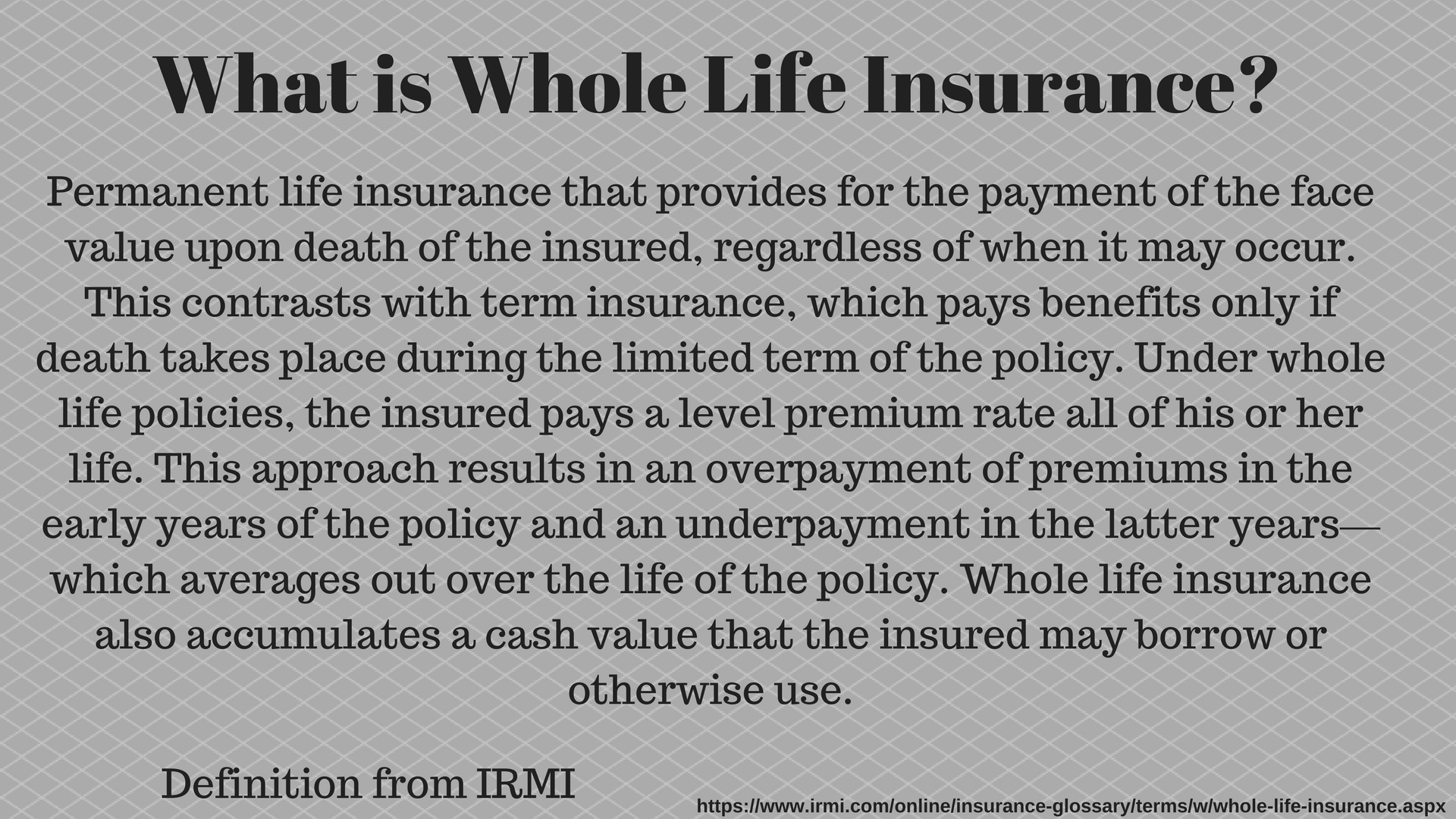

Permanent Insurance, which includes Whole, Variable, and Universal life insurance lasts forever. The life insurance death benefit AND the annual premium typically last as long as the policy remains in force. These contracts often cost ten times more than a the competing option.

Term Insurance is the exact opposite. It is pure insurance and only lasts for given period (the term.) After the term is up, typically the policy cancels. Term insurance is a far cheaper way to buy the coverage that you need. Since these policies last a shorter length of time and provide more coverage you can often afford to have more than one of them. This technique, called laddering uses different length policies to provide coverage.

So what is So Unique to Attorneys about the Whole and Term debate? Whole life policies are first and foremost a contract between the insurer and the insured. The policyowner receives a benefit in case they die as long as the policy stays in force. This type of contract is simpler for lawyers to understand. Therefore they are slightly more liable to blinded by their own knowledge. Because they understand contract they might see the appeal of a good solid contract.

The competing theory of buying whole life insurance, is to buy term and invest the rest (BTITR.) BTITR involves saving money that you would have otherwise invested in whole life and instead invest it in tax differed/ tax free accounts. These are often know as Qualified accounts. But the world of qualified investments may be more foreign to litigators. And this is the unique aspect of lawyers to consider.

Life Insurance Calculations for Lawyers:

Calculating how much life insurance that an attorney needs is not as simple as the general population. Whereas it may be sufficient to just suggest that they need ten times earnings, it is often not the case with them.

That being said it is such a simple rule, we almost must review it. Simply put take ten times your earnings and buy that amount of term insurance.

$200,000 Per Year in Earnings

Multiplied by 10

Equals $2,000,000 in term insurance for an Attorney.

Alas, it is not that simple. This method avoids your true take home income. It ignores your debts and it ignores your net worth. Most importantly it also seems to avoid your goals. The more thorough approach involves calculating your net worth. Then to consider what your goals might be. For many that it getting your kids out of the house and through college. Let us assume, theoretically that this involves 20 years of $100,000 of costs, this demonstrates a need for $2,000,000 in term insurance.

However we may reduce this coverage amount based off what you have already saved up (your net worth) than it can come down dramatically. If you already have a net worth of $800,000 than you perhaps a $1,200,000 policy might be sufficient. ($2,000,000 in life insurance needs less $800,000 in saved money.)

Even this method has numerous drawbacks as it tends to ignore that some of your net worth might not be accessible or set aside for another purpose. However it is generally more accurate than using just the ten times rule of thumb.

Sample Term Rates for Attorneys:

Below is a simple chart of pricing for twenty five year $1,500,000 term life insurance policies.

Term Life INsurance Rates $1,500,000 - Non Smoker

Various Ages, Various Sex, Various Classes, CA, 20 Year Term

$1.5MM 20 Year | Preferred Plus | Preferred | Standard Plus | Standard |

|---|---|---|---|---|

Female Age 33 | $484 | $625 | $334 | $745 |

Female Age 43 | $1,073 | $1,290 | $1,721 | $2,033 |

Male Age 33 | $550 | $784 | $1,035 | $1,078 |

Male Age 43 | $1,380 | $1,676 | $2,423 | $2,675 |

*all sample pricing - subject to change. All prices per annum.

Possible Life Insurance Solutions for Attorneys:

Below are few theoretical examples of life insurance solutions.

Attorney Life Insurance Solutions:

The young public attorney who is single with no children. Fresh out of law school, in her first job with lots of student loans she opts to not yet purchase a life insurance policy. After reading about the different forms of insurance she is intrigued by whole life but thinks she will opt for a thirty year term policy.

The Fifth year associate at a private law firm in Florida. He is about to get married and plans on having a family. The Law firm offers $100K in group term life. He has just purchased a thirty year term policy from Banner life for $2 Million Dollars. His future wife, will no longer work, but will also get a smaller term policy of a similar length but a lower amount,

The working Senior Attorneys married to each other with two children. They both have group life policies through separate employers at $200K and $300K in coverage. The each purchase 20 year term policies through Mutual of Omaha and AIG for amounts of $1.5MM and $2.0MM.

The Senior Partner whose spouse does not work. Strangely enough he has absolutely no life insurance. When his assistant heard this she about fell over and insisted that he does indeed need a policy since he has three kids. He is reviewing three competing offers from AIG, Banner, and Pruco Life Insurance for $1 Million Dollars.

The retired female attorney that has worked for as a public defender her entire life. She is a widow and her children are themselves in college and law school. She has three years left on her 25 year policy through a Home insurer, rated A++. She plans to keep the policy mostly because the rates are so low until its end. Although she is not certain she needs it anymore.

Summary of Life Insurance for Lawyers:

Attorneys need life insurance in the same way as most other Americans need it: to assist in the event of an untimely death by supporting loved ones. Just because attorneys often have high incomes and high student loan debts does not mean that life insurance is not for them. Special considerations do exist for lawyers when shopping for insurance.

Questions About Life Insurance:

Kindly send along your questions email in the comment box below or direct to scott @ marindependent.com

Question: Do all Attorneys need life insurance?

Answer: No, just like the general public not everyone needs life insurance. Life insurance is best used by those that have people that depend on them.

Thank you for Reading our article about physicians and life insurance.

Speak with an experienced advisor!

Speak with an experienced advisor!