Calculating life insurance needs is not as simple as many people tell you. Even experts struggle with calculating this valuable number.

In this sample life insurance calculation we will show you both the rule of thumb calculation and the more detailed method...

Learn how to calculate your true term insurance coverage needs.

Sample Life Insurance Calculation for a Dad with One Child:

In a past post answering How Much Life Insurance Do I Need? - we used a candidate example John who is an attorney in Illinois. In this short article we will do a deep dive into John's financial situation and his individual life insurance calculation. In the end of this article we will explain his life insurance decision.

John's Financial Story as an Example:

John is a thirty five year old attorney in Chicago Illinois. He works hard, very hard. John's upward career track has him hoping that he will attain the level of partner at his firm in the next couple of years, before the age of forty. Partially because of this, he is loath to spend too much money, as making partner often involves plunking down a partner buy in fee of over $500,000. Sometimes it is possible to take loans out to do this, however, John would rather not. Therefore he and his wife Kim are big savers.

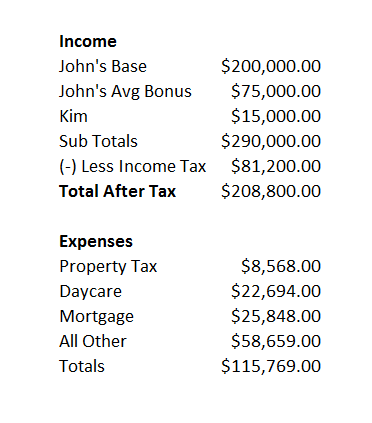

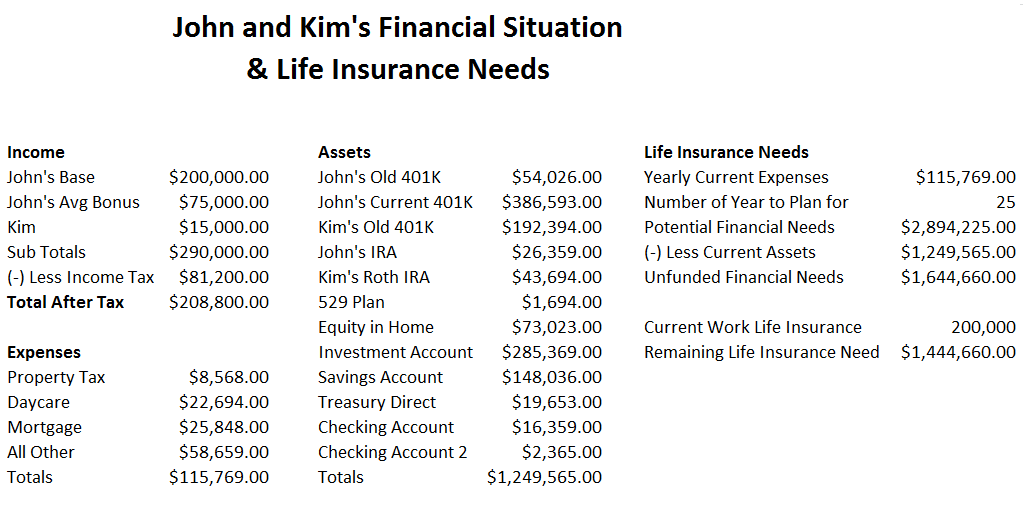

After the birth of their first and only child Samantha, Kim went back to work only part time and brings in around $15,000 per year. The income does not fully offset the cost of additional daycare, but Kim says it frees her up to be "human." Therefore John's wage is the main source of income and he makes about $200,000 per year plus a bonus of between $50,000 and $100,000 per year. This salary is more or less on par with average Law Associate's income.

The typical ten times earnings rule for life insurance therefore may indicate that he should have $2,000,000 or $3,000,0000 in term life insurance. However the situation is not nearly that simple. John has a $200,000 group life term insurance policy through his firm. Unless he is fired for cause it is generally a portable policy, meaning that he could take it with them.

John and Kim have a terrific financial situation going for them.They both have studied and saved and were lucky that both of their parents were able to pay for their college educations.

John and Kim's Life Insurance Needs:

Going back to the simple way of calculating financial needs, John could just go ahead and purchase a $2,000,000 term life insurance and Kim could purchase a $200,000 term life insurance policy. However with them trying to save for the potential partnership, his employer sponsored plan, and Kim not working this does not seem to make sense. A needs based analysis is what is needed in this life insurance calculation:

- First off, they plan on having a second child, but probably no more.

- Kim plans on going back to work full time as a paralegal once Samantha starts first grade.

- They have little student loans for Law School and none from college.

- They are cash flow positive. In other words they make more than they spend.

- They are heavily invested in the market, but conservatively.

- They aggressively save for retirement in 401Ks, IRAs, Backdoor IRAs.

- They live in a high tax state.

John and Kim's Life Income and Expense Situation:

John and Kim earn a good wage. Because Kim is not working a full time job they are making less than they typically would make. After taxes they are making about $210,000 per year and not spending it all.

John and Kim are exceptionally frugal and work very hard to save as much as they can. Currently they are only spending about $115,000 per year or just over 55% of their after tax take income. This is slowly allowing them to amass quite a bit of savings. The do anticipate, at a later time, their mortgage and property taxes going up if and when they decide to buy a new home.

Their Personal Financial Situation:

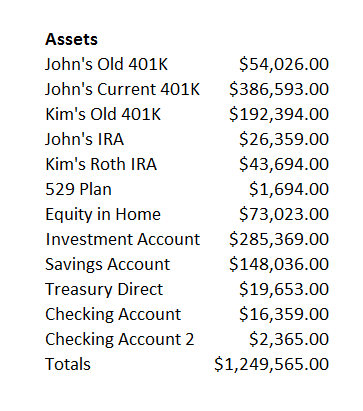

Being that they are able to save more than 40% of their income they are making great strides now in saving. Much of their savings go towards retirement accounts such as 401Ks and short term savings for the exclusive purpose of John being able to buy in to his partnership.

They have a broad based allocation of savings accounts, US Treasuries, Corporate Bonds, Bond Funds, Stocks, and Stock Funds. They have also a very small amount of money set aside in a 529 college savings plan. In the next several years they are seeking to dramatically increase this account.

John and Kim's Life Insurance Needs Calculation:

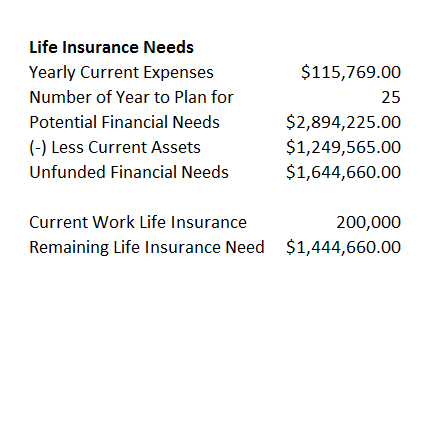

John and Kim are currently spending about $116,000 per year. Since their financial situation is in such good condition they are focused on merely buying life insurance to help protect their one child. They also plan on having another child at some later time. Therefore they believe that the 25 year time frame is the correct time frame.

In order to do this calculation they multiply 25 years times their current annual expenditures of $115,769. This results in a focased total potential financial needs of about $2,900,000. They then subtract out their current assets of $1,294,565. This results in $1,644,660 in "unfunded" financial needs, meaning there is a gap if something were to happen.

This gap is where life insurance could come into play. This gap of $1.6 MM could and should be filled in with term life insurance. Since John has a two hundred thousand dollar life insurance policy through his law firm and since it small relative to the need and since he expects to continue working at this firm, we will reduce this amount from his needed coverage. If the situation were different we might not suggest that he calculate in this entire amount. However in this situation we reduce the necessary term insurance from a calculation of $1,644,660 to $1,444,660. In other words John needs about $1,400,000 in term insurance.

A Life Insurance Recap for John and Kim:

Both Kim and John, need a low amount of insurance relative to their income because they have saved so well. The Ten Times earnings rule leads you to believe that they need between $2,000,000 to $3,000,000 in term insurance. However this more detailed method shows you that this may be too much coverage.

This of course, is not the entire story. John has a minor health issue that makes life insurance more expensive for him.

The Underwriting Issue that Causes John to Choose a Lower Face Value:

When frugal Kim goes to search for life insurance options for John, her lawyer husband, she is surprised to learn that the advertised rates that she hears on the radio do not pertain to them because of John's minor health issues.

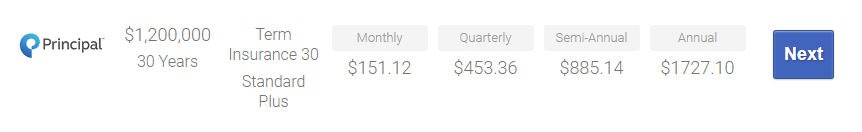

After thinking things over a bit the family decides to buy a slightly lower amount of term insurance and opt for a longer term coverage period. Their time frame analysis showed that they probably need term insurance for twenty five years, but they choose thirty years mostly because its possible that they may opt for a third child and Kim does not want the life insurance dictating their decision.

They reason that since they are saving almost $100,000 per year and spending $115,000 per year that in one short year it is arguable that they will need about $200,000 per year and decide to take a risk. However in comparison to their current situation where they only have $200,000 in life insurance this risk seems very minor.

Therefore John and Kim opt for John to purchase this Thirty Year Term Policy at the Standard Plus Health Class for $151.12 per month.

Kim is planning on securing a separate term policy of her own in a couple of months as well.

What this Detailed Sample Life Insurance Calculation Taught Us:

This in depth financial and life insurance calculation shows us that many people do not need ten times earnings when they have significant assets set aside. This in depth life insurance analysis could have also confirmed the exact same coverage needs as the ten times rule, but in this situation it did not. Obviously it could have shown a higher coverage than the time times rule as well.

The ten times rule is a pretty crude tool. The life insurance analysis method is more specific but is also crude in its own way. There is no "one way" to do this analysis. Our way, in this example, is thorough but we have omitted much. We have ignored a discussion of the small law school loan. We have ignored the ratio of money saved in retirement accounts vs non requirement accounts. There are numerous other considerations not discussed, often for brevity's purpose.

In this article we attempted to go deep enough into this specific situation to provide clarity and honesty. We did not go as deep as we could, which may have made this article not understandable. There are numerous considerations when determining your ideal amount of life coverage. In general we stand by our mantra that almost any term insurance is better than no term insurance if you have a true need.

Go Get Insured!

Speak with an experienced advisor!

Speak with an experienced advisor!