Life Insurance can be offered from Companies that are established in many different ways. One type of company is called a Mutual Insurance Company. These type companies are very popular, especially for those that purchase Whole Life Insurance.

But their percentage of Mutuals relative to All Life Insurers are near historic lows. What is happening to Mutual Life Insurance Companies?

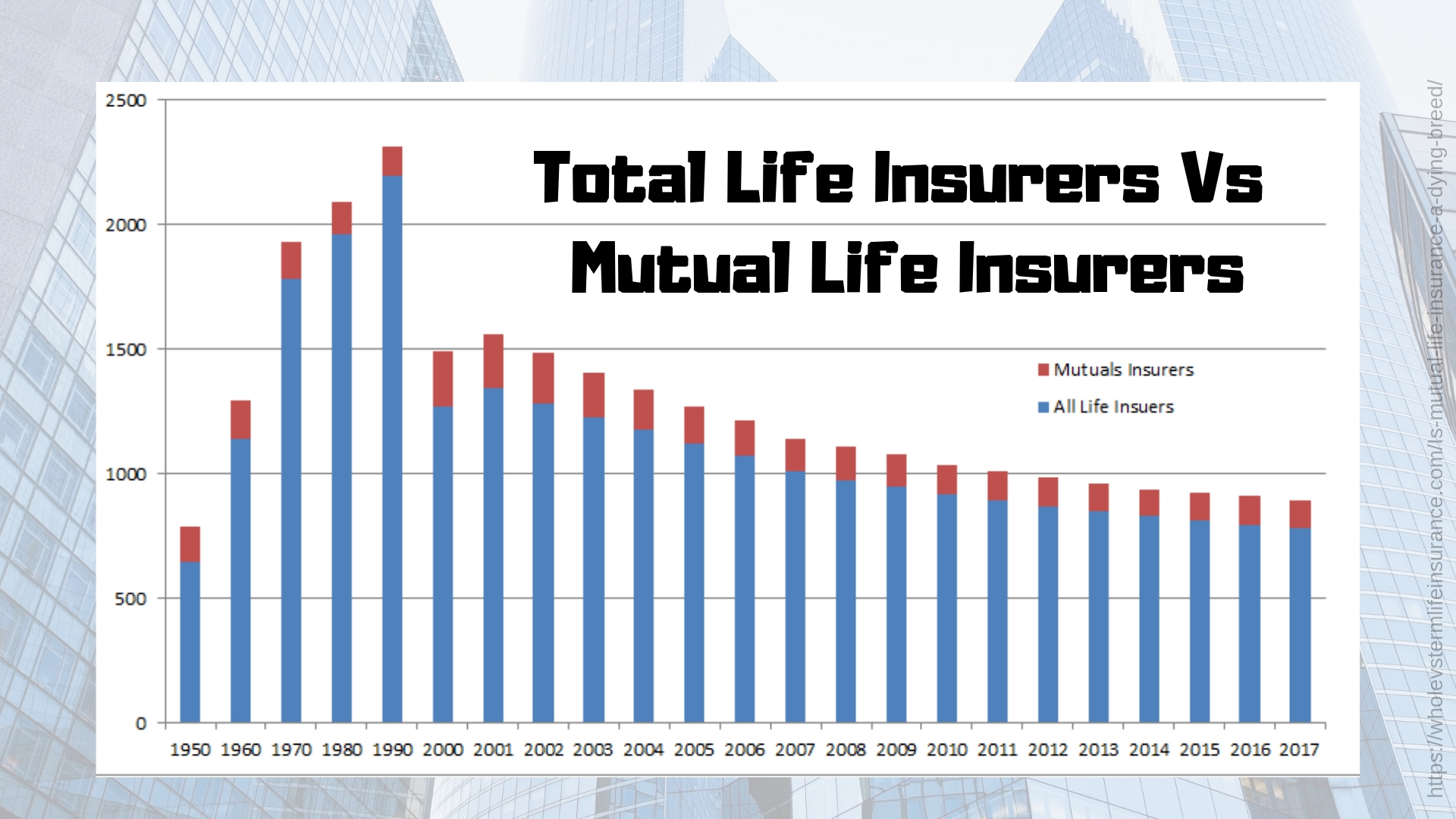

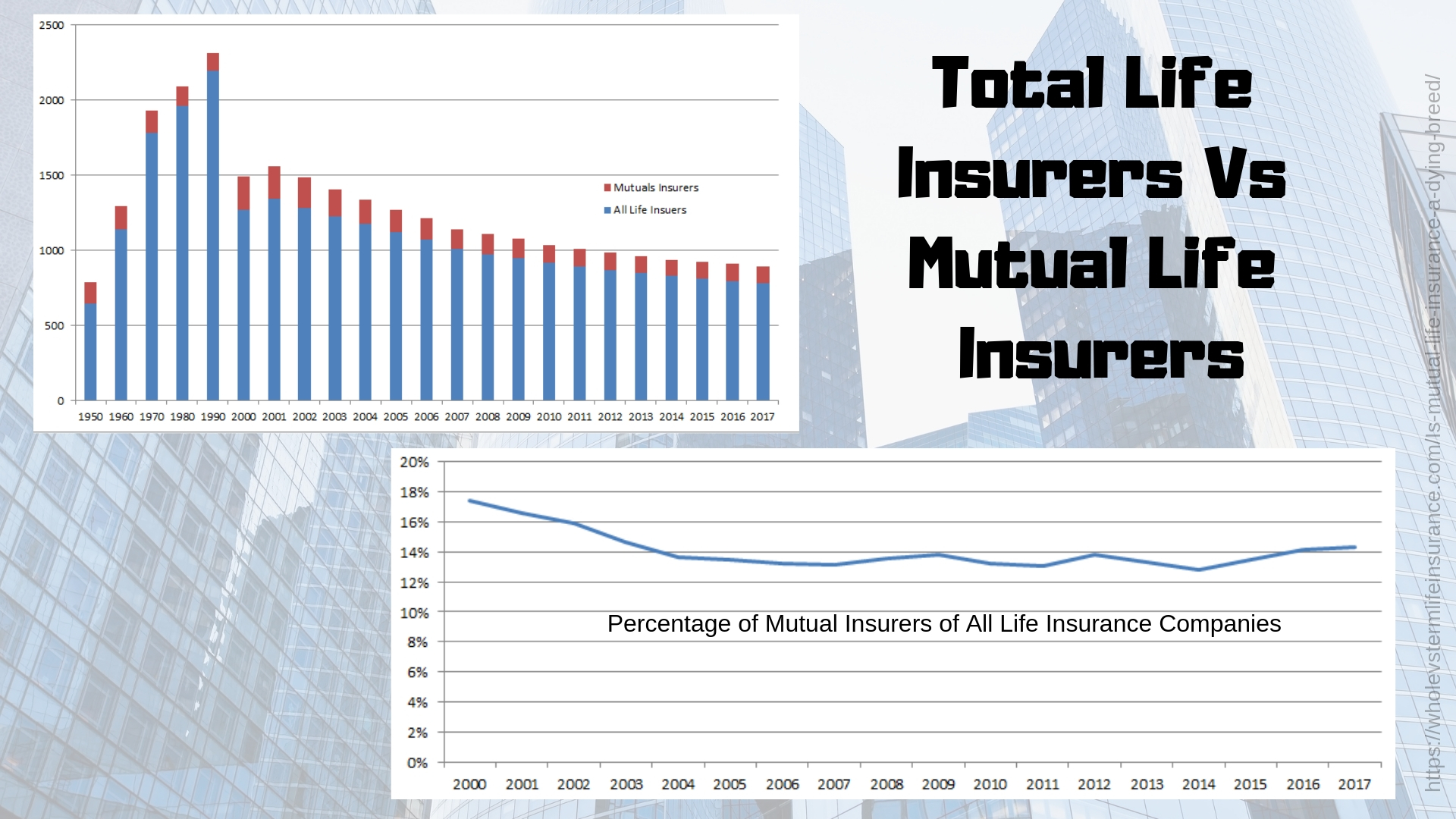

In 1950 there were about 155 Mutual Life Insurance companies in the United States. In the year 2000 that number was about 221, as of 2017 there are only about 112 left. Part of the explanation of this phenomena can be explained by a similar decrease in overall life insurance companies. In the year 2000 there were 1,269 total life insurers and in 2017 there were only 781. When looked at from a total percentage amount, Mutual Insurers have still shrunk from 22% in the 1950s to about 17% in 2000 and about 14% today. Therefore even in the last twenty or so years, the total percentage of Mutual Insurance Companies has shrunk about 3%...

Why is this?

Mutual Life Insurance Companies: A Quick Recap:

Mutual Insurance is a method of creating an insurance company whereby the policyowners are the company owners. Collins defines it as: "an insurance company which is owned by its members or policyholders rather than by shareholders." The general idea with Mutuals (as they are often known) is that all of the profits are returned to the policyowners. This often happens via policy dividends. Policy dividends are paid out to Permanent Policy owners. Mutal Insurance also exists in the Property Causality world.

Who Should Buy from a Mutual Insurer:

Since permanent policyowners receive dividends from Mutual Insurers, Mutual Insurers are a really good option to get Whole Life Insurance from. Therefore most of the consumers that are interested in whole life insurance should take a serious look at Mutuals. Whole Life Insurance and Mutuals make great, obvious sense together.

Other consumers that should consider taking a look are Term candidates. Some Mutuals offer extremely competitive pricing. A few have both competitive pricing AND a terrific convertible option

This brings us to our third best candidate: People that want Convertible Term plans. Convertible options allows a consumer to convert or change the policy to another form - within some predefined time frame.

Therefore if you are interested in a Convertible Term Plan, a Regular Term Plan, or a Whole Life Policy - than a Mutual Life Insurance Company might be right for you.

Examples of Mutual Life Insurers are: Ohio National, New York Life, Mass Mutual, Penn Mutual, and many more.

The Decline of Mutuals:

No doubt about it - there are less Life Insurance Companies and Less Mutual Life Insurance companies today. Our first chart, easily shows the decline of life insurance companies over the past seventy years. But the gradual decline of mutual life insurers is less clear.

In our second chart you can easily see the percentage of mutual life insurers has decreased significantly in the last twenty years. According to available data we are near the low point in terms of the quantity of total mutual life insurance companies.

Reasons that Mutual Insurers are Less Common:

Here are some opinions about why mutual insurers are more rare today than they used to be.

According to Investopedia: "Mutual companies are often formed to fill an unfilled or unique need for insurance." Therefore this seems to be first theory as to why there are less Mutuals: Market Forces. Perhaps its possible that enough private stocks companies are able to offer up life insurance. Enough of them are crowding out the reason that mutuals come into existence.

My second theory is that Whole Life Insurance, isn't what it used to be. Since the financial crisis of 2008, whole life sales seems to have grown and (rather dramatically.) According to some sources, it went from representing about 22% of the market to about 37% of the market. They grew on an absolute number as well. But the product does not represent (often) the best that financial markets have to offer. Whole life was created before Roth IRAs, 401Ks, 529s.

Demutualization is a third reason or theory. Two big companies have gone through this process: Metlife and Prudential. Demutualization is when an Insurance company changes its form of creation and goes from being a Mutual to a Stock company. Although past current Mutuals have changed from Stock Companies to Mutuals - it seems that this is less likely now.

Another partial reason may be due to the rise of Group Life Insurance, which has become much more popular. Group life, now, is a force to be reckoned with in the life insurance space.

Concentration of the life insurance industry probably is the best explanation though. As with all things financial (think of Banks) bigger might not necessarily be better, but it tends to be more popular. The concentration that I am speaking of is that fewer life insurers are absorbing more and more policies. Most of the largest Participating Insurers, such as New York LIfe, Northwester, and Mass Mutual are all quickly growing their book of business. I cannot help but wonder if some of that growth is coming at the expense of smaller mutual insurers. After all the Financial Size Category (or Policyholder Surplus) is an AM Best rating category.

All of this still does not explain the drop off in the total number of Mutual Insurance companies.

Is Mutual Life Insurance a Dyeing Breed?

No, mutual insurers are not going away anytime soon. But there does appear to be a lot of concentration in within the sub industry. Fewer insurers are writing a larger percentage of the whole life policies (it appears.) And whole life sales are increasing. Therefore Mutual Life Insurance is not at all dyeing.

As our data and charts have shown, the number of mutual life insurance companies are near historic lows, but that does not mean that this trend will continue. My guess is that this trend will reverse itself one day, just as I believe the trend towards whole life will reverse itself as well. They almost have to.

Thanks for reading our post about the Mutual Life Insurance Industry. We always welcome feedback, especially concerning inconsistencies or errors that anyone may find.

Thanks For Reading.

Speak with an experienced advisor!

Speak with an experienced advisor!