The Equitrust life insurance company is an Iowa based insurer that has recently been in the news because Magic Johnson purchased a "controlling interest" in the company. The insurer offers numerous life insurance and annuity products and has an AM Best financial strength rating of B++.

About EquiTrust Life Insurance Company:

The EquiTrust Life Insurance Company is an American Insurer based in Iowa and Illinois that is most notable for being owned by Earvin Magic Johnson. The sell and service Life Insurance and Annuity products. The company is currently rated B++ by AM Best.

EquiTrust Contact Information:

EquiTrust Life Insurance Company Address: 7100 Westown Parkway, suite 200 West Des Moines, IA 50266 USA

Company Mailing Address: PO 14500 Des Moines, IA 50306

EquiTrust Phone Number: 312-702-3400

EquiTrust Fax Number: 312-634-9550

EquiTrust Website: equitrust dot com

EquiTrust NAIC Number: 62510

Executive Leadership of EquiTrust:

Eric Holoman - Chief Executive Officer and President

Paul Miller - Chief Operating Officer

Keynatta Matheny - Chief Investment Officer

EquiTrust History:

EquiTrust has a rather complicated history. Originally created from the Financial Bureau Group, which has its origins from the 1930s, it began selling and servicing insurance and annuity products in the 2000s. The Farm Bureau Group sold Equitrust to Guggenheim Partners in 2011.

In 2014 Equitrust moved its legal headquarters to Iowa from Illinois.

In 2015, Magic Johnson Enterprises acquired a majority controlling interest in the EquiTrust Life Insurance company. "The deal becomes the largest acquisition by a minority-owned business of a financial services firm in history," says Black Enterprise.

The company received Ward's Top 50 Performing Insurance Companies recognition.

The company is probably most well known for being owned by Magic Johnson.

EquiTrust Life & Annuity Products:

They offer numerous life insurance and annuity products.

Equitrust life Insurance products:

EquiTrust offers generally three different categories of life insurance products.

All of these are various forms of Whole Life Insurance. Whole, in comparison to term life insurance is life insurance that you keep for your entire life.

Simplified Issue insurance goes by many other names. Essentially its a life insurance without the full medical exam and is intended to issued in a much speedier period of time.

The single premium life insurance is a type of whole life insurance that is paid for once but that lasts forever. Single Premium life insurance, is a very interesting option for those considering whole life insurance policies. The single premium can in theory eliminate the need to budget the rather expensive cost of whole life insurance, especially during the retirement years. Their Single Premium Life policy has three different chasis that it pairs with. Your options include the EquiTrust WealthSure Life product, their EquiTrust WealthMax Bonus Life product, and their EquiTrust WealthHorizon Life product. Most of these have minimum issue age of 50 and 55 years old.

EquiTrust also offers a Fixed-Premium Life Insurance product the WealthPay Life product. The EquiTrust WealthPay Life product has a minimum issue age of 60 years old.

Equitrust annuity products:

This company also offers numerous annuities. All of the equitrust annuities appear to be Fixed annuities. They offer both "accumulation" and "payout" annuities.

Extreme care should be taken whenever you are purchasing any form or type of annuity, for any reason.

Annuities are not the focus on this website, therefore we mention them, but do not go into depth with regard to them. If you are looking for a reputable firm to assist you in your purchase and consideration of an annuity we are more than happy to refer you along.

For more detailed information, kindly please see the their Insurance company's products page. As with any business their products are subject to change.

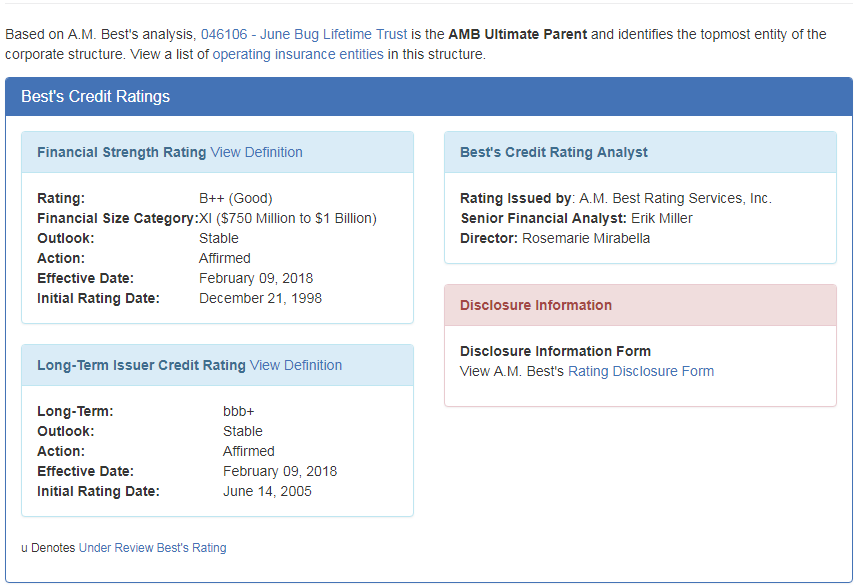

EquiTrust Financial Strength Rating:

The Equitrust Life Insurance Company has a financial strength rating of B++. According to AM Best this is considered "good." Their financial size rating is an XI which means that they have between $500M and $750M in adjusted policy holder surplus.

In many areas of life a B++ rating may be considered just fine, however in the world of life insurance, a B++ rating is not great. For this reason, I find it difficult to offer up this insurance company as a suitable product, especially for longer term life products such as Whole Life Insurance. There are so many A+ and A++ rated insurers available to american consumers. Over 125 by my last count. With so many carriers in those rankings I struggle to find justification to offer this product.

Equitrust Financial Strength Ratings from All Agencies:

AM Best Financial Strength Rating: B++

Standard and Poor's Strength Rating: BBB+

Both Moodys and Fitch Ratings due not appear to have a rating.

*Image taken direct from AMBest.com - March 2018.

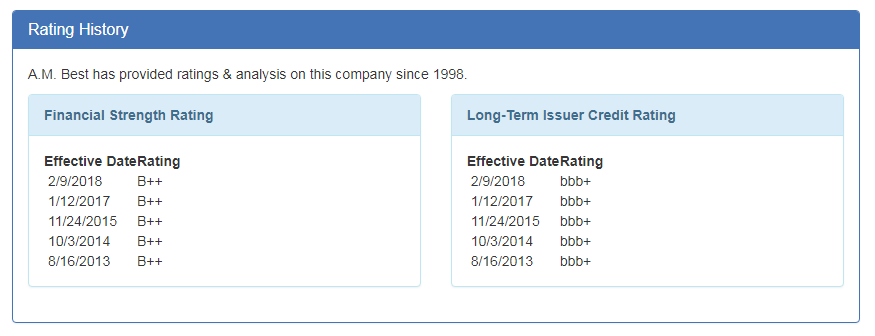

Equitrust AM Best History of their Financial Strength Rating

August 2013: B++

October 2014: B++

November 2015: B++

January 2017: B++

February 2018: B++

*Image taken direct from AMBest.com - March 2018.

So what do all of these Financial Strength Ratings mean exactly? The AM Best and other rating agency's opinions of this insurance company is that this company is in good shape. However, a good rating is not nearly as good of a rating as many other life insurers. Therefore clients are best advised to tread carefully purchasing from any life insurer that is sub A- rated.

If you are considering using an EquiTrust life insurance product for any sort of use other than pure insurance, I would strongly encourage you to get quotes from more highly rated competitors before making your decision.

In the case of the Equitrust life insurance company their financial strength rating (FSR) of B++ is truly the most important consideration of all.

Questions:

Why have I heard so much about EquiTrust in the media?

EquiTrust has been in the media for numerous reasons, however Magic Johnson purchasing the company is the most likely reason.

Does EquiTrust sell Life Insurance?

The EquiTrust Life Insurance company is licensed to sell Life Insurance and /or Annuities in about 49 of the 50 US States.

Can I buy EquiTrust life insurance in New York?

At the time of this publication (March 2018) EquiTrust does not appear to be licensed to provide life insurance or annuities in the state of New York.

What is a Financial Strength Rating?

A financial strength rating is a credit rating agencies opinion of an insurers ability to meet and pay claims. There are multiple rating agencies that each use their own rating system and scale.

Whole Vs Term life insurance is not appointed to sell life insurance with this organization. We provide this information to assist consumers in their search for life insurance.

Speak with an experienced advisor!

Speak with an experienced advisor!